Parex Resources Inc. (“Parex” or the “Company”) (TSX:PXT), a

company headquartered in Calgary, Alberta that focuses on

sustainable, conventional oil and gas production, is pleased to

announce its unaudited financial and operating results for the

three months ended September 30, 2021 (“Third Quarter” or

“Q3”).

All amounts herein are in United States Dollars

(“USD”) unless otherwise stated.

Key Highlights

- Parex' board of directors ("Board")

approves a dividend for the fourth quarter of 2021 in the amount of

CAD$0.125 per common share, to be payable on December 31, 2021 to

shareholders of record as of December 15, 2021.

- The Board also approves a special

cash dividend in the amount of CAD$0.25 per common share, to be

payable on November 22, 2021 to shareholders of record as of

November 16, 2021.

- Funds flow provided by operations

("FFO")(1) of $1.24 per share in the third quarter, results in

year-to-date total FFO of $3.23 per share.

- Free funds flow(1) of $78.4 million

in the third quarter, results in year-to-date total free funds flow

of $250.6 million.

- Drilled a three leg multilateral

well, Cayena-1 on the Fortuna block (Parex 100% WI). The third leg

of the Cayena-1 multilateral well was drilled to a lateral length

of approximately 7,200 feet which is the longest horizontal well in

Colombia to date. This well is currently awaiting completion

work.

Q3 2021 Financial & Operational

Highlights

- Implemented a quarterly dividend

with respect to its common shares and the Board approved the

payment of a dividend of $12.0 million (CAD$0.125 per common

share), which was paid on September 29, 2021 to shareholders of

record as of September 15, 2021.

- Quarterly average production was

47,496 barrels of oil equivalent per day ("boe/d") (consisting of

6,955 barrels per day ("bbls/d") of light crude oil and medium

crude oil, 38,949 bbls/d of heavy crude oil and 9,552 thousand

cubic feet per day ("mcf/d") of conventional natural gas), which is

an 8% increase from Q2 2021 average production of 43,900 boe/d

(consisting of 5,881 bbls/d of light crude oil and medium crude

oil, 36,308 bbls/d of heavy crude oil and 10,266 mcf/d of

conventional natural gas).

- Recognized net income of $67.9

million ($0.55 (or CAD $0.69)(2) per share basic) compared to net

income of $91.7 million ($0.72 (or CAD $0.88)(2) per share basic)

in the previous quarter ended June 30, 2021 and net income of $27.6

million ($0.20 (or CAD $0.27)(2) per share basic) in Q3 2020;

- Generated an operating netback(1)

of $44.12 per barrel of oil equivalent ("boe") and FFO(1) per boe

of $35.46 from an average Brent price of $73.23 per barrel ("bbl").

With no commodity derivatives in place, Parex continues to have

100% exposure to higher oil prices;

- FFO of $152.7 million ($1.24 (or

CAD $1.56)(2) per share basic) as compared to $79.4 million ($0.57

(or CAD $0.76)(2) per share basic) for Q3 2020. FFO increased in

the current quarter due to higher Brent prices and higher

production;

- Capital expenditures were $74.3

million in the period resulting in free funds flow(1) for the three

months ended September 30, 2021 of $78.4 million;

- Utilized a portion of free funds

flow to purchase 3,644,866 of the Company's common shares for a

total cost of $58.0 million (average price of CAD$20.12/share)

pursuant to the Company's normal course issuer bid program ("NCIB")

and to pay the quarterly dividend on September 29, 2021 of

$12.0 million;

- Further reduced basic outstanding

common shares as a result of the active NCIB from 155.4 million

shares as at September 30, 2018 to 121.4 million common shares at

September 30, 2021 or a decrease of approximately 20%. Fully

diluted common shares were reduced from 162.7 million common shares

as of September 30, 2018 to 123.2 million common shares as at

September 30, 2021.

