Pine Cliff Energy Ltd. (“

Pine Cliff” or the

“

Company”) (

TSX: PNE) is pleased

to announce the filing of its second quarter financial and

operating results. Included in the filings were Pine Cliff's

unaudited interim condensed consolidated financial statements and

related management's discussion and analysis for the three and six

months ended June 30, 2018 (the "

Q2-Report").

Selected highlights are shown below and should be read in

conjunction with the Q2-Report.

SECOND QUARTER 2018 HIGHLIGHTS

Highlights from the second quarter of 2018 are

as follows:

- produced an average of 19,557 Boe/d

(94% natural gas) in the three months ended June 30, 2018, a 7%

decrease compared to the same period of 2017, mainly related to

shut-ins for the quarter when the daily AECO reference price fell

below the Company’s internal economic threshold levels; and

- reduced bank debt by $0.5 million

during the quarter and by $5.3 million during the six months ended

June 30, 2018 to $12.7 million, the lowest Company bank debt level

since 2014. The reduction in bank debt resulted in interest expense

and bank charges, net of dividend income, of $0.41 per Boe and

$0.42 per Boe for the three and six months ended June 30, 2018,

compared to $0.49 per Boe and $0.50 per Boe for the comparable

periods in 2017.

Impact of Pine Cliff’s Diversification

Strategy

This past quarter Pine Cliff was able to realize

a natural gas price of $1.55 per Mcf, an increase of $0.37 per Mcf,

or 31% higher than the average daily AECO price of $1.18 per Mcf,

primarily due to the Company’s commodity price management

initiatives. Pine Cliff’s main operational focus in the first

quarter of 2018 was optimizing infrastructure to increase the

flexibility to move production volumes to different delivery

points. The result of that field-work is that approximately 48% of

the Company’s forecasted 2018 natural gas production is currently

being sold to non-AECO markets.

In this past quarter, Pine Cliff had negative

adjusted funds flow of $1.0 million on production of 19,557 Boe/d.

For a sense of comparison, the only other quarter in the past 25

quarters where Pine Cliff suffered negative adjusted funds flow was

Q2 of 2016, when Pine Cliff had negative adjusted funds flow of

$3.7 million. During that quarter, the average daily AECO price was

$0.21 per Mcf higher than this past quarter at $1.39 per Mcf and

Pine Cliff’s production was at 22,647 Boe/d. This comparison

highlights how impactful Pine Cliff’s Q1 infrastructure and ongoing

operational improvements have been in lowering the Company’s AECO

adjusted funds flow breakeven point down to approximately $1.27 per

Mcf.

Balance Sheet Strategy Shift

In July, Pine Cliff completed a process started

in 2016 to align the balance sheet with the Company’s longer term

business model, by replacing the existing bank debt with a tranche

of term debt due in 2022 from Alberta Investment Management

Corporation (AIMCo), the same group Pine Cliff placed term debt

with in 2016. At the same time, Pine Cliff also increased and

extended its insider debt to 2020. These moves do not alter Pine

Cliff’s overall net debt level, but they do move debt away from the

short term nature of bank debt, to more flexible longer term

debt.

Outlook

AECO gas prices have improved in Q3 from Q2, but

are still not at levels the Company believes will justify producers

drilling for dry natural gas in Western Canada. The 2018 storage

injection season is scheduled to end in three months and although

US natural gas supply continues to come on at a record pace, North

American gas storage appears to be heading into the fall at the

lowest level in 10 years. If this trend continues, Pine Cliff

expects natural gas prices should strengthen this winter when

seasonal heating demand increases to deal with colder weather while

storage levels are at a decade low.

