TSX: SHLE

Source Energy Services Ltd. (“Source” or the “Company”) is

pleased to announce its financial results for the three and nine

months ended September 30, 2024.

Q3 2024 PERFORMANCE

HIGHLIGHTS

Key achievements for the quarter ended September

30, 2024 include the following:

- recorded sand sales

volumes of 963,539 metric tonnes (“MT”) and sand revenue of $142.2

million, an increase of $40.1 million from the third quarter of

2023, representing the highest quarterly sand volumes and revenue

achieved to date;

- generated total

revenue of $183.1 million, a $58.4 million increase from the third

quarter last year;

- realized gross

margin of $33.7 million and Adjusted Gross Margin(1) of $43.3

million, increases of 34% and 41%, respectively, when compared to

the same period of 2023;

- reported net income

of $10.2 million, an increase of $6.4 million compared to the third

quarter last year;

- realized Adjusted

EBITDA(1) of $35.3 million, a 55% increase from the same period of

2023;

- announced a

partnership with Trican Well Service Ltd. (“Trican”) to construct a

unit train capable terminal facility located in Taylor, British

Columbia;

- closed an

acquisition of additional sand trucking assets, enhancing the

existing trucking fleet and further strengthening Source’s well

site solutions platform;

- completed

construction of Source’s tenth Sahara unit, now deployed and

operating on the North Slope in Alaska; and

- delivered record

sand volumes for the third consecutive quarter to our customer well

sites through last mile logistics, and achieved utilization of 83%

across the ten-unit Sahara fleet, compared to 79% utilization for

the third quarter of 2023.

Note:(1)

Adjusted Gross Margin (including on a per MT basis) and Adjusted

EBITDA are not defined under IFRS and might not be comparable to

similar financial measures disclosed by other issuers, refer to

‘Non-IFRS Measures’ below for reconciliations to measures

recognized by IFRS. For additional information, please refer to

Source’s Management’s Discussion and Analysis (“MD&A”), dated

November 6, 2024, available online at www.sedarplus.ca.

