Critical Elements Reports Robust Tantalum Recoveries in Optimization Batch Testing With Up to 84% Ta2O5 Recovery Compared to ...

September 23 2013 - 9:25AM

Marketwired Canada

Critical Elements Corporation (TSX VENTURE:CRE)(OTCQX:CRECF) (FRANKFURT:F12) is

pleased to report the latest results of the optimization metallurgical program

underway at SGS Canada Inc. (Lakefield) for its Rose lithium-tantalum deposit in

James Bay, Quebec.

The program has resulted in significant tantalite optimization recoveries,

achieving tantalum recoveries of up to 84% with a concentration grade of 11,713

g/t Ta (14,303 g/t Ta2O5) in laboratory batch tests using wet high intensity

magnetic separation (WHIMS). The average Ta recovery rate for the program stands

at 77.6% with a concentration grade of 10,700 g/t Ta (13,066 g/t Ta2O5) in batch

magnetic separation tests (see table below).

The Corporation expects these results to dramatically increase the projected

amount of tantalite (Ta2O5) produced from the Rose project, although additional

testing is needed to confirm this with greater certainty. The initial economic

numbers from the December 2011 PEA analysis were based on a tantalum recovery of

50%. The latest results indicate a 27.6% increase in average recovery compared

to the PEA figures, which could potentially mean more than 100,000 additional

pounds of tantalite (Ta2O5) produced per year. The estimated final recovery rate

and quantity of tantalite to be produced will be better defined by pilot plant

testing, as well as in the upcoming feasibility study.

''To the best of our knowledge, the Rose lithium-tantalum deposit is the only

new economic conflict-free tantalum industrial-scale source in the world. The

recent robust recoveries and high purity results from the optimization testing

program prove the stand-alone class of the deposit, which has the potential to

become a key source of strategic metal supply,'' said Jean-Sebastien Lavallee,

President and Chief Executive Officer of Critical Elements Corporation.

Results of Batch Magnetic Separation Tests to Recover Ta Concentrate

-------------------------------------------------------------------------

Test No. Assay Assay Distribution %

------------------------------------------------

Ta g/t Ta2O5g/t Ta

-------------------------------------------------------------------------

F10

11,713 14,303 80.3

-------------------------------------------------------------------------

F11

10,388 12,685 84.0

-------------------------------------------------------------------------

F12

11,200 13,676 73.9

-------------------------------------------------------------------------

F13

10,200 12,455 77.6

-------------------------------------------------------------------------

F14

10,000 12,211 72.2

-------------------------------------------------------------------------

AVERAGE

10,700 13,066 77.6

-------------------------------------------------------------------------

Mr. Lavallee said: "This new forecast level of tantalite concentrate production

could make Critical Elements one of the largest tantalum producers in the world.

Recent tantalum mine closures in Canada, Mozambique and Australia are creating a

major shortage of supply from which we expect to benefit".

The results of the optimization metallurgical testing program for the processing

of the ore from the Rose deposit were generated by SGS Canada Inc. in Lakefield,

Ontario. The tests were carried out on a composite sample from surface outcrop

of the Rose mineralized zone.

The recent results from the optimization program are very positive and will be

used to finalize the flow sheet for the pilot plant program. The pilot plant

program will produce enough material to proceed with a flotation or other

suitable beneficiation methods aimed at increasing the grade of the tantalite

concentrate.

As announced in press release dated September 5th, 2013, the program has also

resulted in the successful optimization of lithium recovery rates and grades.

Batch flotation tests yielded an average recovery of 90.88% at 6.20% Li2O, but

most importantly, the flow sheet is substantially simplified. Moreover, the

reagents used in the optimization program are significantly cheaper. This could

dramatically reduce the mill construction costs (CAPEX) and the operating costs

(OPEX) to produce the Li2O concentrate. These assumptions should be confirmed by

the upcoming feasibility study.

In addition to recovery and grade testing, the iron content of spodumene grains

and the flotation concentrate as a whole have been determined. Analytical

results indicate that the average spodumene grain contains 0.13% Fe2O3 as solid

solution in its crystal structure. To the best of the Company's knowledge, this

is the lowest spodumene iron substitution seen in Quebec and Ontario lithium

deposits. As a result, the flotation concentrate as a whole may contain less

than 0.3% Fe2O3. Due to the low iron content, the lithium concentrate could also

be appropriate for use in the ceramics industry. The roasted concentrate is

white as opposed to the light reddish colour normally seen in spodumene

concentrates with high iron content. Pictures are available on the Company's

website at: www.cecorp.ca.

A small batch of flotation concentrate has been collected and roasted and sent

to SGS Canada Inc.'s hydrometallurgical testing department to start the

carbonation optimization program.

The laboratory is planning to produce more spodumene concentrate to be

distributed to various glass and ceramic producers for specification evaluation.

