Perth, Western Australia/ August 21,

2024/Perseus Mining Limited (ASX/TSX: PRU) wishes to

update the estimates of the Mineral Resources and Ore Reserves at

each of its African operations as summarised in Table

1 and Table 2 below, and detailed in this

report. Highlights

-

Perseus Mining has delivered another year of organic growth from

resource definition drilling and studies, leading to new Measured

and Indicated (M&I) Mineral Resources and Proved and Probable

Ore Reserves, adding to the long-term sustainability of the Group’s

production profile.

-

The Group’s total M&I Mineral Resources at 30 June 2024 are

estimated to be 115.9 Mt grading 1.31 g/t gold,

containing 4.9 Moz of gold, compared with the estimate of 30

June 2023 of 122.8 Mt grading at 1.31 g/t Au for

5.2 Moz of gold.

-

Group Proved and Probable Ore Reserves are now estimated at

64.9 Mt at 1.39 g/t gold for 2.9 Moz, compared to

the estimate of 30 June 2023 of 73.8 Mt at 1.45 g/t gold

for 3.4 Moz of gold.

-

Inorganic growth during FY24 included the acquisition of OreCorp

Limited including its primary asset, the Nyanzaga Gold Project. In

compliance with Canadian Instrument NI 43-101 these Mineral

Resources and Ore Reserves remain treated as Foreign Estimates, not

current Perseus estimates, until further work can be

completed.

Table 1: Perseus Mining Mineral

Resources1,2,4,5

|

PROJECT |

MEASURED RESOURCES |

INDICATED RESOURCES |

MEASURED & INDICATED RESOURCES |

INFERRED RESOURCES |

|

QUANTITY |

GRADE |

GOLD |

QUANTITY |

GRADE |

GOLD |

QUANTITY |

GRADE |

GOLD |

QUANTITY |

GRADE |

GOLD |

|

Mt |

g/t gold |

‘000 oz |

Mt |

g/t gold |

‘000 oz |

Mt |

g/t gold |

‘000 oz |

Mt |

g/t gold |

‘000 oz |

|

Edikan |

13.8 |

1.03 |

457 |

37.7 |

1.05 |

1,273 |

51.5 |

1.04 |

1,731 |

6.4 |

1.5 |

317 |

|

Sissingué3 |

3.1 |

1.48 |

147 |

5.7 |

1.62 |

294 |

8.7 |

1.57 |

441 |

0.2 |

1.4 |

11 |

|

Yaouré |

5.9 |

0.78 |

146 |

49.8 |

1.60 |

2,565 |

55.6 |

1.52 |

2,711 |

17.4 |

1.7 |

926 |

|

Total |

22.8 |

1.03 |

751 |

93.2 |

1.38 |

4,132 |

115.9 |

1.31 |

4,883 |

24.1 |

1.6 |

1,254 |

Table 2: Perseus Mining Ore

Reserve1,4,5

|

PROJECT |

PROVED |

PROBABLE |

PROVED AND PROBABLE |

|

QUANTITY |

GRADE |

GOLD |

QUANTITY |

GRADE |

GOLD |

QUANTITY |

GRADE |

GOLD |

|

Mt |

g/t gold |

‘000 oz |

Mt |

g/t gold |

‘000 oz |

Mt |

g/t gold |

‘000 oz |

|

Edikan |

5.8 |

1.03 |

193 |

19.6 |

1.13 |

716 |

25.4 |

1.11 |

909 |

|

Sissingué 3 |

2.2 |

1.67 |

116 |

2.2 |

1.98 |

139 |

4.3 |

1.82 |

254 |

|

Yaouré |

5.9 |

0.78 |

146 |

29.3 |

1.68 |

1,584 |

35.2 |

1.53 |

1,730 |

|

Total |

13.8 |

1.02 |

455 |

51.1 |

1.48 |

2,438 |

64.9 |

1.39 |

2,893 |

Notes for Table 1 and Table 2:

1 Refer to Notes to

individual tables of Mineral Resources and Ore Reserves in respect

of each project presented below.