Financial and Operating Results

| |

|

|

Three months ended June 30, |

Six months ended June 30, |

|

|

|

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

| ($000s, unless otherwise indicated) |

|

|

|

|

| Oil and gas

sales (before royalty expense) |

21,939 |

|

35,561 |

|

51,650 |

|

70,709 |

|

| Cash flow

from operating activities |

531 |

|

10,007 |

|

7,510 |

|

23,842 |

|

| Adjusted

funds flow1 |

(977 |

) |

10,834 |

|

4,160 |

|

22,067 |

|

| Per share –

Basic and Diluted ($/share)1 |

0.00 |

|

0.04 |

|

0.01 |

|

0.07 |

|

| Loss |

(17,909 |

) |

(2,118 |

) |

(33,489 |

) |

(4,654 |

) |

| Per share –

Basic and Diluted ($/share) |

(0.06 |

) |

(0.01 |

) |

(0.11 |

) |

(0.02 |

) |

| Capital

expenditures |

1,276 |

|

3,267 |

|

4,453 |

|

7,068 |

|

| Net

Debt1 |

54,737 |

|

52,562 |

|

54,737 |

|

52,562 |

|

| Production

(Boe/d) |

19,557 |

|

21,077 |

|

19,781 |

|

21,145 |

|

|

Weighted-average common shares outstanding (000s) |

|

|

|

|

| Basic and diluted |

307,076 |

|

307,076 |

|

307,076 |

|

307,076 |

|

| Combined

sales price ($/Boe) |

12.33 |

|

18.55 |

|

14.43 |

|

18.48 |

|

| Operating

netback ($/Boe)1 |

0.72 |

|

7.41 |

|

2.39 |

|

7.28 |

|

| Corporate

netback ($/Boe)1 |

(0.55 |

) |

5.65 |

|

1.16 |

|

5.78 |

|

| Operating

netback ($ per Mcfe)1 |

0.12 |

|

1.24 |

|

0.40 |

|

1.21 |

|

| Corporate netback ($ per Mcfe)1 |

(0.09 |

) |

0.94 |

|

0.19 |

|

0.96 |

|

1 This is a non-GAAP measure, see NON-GAAP Measures for

additional information.

For further information, please contact:

Philip B. Hodge – President and CEOAlan

MacDonald – Interim CFO and Corporate SecretaryTelephone: (403)

269-2289Fax: (403) 265-7488Email: info@pinecliffenergy.com

NON-GAAP Measures

This press release uses the terms “adjusted

funds flow”, “operating netbacks”, “corporate netbacks” and “net

debt” which are not recognized under International Financial

Reporting Standards (“IFRS”) and may not be

comparable to similar measures presented by other companies.

These measures should not be considered as an alternative to, or

more meaningful than, IFRS measures including earnings (loss), cash

flow from operating activities, or total liabilities. The

Company uses these measures to evaluate its performance, leverage

and liquidity. Adjusted funds flow is a non-Generally

Accepted Accounting Principles (“non-GAAP”)

measure that represents the total cash flow from operating

activities, before adjusting for changes in non-cash working

capital, and decommissioning obligations settled. Net debt is

a non-GAAP measure calculated as the sum of bank debt, subordinated

promissory notes at the principal amount, amounts due to related

party and trade and other payables less trade and other

receivables, cash, prepaid expenses and deposits and

investments. Operating netback is a non-GAAP measure

calculated as the Company’s total revenue, less operating and

transportation expenses, divided by the Boe production of the

Company. Corporate netback is a non-GAAP measure calculated

as the Company’s operating netback, less general and administrative

expenses, interest and bank charges plus finance and dividend

income, divided by the Boe production of the Company. Please

refer to the Q2-Report for additional details regarding non-GAAP

measures and their calculation.

Cautionary Statements

Certain statements contained in this news

release include statements which contain words such as

“anticipate”, “could”, “should”, “expect”, “seek”, “may”, “intend”,

“likely”, “will”, “believe” and similar expressions, statements

relating to matters that are not historical facts, and such

statements of our beliefs, intentions and expectations about

developments, results and events which will or may occur in the

future, constitute “forward-looking information” within the meaning

of applicable Canadian securities legislation and are based on

certain assumptions and analysis made by us derived from our

experience and perceptions. Forward-looking information in

this news release includes, but is not limited to: expected

production levels, expected operating cost, royalty and general

& administrative expense levels; future capital expenditures,

including the amount and nature thereof; future acquisition

opportunities including Pine Cliff’s ability to execute on those

opportunities; future drilling opportunities and Pine Cliff’s

ability to generate reserves and production from the undrilled

locations; ability to implement a dividend or buy back shares; oil

and natural gas prices and demand; expansion and other development

trends of the oil and natural gas industry; business strategy and

guidance; expansion and growth of our business and

operations; amounts drawn on Pine Cliff’s credit facility and

repayment thereof; maintenance of existing customer, supplier and

partner relationships; supply channels; accounting policies; risks;