RESULTS OVERVIEW

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

|

($000’s, except MT and per unit amounts) |

2024 |

2023 |

2024 |

2023 |

|

|

Sand volumes (MT)(1) |

963,539 |

709,826 |

2,759,536 |

2,319,388 |

|

| |

|

|

|

|

|

| Sand

revenue |

142,236 |

102,180 |

415,286 |

335,885 |

|

| Well

site solutions |

39,908 |

21,725 |

110,988 |

76,332 |

|

|

Terminal services |

906 |

759 |

2,700 |

3,099 |

|

|

Sales |

183,050 |

124,664 |

528,974 |

415,316 |

|

| Cost

of sales |

139,768 |

93,876 |

400,364 |

316,567 |

|

|

Cost of sales – depreciation |

9,613 |

5,746 |

26,662 |

17,040 |

|

|

Cost of sales |

149,381 |

99,622 |

427,026 |

333,607 |

|

|

Gross margin |

33,669 |

25,042 |

101,948 |

81,709 |

|

|

Operating expense |

6,493 |

5,306 |

18,862 |

17,206 |

|

|

General & administrative expense |

3,518 |

3,119 |

14,719 |

11,252 |

|

|

Depreciation |

4,753 |

2,174 |

13,252 |

7,998 |

|

|

Income from operations |

18,905 |

14,443 |

55,115 |

45,253 |

|

|

Total other expense |

6,522 |

10,711 |

31,001 |

30,908 |

|

|

Income before income taxes |

12,383 |

3,732 |

24,114 |

14,345 |

|

|

Current tax expense |

812 |

— |

4,550 |

— |

|

|

Deferred tax expense |

1,416 |

— |

2,831 |

— |

|

|

Net income(2) |

10,155 |

3,732 |

16,733 |

14,345 |

|

|

Net earnings per share ($/share) |

0.75 |

0.28 |

1.24 |

1.06 |

|

|

Diluted net earnings per share ($/share) |

0.74 |

0.28 |

1.24 |

1.06 |

|

|

Adjusted EBITDA(3) |

35,341 |

22,735 |

98,160 |

70,793 |

|

|

Sand revenue sales/MT |

147.62 |

143.95 |

150.49 |

144.82 |

|

|

Gross margin/MT |

34.94 |

35.28 |

36.94 |

35.23 |

|

|

Adjusted Gross Margin(3) |

43,282 |

30,788 |

128,610 |

98,749 |

|

|

Adjusted Gross Margin/MT(3) |

44.92 |

43.37 |

46.61 |

42.58 |

|

Notes:(1) One

MT is approximately equal to 1.102 short tons. (2) The average

Canadian to United States (“US”) dollar exchange rate for the three

and nine months ended September 30, 2024, was $0.7331 and $0.7351,

respectively (2023 - $0.7457 and $0.7432, respectively).(3)

Adjusted EBITDA and Adjusted Gross Margin (including on a per MT

basis) are not defined under IFRS, refer to ‘Non-IFRS Measures’

below for reconciliations to measures recognized by IFRS. For

additional information, please refer to Source’s MD&A available

online at www.sedarplus.ca.

THIRD QUARTER 2024 RESULTS

Source achieved record total revenue for the

three months ended September 30, 2024, a $58.4 million or 47%

increase compared to the third quarter last year. Strong customer

activity levels in the Western Canadian Sedimentary Basin (“WCSB”),

including new customers, contributed to the increase in sand sales

volumes. The customer additions and strong activity levels also led

to a third consecutive quarter of record volumes delivered for

“last mile” logistics during the period. Utilization for Sahara

units in both Canada and the US was strong, and included the

commencement of operations for the newly constructed unit delivered

to Alaska during the third quarter.

Cost of sales, excluding depreciation, was

$139.8 million compared to $93.9 million for the third quarter of

2023. The quarter-over-quarter increase of $45.9 million is

primarily attributed to the higher sand sales volumes, as well as

increased transportation costs resulting from the record volumes

hauled by “last mile” logistics. Cost of sales, excluding

depreciation, was negatively impacted by an increase in rail

transportation costs, but this was largely offset by a favorable

shift in terminal mix. A weakening of the Canadian dollar increased

cost of sales denominated in US dollars by $2.08 per MT, compared

to the third quarter of 2023, which was partially offset by the

movement in exchange rates on revenue denominated in US dollars for

the quarter.

For the three months ended September 30, 2024,

gross margin increased by $8.6 million, or 34% compared to the same

period in 2023. Excluding gross margin from mine gate volumes,

Adjusted Gross Margin was $45.89 per MT compared to $46.60 per MT

for the third quarter of last year. Adjusted Gross Margin benefited

from increased sand volumes trucked and cost savings generated by

trucking assets acquired this year, compared to the third quarter

of 2023. These improvements were offset by the impact of product

mix, as well as the prolonged heat experienced early in the third

quarter which impacted rail transportation and resulted in

increased trucking costs. The weakening of the Canadian dollar

negatively impacted Adjusted Gross Margin by $0.92 per MT for the

quarter, compared to the same period last year.

Operating expenses increased by $1.2 million for

the third quarter of 2024, due primarily to increased compensation

expenses and royalty costs attributed to the higher sand sales

volumes realized. General and administrative expense increased by

$0.4 million for the third quarter, largely the result of higher

professional fees for legal expenses and IT costs compared to the

same period last year.

Adjusted EBITDA increased by 55%, or $12.6

million, to $35.3 million for the three months ended September 30,

2024, attributed primarily to record sand sales volumes and well

site solutions performance, and incremental benefit from trucking

assets acquired during the year. Adjusted EBITDA also benefited

from the commencement of the lease for Source’s tenth Sahara unit,

operating on the North Slope in Alaska. The weakening of the

Canadian dollar favorably impacted Adjusted EBITDA by $0.1 million

for the third quarter, attributed to the movement in exchange rates

on the settlement of working capital.

