Third-Quarter Revenue Grows 96% on GMV Growth

of 109% Year on Year

Shopify reports in U.S. dollars and in

accordance with U.S. GAAP

Shopify Inc. (NYSE:SHOP)(TSX:SHOP), a leading global commerce

company, announced today strong financial results for the third

quarter ended September 30, 2020.

“The accelerated shift to digital commerce triggered by COVID-19

is continuing, as more consumers shop online and entrepreneurs step

up to meet demand,” said Harley Finkelstein, Shopify’s President.

“Entrepreneurs will be the force in rebuilding economies all over

the world, which makes it even more important for Shopify to

innovate and build the critical tools that merchants need to

succeed in a low-touch retail environment.”

“Shopify’s tremendous third-quarter results reflect the

resilience and entrepreneurial spirit of our merchants,” said Amy

Shapero, Shopify’s CFO. “More entrepreneurs are signing on to

Shopify so they can quickly and easily put their ideas into action.

We continue to evolve our global commerce operating system to make

it easier for merchants to get online and start selling, get

discovered, and get their goods to buyers, while providing a

delightful shopping experience.”

Third-Quarter Financial Highlights

- Total revenue in the third quarter was $767.4 million, a 96%

increase from the comparable quarter in 2019.

- Subscription Solutions revenue was $245.3 million, up 48% year

over year, primarily due to more merchants joining the

platform.

- Merchant Solutions revenue growth increased 132%, to $522.1

million, driven primarily by the growth of Gross Merchandise

Volume1 ("GMV").

- Monthly Recurring Revenue2 ("MRR") as of September 30, 2020 was

$74.4 million. Growth accelerated to 47% year-over-year with MRR up

from $50.7 million as of September 30, 2019 as merchants from both

the 90-day free trial (offered from March 21, 2020 through May 31,

2020) and standard 14-day free trial (offered from June 1, 2020

onwards) converted into paying merchants in the quarter, creating a

‘double cohort’ effect. Shopify Plus contributed $18.7 million, or

25%, of MRR compared with 27% of MRR as of September 30, 2019 as a

result of the significantly higher number of Standard merchants

joining the platform in Q3 2020.

- GMV for the third quarter was $30.9 billion, an increase of

$16.1 billion, or 109% over the third quarter of 2019. Gross

Payments Volume3 ("GPV") grew to $14.0 billion, which accounted for

45% of GMV processed in the quarter, versus $6.2 billion, or 42%,

for the third quarter of 2019.

- Gross profit dollars grew 87% to $405.1 million in the third

quarter of 2020, compared with $216.7 million for the third quarter

of 2019.

- Adjusted gross profit4 grew 88% to $412.6 million in the third

quarter of 2020, compared with $219.4 million for the third quarter

of 2019.

- Operating income for the third quarter of 2020 was $50.6

million, or 7% of revenue, versus a loss of $35.7 million, or 9% of

revenue, for the comparable period a year ago.

- Adjusted operating income4 for the third quarter of 2020 was

$130.9 million, or 17% of revenue, compared with adjusted operating

income of $10.5 million or 3% of revenue in the third quarter of

2019.

- Net income for the third quarter of 2020 was $191.1 million, or

$1.54 per diluted share, compared with a net loss of $72.8 million,

or $0.64 per basic and diluted share, for the third quarter of

2019.

- Adjusted net income4 for the third quarter of 2020 was $140.8

million, or $1.13 per diluted share, compared with adjusted net

loss of $33.6 million, or $0.29 per basic and diluted share, for

the third quarter of 2019. Adjusted net income in the third quarter

of 2020 excludes an unrealized gain on an equity investment of

$133.2 million or $1.07 per share, stock-based compensation and

related payroll taxes of $75.4 million or $0.60 per share, and

other adjustments totaling $7.5 million or $0.06 per share.

