Azucar Minerals Ltd. ("Azucar" or the "Company") (TSX-V: AMZ;

OTCQX: AXDDF) is pleased to announce completion of its initial

mineral resource estimate (MRE) with respect to the Norte Zone of

the El Cobre porphyry copper-gold project (“El Cobre Project”, or

the “Project”) in Veracruz State, Mexico.

The Norte Zone is one of five copper-gold

porphyry zones identified to date within the El Cobre Project and

has been the focus of the majority of exploration work conducted at

the El Cobre Project since 2016 (see Figure 1, Exploration

Targets).

Highlights:

-

Indicated Mineral

Resource of

1.2Moz

AuEq (million ounce gold

equivalent) using the base case

NSR (net smelter return)

cutoff of

US$12/tonne,

comprised of 47.2 million tonnes grading at 0.77 g/t AuEq (0.49 g/t

Au, 0.21% Cu and 1.4 g/t Ag);

-

Inferred Mineral Resource

of 1.4

Moz

AuEq using the base case

NSR cutoff of

US$12/tonne,

comprised of 64.2 million tonnes grading at 0.66 g/t AuEq (0.42 g/t

Au, 0.18% Cu and 1.3 g/t Ag);

- Amenable

to an open pit mining

method;

- Potential for resource

expansion at depth within

the Norte Zone

as well as at other significant porphyry bodies identified

across 5km strike length at the

Project.

The El Cobre Project has a total area of

approximately 7,000 hectares and is located adjacent to the Gulf of

Mexico, about 75 kilometres northwest of the major port city of

Veracruz, Mexico in an area of excellent infrastructure. The

Project is situated 200 metres above sea level with extensive road

access and is located less than 10 kilometres from a power plant,

highway, gas line and other major infrastructure. Major power lines

cross the Project area (see Figure 2, Infrastructure).

The Mineral Resource Estimate (MRE) and NSR

cut-off sensitivities are presented in Table 1 with the base case

cutoff at $US12.00 NSR highlighted. The favorable infrastructure at

the El Cobre Project suggests that the threshold for economic

mineralization will be low relative to many other deposits. Copper

and gold mineralization at the Norte Zone is associated with a

multiphase variably potassic-phyllic altered porphyritic diorite

intrusive complex that is cut by late mafic and intermediate dykes

and post mineral feldspar porphyry. The Norte Zone is approximately

0.6 km x 0.4 km along an E-W strike. Sulphide mineralization, which

extends up to 900 metres depth, consists of disseminated and

vein-hosted chalcopyrite and trace bornite (Cu mineralization)

exposed in surface outcrops and intersected in drill core.

J. Duane Poliquin, Chairman of Azucar commented,

“We are pleased to provide this initial resource estimate for the

Norte Zone, which is a significant mineral endowment at just one of

the many targets at the Project. This resource provides an

excellent basis for continued exploration at the El Cobre Project,

both at the Norte Zone itself as well as at the other significant

zones discovered between the Norte Zone and the Encinal Zone, 5km

to the southeast.”