Taylor Facility

On July 25, 2024, Source announced the execution

of a partnership arrangement with Trican to construct a new

terminal facility located in Taylor, British Columbia. Construction

of the facility has commenced, and will result in a unit train

capable terminal which will accommodate approximately 55,000 MT of

sand storage and more than 12,000 MT of daily sand throughput

capacity (the “Taylor Facility”). The first phase of the project is

expected to be operational late this year, with completion of the

Taylor Facility expected in early 2025.

Under the terms of the arrangement, Trican will

advance funding for construction on a cost-to-complete basis in

exchange for transloading and sand supply services, as well as a

fee payable to Trican on each advance drawn, repayable through

transloading credits at the Taylor Facility and optional cash

payments over a three-year term.

Acquisition of Sand Trucking

Assets

On August 19, 2024, Source completed the

acquisition of the sand trucking assets of PVT Group Ltd., PVT

Energy Group Inc., and PVT Transport Group Inc., a transportation

and logistics company located in northwestern Alberta, for an

aggregate purchase price of $2.2 million. The purchase price was

comprised of $0.4 million paid in cash upon closing and a

promissory note payable over a nine-month term. The acquisition

complements the sand trucking acquisition completed earlier this

year and further enhances Source’s mine to well site offering in

the WCSB.

Liquidity and Capital Resources

|

Free Cash Flow |

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

($000’s) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Adjusted EBITDA(1) |

35,341 |

|

22,735 |

|

98,160 |

|

70,793 |

|

|

Financing expense paid |

(6,655 |

) |

(7,001 |

) |

(20,092 |

) |

(21,845 |

) |

|

Capital expenditures, net of proceeds on disposal of property,

plant and equipment and reimbursement of capital costs(2) |

(3,277 |

) |

(3,585 |

) |

(13,536 |

) |

(6,373 |

) |

|

Payment of lease obligations |

(5,328 |

) |

(4,758 |

) |

(15,434 |

) |

(14,504 |

) |

|

Free Cash Flow(1) |

20,081 |

|

7,391 |

|

49,098 |

|

28,071 |

|

Notes:(1)

Adjusted EBITDA and Free Cash Flow are not defined under IFRS and

might not be comparable to similar financial measures disclosed by

other issuers, refer to ‘Non-IFRS Measures’ below. The

reconciliation to the comparable IFRS measure can be found in the

table below. (2) Excludes capital expenditures for the Taylor

Facility.

Source realized an increase in Free Cash Flow of

$12.7 million for the three months ended September 30, 2024

compared to the third quarter of 2023, primarily due to the

increase in Adjusted EBITDA. Lower financing expense paid,

including a $0.6 million reduction in interest for the senior

secured notes, and lower net expenditures for capital assets, as

outlined below, also contributed to the improvement in Free Cash

Flow. Higher payments for lease obligations, attributed to

additional equipment and leases for certain sand trucking assets

acquired, partially offset the increase in Free Cash Flow for the

third quarter. On a year-to-date basis, the $21.0 million increase

in Free Cash Flow is attributed to higher Adjusted EBITDA and lower

financing expense, as noted above, partly offset by increased net

capital expenditures, as described below, and higher payments for

lease obligations.

Source’s capital expenditures, net of proceeds

on disposals and reimbursements, totaled $6.0 million for the third

quarter of 2024, an increase of $2.4 million compared to the third

quarter last year. The increase was primarily due to the

commencement of construction for the Taylor Facility, as outlined

above. Higher expenditures for the terminals, including costs

incurred for the rail expansion project at the Chetwynd terminal

facility and expenditures for heavy equipment, also contributed to

the quarter-over-quarter increase. Lower capital expenditures for

mining and production facilities offset the increase in costs

associated with overburden removal for mining operations. During

the third quarter, construction on Source’s tenth Sahara unit was

completed, and the unit was shipped to Alaska for mobilization in

the field. Construction costs associated with building Source’s

eleventh Sahara unit continued, with all expenditures incurred

recovered during the quarter.