- Working capital was $349.7 million

at September 30, 2021 compared to $352.2 million at June 30,

2021 and $370.7 million at September 30, 2020. The Company

also has an undrawn syndicated bank credit facility of $200.0

million, resulting in available liquidity of $550 million; and

- Participated in drilling 15 gross

(10.60 net) wells(3) in Colombia resulting in 7 oil wells, 5 wells

under test and 3 abandoned wells, for a success rate of 70%.

(1) See "Non-GAAP Terms" for further

discussion.(2) Using USD-CAD Bank of Canada 2021 Third Quarter

average rate of 1.2600, Q2 2021 average rate of 1.2282 and Q3 2020

average rate of 1.3321. (3) Oil wells: LLA-34: Tigana Norte-34

& 57, Tigui-24 and Tigui Este-1; Cabrestero: Bacano Oeste-6

& 9, Bacano Sur-1. Wells under test: Fortuna: Perla Negra,

LLA-34: Tigana Sur-19 and Tigana-7, VIM-1: Basilea-1 and

Cabrestero: Totoro Oeste-1. Abandoned: LLA-32: Carcayu-1; Midas:

Ayombero Sur-1; LLA-34: Guerere-1.

| |

|

Three Months Ended |

Nine months ended |

|

| |

|

Sept 30, |

June 30, |

|

Sept 30, |

|

|

|

|

2021 |

|

2020 |

|

2021 |

|

2021 |

|

|

Operational |

|

|

|

|

|

| Average daily

production |

|

|

|

|

|

|

Light Crude Oil and Medium Crude Oil (bbl/d) |

|

6,955 |

|

4,626 |

|

5,881 |

|

6,985 |

|

|

Heavy Crude Oil (bbl/d) |

|

38,949 |

|

38,309 |

|

36,308 |

|

37,409 |

|

|

Crude oil (bbl/d) |

|

45,904 |

|

42,935 |

|

42,189 |

|

44,394 |

|

|

Conventional Natural Gas (mcf/d) |

|

9,552 |

|

8,220 |

|

10,266 |

|

10,008 |

|

|

Oil & Gas (boe/d)(1) |

|

47,496 |

|

44,305 |

|

43,900 |

|

46,062 |

|

| |

|

|

|

|

|

| Average daily sales of

produced oil & natural gas |

|

|

|

|

|

|

Oil (bbl/d) |

|

45,222 |

|

42,802 |

|

43,455 |

|

44,434 |

|

|

Gas (Mcf/d) |

|

9,552 |

|

8,220 |

|

10,266 |

|

10,008 |

|

|

Oil & Gas (boe/d) |

|

46,814 |

|

44,172 |

|

45,166 |

|

46,102 |

|

| |

|

|

|

|

|

| Oil inventory - end of period

(bbls) |

|

88,460 |

|

88,000 |

|

25,691 |

|

88,460 |

|

| |

|

|

|

|

|

| Operating netback

($/boe)(2) |

|

|

|

|

|

|

Reference price - Brent ($/bbl) |

|

73.23 |

|

43.34 |

|

69.08 |

|

67.97 |

|

|

Oil & natural gas revenue |

|

62.77 |

|

33.88 |

|

59.68 |

|

58.46 |

|

|

Royalties |

|

(9.67 |

) |

(2.97 |

) |

(8.69 |

) |

(8.18 |

) |

|

Net revenue |

|

53.10 |

|

30.91 |

|

50.99 |

|

50.28 |

|

|

Production expense |

|

(5.99 |

) |

(5.00 |

) |

(6.70 |

) |

(6.18 |

) |

|

Transportation expense |

|

(2.99 |

) |

(2.81 |

) |

(3.00 |

) |

(3.14 |

) |

|

Operating netback ($/boe)(2) |

|

44.12 |

|

23.10 |

|

41.29 |

|

40.96 |

|

| |

|

|

|

|

|

| Funds flow provided by

operations ($/boe)(2) |

|

35.46 |

|

19.53 |

|

32.02 |

|

32.52 |

|

| |

|

|

|

|

|

| Financial (USD$000s

except per share amounts) |

|

|

|

|

|

| Oil and natural gas

revenue |

|

272,481 |

|

146,231 |

|

247,318 |

|

741,857 |

|

| |

|

|

|

|

|

| Net

income |

|

67,942 |

|

27,619 |

|

91,662 |

|

207,064 |

|

|

Per share - basic(3) |

|

0.55 |

|

0.20 |

|

0.72 |

|

1.63 |

|

| |

|

|

|

|

|

| Funds flow provided by

operations(2) |

|

152,713 |

|

79,384 |