2 Mineral Resources

are inclusive of Ore Reserves.

3 Sissingué Mineral

Resources and Ore Reserves include the Fimbiasso and Bagoé Projects

in addition to the Sissingué Gold Mine.

4 The Company holds

90% of Edikan Gold Mine (EGM), 86% of Sissingué Gold Mine (SGM)

except Bagoé at 90%, and 90% of Yaouré Gold Mine (YGM).

5 Excludes

Foreign/Historical Estimates

The change in Group Ore Reserve estimate from

June 2023 to June 2024 is shown below in Figure 1.

Perseus Group Ore Reserves have been estimated at a gold price of

$1,500/oz for existing pits and $1,700/oz for some new or updated

designs. Please refer to individual tables below for details of

which price applies to individual Ore Reserves.

Figure 1: Change in Group Ore Reserves by

Project – June 2023 to June 2024

Technical Disclosure:

All Mineral Reserves and Mineral Resources were

calculated as of 30 June 2024 and have been calculated and prepared

in accordance with the standards set out in the Australasian Code

for Reporting of Exploration Results, Mineral Resources and Ore

Reserves dated December 2012 (the “JORC Code”) and in accordance

with National Instrument 43-101 of the Canadian Securities

Administrators (“NI 43-101”). The JORC Code is the accepted

reporting standard for the Australian Stock Exchange Limited

(“ASX”).

The definitions of Ore Reserves and Mineral

Resources as set forth in the JORC Code (2012) have been reconciled

to the definitions set forth in the CIM Definition Standards. If

the Mineral Reserves and Mineral Resources were estimated in

accordance with the definitions in the JORC Code, there would be no

substantive difference in such Mineral Reserves and Mineral

Resources.

Competent Person Statement:

The information in this report that relate to

Mineral Resources for the Edikan Gold Mine and the Sissingué Gold

Mine (including Bagoé but excluding Fimbiasso and the Airport West

Deposits) is based on, and fairly represents, information and

supporting documentation prepared by Matt Bampton, a Competent

Person, Director of Cube Consulting Pty Ltd and Member of the

Australian Institute of Geoscientists. Mr Bampton, has sufficient

experience, which is relevant to the style of mineralisation and

type of deposit under consideration and to the activity being

undertaken, to qualify as a Competent Person as defined in the 2012

Edition of the ‘Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves’” and to qualify as a

“Qualified Person” under National Instrument 43-101 – Standards of

Disclosure for Mineral Projects (“NI 43-101”). Matt Bampton

consents to the inclusion in the report of the matters based on his

information in the form and context in which it appears.

The information in this report that relates to

Mineral Resources for the Yaouré Gold Mine, and the Fimbiasso and

Sissingué Airport West Deposits (as part of the Sissingué Gold

Mine) is based on, and fairly represents, information and

supporting documentation prepared by Daniel Saunders, a Competent

Person who is a Fellow of The Australasian Institute of Mining and

Metallurgy. Mr Saunders is a full-time employee of Perseus Mining

Limited. Mr Saunders has sufficient experience, which is relevant

to the style of mineralisation and type of deposit under

consideration and to the activity being undertaken, to qualify as a

Competent Person as defined in the 2012 Edition of the

‘Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves’” and to qualify as a “Qualified Person”

under National Instrument 43-101 – Standards of Disclosure for

Mineral Projects (“NI 43-101”). Mr Saunders consents to the

inclusion in the report of the matters based on his information in

the form and context in which it appears.

The information in this report that relates to

Ore Reserves for Edikan Gold Mine and the Bagoé Project (as part of

the Sissingué Gold Mine) is based on information compiled by Mr

Quinton de Klerk, a Competent Person who is a Fellow of The

Australasian Institute of Mining and Metallurgy. Mr de Klerk is a

full-time employee of Cube Consulting. Mr de Klerk has sufficient

experience which is relevant to the style of mineralisation and

type of deposit under consideration and to the activities which he

is undertaking to qualify as a Competent Person as defined in the

2012 Edition of the “Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves” and a Qualified Person

as defined in NI 43-101. Mr de Klerk consents to the inclusion

in this report of the matters based on his information in the form

and context in which it appears.

