Osisko Gold Royalties Ltd (“

Osisko”) (OR: TSX

& NYSE) is pleased to announce that it has entered into a

binding agreement to acquire a 1.0% copper net smelter return

(“

NSR”) royalty and a 3.0% gold NSR royalty (the

“

Royalties”) from Hot Chili Limited (“

Hot

Chili”) covering Hot Chili’s Costa Fuego Copper-Gold

Project (“

Costa Fuego” or the

“

Project”) in Chile, for total cash consideration

of US$15.0 million.

Sandeep Singh, President and CEO of Osisko

commented: “Costa Fuego has the potential to be a long-life,

lower-cost copper mine in Chile, with significant by-product

credits, importantly situated at low elevation and in close

proximity to key infrastructure. We are impressed with what the Hot

Chili team has been able to accomplish to date, most notably on the

exploration and permitting fronts, and we look forward to future

development milestones at Costa Fuego.”

COSTA FUEGO HIGHLIGHTS

-

One of the world’s largest undeveloped copper projects not

currently controlled by a major mining company;

-

A March 2022 NI 43-101 updated global Mineral Resource Estimate

(“MRE”), including both the open pit and

underground portions of the Cortadera and Productora deposits,

contains an Indicated Resource of 725 million tonnes

(“Mt”) grading 0.47% Copper Equivalent

(“CuEq”), grading 0.38% Copper

(“Cu”), 0.11 g/t gold (“Au”),

0.45 g/t silver and 93 ppm Molybdenum;

-

The MRE also includes an Inferred Resource of 202Mt grading 0.30%

Cu and 0.06g/t Au;

-

Hot Chili’s June 28, 2023 Preliminary Economic Assessment

(“PEA”) projects a 16-year life-of-mine with an

annual average production rate of 95kt Cu and 49koz Au in the first

14 years;

- The PEA projects one of the lowest

capital intensity copper development projects globally;

-

Costa Fuego is situated at low altitude and is in close proximity

to all key infrastructure requirements;

- Secured a water permit and power

connection to the grid, and the Project’s Environmental Impact

Assessment is significantly advanced; and

-

An updated MRE for the Project is scheduled for late 2023 and will

serve as the basis for Pre-Feasibility Study

(“PFS”), scheduled for completion in 2024.

ADDITIONAL TRANSACTION

CONSIDERATIONS

-

Osisko has granted Hot Chili an option to buy down a portion of the

royalty, which can only occur upon change of control and

exercisable until the fourth anniversary of the transaction close.

The buydown option can reduce the copper and gold royalties by 0.5%

respectively (resulting in 0.5% Cu royalty and 2.5% Au royalty), in

exchange for payment in an amount equal to 130%, 140%, or 150% of

the up-front price paid by Osisko if exercised before the 2nd, 3rd

or 4th anniversary of the transaction close;

-

Hot Chili has granted Osisko a corporate right of first offer on

all future potential royalty and streaming opportunities, as well

as certain other rights on proposed future royalty financings;

and

-

Osisko will be granted the Royalties on Hot Chili’s effective

ownership of the properties (see below). Should Hot Chili’s

ownership of these properties increase, the royalty will thereafter

apply to the increased ownership level.

THE COSTA FUEGO PROJECT

The Costa Fuego Project contains three deposits

with current Mineral Resources (Productora, Cortadera and San

Antonio), and is located in the Atacama region of Chile in the low

altitude coastal range belt (~800m elevation). The Project is

surrounded by existing infrastructure with the Project centre at

Productora located 15 minutes by road from the city of Vallenar on

the Pan-American Highway. Costa Fuego will leverage existing

surface rights (already secured) for proposed central processing

facilities at Productora. In addition, the Project will take

advantage of existing infrastructure access in the form of

already-obtained powerline and seawater pipeline corridor

easements; of note is that a maritime concession has been recently

granted to Hot Chili for the Project, referring to coastal land

access as well as the right to extract sea water for processing

purposes as metallurgical test work has indicated that no

de-salinization will be required. A key port facility and power

sub-station are located 55 km and 20 km away, respectively, with

Hot Chili having already secured an electrical connection to the

national power grid. An aerodrome is located approximately 14km

from Productora. Finally, of note is that Glencore has an offtake

agreement for 60% of the mine’s production over the first 8

years.