- At September 30, 2020, Shopify had $6.12 billion in cash, cash

equivalents and marketable securities, compared with $2.46 billion

on December 31, 2019. The increase reflects $2.03 billion of net

proceeds from Shopify’s offering of Class A subordinate voting

shares and convertible senior notes in the third quarter of 2020

and $1.46 billion of net proceeds from Shopify's offering of Class

A subordinate voting shares in the second quarter of 2020.

Third-Quarter Business Highlights

- Shopify began rolling out to a select number of merchants early

access to Shop Pay Installments, a ‘buy now, pay later’ product

that lets merchants offer their customers more payment choice and

flexibility at checkout, helping merchants boost sales through

increased cart size and higher conversion.

- Shopify continued to build the foundation of Shopify

Fulfillment Network, including developing the software that

connects the network, adding partner nodes and improving their

performance, and enhancing the merchant-facing app and merchant

support functions. With strong demand for Shopify Fulfillment

Network’s services expected heading into the holiday selling season

in Q4 2020, we intend to continue to enroll merchants and build

volume at a rate where we can maintain high quality standards to

achieve product-market fit at this early stage of our fulfillment

network’s development.

- 6 River Systems held its second annual user conference, FLOW

2020, a fully interactive online event where several enhancements

to its wall-to-wall fulfillment solution were announced, including

The Bridge, an overarching tool that connects the data from what’s

happening in a physical warehouse operation to an intuitive

cloud-based control center, providing more visibility into

operations and increasing efficiency.

- Shopify launched Shopify Payments in Belgium, enabling iDEAL as

a local payment method and supporting Bancontact debit payments,

expanding the availability of Shopify Payments to 17

countries.

- 51% of eligible merchants in the United States and Canada

utilized Shopify Shipping in the third quarter of 2020, versus 45%

in the third quarter of 2019.

- Merchants in the U.S., Canada, and the U.K. received $252.1

million in merchant cash advances and loans from Shopify Capital in

the third quarter of 2020, an increase of 79% versus the $141.0

million received by U.S. merchants in the third quarter of last

year. Shopify Capital has grown to approximately $1.4 billion in

cumulative capital advanced since its launch in April 2016, with

approximately $248.0 million of which was outstanding on September

30, 2020.

- Shopify’s partner ecosystem continued to expand, as

approximately 37,400 partners referred a merchant to Shopify over

the past 12 months, compared with 23,000 over the 12 months ended

September 30, 2019.

Subsequent to Third-Quarter 2020

- Shopify announced a collaboration with Operation HOPE to help

the organization’s goal to create one million new Black-owned

businesses in the U.S. by 2030. Shopify intends to provide up to

$130 million of resources to support Operation HOPE’s efforts to

reduce systemic barriers to entry to entrepreneurship historically

faced by the Black community.

- Shopify launched the TikTok channel, enabling merchants to

market their products using TikTok for Business. Merchants are able

to create in-feed video ads that autoplay between videos while

users scroll through their For You page. Shopify and TikTok will

also collaborate to test new commerce features over the coming

months that will further empower merchants to expand their paid and

organic reach in video and on profiles.

Financial Outlook

While Shopify expects both sellers and buyers to continue

adopting multi-channel commerce for safety as the COVID-19 pandemic

continues, and to continue using multi-channel commerce for

selection and convenience, near-term demand for our subscription

and merchant solutions depends on several external factors that are

particularly fluid at present. These include unemployment, fiscal

stimulus, and the magnitude and duration of the COVID-19 pandemic,

all of which may impact new shop creation on our platform and

consumer spending.

Despite the heightened uncertainty surrounding the macro

environment, Shopify remains uniquely positioned to level the

playing field for entrepreneurs during this period of rapid change

in the retail landscape. While Shopify is not providing a financial

outlook for Q4 2020 or for full year 2020, as a leading global

commerce operating system that can help merchants of all sizes

adapt their businesses to this new reality, Shopify expects to

continue to attract more independent voices to commerce, and will

continue investing to innovate on their behalf.

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss

our third-quarter results today, October 29, 2020, at 8:30 a.m. ET.

The conference call will be webcast on the investor relations

section of Shopify’s website at

https://investors.shopify.com/news-and-events/default.aspx#upcoming-events.

