NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Amazon Mining Holding Plc (TSX VENTURE:AMZ) ("Amazon" or the "Company")

announced today its unaudited interim consolidated financial statements for the

three month period ended March 31, 2009 and provides the following corporate

update.

Reports indicated for the three-month period ended March 31, 2009 there was a

net loss of Pounds Sterling 185,674 compared to a loss of Pounds Sterling

460,767 for the three-month period ended March 31, 2008. As the Company remains

engaged in exploration activity, no revenues are presently generated from its

operations. The lower loss reflects reduced exploration activities during the

quarter.

Subsequent Period Summary:

- Signed Agreement in principle to acquire Uaua Pesquisa Mineral Ltda, Closing

of the transaction is subject to the satisfaction of certain conditions,

including the approval of the TSX Venture Exchange.;

- Announced that Brazil's Centre for Mineral Technology (CETEM), a government

sponsored research and development institute, had agreed to fund metallurgical

tests on verdete rock from Amazon's Cerrado Verde potash project, and

- Public hearings held by the State Parliament of Minas Gerais together with

Federal and State government institutions of Brazil concluded in government

officials declaring their intentions to establish development partnerships to

support geological, metallurgical and agronomic efficacy work related to verdete

slate;

Amazon currently has a working capital position of approximately Pounds Sterling

4.7MM (Cdn$8.2MM). The company is maintaining a conservative approach to

advancing its portfolio of assets. Seeking opportunities to share costs related

to developing the Cerrado Verde project with help from government and strategic

partners.

About Amazon

Amazon Mining, listed on the TSX Venture Exchange, is a mineral exploration

company engaged in creating shareholder value via cost effectively advancing its

portfolio of projects. Amazon is preserving cash and adopting a highly

conservative and risk mitigating approach to opportunity assessment and project

development.

On behalf of the Board of Directors of Amazon Mining Holding Plc, Cristiano

Veloso, President and CEO.

Cautionary Language and Forward Looking Statements

THIS PRESS RELEASE CONTAINS CERTAIN "FORWARD LOOKING STATEMENTS", WHICH INCLUDE

BUT IS NOT LIMITED TO, STATEMENTS WITH RESPECT TO THE FUTURE FINANCIAL OR

OPERATING PERFORMANCE OF THE COMPANY, ITS SUBSIDIARIES AND ITS PROJECTS,

STATEMENTS REGARDING USE OF PROCEEDS, EXPLORATION PROSPECTS, IDENTIFICATION OF

MINERAL RESERVES, COSTS OF AND CAPITAL FOR EXPLORATION PROJECTS, EXPLORATION

EXPENDITURES, TIMING OF FUTURE EXPLORATION AND PERMITTING, REQUIREMENTS FOR

ADDITIONAL CAPITAL, GOVERNMENT REGULATIONS OF MINING OPERATIONS, ENVIRONMENTAL

RISKS, RECLAMATION EXPENSES, TITLE DISPUTES OR CLAIMS, AND LIMITATIONS OF

INSURANCE COVERAGE. FORWARD LOOKING STATEMENTS CAN GENERALLY BE IDENTIFIED BY

THE USE OF WORDS SUCH AS "PLANS", "EXPECTS", OR "DOES NOT EXPECT" OR "IS

EXPECTED", "ANTICIPATES" OR "DOES NOT ANTICIPATE", OR "BELIEVES", "INTENDS",

"FORECASTS", "BUDGET", "SCHEDULED", "ESTIMATES" OR VARIATIONS OF SUCH WORDS OR

PHRASES OR STATE THAT CERTAIN ACTIONS, EVENT, OR RESULTS "MAY", "COULD",

"WOULD", "MIGHT", OR "WILL BE TAKEN", "OCCUR" OR "BE ACHIEVED". FORWARD LOOKING

STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS

WHICH MAY CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE COMPANY

TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS

EXPRESSED OR IMPLIED BY SAID STATEMENTS. THERE CAN BE NO ASSURANCES THAT

FORWARD-LOOKING STATEMENTS WILL PROVE TO BE ACCURATE, AS ACTUAL RESULTS AND

FUTURE EVENTS COULD DIFFER MATERIALLY FROM THOSE ANTICIPATED IN SAID STATEMENTS.

