Avrupa and Antofagasta Intersect Copper-Rich VMS in Pyrite Belt,

Portugal

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb 27, 2014) -

Avrupa Minerals Ltd. (TSX-VENTURE:AVU)(FRANKFURT:8AM) -

- First greenfields discovery of massive sulfide mineralization

in 20 years in the Iberian Pyrite Belt

- 10.85 meters of massive and semi-massive/stockwork sulfide

mineralization grading 1.81% Cu, 2.57% Pb, 4.38% Zn, 0.13% Sn, and

75.27 ppm Ag

- Including 7.95 meters @ 2.21% Cu, 3.05% Pb, 4.82% Zn, 0.15% Sn,

89.8 ppm Ag

- Followed by 2.90 meters @ 0.71% Cu, 1.27% Pb, 3.17% Zn, 0.092%

Sn, 35.4 ppm Ag

- Avrupa and Antofagasta sign an amended Joint Venture

Agreement

Avrupa Minerals Ltd. is pleased to announce that recent drilling

at Sesmarias South in the Alvalade Joint Venture project, located

in the Pyrite Belt of southern Portugal, intersected copper-bearing

massive and semi-massive sulfide mineralization. The Alvalade

Project is operated by Avrupa and funded by a wholly-owned

subsidiary of Antofagasta plc ("Antofagasta"). As previously

reported, Antofagasta has earned-in to 51% of the project with

total funding of US$4.3 million. Since the beginning of the

project, the partners have drilled 28 holes and nearly 12,250

meters in all phases of drilling around the project area.

The discovery of massive sulfide mineralization occurred in the

second drill hole at the new Sesmarias South target area, which is

covered by approximately 100 meters of young cover sediments that

completely obscure visual sighting of the target rocks. Sesmarias

South is located approximately seven kilometers south of the

past-producing Lousal Mine and 50 kilometers northwest of Lundin

Mining's Neves Corvo Mine, along the Neves Corvo trend of the

Iberian Pyrite Belt in Portugal. The discovery is the first

greenfields success in the Pyrite Belt of both Portugal and Spain

since 1994.

The mineralized intercept in SES002 totals 16.85 meters, as

described in the table below. The intercept includes a zone of

massive sulfide mineralization, then underlain by a zone of

semi-massive sulfides and strong stockwork sulfide veining. There

follows a narrow shear zone, which is, in turn, underlain by a

further zone of strong alteration with anomalous disseminated and

stockwork sulfide mineralization. The analytical results for each

of the three zones follow:

|

SULFIDE TYPE |

FROM |

TO |

TOTAL |

Cu % |

Ag ppm |

Pb % |

Zn % |

Sn % |

Co % |

|

Massive |

151.65 |

159.60 |

7.95 |

2.21 |

89.8 |

3.05 |

4.82 |

0.15 |

0.084 |

|

Semi-massive/stockwork |

159.60 |

162.50 |

2.90 |

0.71 |

35.45 |

1.27 |

3.17 |

0.092 |

0.051 |

|

TOTAL |

|

|

10.85 |

1.81 |

75.27 |

2.57 |

4.38 |

0.13 |

0.075 |

|

|

FROM |

TO |

TOTAL |

Cu ppm |

Ag ppm |

Pb ppm |

Zn ppm |

--- |

Co ppm |

|

Weak/moderate stockwork |

162.50 |

168.50 |

6.00 |

4514 |

10.57 |

1886 |

4838 |

--- |

528 |

Follow-up drilling at Sesmarias South will commence on March

1st. Up to three holes are initially planned in order to determine

the orientation of the potential mineralized body, which is totally

blind from the surface.

Paul W. Kuhn, President and CEO of Avrupa Minerals, commented,

"The discovery of the Sesmarias South mineralization is really and

truly an exciting event! This is the first greenfields VMS

intersect the Pyrite Belt in 20 years. This discovery of massive

sulfide mineralization is the result of three years of study,

drilling, re-study, more drilling, reliance on the still-evolving

structural and geological model for mineralization in the Pyrite

Belt, full dedication from both the Avrupa and Antofagasta teams,

and a willingness by Antofagasta to continue the necessary funding

for the program. We are looking forward to the start of the

follow-up drilling at Sesmarias, as well as continued first-pass

exploration in our other target areas."

In addition to the Sesmarias South success the Alvalade JV

partners have also signed an amended Joint Venture Agreement (JVA)

which allows for more interim funding by Antofagasta, an expanded

time frame in which to get to a feasibility study decision, and a

means for Avrupa to be carried to production, if there is a

production decision to be made for the project. The amended

agreement carries the following terms (in summary):

- After due diligence, exploration funding of US$ 300,000

(completed).

- Antofagasta must spend US$ 4 million on exploration to earn-in

to 51% of the joint venture (Option 1 completed).

- To earn a further 9% of the JV (for an aggregate total of 60%),

Antofagasta must fund US$ 2 million exploration by December 31,

2015 (Option 2 underway).