An archived replay of the webcast will be available following the

conclusion of the call.

Shopify’s Third-Quarter 2020 Interim Unaudited Condensed

Consolidated Financial Statements and Notes and its Third Quarter

2020 Management's Discussion and Analysis are available on

Shopify’s website at www.shopify.com and will be filed on SEDAR at

www.sedar.com and on EDGAR at www.sec.gov.

About Shopify

Shopify is a leading global commerce company, providing trusted

tools to start, grow, market, and manage a retail business of any

size. Shopify makes commerce better for everyone with a platform

and services that are engineered for reliability, while delivering

a better shopping experience for consumers everywhere.

Headquartered in Ottawa, Canada, Shopify powers over one million

businesses in more than 175 countries and is trusted by brands such

as Allbirds, Gymshark, Heinz, Staples and many more. For more

information, visit www.shopify.com.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with United States generally

accepted accounting principles ("GAAP"), Shopify uses certain

non-GAAP financial measures to provide additional information in

order to assist investors in understanding our financial and

operating performance.

Adjusted gross profit, adjusted operating income, non-GAAP

operating expenses, adjusted net income (loss) and adjusted net

income (loss) per share are non-GAAP financial measures that

exclude the effect of stock-based compensation expenses and related

payroll taxes and amortization of acquired intangibles. Adjusted

net income and adjusted net income per share also exclude an

unrealized gain on an equity investment, amortization of the debt

discount related to Shopify’s convertible senior notes, and tax

effects related to non-GAAP adjustments.

Management uses non-GAAP financial measures internally for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons. Shopify believes that these

non-GAAP measures provide useful information about operating

results, enhance the overall understanding of past financial

performance and future prospects, and allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision making. Non-GAAP financial

measures are not recognized measures for financial statement

presentation under U.S. GAAP and do not have standardized meanings,

and may not be comparable to similar measures presented by other

public companies. Such non-GAAP financial measures should be

considered as a supplement to, and not as a substitute for, or

superior to, the corresponding measures calculated in accordance

with GAAP. See the financial tables below for a reconciliation of

the non-GAAP measures.

Forward-looking Statements

This press release contains certain forward-looking statements

within the meaning of applicable securities laws, including

statements regarding Shopify’s planned business initiatives and

operations and financial outlook, the performance of Shopify's

merchants, the impact of Shopify's business on its merchants and

other entrepreneurs, and economic activity and consumer spending.

Words such as “believe”, "continue", "will", "intends", "support",

“allow”, and "expect" or similar expressions are intended to

identify forward-looking statements.

These forward-looking statements are based on Shopify’s current

projections and expectations about future events and financial

trends that management believes might affect its financial

condition, results of operations, business strategy and financial

needs, and on certain assumptions and analysis made by Shopify in

light of the experience and perception of historical trends,

current conditions and expected future developments and other

factors management believes are appropriate. These projections,

expectations, assumptions and analyses are subject to known and

unknown risks, uncertainties, assumptions and other factors that

could cause actual results, performance, events and achievements to

differ materially from those anticipated in these forward-looking

statements. Although Shopify believes that the assumptions

underlying these forward-looking statements are reasonable, they

may prove to be incorrect, and readers cannot be assured that

actual results will be consistent with these forward-looking

statements. Actual results could differ materially from those

projected in the forward-looking statements as a result of numerous

factors, including certain risk factors, many of which are beyond

Shopify’s control, including but not limited to: (i) uncertainty

around the duration and scope of the COVID-19 pandemic and the

impact of the pandemic and actions taken in response on global and

regional economies and economic activity; (ii) shifting our

operations to be “digital-by-default”; (iii) merchant acquisition

and retention; (iv) managing our growth; (v) our history of losses;

(vi) our limited operating history; (vii) our ability to innovate;

