Euro Manganese Inc. (TSX-V and ASX: EMN; OTCQX: EUMNF; Frankfurt:

E06) (the "Company" or "EMN") is pleased to announce key

developments during the fourth fiscal quarter 2023 and to date. The

Company has now filed its September 30, 2023 year-end Financial

Statements, Management’s Discussion and Analysis, and other

financial reports.

Key Developments During and Subsequent

to the Quarter

Chvaletice Project, Czech Republic

- US$100

million non-dilutive funding package announced to advance

development of the Chvaletice Manganese Project (the "Project");

US$20 million received on closing. Definitive agreements

signed with OMRF (BK) LLC ("Orion"), which is managed by the Orion

Resource Group, for a US $100 million funding package, split into

two US$50 million components: a US$50 million Convertible Loan

Facility and a US$50 million Royalty Financing.The 36-month secured

Convertible Loan Facility bears interest at 12% p.a. and is

structured in two tranches: US$20 million, which was received upon

closing, and an additional US$30 million to be received upon

meeting key technical and commercial milestones. The loan is

convertible into a royalty stream on Project revenue. The US$50

million Royalty Financing can be drawn following a final investment

decision by the Board.All aspects of the funding package were

structured to meet Project finance bankability requirements and

will sit alongside, and reduce, the project finance debt and equity

required for the full Project financing. For further details on the

Convertible Loan Facility and Royalty Financing, please refer to

the Company’s announcement on November 28, 2023.In connection with

the funding package, Orion have an offtake option of between

20-22.5% of the Project’s high-purity manganese total production,

for a term of 10 years from first delivery and matching the

commercial terms of the Company’s sales. Such right is exercisable

until the Company signs 60% of the total Project offtake.

-

Production of HPMSM from the Chvaletice Demonstration Plant

de-risks the process flow sheet. Two independent external

laboratories confirmed samples sent for testing met the

Demonstration Plant target specifications for high-purity manganese

sulphate ("HPMSM") with low levels of impurities.Third-party

high-purity electrolytic manganese metal ("HPEMM"), with similar

product impurity levels to those of the Chvaletice HPEMM product,

was used as feedstock during the commissioning of the dissolution

and crystallization module. As part of the final commissioning

stages of the Demonstration Plant, the Company will use HPEMM

produced from the electrowinning circuit for HPMSM production.The

team is gaining valuable insights from operation of the

Demonstration Plant, which are leading to engineering and

operational process improvements.

- Revised

ESIA resubmitted to Czech Ministry of Environment, no anticipated

effect on timeline to final investment decision. Work was

completed to address the comments received related to noise

abatement. The Company anticipates the issuance of a positive

decision on the revised Environmental Social Impact Assessment

("ESIA") in early 2024.

-

Preparation of other key permits is progressing

well. Documentation for the Land Planning Permit is

substantially complete and will be finalised upon receipt of the

conditions in the approved ESIA. The Land Planning Permit will be

submitted on approval of the ESIA. The Construction Permit is a

deliverable of the FEED phase of engineering and is expected to be

submitted in H2 2024.

-

Definitive Lease Agreement with ČEZ a.s. ("ČEZ")

provides access to approximately 60% of the Proven and

Probable Manganese Reserves in the historic tailings area.

Land access is granted in return for a royalty on gross sales from

the Project. During the seven-year project finance debt period, the

royalty will operate on a sliding scale from 0.2-1.8%, dependent on

the average prices received for the Project’s high-purity manganese

products. The sliding scale royalty is designed to ensure

anticipated project finance debt covenants are met. Post the debt

period, the royalty will be 1.8% of gross sales from the

Project.

- Access

to approximately 85% of Chvaletice Proven and Probable Reserves

secured. The ČEZ Lease Agreement, together with previously

announced land access agreements, secures access to approximately

85% of the total Reserves of the Project. Negotiations with respect

to acquisition of the balance of the surface rights with the

remaining landowner are progressing.