The information in this report that relates to

Ore Reserves for Yaouré Gold Mine and Sissingué Gold Mine

(including Fimbiasso and Airport West) is based on information

compiled by Mr Adrian Ralph, a Competent Person who is a Fellow of

The Australasian Institute of Mining and Metallurgy. Mr Ralph is a

full-time employee of Perseus Mining Limited. Mr Ralph has

sufficient experience which is relevant to the style of

mineralisation and type of deposit under consideration and to the

activities which he is undertaking to qualify as a Competent Person

as defined in the 2012 Edition of the “Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves” and a Qualified Person as defined in NI 43-101. Mr

Ralph consents to the inclusion in this report of the matters based

on his information in the form and context in which it appears.

The Company confirms that the material

assumptions underpinning the estimates of Ore Reserves described in

“Technical Report — Edikan Gold Mine, Ghana” dated 6 April 2022,

“Technical Report — Yaouré Gold Project, Côte d’Ivoire” dated 18

December 2023, and “Technical Report — Sissingué Gold Project, Côte

d’Ivoire” dated 29 May 2015 continue to apply.

Caution Regarding Forward Looking Information:

This report contains forward-looking information

which is based on the assumptions, estimates, analysis and opinions

of management made in light of its experience and its perception of

trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be

relevant and reasonable in the circumstances at the date that such

statements are made, but which may prove to be incorrect.

Assumptions have been made by the Company regarding, among other

things: the price of gold, continuing commercial production at the

Yaouré Gold Mine, the Edikan Gold Mine and the Sissingué Gold Mine

without any major disruption, the receipt of required governmental

approvals, the accuracy of capital and operating cost estimates,

the ability of the Company to operate in a safe, efficient and

effective manner and the ability of the Company to obtain financing

as and when required and on reasonable terms. Readers are cautioned

that the foregoing list is not exhaustive of all factors and

assumptions which may have been used by the Company. Although

management believes that the assumptions made by the Company and

the expectations represented by such information are reasonable,

there can be no assurance that the forward-looking information will

prove to be accurate. Forward-looking information involves known

and unknown risks, uncertainties, and other factors which may cause

the actual results, performance or achievements of the Company to

be materially different from any anticipated future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

the actual market price of gold, the actual results of current

exploration, the actual results of future exploration, changes in

project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents.

The Company believes that the assumptions and expectations

reflected in the forward-looking information are reasonable.

Assumptions have been made regarding, among other things, the

Company’s ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of

gold, the ability of the Company to operate in a safe, efficient

and effective manner and the ability of the Company to obtain

financing as and when required and on reasonable terms. Readers

should not place undue reliance on forward-looking information.

Perseus does not undertake to update any forward-looking

information, except in accordance with applicable securities

laws.

|

ASX/TSX CODE: PRUREGISTERED

OFFICE:Level 2437 Roberts RoadSubiaco WA 6008Telephone:

+61 8 6144 1700Email: IR@perseusmining.comABN: 27

106 808 986www.perseusmining.com |

CONTACTS:Nathan RyanMedia

Relations+61 4 20 582

887nathan.ryan@nwrcommunications.com.auJeff

QuartermaineChairman &

CEOjeff.quartermaine@perseusmining.com |

- 20240821 TSX Annual Resources and Reserves

Statement_Final_with_Table_1

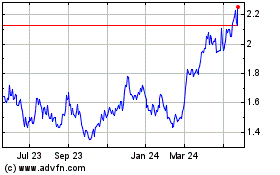

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Nov 2024 to Dec 2024

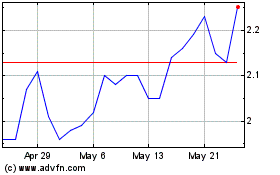

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Dec 2023 to Dec 2024