Table 1. Indicated and Inferred

Mineral Resource and Sensitivity

Analysis

|

Classification |

Cutoff |

in situ |

In situ Grades |

In situ Metal Content |

|

(NSR$US) |

(ktonnes) |

NSR |

Au(gpt) |

Cu(%) |

Ag(gpt) |

AuEqv(gpt) |

Au(kOz) |

Cu(Mlbs) |

Ag(kOz) |

AuEq(kOz) |

|

Indicated |

7.5 |

52,828 |

29.17 |

0.45 |

0.20 |

1.3 |

0.72 |

772 |

230 |

2,189 |

1,217 |

|

9 |

51,134 |

29.86 |

0.47 |

0.20 |

1.3 |

0.73 |

766 |

228 |

2,150 |

1,207 |

|

12 |

47,211 |

31.47 |

0.49 |

0.21 |

1.4 |

0.77 |

748 |

221 |

2,049 |

1,175 |

|

20 |

42,923 |

33.26 |

0.52 |

0.22 |

1.4 |

0.82 |

723 |

211 |

1,924 |

1,131 |

|

25 |

34,711 |

36.99 |

0.59 |

0.24 |

1.5 |

0.91 |

660 |

187 |

1,630 |

1,020 |

|

30 |

19,092 |

47.07 |

0.78 |

0.29 |

1.6 |

1.17 |

482 |

123 |

982 |

718 |

|

40 |

10,634 |

56.97 |

0.98 |

0.34 |

1.7 |

1.42 |

336 |

79 |

569 |

487 |

|

Classification |

Cutoff |

in situ |

In situ Grades |

In situ Metal Content |

|

(NSR$US) |

(ktonnes) |

NSR |

Au(gpt) |

Cu(%) |

Ag(gpt) |

AuEqv(gpt) |

Au(kOz) |

Cu(Mlbs) |

Ag(kOz) |

AuEq(kOz) |

|

Inferred |

7.5 |

103,105 |

20.31 |

0.30 |

0.14 |

1.2 |

0.49 |

998 |

324 |

3,819 |

1,630 |

|

9 |

86,821 |

22.57 |

0.34 |

0.16 |

1.2 |

0.55 |

949 |

298 |

3,414 |

1,531 |

|

12 |

64,191 |

26.88 |

0.42 |

0.18 |

1.3 |

0.66 |

860 |

254 |

2,768 |

1,354 |

|

20 |

51,617 |

30.16 |

0.48 |

0.20 |

1.4 |

0.74 |

792 |

224 |

2,338 |

1,226 |

|

25 |

37,381 |

35.03 |

0.57 |

0.22 |

1.5 |

0.86 |

685 |

182 |

1,790 |

1,036 |

|

30 |

20,314 |

43.84 |

0.74 |

0.26 |

1.6 |

1.09 |

485 |

116 |

1,067 |

709 |

|

40 |

10,280 |

52.93 |

0.93 |

0.29 |

1.8 |

1.32 |

307 |

67 |

582 |

435 |

Notes for Mineral Resource Table:

- The Mineral Resource Estimate was

prepared by Sue Bird M.Sc., P.Eng. of Moose Mountain Technical

Services, the QP, in accordance with NI 43-101, and with an

effective date of August 3, 2020.

- Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability.

- The NSR and AuEq values were

calculated using US$1,500/oz gold, US$3.00/lb copper and US$18/oz

silver, and using metallurgical recoveries of 88% for gold and

copper, and 70% for silver. Smelter terms and offsite costs have

been applied as follows: gold payable = 94%, copper payable =

96.5%, silver payable = 90%, gold refining costs = US$5.00/oz,

silver refining costs = US$0.50/oz, copper treatment and offsite

(transportation) costs = US$0.30/lb. NSR royalty = 2.5%. The final

equations for NSR and AuEq are:NSR = Au*(US$44.04*88%) +

Cu%*(US$2.53*88%) + Ag*(US$0.49*70%);AuEq = Au(g/t) +1.27*Cu(%) +

0.009*Ag(g/t).

- The MRE has been confined by a

“reasonable prospects of eventual economic extraction” pit using 45

degree slopes, with the pit size determined at a gold price of

US$1,950/oz, a copper price of US$4.50/lb and a silver price of

US$28.50/oz. The mining costs used are US$2.00/tonne. A process

cost of US$12.00/tonne is used as the cutoff of processed

material.

- The specific gravity of the deposit

is estimated to be 2.68

- Numbers may not add due to

rounding.

The Norte Zone MRE is classified in accordance

with guidelines established by the Canadian Institute of Mining

(CIM) “Estimation of Mineral Resources and Mineral Reserves Best

Practice Guidelines” dated November 29, 2019 and CIM “Definition

Standards for Mineral Resources and Mineral Reserves” dated May 10,

2014.