For the nine months ended September 30, 2024,

net capital expenditures increased by $9.9 million compared to the

same period last year, primarily attributed to the rail project

completed at the Chetwynd terminal facility, the commencement of

construction at the Taylor Facility and the purchase of sand

trucking assets and higher amounts incurred for the removal of

overburden. In 2023, Source sold its previously closed Berthold

terminal facility, as well as excess rail cars and production

equipment, during the period.

The Company is currently working on financing

alternatives to address the maturity and obligations under the

Credit Facility and the Notes which are expected to be completed

during the fourth quarter.

BUSINESS OUTLOOK

With construction of the Taylor Facility,

expected to be completed early next year, and the completion of the

rail project at the Chetwynd terminal facility, Source is

strategically positioned in northeastern British Columbia to

accommodate increased demand for mine to well site services as LNG

Canada comes online. These Source projects, combined with the sand

trucking asset acquisitions completed during the year, Source’s

existing terminal network footprint and its Wisconsin and Peace

River production facilities will create additional opportunities

for Source to continue to grow its business and take advantage of

activity levels in the WCSB, expected to remain strong to the end

of the year and through 2025.

In the longer-term, Source believes the

increased demand for natural gas, driven by liquefied natural gas

exports, increased natural gas pipeline export capabilities and

power generation facilities, will drive incremental demand for

Source’s services in the WCSB. Source continues to see increased

demand from customers that are primarily focused on the development

of natural gas properties in the Montney, Duvernay and Deep Basin.

This trend is consistent with Source’s view that natural gas will

be an important transitional fuel that is critical for the

successful movement to a less carbon-intensive world.

Source continues to focus on increasing its

involvement in the provision of logistics services for other items

needed at the well site in response to customer requests to expand

its service offerings and to further utilize its existing Western

Canadian terminals to provide additional services.

THIRD QUARTER CONFERENCE CALL

A conference call to discuss Source’s third

quarter financial results has been scheduled for 7:30 am MST (9:30

am ET) on Thursday, November 7, 2024.

Interested analysts, investors and media

representatives are invited to register to participate in the call.

Once you are registered, a dial-in number and passcode will be

provided to you via email. The link to register for the call is on

the Upcoming Events page of our website and as

follows:

Source Energy Services Q3 2024 Results

Call

The call will be recorded and available for

playback approximately 2 hours after the meeting end time, until

December 7, 2024, using the following dial-in:

Toll-Free Playback Number: 1-855-669-9658

Playback Passcode: 9685809

ABOUT SOURCE ENERGY

SERVICES

Source is a company that focuses on the

integrated production and distribution of frac sand, as well as the

distribution of other bulk completion materials not produced by

Source. Source provides its customers with an end-to-end solution

for frac sand supported by its Wisconsin and Peace River mines and

processing facilities, its Western Canadian terminal network and

its “last mile” logistics capabilities, including its trucking

operations, and Sahara, a proprietary well site mobile sand storage

and handling system.

Source’s full-service approach allows customers

to rely on its logistics platform to increase reliability of supply

and to ensure the timely delivery of frac sand and other bulk

completion materials at the well site.

IMPORTANT INFORMATION

These results should be read in conjunction with

Source’s unaudited interim condensed consolidated financial

statements for the three and nine months ended September 30, 2024

and 2023 and the audited consolidated financial statements for the

years ended December 31, 2023 and 2022, together with the

accompanying notes (the “Financial Statements”) and its

corresponding MD&A for such periods. The Financial Statements

and MD&A and other information relating to Source, including

the Annual Information Form, are available under the Company’s

SEDAR+ profile at www.sedarplus.ca. The Financial Statements and

comparative statements have been prepared in accordance with

International Financial Reporting Standards (“IFRS”) as issued by

the International Accounting Standards Board. Unless otherwise

stated, all amounts are expressed in Canadian dollars.