(viii) the security of personal information we store relating to

merchants and their customers and consumers with whom we have a

direct relationship; (ix) a disruption of service or security

breach; (x) our potential inability to compete successfully against

current and future competitors; (xi) international sales and the

use of our platform in various countries; (xii) the reliance of our

growth in part on the success of our strategic relationships with

third parties; (xiii) our potential failure to effectively

maintain, promote and enhance our brand; (xiv) our use of a single

cloud-based platform to deliver our services; (xv) our potential

inability to achieve or maintain data transmission capacity; (xvi)

our reliance on a single supplier to provide the technology we

offer through Shopify Payments; (xvii) payments processed through

Shopify Payments; (xviii) our potential inability to hire, retain

and motivate qualified personnel; (xix) serious errors or defects

in our software or hardware or issues with our hardware supply

chain; (xx) evolving privacy laws and regulations, cross-border

data transfer restrictions, data localization requirements and

other domestic or foreign regulations may limit the use and

adoption of our services; and (xxi) other one-time events and other

important factors disclosed previously and from time to time in

Shopify’s filings with the U.S. Securities and Exchange Commission

and the securities commissions or similar securities regulatory

authorities in each of the provinces or territories of Canada. The

forward-looking statements contained in this news release represent

Shopify’s expectations as of the date of this news release, or as

of the date they are otherwise stated to be made, and subsequent

events may cause these expectations to change. Shopify undertakes

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by law.

Shopify Inc.

Condensed Consolidated

Statements of Operations and Comprehensive Income (Loss)

(Expressed in US $000’s, except

share and per share amounts, unaudited)

Three months ended

Nine months ended

September 30, 2020

September 30, 2019

September 30, 2020

September 30, 2019

$

$

$

$

Revenues

Subscription solutions

245,274

165,577

629,317

459,075

Merchant solutions

522,131

224,975

1,322,430

613,938

767,405

390,552

1,951,747

1,073,013

Cost of revenues

Subscription solutions

52,170

33,263

134,282

90,786

Merchant solutions

310,087

140,593

780,333

380,475

362,257

173,856

914,615

471,261

Gross profit

405,148

216,696

1,037,132

601,752

Operating expenses

Sales and marketing

147,608

116,546

447,320

340,778

Research and development

143,427

90,387

393,050

252,262

General and administrative

51,799

38,022

179,948

103,247

Transaction and loan losses

11,753

7,399

39,202

16,533

Total operating expenses

354,587

252,354

1,059,520

712,820

Income (loss) from operations

50,561

(35,658)

(22,388)

(111,068)

Other income, net

135,806

11,212

152,999

33,793

Income (loss) before income

taxes

186,367

(24,446)

130,611

(77,275)

Recovery of (provision for) income

taxes

4,701

(48,338)

65,026

(48,338)

Net income (loss)

191,068

(72,784)

195,637

(125,613)

Other comprehensive income

(loss)

4,190

(6,097)

(1,790)

9,923

Comprehensive income (loss)

195,258

(78,881)

193,847

(115,690)

Net income (loss) per share

attributable to shareholders:

Basic

1.59

(0.64)

1.65

(1.12)

Diluted

1.54

(0.64)

1.59

(1.12)

Shares used to compute net income

(loss) per share attributable to shareholders:

Basic

120,511,484

113,086,997

118,692,898

112,015,160

Diluted

124,908,279

113,086,997

123,399,606

112,015,160

Shopify Inc.

Condensed Consolidated Balance

Sheets

(Expressed in US $000’s except

share amounts, unaudited)

As at

September 30, 2020

December 31, 2019

$

$

Assets

Current assets

Cash and cash equivalents

3,089,884

649,916

Marketable securities

3,031,277

1,805,278

Trade and other receivables, net

109,700

90,529

Merchant cash advances, loans and related

receivables, net

247,977

150,172

Income taxes receivable

71,303

—

Other current assets

63,076

46,333

6,613,217

2,742,228

Long-term assets

Property and equipment, net

94,698

111,398

Intangible assets, net

143,925

167,282

Right-of-use assets, net

122,710

134,774

Deferred tax assets

5,116

19,432

Equity and other investments

170,500

2,500

Goodwill

311,865

311,865

848,814

747,251

Total assets

7,462,031

3,489,479

Liabilities and shareholders’