There are no other known factors or issues known

by the QP that materially affect the MRE other than normal risks

faced by mining projects.

The El Cobre Project is subject to the same

types of risks that large base metal projects experience at an

early stage of development in Mexico. The nature of the risks

relating to the Project will change as the Project evolves and more

information becomes available. The Company has engaged experienced

management and specialized consultants to identify, manage and

mitigate those risks.

The El Cobre Project is located in a general

region where Pre-Columbian archaeological sites are known. To date

exploration programs on the project have been conducted in

consultation with Mexico’s Federal Agency for Archeology, INAH,

which resulted in the identification of several small areas for

further study and classification, including one area lying within

the MRE pit outline. As is standard practice in Mexico, areas

required for development and mining activity would require a

clearance from INAH following the implementation of more detailed

archaeological investigations and an archaeological salvage

program, if necessary. The Company is committed to working with

INAH as part of its future exploration and development plans.

Mineral Resource Estimate

Details

The drillhole database used to calculated the

MRE is comprised of 45 exploration diamond drillholes completed

between 2008 and 2019 totalling 28,448 metres, containing a total

of 27,173.12m of drill core analyzed for gold and copper by fire

assay and Inductively Coupled Plasma – Atomic Emission Spectroscopy

(“ICP-AES”), with four acid digestion. Sample intervals within the

mineralized domains ranged from 0.45m to 3.81m in length, with 98%

of the intervals having a length of 3.0 metres or less.

The Norte Zone 3D geological model created by

Azucar integrates assay and geological data collected from diamond

core drilling; surface geologic mapping; soil geochemical; and

geophysical surveys. Based on these data, the Norte Zone is

modelled as an east-west elongate 600 metre x 400 metre subvertical

zone of porphyry copper-gold mineralization extending to a maximum

depth of approximately 900 metres vertically below surface.

Mineralization is constrained by 3D geological solids representing

host diorite intrusive, and peripheral andesite and dacite tuff

volcanic rocks.

Length-weighted averaged composites of 3 metre

core length, restricted to each rock type, were calculated and used

for exploratory data analysis and resource estimation. Assays were

capped by zone and domain based on cumulative probability plots to

remove outliers. The modelled variograms from each domain were used

for resource estimation.

A block model with a regularized cell size of 20

m by 20 m by 10 m was used to estimate grade for each metal using

Ordinary Kriging (OK). The percentage of each block below the

overburden surface and within each domain is used for interpolation

and the resource calculations. A total of 489 density measurements

have been collected at site. Based on this data, the specific

gravity (sg) within the sulphide material is consistent with a mean

value of 2.68. The final grade estimates are validated visually by

comparing each block’s metal estimates to the raw downhole assay

data and statistically by comparing the modelled grades to the

de-clustered composite grades (NN model), by swath plots and by

grade-tonnage curves.

About the El Cobre Project

To date, Azucar has discovered five copper-gold

porphyry zones within the El Cobre Project along an approximately

5km trend, stretching from Norte down to Encinal in the southeast

(see Figure 1, Exploration Targets). These zones are defined by

distinct Cu-Au soil anomalies, discrete, positive magnetic

features, a large IP chargeability anomaly, and drilling. A summary

of the various zones is provided below.

NORTE ZONE: All five holes

drilled in the Norte Zone prior to 2016 intersected porphyry-style

mineralisation. Hole 08-CBCN-022, one of the deepest holes drilled

at Norte in 2008, returned values of 0.14% Cu with 0.19 g/t Au over

259 m and 08-CBCN-19 intersected 41.15 metres averaging 0.42 g/t

gold and 0.27% copper to the end of the hole at 187.45 metres.

