DIVERGENT Energy Services Corp.

(“Divergent”, the "

Company",

“

our” or

“

DVG”

) (DVG: TSX-V)

announces the release of its financial results for the year ended

December 31, 2019.

FINANCIAL AND OPERATING HIGHLIGHTS –

YEAR ENDED DECEMBER 31, 2019

Demand for artificial lift services across the

United States remained strong throughout 2019 and the Company was

able to secure work in adjacent geographic areas within the region

that delivered higher revenues per job. As a result, revenues

increased in both the three and twelve month periods of 2019 as

compared to 2018.

A significant majority of the Company’s sales

are generated from one customer who is focused solely on coal bed

methane (“CBM”) wells in the Powder River Basin. The level of

activity with this customer has remained relatively consistent over

the past three years, and effective October 1, 2019, the customer

agreed to amend the master services contract with a cost recovery

price increase of 13 percent.

Select Financial Information for the three and

twelve-month periods ending December 31, 2019 have been summarized

as follows:

RESULTS OF

OPERATIONSSelect Financial Information - Tables

contain fourth quarter and year-end results for 2019 and

2018. Refer to the Company’s consolidated audited financial

statements and related management’s discussion and analysis

(“MD&A”) for a full description.

| (in 000’s of USD $

unless otherwise stated) |

Three Months Ended Dec 31 |

Year Ended Dec 31 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

| Revenue |

$2,264 |

|

$1,925 |

|

$8,178 |

|

$7,535 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

(1,463 |

) |

|

(1,420 |

) |

|

(5,897 |

) |

|

(5,257 |

) |

|

| Provision for slow moving

inventory |

|

(1,325 |

) |

|

(225 |

) |

|

(1,325 |

) |

|

(225 |

) |

|

| Gross Profit |

|

(524 |

) |

|

280 |

|

|

956 |

|

|

2,053 |

|

|

| |

|

|

|

|

|

| General and

administration |

|

(575 |

) |

|

(591 |

) |

|

(2,140 |

) |

|

(2,545 |

) |

|

| Depreciation and

amortization |

|

(237 |

) |

|

(54 |

) |

|

(408 |

) |

|

(129 |

) |

|

| Stock based compensation |

|

(6 |

) |

|

(18 |

) |

|

(37 |

) |

|

(89 |

) |

|

| Results from operating

activities |

|

(1,342 |

) |

|

(383 |

) |

|

(1,629 |

) |

|

(710 |

) |

|

| |

|

|

|

|

|

| Product development credit

(expense) |

|

326 |

|

|

(5 |

) |

|

270 |

|

|

(9 |

) |

|

| Finance (expense) income |

|

(401 |

) |

|

700 |

|

|

(1,285 |

) |

|

730 |

|

|

| Gain on disposal of

assets |

|

- |

|

|

7 |

|

|

- |

|

|

7 |

|

|

| (Loss) income from

continuing operations before income taxes |

|

(1,417 |

) |

|

319 |

|

|

(2,644 |

) |

|

18 |

|

|

| Deferred tax recovery |

|

- |

|

|

- |

|

|

- |

|

|

53 |

|

|

| (Loss) income from

continuing operations |

|

(1,417 |

) |

|

319 |

|

|

(2,644 |

) |

|

71 |

|

|

| Income from discontinued

operations |

|

- |

|

|

- |

|

|

- |

|

|

1,179 |

|

|

| Net (loss)

income |

($1,417 |

) |

$319 |

|

($2,644 |

) |

$1,250 |

|

|

| (Loss) income per

share – basic and dilutive (cents per share) |

($0.01 |

) |

$0.00 |

|

($0.02 |

) |

$0.01 |

|

|

|

|

|

|

|

|

|

| As at December

31 |

|

2019 |

|

|

2018 |

|

| Assets |

|

|

| Current

assets |

$2,555 |

|

$2,272 |

|

| Long-term

assets |

|

739 |

|

|

529 |

|

| |

$3,294 |

|

$2,801 |

|

| Liabilities |

|

|

| Current

liabilities |

$5,605 |

|

$3,400 |

|

| Long-term

liabilities |

|

4,344 |

|

|

3,947 |

|

| |

|

9,949 |

|

|

7,347 |

|

| Shareholders’

deficit |

|

(6,655 |

) |

|

(4,546 |

) |

| Liabilities and

shareholders’ deficit |

$3,294 |

|

$2,801 |

|

| Working

capital ratio |

|

0.46 |

|

|

0.67 |

|

The Company’s complete set of 2019 year end

filings have been filed on the SEDAR website at www.sedar.com and

are also available on the Company’s website at

www.divergentenergyservices.com.

OUTLOOK

As of the date of this MD&A the oil and gas

market has been negatively impacted by major international supply

competition and the COVID 19 pandemic. On March 30, 2020 the

Company issued a press release clearly outlining the direct impact

of these events on the Company and the steps it has taken to work

with customers, suppliers, creditors and other stakeholders to work

through this unprecedented situation.