equity

Current liabilities

Accounts payable and accrued

liabilities

261,561

181,193

Income taxes payable

799

69,432

Deferred revenue

96,777

56,691

Lease liabilities

10,994

9,066

370,131

316,382

Long-term liabilities

Deferred revenue

23,080

5,969

Lease liabilities

141,539

142,641

Convertible senior notes

750,452

—

Deferred tax liabilities

—

8,753

915,071

157,363

Commitments and contingencies

Shareholders’ equity

Common stock, unlimited Class A

subordinate voting shares authorized, 110,044,179 and 104,518,173

issued and outstanding; unlimited Class B multiple voting shares

authorized, 11,868,020 and 11,910,802 issued and outstanding

6,035,099

3,256,284

Additional paid-in capital

251,061

62,628

Accumulated other comprehensive (loss)

income

(744

)

1,046

Accumulated deficit

(108,587

)

(304,224

)

Total shareholders’ equity

6,176,829

3,015,734

Total liabilities and shareholders’

equity

7,462,031

3,489,479

Shopify Inc.

Condensed Consolidated

Statements of Cash Flows

(Expressed in US $000’s,

unaudited)

Nine months ended

September 30, 2020

September 30, 2019

$

$

Cash flows from operating

activities

Net income (loss) for the period

195,637

(125,613

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Amortization and depreciation

52,167

22,950

Stock-based compensation

179,883

110,464

Amortization of debt discount and offering

costs

1,200

—

Impairment of right-of-use assets and

leasehold improvements

31,623

—

Provision for transaction and loan

losses

19,954

11,186

Deferred income taxes

5,598

(15,295

)

Unrealized gain on equity and other

investments

(133,239

)

—

Unrealized foreign exchange (gain)

loss

(1,186

)

2,404

Changes in operating assets and

liabilities:

Trade and other receivables

(21,053

)

(25,153

)

Merchant cash advances, loans and related

receivables

(112,447

)

(84,869

)

Other current assets

(17,441

)

(3,139

)

Equity and other investments

(24,710

)

—

Accounts payable and accrued

liabilities

86,067

53,666

Income tax assets and liabilities

(139,936

)

61,485

Deferred revenue

57,197

9,029

Lease assets and liabilities

278

612

Net cash provided by operating

activities

179,592

17,727

Cash flows from investing

activities

Purchase of marketable securities

(3,661,092

)

(2,003,102

)

Maturity of marketable securities

2,436,216

2,034,933

Equity and other investments

(10,051

)

—

Acquisitions of property and equipment

(35,377

)

(43,357

)

Acquisitions of intangible assets

(262

)

(5,484

)

Acquisition of businesses, net of cash

acquired

—

(12,476

)

Net cash used in investing activities

(1,270,566

)

(29,486

)

Cash flows from financing

activities

Proceeds from public equity offerings, net

of issuance costs

2,578,591

688,014

Proceeds from convertible senior notes,

net of underwriting fees and offering costs

907,950

—

Proceeds from the exercise of stock

options

50,076

37,301

Net cash provided by financing

activities

3,536,617

725,315

Effect of foreign exchange on cash and

cash equivalents

(5,675

)

290

Net increase in cash and cash

equivalents

2,439,968

713,846

Cash and cash equivalents – Beginning

of Period

649,916

410,683

Cash and cash equivalents – End of

Period

3,089,884

1,124,529

Shopify Inc.