|

131,602 |

|

409,284 |

|

|

Per share - basic(3) |

|

1.24 |

|

0.57 |

|

1.03 |

|

3.23 |

|

| |

|

|

|

|

|

| Dividends

paid |

|

12,021 |

|

— |

|

— |

|

12,021 |

|

|

Per share - Cdn$(3) |

|

0.125 |

|

— |

|

— |

|

0.125 |

|

| |

|

|

|

|

|

| Capital

expenditures |

|

74,289 |

|

17,756 |

|

44,847 |

|

158,728 |

|

| |

|

|

|

|

|

| Free funds

flow(2) |

|

78,424 |

|

61,628 |

|

86,755 |

|

250,556 |

|

| |

|

|

|

|

|

| Working capital

surplus |

|

349,694 |

|

370,722 |

|

352,188 |

|

349,694 |

|

| Bank

debt(4) |

|

— |

|

— |

|

— |

|

— |

|

| Cash |

|

361,353 |

|

353,257 |

|

371,353 |

|

361,353 |

|

| |

|

|

|

|

|

| Outstanding shares

(000s) |

|

|

|

|

|

|

Basic (end of period) |

|

121,415 |

|

137,037 |

|

124,938 |

|

121,415 |

|

|

Weighted average basic |

|

123,184 |

|

138,303 |

|

127,346 |

|

126,724 |

|

|

Diluted (end of period)(5) |

|

123,155 |

|

140,820 |

|

126,818 |

|

123,155 |

|

(1) Reference to crude oil or natural gas

production in the above table and elsewhere in this press release

refer to the light and medium crude oil and heavy crude oil and

conventional natural gas, respectively, product types as defined in

National Instrument 51-101 - Standards of Disclosure for Oil and

Gas Activities.(2) The table above contains Non-GAAP measures. See

“Non-GAAP Terms” for further discussion. (3) Per share amounts

(with the exception of dividends) are based on weighted average

common shares. (4) Borrowing limit of $200.0 million as of

September 30, 2021. (5) Diluted shares as stated include the

effects of common shares and stock options outstanding at the

period-end. The September 30, 2021 closing stock price was

Cdn$23.04 per share.

Operational Update and Upcoming Activity

Highlights

Parex provides the update below on our ongoing

exploration and growth activities:

Production

- Current production is approximately

49,000 boe/d (consisting of approximately 6,370 bbls/d of light

crude oil and medium crude oil, 40,670 bbls/d of heavy crude oil

and 11,760 mcf/d of conventional natural gas).

Implementation of Technology in Colombia

Operations

Multilateral Drilling: Parex is utilizing

multilateral wells on the Fortuna block (Parex 100% WI) in order to

access four separate prospective zones. The multilateral wells are

expected to maximize reservoir contact, reduce costs and reduce the

surface footprint associated with single lateral drilling.

- The Cayena-1 well was initially

drilled in 2020 as a single lateral into the Galembo Formation with

a lateral length of approximately 3,000 feet. In October 2021 this

well was sidetracked for the first multilateral leg which was

drilled to a lateral length of approximately 5,700 feet and the

second multilateral leg has been drilled to a lateral length of

approximately 7,200 feet which is the longest horizontal well in

Colombia to date.

- The next three leg multilateral

well will be Cayena-2 which is expected to be drilled in Q4 2022

and it will also be targeting the Galembo Formation. This well will

be followed by Fidalga-1 targeting the Salada Formation, which will

be the first well on this block targeting this formation.