Drilling at the Norte Zone in 2016 and 2017 resulted in

intersections including 114.60 metres grading 1.33 g/t Au and 0.48%

Cu (Hole EC-17-018, see press release of April 5, 2017), 80.50

metres grading 1.34 g/t Au and 0.46% Cu (Hole EC-16-012, see press

release of October 24, 2016), and 70.45 metres grading 2.32 g/t Au

and 0.59% Cu (Hole EC-17-026, see press release of July 25, 2017).

Continued drilling through 2018 and 2019 has culminated in the

mineral resource estimate released today.

VILLA RICA ZONE:

The Villa Rica Zone is located about 1.8 km south of the Norte

zone, and comprises a roughly 2.5 kilometre by 1 kilometre area of

hydrothermal alteration defined also by a strong north-northwest

trending magnetic-chargeability high and associated copper-gold

soil geochemical anomalies. Past mapping and sampling defined

several areas of exposed porphyry mineralisation within the Villa

Rica zone, including the Raya Tembrillo target and the Naranjo

target, both at the north end of the Villa Rica zone. Initial

drilling in 2017 on the Raya Tembrillo target intersected two

styles of mineralisation; hypogene copper-gold porphyry

mineralisation (115.00 metres of 0.57 g/t gold and 0.27% copper,

see press release of November 28, 2017) and near surface exotic

enriched copper mineralisation with an apparent tabular

distribution (94.00 metres of 1.36% copper; see press release of

December 13, 2017).

The Primo target

area, first announced on October 16, 2019, is also considered to be

part of the Villa Rica zone, and is located approximately 1km south

of Raya Tembrillo. Primo has been the location of some of the

highest copper grades intersected at the Project, such as 200

metres of 0.40 g/t gold and 0.24% copper from 718 metres downhole,

which included 86.50 metres of 0.70 g/t gold and 0.42% copper from

831.50 metres (see press release of October 16, 2019).

EL

PORVENIR ZONE:

The El Porvenir zone is located about 2 km east of the Villa Rica

zone. Significant copper and gold grades have been intersected at

El Porvenir, such as 0.16% Cu and 0.39 g/t Au over 290 m in hole

DDH04CB1. Results from minimal drilling in 2017 include hole

EC-17-040 which intersected 108.00 metres grading 0.88 g/t Au and

0.29% Cu, and hole EC-17-044 which intersected 40.25 metres grading

0.50 g/t Au and 0.25% Cu.

SUEGRO

ZONE: Drilling in 2019 identified this

new porphyry centre between the El Porvenir and Encinal Zones. The

Suegro Zone is located approximately 250 metres south of the

Porvenir Zone, within a large area of alteration associated with

more subdued magnetics, and low zinc and manganese in soil. The

Suegro mineralisation intersected in the drilling to date is

associated with an altered (locally intense phyllic alteration

overprinting potassic) intrusive. Intercepts to date include 28.20

m of 0.54 g/t Au and 0.17% Cu (hole EC-19-064; see press release of

March 19, 2019).

ENCINAL ZONE: The Encinal zone is

located approximately 1km south of the El Porvenir zone. Previous

drilling at Encinal has intersected a highly altered breccia pipe

containing fragments of stockwork veining and porphyry

mineralisation across which 18.28 metres returned 1.42 g/t Au and

0.10% Cu (Hole CB5). The breccia pipe occurs in a large alteration

zone, IP chargeability high and magnetics low which has not been

tested to depth. On June 19, 2017 Azucar announced that a new area

of exposed stockwork quartz veining and gold mineralisation had

been identified in the Encinal Zone. On June 29, 2017 Azucar

announced the results of initial drilling on this exposed stockwork

(Hole EC-17-025) which returned results including 34.47 metres

grading 0.73 g/t Au and 0.20% Cu.

More information on El Cobre is available on the

Azucar website at http://www.azucarminerals.com.

