Further to its news release dated September 18, 2024, Fredonia

Mining Inc. (TSXV: FRED) (the “

Company” or

“

Fredonia”) is pleased to announced that the Board

of directors of the Company (the “

Board”) has

approved a share consolidation at a ratio of five pre-consolidated

common shares in the capital of the Company (“

Common

Shares”) for each one post-consolidation Common Share (the

“

Consolidation”). Shareholders of the Company

approved a resolution authorizing the Board to proceed with the

Consolidation at a special meeting of shareholders held on October

23, 2024.

The Company intends to file articles of

amendment with respect to the Consolidation on November 12, 2024

and expects trading of the post-Consolidation Common Shares to

commence on or about November 14, 2024. The new CUSIP and ISIN

numbers for the post-Consolidation Common Shares are 356063404 and

CA3560634048, respectively.

As at the date of this news release, there are

228,043,257 outstanding Common Shares. After completion of the

Consolidation, there will be approximately 45,608,651 Common Shares

outstanding (which number is prior to giving effect to rounding

down of fractional Common Shares at each individual account

level).

Further information on the Consolidation can be

found in the Company’s management information circular dated

September 19, 2024 available on the Company’s profile on SEDAR+ at

www.sedarplus.ca.

TSX Trust Company (“TSX

Trust”), the Company’s transfer agent, will act as

exchange agent for the Consolidation. Registered shareholders of

the Company will receive a mailed letter of transmittal from TSX

Trust with instructions on how to surrender certificates or DRS

advices or statements representing the registered shareholder’s

pre-Consolidation Common Shares in exchange for post-Consolidation

Common Shares.

Further to its news release dated September 27,

2024, and in response to applicable TSX Venture Exchange policies,

the Company also wishes to provide additional information with

respect to insider participation in a private placement of units

(“Units”) completed on September 26, 2024 (the

“Offering”). Estanislao Auriemma, the Chief

Executive Officer and a director of the Company subscribed for

1,266,668 Units, Ricardo Auriemma, a director of the Company

subscribed for 1,333,333 Units and Waldo Perez, a director of the

Company subscribed for 1,666,666 Units in the Offering, each on the

same commercial terms as arm’s length investors. Insider

participation in the Offering was disclosed in the Company’s news

release on closing of the Offering, and detailed information with

respect to the Offering and insider participation in accordance

with applicable securities laws was publicly disclosed in the

Company’s material change report with respect to the Offering filed

on the Company’s profile on SEDAR+ at www.sedarplus.ca dated

September 27, 2024.

About Fredonia

Fredonia indirectly owns a 100% interest in

certain license areas (totaling approximately 18,300 ha.)

(collectively, the “Project”), all within the

Deseado Massif geological region in the Province of Santa Cruz,

Argentina, including the following principal areas: El Aguila

(approximately 9,100 ha.), Petrificados (approximately 3,000 ha.),

and the flagship, advanced El Dorado-Monserrat property

(approximately 6,200 ha.) located close to AngloGold Ashanti’s

Cerro Vanguardia mine, subject to a 1.5% net smelter return royalty

on the EDM project, and a 0.5% net profits interest on Winki II, El

Aguila I, El Aguila II and Hornia (ex Petrificados).

For further information, please visit

the Company’s website at www.fredoniamanagement.com or contact:

Carlos Espinosa, Chief Financial Officer, Direct: +1-647-401-9292,

Email: cespinosa@slgmexico.com.

Forward-looking Information Cautionary

Statement

This news release contains “forward‐looking

information” within the meaning of the applicable Canadian

securities legislation that is based on expectations, estimates,

projections and interpretations as at the date of this news

release. The information in this news release about the intention

to complete the Consolidation and timing and effect thereof, the

expected trading date of the post-Consolidation Common Shares, and

any other information herein that is not a historical fact may be

“forward-looking information”. Any statement that involves

discussions with respect to predictions, expectations,

interpretations, beliefs, plans, projections, objectives,

assumptions, future events or performance (often but not always

using phrases such as “expects”, or “does not expect”, “is

expected”, “interpreted”, “management's view”, “anticipates” or

“does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”,

“estimates”, “believes” or “intends” or variations of such words

and phrases or stating that certain actions, events or results

“may” or “could”, “would”, “might” or “will” be taken to occur or

be achieved) are not statements of historical fact and may be

forward-looking information and are intended to identify

forward-looking information. This forward-looking information is

based on reasonable assumptions and estimates of management of the

Company, at the time such assumptions and estimates were made, and

involves known and unknown risks, uncertainties or other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

volatility in the trading price of the Common Shares and risks

relating to the ability of the Company to obtain required

approvals. Although the forward-looking information contained in

this news release is based upon what management believes, or

believed at the time, to be reasonable assumptions, the Company

cannot guarantee shareholders and prospective purchasers of

securities of the Company that actual results will be consistent

with such forward-looking information, as there may be other

factors that cause results not to be as anticipated, estimated or

intended, and neither Company nor any other person assumes

responsibility for the accuracy and completeness of any such

forward looking information. Company does not undertake, and

assumes no obligation, to update or revise any such forward looking

statements or forward-looking information contained herein to

reflect new events or circumstances, except as may be required by

law.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

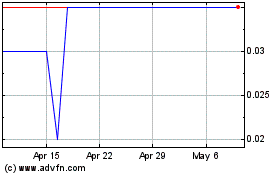

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

From Dec 2024 to Jan 2025

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

From Jan 2024 to Jan 2025