- Rezoning

of all land required for the Project now complete. The

Municipality of Chvaletice formally approved the rezoning of

tailings land for mining use and certain areas within the

commercial plant site that were required to be reclassified for

heavy industrial use. Together with the rezoning of the Village of

Trnavka’s tailings land for mining use, announced in March 2022,

the rezoning requirements for the Project are now complete.

-

Chvaletice Project selected for support under

inter-governmental Mineral Security Partnership ("MSP").

The MSP is a collection of 13 countries and the European Union that

aims to catalyze public and private sector investment to build

diverse, secure and responsible critical mineral supply chains

globally. Chvaletice was the only manganese project amongst the 17

projects the MSP is working to advance. Projects are to receive

support by leveraging the collective financial and diplomatic

resources of the MSP’s 14 Partners and private sector financiers

partnering with the MSP.

- €3

billion fund proposed by the European Commission to boost growth in

EU battery industry a potential opportunity. Starting in

2024, up to €3 billion in funding is proposed to be provided via

the Commission’s Innovation Fund to incentivize investment in the

European Union’s battery manufacturing capacity. The Commission

intends to set up a dedicated instrument under the Innovation Fund

to provide support, possibly as a fixed premium to European

manufacturers of the most sustainable batteries, creating impact

across the entire battery value chain, including its upstream raw

material segment.

Offtake Process

- Offtake

process progressing with over 100% of annual production capacity

under discussion. Active discussions and negotiations are

taking place with potential customers across the battery supply

chain, including battery, chemical and automobile manufacturers.

The Company is targeting 80% of production capacity under offtake

contract to support project finance. In addition, several larger

potential customers are yet to provide an allocation of tonnage to

the Company but have expressed an expectation to do so.

Bécancour Facility, Quebec, Canada

-

Bécancour Dissolution Plant Scoping Study delivered strong

preliminary project economics.1 The

Scoping Study outlined a post-tax Net Present Value ("NPV") of

C$190 million using an 8% discount rate, a post-tax Internal Rate

of Return ("IRR") of 26%, and a payback period of approximately 4

years. The economic analysis has a margin of error of -30%/+50% and

was run on an unlevered and constant dollar basis with no inflation

or government grants considered. Initial capital is estimated at

C$110.8 million, including contingencies of C$15.1 million. Plant

production capacity is estimated to be 48,500 tonnes per annum

("tpa") of HPMSM, assuming sufficient supply of HPEMM feedstock.

This could meet up to 20% of projected North American 2027 demand

for HPMSM, according to forecasts by CPM Group. There is no current

processing capacity or production of battery-grade manganese in

North America.

- MoU

signed with Manganese Metal Company ("MMC") for supply of

HPEMM. The MoU provides feedstock optionality for the

Bécancour Plant, allowing it to be fed with HPEMM from MMC and/or

with HPEMM from the Company’s Chvaletice Project. This enables the

potential for the Bécancour Plant to supply the North American

market as early as mid-2027, thus bringing forward cash flows for

the Company.

- WSP

Canada selected for Bécancour Dissolution Plant Feasibility

Study. The Feasibility Study will further define project

design, costs, economics, and customer off-take opportunities and

is subject to financing. Permitting is expected to advance in

parallel with the Study to facilitate the path to production.

-

Cooperation Agreement signed with the Grand Conseil de la

Nation Waban-Aki ("W8banaki"). The Agreement defines how

the Company and the W8banaki intend to communicate openly and

regularly, and to work together for the mutually acceptable

development of the Bécancour Project, especially during the

evaluation and planning phases.

Financial Position

- Cash and

cash equivalents of approximately C$7.6 million at FQ4/fiscal

year-end (September 30, 2023); compared to C$10.9 million

at FQ3 (June 30, 2023) and C$21.6 million at fiscal year-end 2022.

The decrease in cash of $13.9 million year over year is a result of

$10.8 million used in operating activities and $3.1 million used in

investing activities, which included payment for the Demonstration

Plant costs and certain land.