Pictures of the laboratory testing are available on the Company's website at:

www.cecorp.ca.

The objective of the program was to optimize the flow sheet for producing a

spodumene concentrate with a minimum grade of 6% Li2O at a recovery of about 90%

for hydrometallurgical lithium extraction. The next step is the Phase 2 program

aimed at optimizing the purity of the lithium carbonate produced by

bi-carbonation to create a final flow sheet. Another objective was to improve

the recovery of tantalum as a by-product, currently at about 60%. The final flow

sheet will be used to advance the pilot plant for the feasibility study.

The Critical Elements team is also pursuing its discussions regarding potential

long-term sales contracts with a number of potential lithium carbonate and

tantalite end-users.

Jean-Sebastien Lavallee (OGQ #773), geologist, shareholder and President and

Chief Executive Officer of the Company and a Qualified Person under NI 43-101,

has reviewed and approved the technical content of this release.

About Critical Elements Corporation

Critical Elements is actively developing its 100%-owned Rose lithium-tantalum

flagship project located in Quebec.

A recent financial analysis of the Rose project based on price forecasts of

US$260/kg ($118/lb) for Ta2O5 contained in a tantalite concentrate and

US$6,000/t for lithium carbonate (Li2CO3) showed an estimated after-tax Internal

Rate of Return (IRR) of 25% for the Rose project, with an estimated Net Present

Value (NPV) of CA$279 million at an 8% discount rate. The payback period is

estimated at 4.1 years. The pre-tax IRR is estimated at 33% and the NPV at $488

million at a discount rate of 8%. (Mineral resources that are not mineral

reserves and do not have demonstrated economic viability). (See press release

dated November 21, 2011.)

The operation is scheduled to produce 26,606 tons of high purity (99.9% battery

grade) Li2CO3 and 206,670 pounds of Ta2O5 per year over a 17-year mine life.

The project hosts a current NI 43-101-compliant Indicated resource of 26.5

million tonnes of 1.30% Li2O Eq. or 0.98% Li2O and 163 ppm Ta2O5 and an Inferred

resource of 10.7 million tonnes of 1.14% Li2O Eq. or 0.86% Li2O and 145 ppm

Ta2O5.

The Company is presently at the feasibility study stage on the Rose project.

Critical Elements' portfolio also includes rare-earth and tantalum-niobium

projects in the Rocky Mountains of British Columbia and in Quebec, as well as a

50% interest in the Croinor project, which is located in Quebec and hosts a

current NI 43-101-compliant Measured and Indicated resource of 506,700 tonnes at

10.66 g/t Au, for 173,700 ounces of gold at a 5 g/t cut-off.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without

limitation statements relating to realization of resource estimates, reduction

of capital and operating costs, success of mining operations and the ranking of

the project in terms of production. Readers should not place undue reliance on

forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and

other factors which may cause the actual results, performance or achievements of

the Company to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking statements. Until a

positive feasibility study has been completed, and even with the completion of a

positive feasibility study, there are no assurances that the Rose project will

be placed into production. Factors that could affect the outcome include, among

others: the actual results of development activities; project delays; inability

to raise the funds necessary to complete development; general business,

economic, competitive, political and social uncertainties; future prices of

metals; availability of alternative lithium or tantalum sources; actual rates of

recovery; conclusions of economic evaluations; changes in project parameters as

plans continue to be refined; accidents, labour disputes and other risks of the

mining industry; political instability, terrorism, insurrection or war; delays

in obtaining governmental approvals, necessary permitting or in the completion

of development or construction activities. For a more detailed discussion of

such risks and other factors that could cause actual results to differ

materially from those expressed or implied by such forward-looking statements,

refer to the Company's filings with Canadian securities regulators available on

SEDAR at www.sedar.com.

Although the Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors that cause

actions, events or results to differ from those anticipated, estimated or

intended. Forward-looking statements contained herein are made as of the date of

this news release and the Company disclaims any obligation to update any

forward-looking statements, whether as a result of new information, future

events or results or otherwise, except as required by applicable securities

laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Jean-Sebastien Lavallee, P.Geo.

President and Chief Executive Officer

819-354-5146

president@cecorp.ca

www.cecorp.ca

Investor Relations:

Paradox Public Relations

514-341-0408

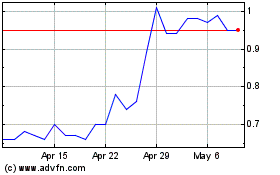

Critical Elements Lithium (TSXV:CRE)

Historical Stock Chart

From Jun 2024 to Jul 2024

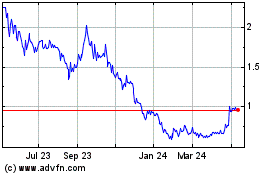

Critical Elements Lithium (TSXV:CRE)

Historical Stock Chart

From Jul 2023 to Jul 2024