NON-IFRS MEASURES

In this press release Source has used the terms

Free Cash Flow, Adjusted Gross Margin and Adjusted EBITDA,

including per MT, which do not have standardized meanings

prescribed by IFRS and Source’s method of calculating these

measures may differ from the method used by other entities and,

accordingly, they may not be comparable to similar measures

presented by other companies. These financial measures should not

be considered as an alternative to, or more meaningful than, net

income (loss) and gross margin, respectively, which represent the

most directly comparable measures of financial performance as

determined in accordance with IFRS.

Reconciliation of Adjusted EBITDA and

Free Cash Flow to Net Income

| |

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

($000’s) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net income |

10,155 |

|

3,732 |

|

16,733 |

|

14,345 |

|

|

Add: |

|

|

|

|

|

Income taxes |

2,228 |

|

— |

|

7,381 |

|

— |

|

|

Interest expense |

6,281 |

|

6,117 |

|

18,848 |

|

19,794 |

|

| Cost

of sales – depreciation |

9,613 |

|

5,746 |

|

26,662 |

|

17,040 |

|

|

Depreciation |

4,753 |

|

2,174 |

|

13,252 |

|

7,998 |

|

|

(Gain) loss on debt extinguishment |

— |

|

(280 |

) |

164 |

|

(280 |

) |

|

Finance expense (excluding interest expense) |

1,936 |

|

2,660 |

|

6,718 |

|

7,473 |

|

|

Share-based compensation expense |

1,016 |

|

1,567 |

|

9,325 |

|

5,038 |

|

|

(Gain) loss on asset disposal |

(862 |

) |

356 |

|

(2,840 |

) |

(1,776 |

) |

| Loss

on sublease |

— |

|

— |

|

638 |

|

3 |

|

|

Other expense(1) |

221 |

|

663 |

|

1,279 |

|

1,158 |

|

|

Adjusted EBITDA |

35,341 |

|

22,735 |

|

98,160 |

|

70,793 |

|

|

Financing expense paid |

(6,655 |

) |

(7,001 |

) |

(20,092 |

) |

(21,845 |

) |

|

Capital expenditures, net of proceeds on disposal of property,

plant and equipment and reimbursement of capital costs(2) |

(3,277 |

) |

(3,585 |

) |

(13,536 |

) |

(6,373 |

) |

|

Payment of lease obligations |

(5,328 |

) |

(4,758 |

) |

(15,434 |

) |

(14,504 |

) |

|

Free Cash Flow |

20,081 |

|

7,391 |

|

49,098 |

|

28,071 |

|

Notes: (1)

Includes expenses related to the incident at the Fox Creek terminal

facility, costs and reimbursements under insurance claims and other

one-time expenses.(2) Excludes capital expenditures for the Taylor

Facility.

Reconciliation of Gross Margin to Adjusted Gross

Margin

| |

Three months ended September 30, |

Nine months ended September 30, |

|

|

($000’s) |

2024 |

2023 |

2024 |

2023 |

|

|

Gross margin |

33,669 |

25,042 |

101,948 |

81,709 |

|

|

Cost of sales – depreciation |

9,613 |

5,746 |

26,662 |

17,040 |

|

|

Adjusted Gross Margin |

43,282 |

30,788 |

128,610 |

98,749 |

|

For additional information regarding non-IFRS

measures, including their use to management and investors, their

composition and discussion of changes to either their composition

or label, if any, please refer to the ‘Non-IFRS Measures’ section

of the MD&A, which is incorporated herein by reference.