Hydraulic Stimulation: The Company recently

employed hydraulic stimulation with energized fluids on vertical

wells for well stimulation with the goal being increased fracture

complexity to improve productivity. Following the successful

pumping of the Akira-7 pilot well the crew has mobilized and is

moving to the next well in the program, Akira-12, with results from

Akira-7 expected in November 2021.

Advanced Acid Stimulation: On the Perla Negra-1

well Parex plans to apply a limited entry technique with the goal

being wider distribution of acid in the horizontal leg to improve

well productivity. The Company believes this is the first

application of the technique in Colombia

Synthetic Drilling Mud: Use of synthetic

drilling mud is expected to commence on the Capachos block (Parex

50% WI) at the Capachos Sur-3 well in December 2021 and will be an

important component of the 2022 Arauca block drilling program. The

Company believes that use of synthetic drilling mud in our other

core areas should result in significant operational

efficiencies.

Airborne Geophysics: Parex commissioned the

acquisition of a regional aero-gravity and aero-magnetics survey in

2021 and is currently processing the data.

- The survey size is in excess of

3,800 square kilometers and covers the LLA-122 area of the

foothills in Colombia.

- The aero-gravity survey utilizes

high resolution Full Tensor Gradiometry (FTG) technology which

measures the rate of change of gravity that is caused by subtle

geological density variations. When the gravity and magnetic

surveys are integrated, they provide a low-impact and

cost-effective regional assessment of the subsurface

potential.

Drilling Operations Summary

|

Block |

Parex WI |

Activity Description |

|

Arauca & LLA-38 |

50% |

Advancing social and civil activities to spud the first of the four

well program planned to begin in Q1 2022. |

|

Cabrestero |

100% |

11-12 wells expected to be drilled and on production by year-end,

which is expected to bring 2021 exit production to approximately

9,000 bbl/d and will expand the Company's pressure maintenance

strategy on the block. |

|

Capachos |

50% |

Commencing a six well program in 2022, comprised of three

development and three exploration wells, subject to partner

approval. |

|

Fortuna |

100% |

The Galembo Formation at the Cayena field is prospective for crude

oil and the Company is targeting two additional stacked hydrocarbon

bearing formations, the Olini (Perla Negra-1 test in Q4 2021) and

the Salada (Fidalga-1 drill in Q1 2022). Completion activities are

underway and we expect to test the wells in November 2021. |

|

VIM-1 |

50% |

Early production from the La Belleza discovery is expected in

November 2021 at gross rates of approximately 2,400 boe/d

(consisting of 1,400 bbls/d of light crude oil per day and 6 mmcf/d

of conventional natural gas). |

|

The Planadas-1 exploration well has been drilled to a measured

depth of approximately 13,700 feet in a Cretaceous aged crystalline

basement. The well was drilled 6.3 kilometers west of the La

Belleza-1 discovery. The well was positioned 1,425 feet down dip of

the La Belleza-1 well and 1,140 feet above the regional structural

closure in order to test the possibility of a continuous

hydrocarbon column existing across the large structural high on the

VIM-1 block. Gas shows were encountered during drilling and a

detailed logging program is currently underway to identify zones

for testing. |

|

LLA-34 |

55% |

Recent promising drilling results in the Tigui field potentially

expand the field to the north and southeast, opening up new

drilling opportunities. |

Returning Capital To Shareholders:

Special Dividend Declared & 2021 Share Buy-back 92%

Complete

The Board has approved the payment of a special

cash dividend in the amount of CAD$0.25 per common share, which

will be payable on November 22, 2021 to shareholders of record as

of November 16, 2021. This special cash dividend is designated as

an “eligible dividend” for the purpose of the Income Tax Act

(Canada).

In its press release dated July 7, 2021, the

Company announced the implementation of a regular quarterly

dividend with respect to its common shares. The Board has also

approved the payment of a dividend for the fourth quarter of 2021

in the amount of CAD$0.125 per common share, which will be payable

on December 31, 2021 to shareholders of record as of December 15,

2021. The dividend is designated as an "eligible dividend" for the

purpose of the Income Tax Act (Canada).