- Working

capital of C$5.7 million at FQ4/fiscal year-end (September

30, 2023), compared toC$9.2 million at FQ3 (June 30, 2023) and

C$19.8 million at fiscal year-end 2022.

-

Sufficient funding for delivery of key project

milestones. The net proceeds from the first US$20 million

tranche of the Convertible Loan Facility, received post fiscal

year-end, is expected to be sufficient funding to complete

permitting of the Project, commissioning of the Chvaletice

Demonstration Plant and its operation, and acquisitions of certain

land parcels. It is also expected to fund initiation of the FEED

phase of the EPCM contract, certain site preparation works, and for

general and administration expenses for more than 12 months.Funding

to progress the Company's North American strategy, including the

Bécancour Plant feasibility study, is expected to be provided by

the Company’s current cash and cash equivalents and future equity

raises, and funding by strategic industry investors and government

programs.

Dr. Matthew James, President & CEO of Euro Manganese,

commented:

“We continued to deliver to plan in 2023 and

achieved several key milestones during and subsequent to the fourth

fiscal and calendar quarter. Our Team successfully produced on-spec

HPMSM from our Demonstration Plant, advanced ESIA permitting, and

completed a significant land-lease agreement, which provides us

with access to approximately 60% of the Project’s manganese

Reserves and overall, secures land access to roughly 85% of

Reserves. Outstanding land rezoning requirements were also

completed.

The Chvaletice Project received high-level

inter-governmental support during the fourth calendar quarter by

being named as a project under the Minerals Security Partnership.

We aim to leverage opportunities to meet with private sector

financiers partnering with the MSP as we advance with Project

financing.

We were very pleased to announce the

non-dilutive US$100 million funding package with Orion in late

November. The proceeds from the initial US$20 million tranche allow

us to further advance the Project, particularly completing

permitting, initiating the FEED phase of the EPCM contract, and

commissioning of the Demonstration Plant. We remain focused on

delivering on these items, in addition to continuing negotiations

with potential customers to enter offtake contracts and initiating

the project finance debt process.

I am proud of the ongoing commitment of our Team

to advance the Chvaletice Project and look forward to continued

delivery of key catalysts in 2024 and beyond. Together, we are

moving closer to our vision of being a leading and environmentally

responsible producer of high-purity manganese.”

Q4 and Year-End 2023 Conference Call

Details

Euro Manganese will host two separate Fourth

Quarter and Year-End 2023 conference calls to serve stakeholders in

their respective time zones. Content of both calls will be the

same. Replays and transcripts of both calls will be available on

Euro Manganese’s website: www.mn25.ca

|

CALL #1 – For North American and UK/European

Audiences |

|

|

North America |

UK/Europe |

|

Date |

Tuesday, January 9, 2024 |

Tuesday, January 9, 2024 |

|

Time |

8:30am PST | 11:30am EST |

4:30pm GMT | 5:30pm CET |

|

Registration: |

https://us06web.zoom.us/webinar/register/WN_AfPAHSfXRHaM1Qp3KlXOMg |

|

CALL #2 – For Australian and North American

Audiences |

|

|

Australia |

North America |

|

Date |

Wednesday, January 10, 2024 |

Tuesday, January 9, 2024 |

|

Time |

9:00am AEDT | 6:00am AWST |

2:00pm PST | 5:00pm EST |

|

Registration: |

https://us06web.zoom.us/webinar/register/WN_mu69TZNYQBqyXrI_1oBGEw |

About Euro Manganese Inc.

Euro Manganese is a battery materials company

focused on becoming a leading producer of high-purity manganese for

the electric vehicle industry. The Company is advancing development

of the Chvaletice Manganese Project in the Czech Republic and

exploring an early-stage opportunity to produce battery-grade

manganese products in Bécancour, Québec.