Source’s MD&A is available online at www.sedarplus.ca and

through Source’s website at www.sourceenergyservices.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press

release constitute forward-looking statements relating to, without

limitation, expectations, intentions, plans and beliefs, including

information as to the future events, results of operations and

Source’s future performance (both operational and financial) and

business prospects. In certain cases, forward-looking statements

can be identified by the use of words such as “expects”,

“believes”, “continues”, “focus”, “trend”, or variations of such

words and phrases, or state that certain actions, events or results

“may” or “will” be taken, occur or be achieved. Such

forward-looking statements reflect Source’s beliefs, estimates and

opinions regarding its future growth, results of operations, future

performance (both operational and financial), and business

prospects and opportunities at the time such statements are made,

and Source undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or

circumstances should change unless required by applicable law.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions made by Source that are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Forward-looking

statements are not guarantees of future performance.

In particular, this press release contains

forward-looking statements pertaining, but not limited to:

expectations that WCSB and E&P activity levels will remain

strong through the balance of the year, particularly in

northeastern British Columbia with the expectation that LNG Canada

will come online; expectations regarding the partnership

arrangement with Trican Well Service Ltd. to construct the Taylor

Facility and the sand storage and daily sand throughput capacity;

expectations that the first phase of the project will be

operational late this year and completion of the Taylor Facility in

early 2025; management’s continued assessment respecting Source’s

equipment and other assets required to service Source’s operations;

increased demand for mine to well site services with the completion

of the rail project at the Chetwynd terminal facility; expectations

regarding the sand trucking asset acquisitions completed during the

year; Source’s terminal network footprint and its Wisconsin and

Peace River production facilities; the expectation that Source will

continue to grow its business through the balance of the year;

improvement of Source’s production efficiencies; strong operational

performance for 2024 through the strengthening of Source’s leading

service offerings and logistic capabilities; expectations that

increased demand for natural gas, increased natural gas pipeline

export capabilities and liquefied natural gas exports will drive

incremental demand for Source’s services in the WCSB; continued

increase in demand from customers primarily focused on the

development of natural gas properties in Montney, Duvernay and Deep

Basin; views that natural gas is an important transitional fuel for

the successful movement to a less carbon-intensive world; Source’s

focus on and expectations regarding increasing its involvement in

the provision of logistics services for other well site items; the

benefits of Source’s existing Western Canadian terminals to provide

additional services to customers; the benefits that Source’s “last

mile” services provide to customers; expectations respecting future

conditions; and profitability.

By their nature, forward-looking statements

involve numerous current assumptions, known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Source to differ materially from

those anticipated by Source and described in the forward-looking

statements.

With respect to the forward-looking statements

contained in this press release, assumptions have been made

regarding, among other things: proppant market prices; future oil,

natural gas and liquefied natural gas prices; future global

economic and financial conditions; future commodity prices, demand

for oil and gas and the product mix of such demand; levels of

activity in the oil and gas industry in the areas in which Source

operates; the continued availability of timely and safe

transportation for Source’s products, including without limitation,

Source’s rail car fleet and the accessibility of additional

transportation by rail and truck; the maintenance of Source’s key

customers and the financial strength of its key customers; the

maintenance of Source’s significant contracts or their replacement

with new contracts on substantially similar terms and that

contractual counterparties will comply with current contractual

terms; operating costs; that the regulatory environment in which

Source operates will be maintained in the manner currently

anticipated by Source; future exchange and interest rates;

geological and engineering estimates in respect of Source’s

resources; the recoverability of Source’s resources; the accuracy

and veracity of information and projections sourced from third

parties respecting, among other things, future industry conditions

and product demand; demand for horizontal drilling and hydraulic

fracturing and the maintenance of current techniques and

procedures, particularly with respect to the use of proppants;

Source’s ability to obtain qualified staff and equipment in a

timely and cost-efficient manner; the regulatory framework

governing royalties, taxes and environmental matters in the

jurisdictions in which Source conducts its business and any other

jurisdictions in which Source may conduct its business in the

future; future capital expenditures to be made by Source; future

sources of funding for Source’s capital program; Source’s future

debt levels; the impact of competition on Source; and Source’s

ability to obtain financing on acceptable terms.