ACCORDINGLY, READERS SHOULD NOT PLACE UNDUE RELIANCE ON FORWARD-LOOKING

STATEMENTS.

Readers are cautioned not to rely solely on the summary of such information

contained in this release and are directed to the complete set of drill results

posted on Amazon's website (www.amazonplc.com) and filed on SEDAR

(www.sedar.com) and any future amendments to such. Readers are also directed to

the cautionary notices and disclaimers contained herein.

AMAZON MINING HOLDING PLC

CONSOLIDATED INCOME STATEMENT

(Unaudited)

3 months 3 months 9 months 9 months

ended ended ended ended

30 Sept 31 Oct 30 Sept 31 Oct

2008 2007 2008 2007

Pounds Pounds Pounds Pounds

Sterling Sterling Sterling Sterling

Administrative expenses (232,782) (70,365) (663,650) (203,521)

Impairment loss (20,750) - (2,092,464) -

--------- --------- ----------- ----------

Operating loss (253,532) (70,365) (2,756,114) (203,521)

Finance income 43,036 920 116,095 6,690

Exchange gains/(losses) 374,337 - 137,434 (1,827)

--------- --------- ----------- ----------

Profit/(loss) before taxation 163,841 (69,445) (2,502,585) (198,658)

Taxation - - - 997

--------- --------- ----------- ----------

Profit/(loss) for the period 163,841 (69,445) (2,502,585) (199,655)

--------- --------- ----------- ----------

--------- --------- ----------- ----------

Basic and diluted earnings/(loss)

per ordinary share 0.59p (0.49p) (9.09p) (1.60p)

--------- --------- ----------- ----------

--------- --------- ----------- ----------

AMAZON MINING HOLDING PLC

CONSOLIDATED BALANCE SHEET

(Unaudited)

Note 30 Sept 31 Dec

2008 2007

Pounds Pounds

Sterling Sterling

Intangible exploration assets 3 337,621 878,803

Property, plant and equipment 4 37,673 10,739

----------- -----------

375,294 889,542

----------- -----------

Other receivables and prepayments 55,104 11,390

Cash and cash equivalents 5,167,443 7,393,769

----------- -----------

Total current assets 5,222,547 7,405,159

----------- -----------

Total assets 5,597,841 8,294,701

----------- -----------

----------- -----------

Equity

Issued share capital 5 6,879,789 6,879,789

Warrant reserve 6 590,480 590,480

Share premium 3,620,082 3,620,082

Translation reserve 50,314 30,082

Merger reserve (2,727,227) (2,727,227)

Accumulated losses (2,957,057) (484,036)

----------- -----------

5,456,381 7,909,170

----------- -----------

Liabilities

Trade and other payables 141,460 385,531

----------- -----------

Total liabilities 141,460 385,531

----------- -----------

Total equity and liabilities 5,597,841 8,294,701

----------- -----------

----------- -----------

AMAZON MINING HOLDING PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited) 3 months 3 months 9 months 9 months

Ended Ended Ended Ended

30 Sept 31 Oct 30 Sept 31 Oct

2008 2007 2008 2007

Pounds Pounds Pounds Pounds

Sterling Sterling Sterling Sterling

Cash flows from operating

activities:

Operating loss (253,532) (70,365) (2,756,114) (203,521)

Adjustments for:

Depreciation 1,609 69 3,391 119

Impairment loss 20,750 - 2,092,464 -

Share-based payments 10,272 - 29,564 -

Loss on disposal of fixed assets 1,919 - 1,919 -

Decrease/(increase) in other

receivables and prepayments 40,127 (177,090) (43,714) (177,846)

(Decrease)/increase in trade and

other payables (66,192) 189,419 (231,102) 227,289

---------- --------- ---------- ---------

Cash used in operating activities (245,047) (57,967) (903,592) (153,959)

Income taxes paid - - - (853)

---------- --------- ---------- ---------

Net cash outflow from operating

activities (245,047) (57,967) (903,592) (154,812)

---------- --------- ---------- ---------

Cash flows from investing

activities:

Interest received 30,065 920 103,124 6,805

Acquisition of intangible

exploration assets (192,764) (129,959) (1,434,302) (403,210)

Acquisition of property, plant

and equipment (3,716) (473) (32,162) (3,544)

---------- --------- ---------- ---------

Net cash outflow from investing

activities (166,415) (129,512) (1,363,340) (399,949)

---------- --------- ---------- ---------

Issue of share capital - - - 649,999

Payment of issue expenses - (15,744) - (15,744)

---------- --------- ---------- ---------

Net cash flow from financing

activities - (15,744) - 634,255

---------- --------- ---------- ---------

Net (decrease)/increase in cash

and cash equivalents (411,462) (203,223) (2,266,932) 79,494

Cash and cash equivalents at

start of period 5,297,506 326,280 7,393,769 41,895

Exchange differences 281,399 1,678 40,606 3,346

---------- --------- ---------- ---------

Cash and cash equivalents at end

of period 5,167,443 124,735 5,167,443 124,735

---------- --------- ---------- ---------

---------- --------- ---------- ---------

AMAZON MINING HOLDING PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(Unaudited)

From 1 May 2007 to 31 December 2007

Issued Share Warrants Merger

capital premium reserve reserve

Pounds Pounds Pounds

Sterling Sterling Sterling

Balance at 1 May 2007 3,546,456 203,259 - (2,727,227)

Shares issued during

period 3,333,333 4,006,110 - -

Share warrants issued

during period - - 590,480 -

Expenses of issue - (696,676) - -

Share based payments - 107,389 - -

Loss for the period - - - -

Foreign exchange

differences - - - -

---------- ---------- ------- -----------

Balance at 31 December

2007 6,879,789 3,620,082 590,480 (2,727,227)

---------- ---------- ------- -----------

---------- ---------- ------- -----------

From 1 May 2007 to 31 December 2007

Accumulated Translation

losses reserve Total

Pounds Pounds Pounds

Sterling Sterling Sterling

Balance at 1 May 2007 (169,601) (831) 852,056

Shares issued during

period - - 7,339,443

Share warrants issued

during period - - 590,480

Expenses of issue - - (696,676)

Share based payments 28,799 - 136,188

Loss for the period (343,234) - (343,234)

Foreign exchange

differences - 30,913 30,913

------------ ------------ ----------

Balance at 31 December

2007 (484,036) 30,082 7,909,170

------------ ------------ ----------

------------ ------------ ----------

From 1 January 2008 to 30 September 2008

Issued Share Warrants Merger

capital premium reserve reserve

Pounds Pounds Pounds

Sterling Sterling Sterling

Balance at 1 January 2008 6,879,789 3,620,082 590,480 (2,727,227)

Loss for period - - - -

Share-based payments - - - -

Foreign exchange differences - - - -

---------- ---------- --------- -----------

Balance at 30 Sept 2008 6,879,789 3,620,082 590,480 (2,727,227)

---------- ---------- --------- -----------

---------- ---------- --------- -----------

From 1 January 2008 to 30 September 2008

Accumulated Translation

losses reserve Total

Pounds Pounds Pounds

Sterling Sterling Sterling

Balance at 1 January 2008 (484,036) 30,082 7,909,170

Loss for period (2,502,585) - (2,502,585)

Share-based payments 29,564 - 29,564

Foreign exchange

differences - 20,232 20,232

------------ ------------ ----------

Balance at 30 Sept 2008 (2,957,057) 50,314 5,456,381

------------ ------------ ----------

------------ ------------ ----------

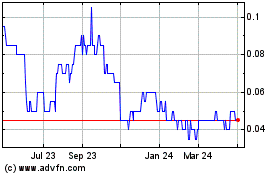

Azucar Minerals (TSXV:AMZ)

Historical Stock Chart

From Mar 2025 to Apr 2025

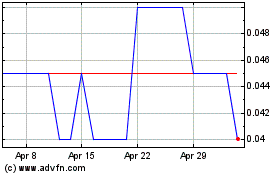

Azucar Minerals (TSXV:AMZ)

Historical Stock Chart

From Apr 2024 to Apr 2025