As of October 31, 2021, the Company has

repurchased for cancellation 11,987,879 common shares under its

NCIB which commenced on December 23, 2020, at an average cost of

CAD$21.18 per share. As of October 31, 2021, Parex had 120,972,942

basic shares outstanding. From September 15, 2017 to October 31,

2021, Parex has repurchased approximately 43.8 million shares at an

average cost of CAD$19.34 per share returning CAD$848 million to

shareholders. Parex expects to purchase the maximum allowable 12.9

million shares under the NCIB, prior to its expiry on December 22,

2021.

Parex is committed to returning capital to

shareholders and believes the decision to initiate a dividend,

Board approval of the payment of a special dividend, as well as

continuing to utilize its NCIB, demonstrates such commitment.

Third Quarter 2021 Results Conference

Call & Audio Webcast

Parex will host a conference call and webcast to

discuss the Third Quarter financial and operating results on

Thursday, November 4, 2021 beginning at 9:30 am Mountain Time. To

participate in the conference call or webcast, see details

below.

|

Toll-free dial-in number (Canada/US): |

1-800-898-3989 |

|

Local dial-in number: |

416-340-2217 |

|

International dial-in numbers: |

https://www.confsolutions.ca/ILT?oss=7P1R8008983989 |

|

Participant passcode: |

5959006# |

This news release does not constitute an

offer to sell securities, nor is it a solicitation of an offer to

buy securities, in any jurisdiction.

For more information, please

contact:Mike KruchtenSenior Vice

President, Capital Markets & Corporate PlanningParex Resources

Inc.Phone: (403) 517-1733Investor.relations@parexresources.com

NOT FOR DISTRIBUTION OF FOR

DISSEMINATION IN THE UNITED STATES

Non-GAAP Terms

The Company discloses several financial measures

("non-GAAP Measures") herein that do not have any standardized

meaning prescribed under International Financial Reporting

Standards ("IFRS"). These financial measures include operating

netback per boe, FFO, FFO per boe, FFO per share and free funds

flow. Management uses these non-GAAP measures for its own

performance measurement and to provide shareholders and investors

with additional measurements of the Company’s efficiency and its

ability to fund a portion of its future capital expenditures.

The Company considers operating netback per boe

to be a key measure as it demonstrates Parex' profitability

relative to current commodity prices. The following is a

description of each component of the Company's operating netback

per boe and how it is determined:

- Oil and natural gas sales per boe

is determined by sales revenue excluding risk management contracts

divided by total equivalent sales volume including purchased oil

volume;

- Royalties per boe is determined by

dividing royalty expense by the total equivalent sales volume and

excludes purchased oil volumes;

- Production expense per boe is

determined by dividing production expense by total equivalent sales

volume and excludes purchased oil volumes; and

- Transportation expense per boe is

determined by dividing transportation expense by the total

equivalent sales volumes including purchased oil volumes.

FFO is a non-GAAP measure that includes all cash

generated (used in) from operating activities and is calculated

before changes in non-cash working capital. In Q2 2019, the Company

changed how it presents FFO to present a more comparable basis to

industry presentation.

FFO per boe is a non-GAAP measure that includes

all cash generated (used in) from operating activities and

calculated before changes in non-cash working capital, divided by

produced oil and natural gas sales volumes.

FFO per share is determined by FFO divided by

basic shares outstanding.

Free funds flow is determined by FFO mid-point

less capital expenditures.

Shareholders and investors should be cautioned

that these measures should not be construed as an alternative to

net income or other measures of financial performance as determined

in accordance with IFRS. Parex' method of calculating these

measures may differ from other companies, and accordingly, they may

not be comparable to similar measures used by other companies.

Please see the Company's most recent Management’s Discussion and

Analysis, which is available at www.sedar.com for additional

information about these financial measures.