A number of factors, risks and uncertainties

could cause results to differ materially from those anticipated and

described herein including, among others: the effects of

competition and pricing pressures; risks inherent in key customer

dependence; effects of fluctuations in the price of proppants;

risks related to indebtedness and liquidity, including Source’s

leverage, restrictive covenants in Source’s debt instruments and

Source’s capital requirements; risks related to interest rate

fluctuations and foreign exchange rate fluctuations; changes in

general economic, financial, market and business conditions in the

markets in which Source operates; changes in the technologies used

to drill for and produce oil and natural gas; Source’s ability to

obtain, maintain and renew required permits, licenses and approvals

from regulatory authorities; the stringent requirements of and

potential changes to applicable legislation, regulations and

standards; the ability of Source to comply with unexpected costs of

government regulations; liabilities resulting from Source’s

operations; the results of litigation or regulatory proceedings

that may be brought by or against Source; the ability of Source to

successfully bid on new contracts and the loss of significant

contracts; uninsured and underinsured losses; risks related to the

transportation of Source’s products, including potential rail line

interruptions or a reduction in rail car availability; the

geographic and customer concentration of Source; the impact of

extreme weather patterns and natural disasters; the impact of

climate change risk; the ability of Source to retain and attract

qualified management and staff in the markets in which Source

operates; labor disputes and work stoppages and risks related to

employee health and safety; general risks associated with the oil

and natural gas industry, loss of markets, consumer and business

spending and borrowing trends; limited, unfavorable, or a lack of

access to capital markets; uncertainties inherent in estimating

quantities of mineral resources; sand processing problems;

implementation of recently issued accounting standards; the use and

suitability of Source’s accounting estimates and judgments; the

impact of information systems and cyber security breaches; the

impact of inflation on capital expenditures; and risks and

uncertainties related to pandemics such as COVID-19, including

changes in energy demand.

Although Source has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in the

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking statements

will materialize or prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. The forward-looking statements contained in this

press release are expressly qualified by this cautionary statement.

Readers should not place undue reliance on forward-looking

statements. These statements speak only as of the date of this

press release. Except as may be required by law, Source expressly

disclaims any intention or obligation to revise or update any

forward-looking statements or information whether as a result of

new information, future events or otherwise.

Any financial outlook and future-oriented

financial information contained in this press release regarding

prospective financial performance, financial position or cash flows

is based on assumptions about future events, including economic

conditions and proposed courses of action based on management’s

assessment of the relevant information that is currently available.

Projected operational information contains forward-looking

information and is based on a number of material assumptions and

factors, as are set out above. These projections may also be

considered to contain future oriented financial information or a

financial outlook. The actual results of Source’s operations for

any period will likely vary from the amounts set forth in these

projections and such variations may be material. Actual results

will vary from projected results. Readers are cautioned that any

such financial outlook and future-oriented financial information

contained herein should not be used for purposes other than those

for which it is disclosed herein. The forward-looking information

and statements contained in this document speak only as of the date

hereof and have been approved by the Company’s management as at the

date hereof. The Company does not assume any obligation to publicly

update or revise them to reflect new events or circumstances,

except as may be required pursuant to applicable laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Scott MelbournChief Executive Officer(403) 262-1312

investorrelations@sourceenergyservices.com

Derren NewellChief Financial Officer(403) 262-1312

investorrelations@sourceenergyservices.com

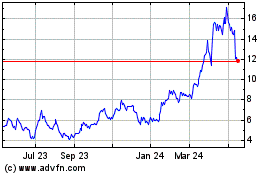

Source Energy Services (TSX:SHLE)

Historical Stock Chart

From Nov 2024 to Dec 2024

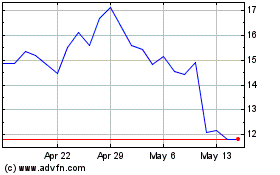

Source Energy Services (TSX:SHLE)

Historical Stock Chart

From Dec 2023 to Dec 2024