The Chvaletice Project is a unique

waste-to-value recycling and remediation opportunity involving

reprocessing old tailings from a decommissioned mine. It is also

the only sizable resource of manganese in the European Union,

strategically positioning the Company to provide battery supply

chains with critical raw materials to support the global shift to a

circular, low-carbon economy.

Euro Manganese is dual listed on the TSX.V and

the ASX, and is also traded on the OTCQX.

Authorized for release by the CEO of Euro

Manganese Inc.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) or the ASX accepts responsibility for the

adequacy or accuracy of this release.

|

Inquiries |

|

| Dr. Matthew

James |

Louise

Burgess |

| President & CEO |

Senior Director, Investor

Relations & Communications |

| mjames@mn25.ca |

lburgess@mn25.ca |

| |

+1 (604) 312-7546 |

Company Address

#709 -700 West Pender StreetVancouver, British Columbia, Canada,

V6C 1G8 www.mn25.ca

Forward-Looking Statements

Certain statements in this news release

constitute “forward-looking statements” or “forward-looking

information” within the meaning of applicable securities laws. Such

statements and information involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of the Company, its Chvaletice mineral

project, its proposed Bécancour Plant or industry results, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information. Such statements can be identified by the

use of words such as “may”, “would”, “could”, “will”, “intend”,

“expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”,

“forecast”, “predict” and other similar terminology, or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will” be taken, occur or be achieved.

Regarding the Chvaletice Project,

forward-looking information or statements include, but are not

limited to, statements regarding the ability of the Company to

deliver on samples meeting specifications to potential customers

from the demonstration plant, the timing for FEED under the EPCM

contract, final investment decision, ESIA approval and other

various regulatory approvals, statements regarding the ability of

the Company to obtain remaining surface rights and various permits,

the benefits of remediating the historic tailings areas, statements

regarding the expectation of the Company that the net proceeds from

the first tranche of the Convertible Loan Facility will be

sufficient funding to complete the permitting of the Chvaletice

mineral project, complete the commissioning of the demonstration

plant and its operation, initiation of FEED, complete the

acquisition of certain land parcels needed for the Project, and

certain site preparation works, and for general and administration

expenses for more than 12 months; the growth and development of the

high purity manganese products market, the desirability of the

Company’s products, the ability of the Company to enter into

binding offtake agreements with potential customers on favorable

terms or at all, the growth of the EV industry, the use of

manganese in batteries, the manganese project supply line, support

from European financial institutions and any government funding,

any anticipated benefits from legislation and the Company’s ability

to obtain financing.

Regarding the Bécancour Plant, forward-looking

statements include, but are not limited to, statements concerning

the Company’s plans for advancing the Bécancour Plant and results

of the Scoping Study including estimates of internal rates of

return, net present values, and estimates of costs. Such

forward-looking information or statements also include, but are not

limited to, statements regarding the timing for completion of the

Bécancour feasibility study, the Company’s ability to reach a

definitive agreement with MMC to supply feedstock, the Company’s

ability to operate the Bécancour Plant and associated production ,

the projected growth of the North American demand for high-purity

manganese products, any benefits of legislation, the Company’s

ability to secure offtake from North American customers, the

Company’s ability to raise the necessary financing, and the timing

of any permit application submissions and approvals and continuing

successful cooperation with the W8banaki Nation.

Readers are cautioned not to place undue

reliance on forward-looking information or statements.

Forward-looking statements are subject to a number of risks and

uncertainties that may cause the actual results of the Company to

differ materially from those discussed in the forward-looking

statements and, even if such actual results are realized or

substantially realized, there can be no assurance that they will

have the expected consequences to, or effects on, the Company.