Oil & Gas Matters

AdvisoryThe term "Boe" means a barrel of oil equivalent on

the basis of 6 thousand cubic feet ("Mcf") of natural gas to 1 bbl.

Boe may be misleading, particularly if used in isolation. A boe

conversion ratio of 6 Mcf: 1 Bbl is based on an energy equivalency

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. Given the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different from the energy equivalency

of 6 Mcf: 1Bbl, utilizing a conversion ratio at 6 Mcf: 1 Bbl may be

misleading as an indication of value.

This press release contains a number of oil and

gas metrics, including operating netbacks. These oil and gas

metrics have been prepared by management and do not have

standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies and should not be used to make comparisons.

Such metrics have been included herein to provide readers with

additional measures to evaluate the Company's performance; however,

such measures are not reliable indicators of the future performance

of the Company and future performance may not compare to the

performance in previous periods and therefore such metrics should

not be unduly relied upon. Management uses these oil and gas

metrics for its own performance measurements and to provide

security holders with measures to compare the Company's operations

over time. Readers are cautioned that the information provided by

these metrics, or that can be derived from the metrics presented in

this news release, should not be relied upon for investment or

other purposes.

References to initial production test rates are

useful in confirming the presence of hydrocarbons; however, such

rates are not determinative of the rates at which such wells will

commence production and decline thereafter and are not indicative

of long-term performance or ultimate recovery. While encouraging,

readers are cautioned not to place reliance on such rates in

calculating the aggregate production for Parex. Parex cautions the

short-term production rates should be considered preliminary.

Dividend AdvisoryFuture

dividend payments, if any, and the level thereof is uncertain. The

Company's dividend policy and any decision to pay further dividends

on the common shares,including any special dividends, will be

subject to the discretion of the Board and may depend on a variety

of factors, including, without limitation the Company's business

performance, financial condition, financial requirements, growth

plans, expected capital requirements and other conditions existing

at such future time including, without limitation, contractual

restrictions and satisfaction of the solvency tests imposed on the

Company under applicable corporate law. The actual amount, the

declaration date, the record date and the payment date of any

dividend are subject to the discretion of the Board. There can be

no assurance that dividends will be paid at the intended rate or at

any rate in the future.

Advisory on Forward Looking

StatementsCertain information regarding Parex set forth in

this document contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", “prospective”, "project",

"intend", "believe", "should", "anticipate", "estimate",

“forecast”, "guidance", “budget” or other similar words, or

statements that certain events or conditions "may" or "will" occur

are intended to identify forward-looking statements. Such

statements represent Parex' internal projections, estimates or

beliefs concerning, among other things, future growth, results of

operations, production, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These

statements are only predictions and actual events or results may

differ materially. Although the Company’s management believes that

the expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee future results, levels of activity,

performance or achievement since such expectations are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could

cause Parex' actual results to differ materially from those

expressed or implied in any forward-looking statements made by, or

on behalf of, Parex.

In particular, forward-looking statements

contained in this document include, but are not limited to,

statements with respect to the Company’s focus, plans, priorities

and strategies; statements with respect to operational activities

including the target lateral lengths to be achieved, the

anticipated timing of drilling programs and targeted formations,

expected timing to commence the use of synthetic drilling mud and

its importance in the 2022 Arauca and other projects, timing to

have wells on production and the benefits to be derived therefrom

and timing of certain drilling and completion activities; targeted

hydrocarbon bearing formations and the ability to maximize

recovery; new drilling opportunities; timing of upcoming planned

drilling operations; terms of the dividends payable on November 22,

2021 and December 31, 2021; Parex' dividend; expectation that Parex

will purchase the maximum allowable shares under its NCIB; and

anticipated timing for quarterly conference call and webcast.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Canada and Colombia;

prolonged volatility in commodity prices; industry conditions

including changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced in Canada and Colombia; impact of the