A PFS for Cost Fuego is anticipated for 2024

following the completion of a 30,000 metre drilling campaign which

is planned to commence in 2023. At present, 82% of Costa Fuego’s

global MRE is classified as Indicated, providing an already-strong

platform for Hot Chili as it prepares the PFS.

Productora is held in a joint venture, presently

80% owned by Hot Chili and Cortadera is 100% owned by Hot Chili.

Hot Chili executed an option agreement with a private party to earn

a 90% interest in the San Antonio copper-gold project over a

four-year period.

Qualified Person

The scientific and technical content of this

news release has been reviewed and approved by Guy Desharnais,

Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold

Royalties Ltd, who is a “qualified person” as defined by National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”).

About Osisko Gold Royalties Ltd.

Osisko Gold Royalties Ltd is an intermediate

precious metal royalty company which holds a North American focused

portfolio of over 180 royalties, streams and precious metal

offtakes. Osisko’s portfolio is anchored by its cornerstone asset,

a 5% net smelter return royalty on the Canadian Malartic mine, one

of Canada’s largest gold mines.

Osisko’s head office is located at 1100 Avenue

des Canadiens-de-Montréal, Suite 300, Montréal, Québec,

H3B 2S2.

For further information, please contact

Osisko Gold Royalties Ltd:

| Grant MoentingVice President,

Capital Markets Tel: (514) 940-0670 #116Email:

gmoenting@osiskogr.com |

Heather TaylorVice President,

Sustainability & Communications Tel: (514) 940-0670 #105Email:

htaylor@osiskogr.com |

CAUTIONARY

NOTE REGARDING

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press

release may be deemed "forward-looking statements" within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. Forward-looking

statements are statements other than statements of historical fact,

that address, without limitation, future events, that development

of the Project will continue in a timely manner, including the

timely delivery of a PFS, that the asset will prove to be a

long-life and low-cost copper mine, that mineral resources will

eventually convert into mineral reserves, that forecasted

production estimates will be achieved, that conditions will be met

to allow Hot Chili to exercise its buydown option and its option in

respect of the San Antonio property, that opportunities will arise

to allow Osisko to exercise its right of first offer as well as

certain other royalty financing rights, production estimates of

Osisko’s assets (including increase of production), timely

developments of mining properties over which Osisko has royalties,

streams, offtakes and investments, management’s expectations

regarding Osisko’s growth, results of operations, estimated future

revenues, production costs, carrying value of assets, ability to

continue to pay dividend, requirements for additional capital,

business prospects and opportunities future demand for and

fluctuation of prices of commodities (including outlook on gold,

silver, diamonds, other commodities) currency, markets and general

market conditions. In addition, statements and estimates (including

data in tables) relating to mineral reserves and resources and gold

equivalent ounces are forward-looking statements, as they involve

implied assessment, based on certain estimates and assumptions, and

no assurance can be given that the estimates will be realized.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

"expects", "plans", "anticipates", "believes", "intends",

"estimates", "projects", "potential", "scheduled" and similar

expressions or variations (including negative variations), or that

events or conditions "will", "would", "may", "could" or "should"

occur. Forward-looking statements are subject to known and unknown

risks, uncertainties and other factors, most of which are beyond

the control of Osisko, and actual results may accordingly differ

materially from those in forward-looking statements. Such risk

factors include, without limitation, (i) with respect to properties

in which Osisko holds a royalty, stream or other interest; risks

related to: (a) the operators of the properties, (b) timely

development, permitting, construction, commencement of production,

ramp-up (including operating and technical challenges), (c)

differences in rate and timing of production from resource

estimates or production forecasts by operators, (d) differences in

conversion rate from resources to reserves and ability to replace

resources, (e) the unfavorable outcome of any challenges or

litigation relating title, permit or license, (f) hazards and

uncertainty associated with the business of exploring, development

and mining including, but not limited to unusual or unexpected

geological and metallurgical conditions, slope failures or

cave-ins, flooding and other natural disasters or civil unrest or

other uninsured risks, (ii) with respect to other external factors:

(a) fluctuations in the prices of the commodities that drive

royalties, streams, offtakes and investments held by Osisko, (b)

fluctuations in the value of the Canadian dollar relative to the

U.S. dollar, (c) regulatory changes by national and local

governments, including permitting and licensing regimes and

taxation policies, regulations and political or economic

developments in any of the countries where properties in which

Osisko holds a royalty, stream or other interest are located or

through which they are held, (d) continued availability of capital

and financing and general economic, market or business conditions,

and (e) responses of relevant governments to infectious diseases

outbreaks and the effectiveness of such response and the potential

impact of such outbreaks on Osisko’s business, operations and

financial condition, (f) that that conditions will be met to allow

Osisko to exercise its right of first offer as well as certain

other royalty financing rights; (iii) with respect to internal

factors: (a) business opportunities that may or not become

available to, or are pursued by Osisko, (b) the integration of

acquired assets or (c) the determination of Osisko’s PFIC status.

The forward-looking statements contained in this press release are

based upon assumptions management believes to be reasonable,

including, without limitation: that Hot Chili will maintain its

development schedule in a manner consistent with past practice

achieve exploration success; the accuracy of public statements and

disclosures made by Hot Chili; no adverse development in respect of

the Project; and the absence of any other factors that could cause

actions, events or results to differ from those anticipated,

estimated or intended and the absence of significant change in

Osisko’s ongoing income and assets relating to determination of its

PFIC status; the absence of any other factors that could cause

actions, events or results to differ from those anticipated,

estimated or intended and, with respect to properties in which

Osisko holds a royalty, stream or other interest, (i) the ongoing

operation of the properties by the owners or operators of such

properties in a manner consistent with past practice and with

public disclosure (including forecast of production), (ii) the

accuracy of public statements and disclosures made by the owners or

operators of such underlying properties (including expectations for

the development of underlying properties that are not yet in

production), (iii) no adverse development in respect of any

significant property, (iv) that statements and estimates relating

to mineral reserves and resources by owners and operators are

accurate and (v) the implementation of an adequate plan for

integration of acquired assets.

For additional information on risks,

uncertainties and assumptions, please refer to the most recent

Annual Information Form of Osisko filed on SEDAR at www.sedar.com

and EDGAR at www.sec.gov which also provides additional general

assumptions in connection with these statements. Osisko cautions

that the foregoing list of risk and uncertainties is not

exhaustive. Investors and others should carefully consider the

above factors as well as the uncertainties they represent and the

risk they entail. Osisko believes that the assumptions reflected in

those forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be accurate as

actual results and prospective events could materially differ from

those anticipated such the forward looking statements and such

forward-looking statements included in this press release are not

guarantee of future performance and should not be unduly relied

upon. In this press release, Osisko relies on information

publicly disclosed by Hot Chili pertaining to its Project and the

development thereof and, therefore, assumes no liability for such

third party public disclosure. These statements speak only

as of the date of this press release. Osisko undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, other than as required by applicable law.

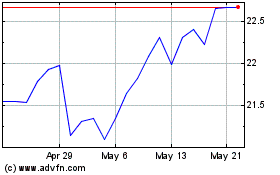

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

From Nov 2024 to Dec 2024

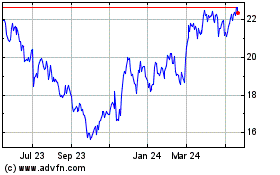

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

From Dec 2023 to Dec 2024