- To earn a further 5% of the JV (for an aggregate total of 65%),

Antofagasta must prepare, fund, and deliver a Preliminary Economic

Assessment on a project within the JV area by December 31, 2017

(Option 3).

- To earn a further 10% of the JV (for an aggregate total of

75%), Antofagasta must prepare, fund, and deliver a Feasibility

Study on a project within the JV area by December 31, 2022 (Option

4).

- And to earn a further 5% of the JV (for an aggregate total of

80%), Antofagasta must fund 100% of all work programs during this

phase and make a Development Decision within one year of the Option

4 exercise date (Option 5).

- Antofagasta will carry Avrupa through to production, and Avrupa

will repay Antofagasta from proceeds, dividends, and sales

generated by the actual production from any mine within the project

area.

Notes on analytical methods and quality control. All samples

were sent to the ALS Chemex sample preparation facility in Seville,

Spain. Chemex shipped the prepped material to their main European

analytical laboratory located in Loughrea, Ireland. In the main

sulfide zone from 151.65 to 162.50 meters, total copper, silver,

lead, zinc, and cobalt results were obtained using a metals'

extraction method developed specifically for analysis of massive

sulfide mineralization. This includes metals' digestion by strong

oxidizing agents, followed by analysis using the industry-standard

technique of inductively coupled plasma - atomic emission

spectroscopy (ICP-AES). Total tin results were obtained using a

lithium borate fusion with the addition of a strong oxidizing

agent, and followed by x-ray fluorescence (XRF) analysis. In the

lower anomalous zone from 162.50 to 168.50 meters, all metals'

results were obtained using a four-acid digestion, followed by

ICP-AES analysis for near-total results in all metals with the

exception of tin, which was not re-analyzed due to low levels. In

addition to ALS Chemex quality assurance/quality control (QA/QC) of

all work orders, the Joint Venture conducted its own normal,

internal QAQC from results generated by the systematic inclusion of

certified reference materials, blank samples and field duplicate

samples. The analytical results from the quality control samples in

the SES002 work order have been evaluated, and conform to industry

best practice standards.

Antofagasta plc is listed on the London Stock Exchange, is a

constituent of the FTSE-100 Index, and has significant mining

interests in Chile. Antofagasta plc operates four copper mines: Los

Pelambres, Esperanza, El Tesoro and Michilla. Total production in

2013 was 721,200 tonnes of copper, 9,000 tonnes of molybdenum, and

293,800 ounces of gold. Antofagasta plc also has exploration,

evaluation and/or feasibility programs in North America, Latin

America, Europe, Asia, Australia and Africa.

Avrupa Minerals Ltd. is a growth-oriented junior exploration and

development company focused on discovery, using a prospect

generator model, of valuable mineral deposits in politically stable

and prospective regions of Europe, including Portugal, Kosovo, and

Germany.

The Company currently holds 15 exploration licenses in three

European countries, including nine in Portugal covering 2,980 km2,

five in Kosovo covering 153 km2, and one in Germany covering 307

km2. Avrupa operates three joint ventures in Portugal,

including:

- The Alvalade JV, with Antofagasta, covering one license in the

Iberian Pyrite Belt of southern Portugal, for Cu-rich massive

sulfide deposits;

- The Covas JV, with Blackheath Resources, covering one license

in northern Portugal, for intrusion-related W deposits; and

- The Arga JV, also with Blackheath Resources, covering one

license located adjacent to the Covas JV, for intrusion-related

Au-W deposits.

Avrupa is currently upgrading precious and base metal targets to

JV-ready status in a variety of districts on their other licenses,

with the idea of attracting potential partners to project-specific

and/or regional exploration programs.

For additional information, visit our website at

www.avrupaminerals.com.

On behalf of the Board,

Paul W. Kuhn, President & Director

This news release was prepared by Company management, who

take full responsibility for its content. Paul W. Kuhn, President

and CEO of Avrupa Minerals, a Licensed Professional Geologist and a

Registered Member of the Society of Mining Engineers, is a

Qualified Person as defined by National Instrument 43-101 of the

Canadian Securities Administrators. He has reviewed the technical

disclosure in this release.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Avrupa Minerals Ltd.(604) 687-3520(888)

889-4874www.avrupaminerals.com

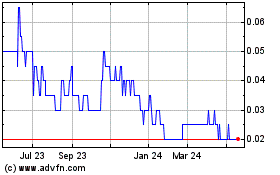

Avrupa Minerals (TSXV:AVU)

Historical Stock Chart

From Dec 2024 to Jan 2025

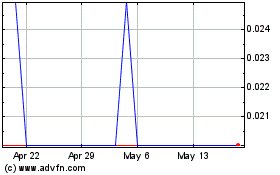

Avrupa Minerals (TSXV:AVU)

Historical Stock Chart

From Jan 2024 to Jan 2025