COVID-19 pandemic and the ability of the Company to carry on its

operations as currently contemplated in light of the COVID-19

pandemic; determinations by OPEC and other countries as to

production levels; competition; lack of availability of qualified

personnel; the results of exploration and development drilling and

related activities; obtaining required approvals of regulatory

authorities in Canada and Colombia; risks associated with

negotiating with foreign governments as well as country risk

associated with conducting international activities; volatility in

market prices for oil; fluctuations in foreign exchange or interest

rates; environmental risks; changes in income tax laws or changes

in tax laws and incentive programs relating to the oil industry;

changes to pipeline capacity; ability to access sufficient capital

from internal and external sources; failure of counterparties to

perform under contracts; risk that Brent oil prices are lower than

anticipated; risk that Parex' evaluation of its existing portfolio

of development and exploration opportunities is not consistent with

its expectations; risk that initial test results are not indicative

of future performance; risk that other formations do not contain

the expected oil bearing sands; risk that Parex does not have

sufficient financial resources in the future to pay a dividend;

risk that the Board does not declare dividends in the future or

that Parex' dividend policy changes; and other factors, many of

which are beyond the control of the Company. Readers are cautioned

that the foregoing list of factors is not exhaustive. Additional

information on these and other factors that could affect Parex'

operations and financial results are included in reports on file

with Canadian securities regulatory authorities and may be accessed

through the SEDAR website (www.sedar.com).

Although the forward-looking statements

contained in this document are based upon assumptions which

Management believes to be reasonable, the Company cannot assure

investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking

statements contained in this document, Parex has made assumptions

regarding, among other things: current and anticipated commodity

prices and royalty regimes; the impact (and the duration thereof)

that COVID-19 pandemic will have on the demand for crude oil and

natural gas, Parex’ supply chain and Parex’ ability to produce,

transport and sell Parex’ crude oil and natural; gas; availability

of skilled labour; timing and amount of capital expenditures;

future exchange rates; the price of oil, including the anticipated

Brent oil price; the impact of increasing competition; conditions

in general economic and financial markets; availability of drilling

and related equipment; effects of regulation by governmental

agencies; receipt of partner, regulatory and community approvals;

royalty rates; future operating costs; uninterrupted access to

areas of Parex' operations and infrastructure; recoverability of

reserves and future production rates; the status of litigation;

timing of drilling and completion of wells; on-stream timing of

production from successful exploration wells; operational

performance of non-operated producing fields; pipeline capacity;

that Parex will have sufficient cash flow, debt or equity sources

or other financial resources required to fund its capital and

operating expenditures and requirements as needed; that Parex'

conduct and results of operations will be consistent with its

expectations; that Parex will have the ability to develop its oil

and gas properties in the manner currently contemplated; that

Parex' evaluation of its existing portfolio of development and

exploration opportunities is consistent with its expectations;

current or, where applicable, proposed industry conditions, laws

and regulations will continue in effect or as anticipated as

described herein; that the estimates of Parex' production and

reserves volumes and the assumptions related thereto (including

commodity prices and development costs) are accurate in all

material respects; that Parex will be able to obtain contract

extensions or fulfill the contractual obligations required to

retain its rights to explore, develop and exploit any of its

undeveloped properties; that Parex will have sufficient financial

resources to pay dividends in the future; and other matters.

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this document in order to provide shareholders with a

more complete perspective on Parex' current and future operations

and such information may not be appropriate for other purposes.

Parex' actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this document and Parex disclaims any intent

or obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

PDF

available: http://ml.globenewswire.com/Resource/Download/5e20c01d-287f-4f31-b16f-1366edbc1713

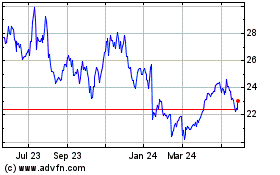

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2024 to Jan 2025

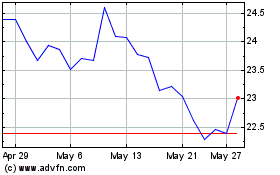

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2024 to Jan 2025