Reconciliation from GAAP to

Non-GAAP Results

(Expressed in US $000’s, except

share and per share amounts, unaudited)

Three months ended

Nine months ended

September 30, 2020

September 30, 2019

September 30, 2020

September 30, 2019

$

$

$

$

GAAP Gross profit

405,148

216,696

1,037,132

601,752

% of Revenue

53

%

55

%

53

%

56

%

add: stock-based compensation

2,667

928

5,003

2,536

add: payroll taxes related to stock-based

compensation

247

113

764

345

add: amortization of acquired

intangibles

4,531

1,649

14,956

4,804

Non-GAAP Gross profit

412,593

219,386

1,057,855

609,437

% of Revenue

54

%

56

%

54

%

57

%

GAAP Sales and marketing

147,608

116,546

447,320

340,778

% of Revenue

19

%

30

%

23

%

32

%

less: stock-based compensation

10,094

8,707

31,914

23,951

less: payroll taxes related to stock-based

compensation

1,387

985

4,432

2,897

less: amortization of acquired

intangibles

388

—

1,164

—

Non-GAAP Sales and marketing

135,739

106,854

409,810

313,930

% of Revenue

18

%

27

%

21

%

29

%

GAAP Research and development

143,427

90,387

393,050

252,262

% of Revenue

19

%

23

%

20

%

24

%

less: stock-based compensation

39,407

23,136

111,372

64,234

less: payroll taxes related to stock-based

compensation

8,334

2,777

22,615

8,050

less: amortization of acquired

intangibles

58

58

174

174

Non-GAAP Research and development

95,628

64,416

258,889

179,804

% of Revenue

12

%

16

%

13

%

17

%

GAAP General and administrative

51,799

38,022

179,948

103,247

% of Revenue

7

%

10

%

9

%

10

%

less: stock-based compensation

11,639

7,261

31,594

19,743

less: payroll taxes related to stock-based

compensation

1,627

592

4,121

1,585

less: impairment of right-of-use assets

and leasehold improvements

—

—

31,623

—

Non-GAAP General and administrative

38,533

30,169

112,610

81,919

% of Revenue

5

%

8

%

6

%

8

%

Shopify Inc.

Reconciliation from GAAP to

Non-GAAP Results (continued)

(Expressed in US $000’s, except

share and per share amounts, unaudited)

Three months ended

Nine months ended

September 30, 2020

September 30, 2019

September 30, 2020

September 30, 2019

$

$

$

$

GAAP Transaction and loan losses

11,753

7,399

39,202

16,533

% of Revenue

2

%

2

%

2

%

2

%

GAAP Operating expenses

354,587

252,354

1,059,520

712,820

% of Revenue

46

%

65

%

54

%

66

%

less: stock-based compensation

61,140

39,104

174,880

107,928

less: payroll taxes related to stock-based

compensation

11,348

4,354

31,168

12,532

less: amortization of acquired

intangibles

446

58

1,338

174

less: impairment of right-of-use assets

and leasehold improvements

—

—

31,623

—

Non-GAAP Operating expenses

281,653

208,838

820,511

592,186

% of Revenue

37

%

53

%

42

%

55

%

GAAP Operating income (loss)

50,561

(35,658

)

(22,388

)

(111,068

)

% of Revenue

7

%

(9

)%

(1

)%

(10

)%

add: stock-based compensation

63,807

40,032

179,883

110,464

add: payroll taxes related to stock-based

compensation

11,595

4,467

31,932

12,877

add: amortization of acquired

intangibles

4,977

1,707

16,294

4,978

add: impairment of right-of-use assets and

leasehold improvements

—

—

31,623

—

Adjusted Operating income

130,940

10,548

237,344

17,251

% of Revenue

17

%

3

%

12

%

2

%

GAAP Net income (loss)

191,068

(72,784

)

195,637

(125,613

)

% of Revenue

25

%

(19

)%

10

%

(12

)%

add: stock-based compensation

63,807

40,032

179,883

110,464

add: payroll taxes related to stock-based

compensation

11,595

4,467

31,932

12,877

add: amortization of acquired

intangibles

4,977

1,707

16,294

4,978

add: impairment of right-of-use assets and

leasehold improvements

—

—

31,623

—

add: amortization of debt discount

1,130

—

1,130

—

less: unrealized gain on equity and other

investments

(133,239

)

—

(133,239

)

—

add: provision for income tax effects

related to non-GAAP adjustments

1,416

(7,018

)

(30,808

)

(18,471

)

Adjusted Net income (loss)

140,754

(33,596

)

292,452

(15,765

)

% of Revenue

18

%

(9

)%

15

%

(1

)%

Shopify Inc.