Pine Cliff’s ability to generate cash flow from operating

activities and adjusted funds flow; and other such matters.

All such forward-looking information is based on

certain assumptions and analyses made by us in light of our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors we

believe are appropriate in the circumstances. The risks,

uncertainties and assumptions are difficult to predict and may

affect operations, and may include, without limitation: foreign

exchange fluctuations; equipment and labour shortages and

inflationary costs; general economic conditions; industry

conditions; changes in applicable environmental, taxation and other

laws and regulations as well as how such laws and regulations are

interpreted and enforced; the ability of oil and natural gas

companies to raise capital; the effect of weather conditions on

operations and facilities; the existence of operating risks;

volatility of oil and natural gas prices; oil and gas product

supply and demand; risks inherent in the ability to generate

sufficient cash flow from operations to meet current and future

obligations; increased competition; stock market volatility;

opportunities available to or pursued by us; and other factors,

many of which are beyond our control. The foregoing factors are not

exhaustive.

Actual results, performance or achievements

could differ materially from those expressed in, or implied by,

this forward-looking information and, accordingly, no assurance can

be given that any of the events anticipated by the forward-looking

information will transpire or occur, or if any of them do, what

benefits will be derived there from. Except as required by

law, Pine Cliff disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise.

Undrilled locations consist of drilling and

recompletion locations booked in the independent reserve report

dated February 12, 2018 prepared by McDaniel & Associates

Consultants Limited and unbooked drilling and recompletion

locations. Unbooked drilling and recompletion locations are

internal estimates based on evaluation of geologic, reserves and

spacing based on industry practice. There is no guarantee

that Pine Cliff will drill these locations and there is no

certainty that the drilling or completing of these locations will

result in additional reserves and production or achieve expected

internal rates of return. Pine Cliff activity depends on

availability of capital, regulatory approvals, commodity prices,

drilling costs and other factors.

Natural gas liquids and oil volumes are recorded

in barrels of oil (“Bbl”) and are converted to a

thousand cubic feet equivalent (“Mcfe”) using a

ratio of one (1) Bbl to six (6) thousand cubic feet. Natural gas

volumes recorded in thousand cubic feet (“Mcf”)

are converted to barrels of oil equivalent (“Boe”)

using the ratio of six (6) thousand cubic feet to one (1) Bbl. This

conversion ratio is based on energy equivalence primarily at the

burner tip and does not represent a value equivalency at the

wellhead. The terms Boe or Mcfe may be misleading, particularly if

used in isolation.

Given that the value ratio based on the current

price of crude oil as compared to natural gas is significantly

different from the energy equivalency of oil, utilizing a

conversion on a 6:1 basis may be misleading as an indication of

value.

The forward-looking information contained in

this news release is expressly qualified by this cautionary

statement.

The TSX does not accept responsibility for the

accuracy of this release.

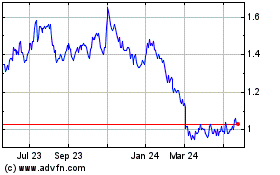

Pine Cliff Energy (TSX:PNE)

Historical Stock Chart

From Jan 2025 to Feb 2025

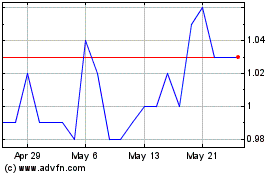

Pine Cliff Energy (TSX:PNE)

Historical Stock Chart

From Feb 2024 to Feb 2025