The Company has significantly reduced its

workforce by temporarily laying off staff and is pursuing all

government wage subsidy programs that may apply in both Canada and

the United States. Senior executive staff have taken salary

reductions and the Board of Directors has waived the current

payment of fees. The Company continues discussions with major

customers and suppliers to enable collection of receivables and to

meet extended payables terms as we manage through these

unprecedented challenges. In response to the COVID-19 pandemic, the

Company has also committed to a "work from home" protocol, where

practical, and has limited access to our facilities by

non-essential and third-party personnel.

The slowdown in activity is expected to remain

until oil and gas prices improve.

The Company’s largest client has indicated that

it intends to perform workovers on only its best producing wells to

preserve its own cash reserves. While this will result in some

sales during the second quarter, collection is expected to be

delayed. A full return to work is contingent on the price of

natural gas rising to meet the clients lifting costs, but is also

stabilized by the necessity of DVG’s client to manage the reservoir

to maintain the long term viability of the field.

There is currently a Senate bill proposed in

Colorado as part of the government’s renewable energy strategy

which would include methane from coal as part of the renewable

energy mix. The bill, when passed, will require large natural

gas utilities to source some of their supply from sources other

than conventional natural gas. DVG’s client anticipates this

bill, if passed, will create a demand for their methane gas at

premium pricing which in turn provides DVG with more stable cash

flow.

During the second quarter of 2020, DVG continues

to be called upon for occasional service work for other clients and

has been awarded a number of jobs which are to be scheduled pending

commodity prices rising above each client’s lifting

costs.

For Further Information:

Ken Berg, President and Chief Executive Officer,

kberg@divergentenergyservices.com

Lance Mierendorf, Interim Chief Financial Officer,

lmierendorf@divergentenergyservices.com

ABOUT DIVERGENT ENERGY SERVICES CORP.

Headquartered in Calgary, Alberta, Divergent

provides Artificial Lift products and services that are used in the

oil and gas industry. Product lines including Electric

Submersible Pumps, Electric Submersible Progressing Cavity Pumps,

and the future development of an Electromagnetic Pump

technology.

DIVERGENT Energy Services Corp., 2020, 715 – 5th Ave SW,

Calgary, AB T2P 2X6, (403) 543-0060, (403) 543-0069 (fax),

www.divergentenergyservices.com

FORWARD LOOKING STATEMENTS

This press release contains forward-looking

statements, including, without limitation, statements pertaining to

anticipated future operational activity levels of Divergent and of

a majority of its customers, and statements pertaining to interest

payments on the Company’s debentures. . All statements

included herein, other than statements of historical fact, are

forward-looking information and such information involves various

risks and uncertainties, including: the risk that the anticipated

slowdown in sales and service of submersible pumps by Divergent’s

customers lasts longer than expected or impacts Divergent’s

revenues more severely than expected, the risk that the COVID-19

pandemic and the low oil and gas price environment cause additional

negative effects on Divergent’s business, the risk that the

suspension of trading of the Company’s common shares by the TSXV

cannot be lifted in a timely manner or at all, and the risk that

the Company cannot remedy the outstanding interest payments under

the terms of its debenture indenture in a timely manner or at all

. There can be no assurance that such information will prove

to be accurate, and actual results and future events could differ

materially from those anticipated in such information. A

description of assumptions used to develop such forward-looking

information and a description of risk factors that may cause actual

results to differ materially from forward-looking information can

be found in the Company's disclosure documents on the SEDAR website

at www.sedar.com. Forward-looking statements are based on

estimates and opinions of management of the Company at the time the

information is presented, including expectations provided to

Divergent by its customers. The Company may, as considered

necessary in the circumstances, update or revise such

forward-looking statements, whether as a result of new information,

future events or otherwise, but the Company undertakes no

obligation to update or revise any forward-looking statements,

except as required by applicable securities laws.

This press release contains financial outlook

information ("FOFI") about prospective revenue reductions, which

are subject to the same assumptions, risk factors, limitations, and

qualifications as set forth in the above paragraphs. FOFI

contained in this press release was made as of the date hereof and

was provided for the purpose of providing an update regarding an

anticipated material reduction in near-term revenue.

Divergent disclaims any intention or obligation to update or revise

any FOFI contained in this press release, whether as a result of

new information, future events or otherwise, unless required

pursuant to applicable law. Readers are cautioned that the

FOFI contained in this press release should not be used for

purposes other than for which it is disclosed herein.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

(Not for dissemination in the United States of

America)

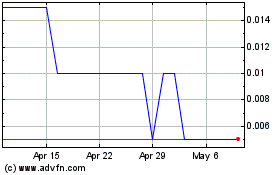

Divergent Energy Services (TSXV:DVG)

Historical Stock Chart

From Nov 2024 to Dec 2024

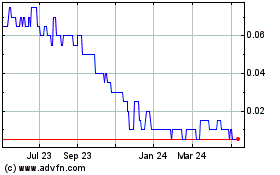

Divergent Energy Services (TSXV:DVG)

Historical Stock Chart

From Dec 2023 to Dec 2024