Reconciliation from GAAP to

Non-GAAP Results (continued)

(Expressed in US $000’s, except

share and per share amounts, unaudited)

Three months ended

Nine months ended

September 30, 2020

September 30, 2019

September 30, 2020

September 30, 2019

$

$

$

$

Basic GAAP Net income (loss) per share

attributable to shareholders

1.59

(0.64

)

1.65

(1.12

)

add: stock-based compensation

0.53

0.35

1.52

0.99

add: payroll taxes related to stock-based

compensation

0.10

0.04

0.27

0.11

add: amortization of acquired

intangibles

0.04

0.02

0.14

0.04

add: impairment of right-of-use assets and

leasehold improvements

0.00

0.00

0.27

0.00

add: amortization of debt discount

0.01

0.00

0.01

0.00

less: unrealized gain on equity and other

investments

(1.11

)

0.00

(1.12

)

0.00

add: provision for income tax effects

related to non-GAAP adjustments

0.01

(0.06

)

(0.26

)

(0.16

)

Basic Adjusted Net income (loss) per share

attributable to shareholders

1.17

(0.29

)

2.46

(0.14

)

Weighted average shares used to compute

GAAP and non-GAAP basic net income (loss) per share attributable to

shareholders

120,511,484

113,086,997

118,692,898

112,015,160

Diluted GAAP Net income (loss) per share

attributable to shareholders

1.54

(0.64

)

1.59

(1.12

)

add: stock-based compensation

0.51

0.35

1.46

0.99

add: payroll taxes related to stock-based

compensation

0.09

0.04

0.26

0.11

add: amortization of acquired

intangibles

0.04

0.02

0.13

0.04

add: impairment of right-of-use assets and

leasehold improvements

0.00

0.00

0.26

0.00

add: amortization of debt discount

0.01

0.00

0.01

0.00

less: unrealized gain on equity and other

investments

(1.07

)

0.00

(1.08

)

0.00

add: provision for income tax effects

related to non-GAAP adjustments

0.01

(0.06

)

(0.25

)

(0.16

)

Diluted Adjusted Net income (loss) per

share attributable to shareholders

1.13

(0.29

)

2.37

(0.14

)

Weighted average shares used to compute

GAAP and non-GAAP diluted net income (loss) per share attributable

to shareholders

124,908,279

113,086,997

123,399,606

112,015,160

1. Gross Merchandise Volume, or GMV, represents the total dollar

value of orders facilitated through the Shopify platform including

certain apps and channels for which a revenue-sharing arrangement

is in place in the period, net of refunds, and inclusive of

shipping and handling, duty and value-added taxes. 2. Monthly

Recurring Revenue, or MRR, is calculated by multiplying the number

of merchants by the average monthly subscription plan fee in effect

on the last day of that period and is used by management as a

directional indicator of subscription solutions revenue going

forward assuming merchants maintain their subscription plan the

following month. 3. Gross Payments Volume, or GPV, is the amount of

GMV processed through Shopify Payments. 4. Non-GAAP financial

measures exclude the effect of stock-based compensation expenses

and related payroll taxes, amortization of acquired intangibles and

related taxes, an unrealized gain on an equity investment and

related taxes, and amortization of the debt discount related to

convertible senior notes and related taxes. Please refer to

"Non-GAAP Financial Measures" in this press release for more

information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201029005170/en/

INVESTORS: Katie Keita Senior Director, Investor Relations

613-241-2828 x 1024 IR@shopify.com

MEDIA: Rebecca Feigelsohn Communications Lead 416-238-6705 x 302

press@shopify.com

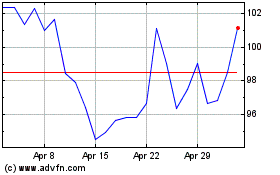

Shopify (TSX:SHOP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Shopify (TSX:SHOP)

Historical Stock Chart

From Dec 2023 to Dec 2024