Aton Announces Bridge Loan and Operations Update

March 31 2021 - 1:52PM

Aton Resources Inc. (AAN: TSX-V) ("Aton" or the "Corporation")

announces that it has entered into an additional bridge loan (the

"

Loan") with OU Moonrider

("

Moonrider"), a significant shareholder of the

Corporation.

The Loan

The Corporation has borrowed C$2,000,000 from

Moonrider, which Loan is repayable on the earlier of six months

from closing, on the occurrence of various standard events of

default, or on the closing of any debt or equity financing by the

Corporation in an amount in excess of C$5.0 million. The Loan will

bear interest at a rate of 12% per annum, payable when the Loan is

due.

Moonrider will be issued 8,510,638 bonus

warrants with an exercise price of $0.235 per share and an

expiration date of March 31, 2022.

The bonus warrants are subject to the approval

of the TSX Venture Exchange.

Operations Update

The Corporation has commenced the process of

evaluating drilling contractors and civil works contractors in

preparation for drilling to commence at Hamama and Rodruin. The

Loan proceeds has put the Corporation in a position to finalize and

sign commitments with such contractors and resume drilling in

advance of completion of an equity financing.

The proceeds of the Loan will be used by the

Corporation for ongoing working capital expenses, finalizing a

drill contract, acquisition of critical capital items required,

completion of civil works in preparation to commence drilling, such

as constructing roads, drill pads, constructing a new exploration

camp at the Corporation’s Rodruin project and resuming the drilling

program.

“I would like to thank OU Moonrider for their

continued support of Aton,” said Bill Koutsouras, Aton’s

Chairman of the Board. “This bridge loan strengthens our capital

position to continue with all work required to commence our next

drilling program, while we continue our ongoing discussions with

potential strategic investors to evaluate other financing

alternatives available to the Corporation. It also avoids a

significantly dilutive equity financing being completed at this

time”.

About Aton Resources Inc. Aton

Resources Inc. (AAN: TSX-V) is focused on its 100% owned Abu

Marawat Concession (“Abu Marawat”), located in Egypt’s

Arabian-Nubian Shield, approximately 200 km north of Centamin’s

world-class Sukari gold mine. Aton has identified numerous gold and

base metal exploration targets at Abu Marawat, including the Hamama

deposit in the west, the Abu Marawat deposit in the northeast, and

the advanced Rodruin exploration prospect in the south of the

Concession. Two historic British gold mines are also located on the

Concession at Sir Bakis and Semna. Aton has identified several

distinct geological trends within Abu Marawat, which display

potential for the development of a variety of styles of precious

and base metal mineralisation. Abu Marawat is 447.7 km2 in size and

is located in an area of excellent infrastructure; a four-lane

highway, a 220kV power line, and a water pipeline are in close

proximity, as are the international airports at Hurghada and

Luxor.For further information regarding Aton Resources Inc., please

visit us at www.atonresources.com or contact:BILL

KOUTSOURASChairman of the Board Tel: +1 345 525 2512Email:

info@atonresources.com

Note Regarding Forward-Looking

Statements Some of the statements contained in this

release are forward-looking statements. Since forward-looking

statements address future events and conditions; by their very

nature they involve inherent risks and uncertainties. Actual

results in each case could differ materially from those currently

anticipated in such statements. Neither TSX Venture Exchange nor

its Regulation Services Provider (as that term is defined in

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

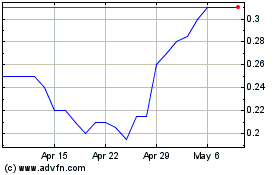

Aton Resources (TSXV:AAN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aton Resources (TSXV:AAN)

Historical Stock Chart

From Feb 2024 to Feb 2025