Factors that could cause actual results or

events to differ materially from current expectations include,

among other things for the Chvaletice Project, lack of sufficient

funding; the ability to develop adequate processing capacity and

production; the availability of equipment, facilities, and

suppliers necessary to complete development; the cost of

consumables and extraction and processing equipment; risks and

uncertainties related to the ability to obtain, amend, or maintain

necessary licenses, or permits, risks related to acquisition of

surface rights; the potential for unknown or unexpected events to

cause contractual conditions to not be satisfied; the failure of

parties to contract with the Company to perform as agreed; risks

and uncertainties related to the accuracy of mineral resource and

reserve estimates, variations in rates of recovery and extraction,

the price of HPEMM and HPMSM, power supply sources and price,

reagent supply resources and prices, future cash flow, total costs

of production, and diminishing quantities or grades of mineral

resources and reserves; the inability to secure sufficient offtake

agreements; the inability to meet conditions under the Company’s

secured credit facility and risks related to granting security; a

delay or inability to get the ESIA approved by relevant

authorities; unexpected results or unsuccessful completion of the

various stages of the EPCM contract; and changes in project

parameters as plans continue to be refined. For the Bécancour

Plant, factors include, among other things: assumptions in the

scoping study not proving accurate over time and negatively

affecting results; an inability to obtain financing, unanticipated

operational difficulties including failure of the Bécancour Plant;

cost escalation for reagents, labour, power and other cost

increases; inability to secure key reagents; a delay or inability

to obtain or maintain necessary licenses or permits; the potential

for unknown or unexpected events to cause contractual conditions to

not be satisfied; inability to complete feasibility study or other

technical studies or unexpected results; and risks and

uncertainties related to limited feedstock supply options.

Additional factors that could cause results or

events to differ materially from current expectations include risks

related to global epidemics or pandemics and other health crises;

availability and productivity of skilled labour; risks and

uncertainties related to interruptions in production; unforeseen

technological and engineering problems; the adequacy of

infrastructure; social unrest or war; the possibility that future

results will not be consistent with the Company's expectations;

increase in competition, developments in EV battery markets and

chemistries; risks related to fluctuations in currency exchange

rates, changes in laws or regulations; and regulation by various

governmental agencies and changes or deterioration in general

economic conditions. For a further discussion of risks relevant to

the Company, see "Risk Factors" in the Company's annual information

form for the year ended September 30, 2023, available on the

Company's SEDAR+ profile at www.sedarplus.ca.

All forward-looking statements are made based on

the Company's current beliefs as well as various assumptions made

by the Company and information currently available to the Company.

In general, these include that the Company can achieve its goals;

that the political and community environment in which the Company

operates in will continue to support its projects; the Company can

meet its obligations under the Convertible Loan Facility and secure

additional financing, and assumptions related to the factors set

out herein.

Although the forward-looking statements

contained in this news release are based upon what management of

the Company believes are reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. These forward-looking statements are

made as of the date of this news release and are expressly

qualified in their entirety by this cautionary statement. Subject

to applicable securities laws, the Company does not assume any

obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this news release.

1 Euro Manganese cautions that the Study does

not constitute a scoping study within the definition used by the

Canadian Institute of Mining, Metallurgy and Petroleum ("CIM"), as

it relates to a standalone industrial project and does not concern

a mineral project of the Company. As a result, disclosure standards

prescribed by National Instrument 43-101 – Standards of Disclosure

for Mineral Projects ("NI-43-101") are not applicable to the

scientific and technical disclosure in the Study. Any references to

Scoping Study or Feasibility Study by Euro Manganese in relation to

the Bécancour Plant are not the same as terms defined by the CIM

Definition Standards and used in NI 43-101.

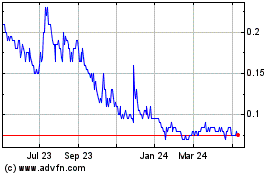

Euro Manganese (TSXV:EMN)

Historical Stock Chart

From Feb 2025 to Mar 2025

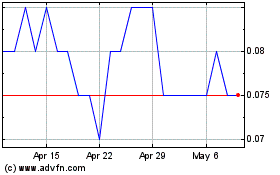

Euro Manganese (TSXV:EMN)

Historical Stock Chart

From Mar 2024 to Mar 2025