QAQC and Reporting

Azucar is currently preparing the NI 43-101 El

Cobre Project Technical Report, which will contain details of the

MRE. This report is required to be announced and filed on SEDAR and

the Azucar website within 45 days of this news release and is

authored by Kris Raffle, P.Geo. of APEX Geoscience Ltd., and Sue

Bird, M.Sc., P.Eng. of Moose Mountain Technical Services both of

whom act as independent consultants to the Company, are Qualified

Persons (QPs) as defined by National Instrument 43-101 ("NI

43-101") and have reviewed and approved the contents of this news

release.

The analyses which underpin the MRE were carried

out at ALS Chemex Laboratories at Guadalajara, Zacatecas, Mexico;

and North Vancouver, Canada using industry standard analytical

techniques. For gold, samples were first analysed by fire assay and

atomic absorption spectroscopy (“AAS”). Samples that returned

values greater than 10 g/t gold using this technique were then

re-analysed by fire assay but with a gravimetric finish. For

copper, samples were first analysed by Inductively Coupled Plasma –

Atomic Emission Spectroscopy (“ICP-AES”), with four acid digestion.

Samples that returned values greater than 10000 g/t copper

using this technique were then re-analysed by HF-HNO3-HCLO4

digestion with HCL leach and ICP-AES finish. Blanks, field

duplicates and certified standards were inserted into the sample

stream as part of Azucar’s quality assurance and control program.

The QPs detected no significant QA/QC issues during review of the

data. Azucar is not aware of any drilling, sampling, recovery or

other factors that could materially affect the accuracy or

reliability of the data referred to herein.

About

Azucar

Azucar is an exploration company with a mandate

to thoroughly explore the El Cobre Project in Veracruz, Mexico,

which covers multiple gold-rich porphyry targets, as demonstrated

by recent drilling. Azucar holds a 100% interest in the El Cobre

Project, subject to net smelter returns (“NSR”) royalty interests,

assuming production from the property exceeds 10,001 tonnes per day

of ore, totaling 2.25% which can be reduced to 2.0% though the

payment of US$3.0 million.

On behalf of the Board of Directors,

“J. Duane Poliquin”J. Duane Poliquin, P.Eng.

ChairmanAzucar Minerals Ltd.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX VentureExchange) accepts responsibility for the adequacy

or accuracy of this release.

This news release includes forward-looking

information that is subject to risks and uncertainties. All

statements within this news release, other than statements of

historical fact, are to be considered forward looking. Although the

Company believes the expectations expressed in such forward-looking

information are based on reasonable assumptions, such as those set

forth in this news release, such statements are not guarantees of

future performance and known and unknown risks, uncertainties, and

other factors may cause actual results or developments to differ

materially from those as expressed or implied in forward-looking

information. Factors that could cause actual results to differ

materially from those expressed or implied in forward-looking

information include those stated in the news release, and, among

others, market prices, exploitation and exploration successes,

risks related to international operations, continued availability

of capital and financing, and general economic, market or business

conditions. There can be no assurances that such statements will

prove accurate and, therefore, readers are advised to rely on their

own evaluation of such uncertainties. The Company does not assume

any obligation to update any forward-looking statements, other than

as required pursuant to applicable securities laws.Contact

Information: Azucar Minerals Ltd.

Tel. 604.689.7644Email:

info@azucarminerals.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/01bd8d48-9193-4e0c-923e-db7f8b560a26

https://www.globenewswire.com/NewsRoom/AttachmentNg/8bf52f6c-91e0-4793-ae74-8876591fec23

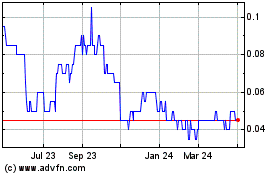

Azucar Minerals (TSXV:AMZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

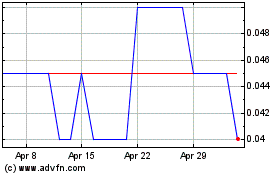

Azucar Minerals (TSXV:AMZ)

Historical Stock Chart

From Dec 2023 to Dec 2024