Oroco Resource Corporation. (“

Oroco” or the

“

Company”) (TSXV: OCO; OTCQB: ORRCF, BF: OR6) is pleased to

announce a revised Preliminary Economic Assessment (“

PEA”)

and updated Mineral Resource Estimate (“

MRE”) for the North

Zone and South Zone of its Santo Tomas Porphyry Copper Project

(“

Santo Tomas” or the “

Project”) in Sinaloa State,

Mexico. The PEA is based on a staged open pit mine and processing

plant achieving 60,000 tonnes per day (“

t/d”) production in

year 1 and expanding to 120,000 t/d in year 8 over a 22.6-year Life

of Mine (“

LOM”). Production is preceded by two years of

construction and one concurrent year of pre-stripping. The PEA has

been prepared by Ausenco Engineering USA South Inc.

(“

Ausenco”). The updated MRE and geologic model were

prepared by SRK Consulting (U.S.), Inc. of Denver, Colorado and SRK

Consulting (Canada) Inc., Vancouver, BC (jointly “

SRK”). SRK

(Canada) was responsible for geotechnical modeling. The mine

planning and mine costs components of the PEA were prepared by SRK

(U.S.).

Highlights of the revised PEA include:

- NPV

(8%) of US$2.64 billion pre-tax and US$1.48 billion post-tax.

- IRR

of 30.3% pre-tax and 22.2% post-tax.

- Total

LOM payable copper production of 4,774 M lb.

-

Pre-tax payback of 2.9 years; post-tax payback of 3.8 years from

first concentrate production.

-

Initial capital costs estimated at US$1,103.5 million; sustaining

and expansion capital costs estimated at US$1,734.1 million.

-

Annual LOM C1 Cash Cost of US$1.54/lb Cu on by-product basis.

-

Average CuEq grade of 0.51% over the first 7 years of

production.

-

Capital efficiency ratio (NPV / Initial Capital Cost) of 1.34.

-

Total mineralized material mined of 825.5 Mt.

Commenting on the updated PEA, CEO Richard

Lock:

“When we completed the initial PEA in December

2023 it was clear there was additional value to be unlocked at

Santo Tomas. Upon careful analysis, a staged approach to the mine

expansion and a focus on exploiting the higher-grade near surface

material in the early years of mining has unlocked a considerable

increase in value. We have established a plan that invokes a very

efficient use of capital and establishes a rapid post-tax payback

of 3.8 years. The plan starts with the use of smaller equipment to

provide rapid entry to the mineralized material and maintains a

higher-grade feed profile to delay the requirement of an expansion

until year 8. Copper Equivalent production in the first 7 years is

forecast at 1.34 billion pounds at a Mill Feed average grade of

0.51% Cu Eq.

Quite significantly, this work establishes Santo

Tomas as one of the most capital efficient large-scale, low-cost

copper projects in the world as illustrated in Figure 1 below.

Figure 1: Santo Tomas Displays Strong Economics

Compared to its Peers

Source/Notes:FactSet. Technical reports (1)

Copper equivalent production calculated using stated metal prices

from each project’s latest technical report (After-Tax NPV 8% /

Total Capex (US$M). Bubble size based on annual production). The

above chart is for illustration purposes only and presents an

abstract and simplified view of the NPV based on published data.

The other projects presented may not take into account individual

risk profiles of each deposit depicted and may not be

contemporaneous with the current NPV of the Santo Tomas update. See

important metal price and study date information for projects

depicted above on Oroco’s website.

PEA Overview

The Santo Tomas property comprises 9,034 ha of

mineral concessions encompassing significant porphyry copper

mineralization in northern Sinaloa and southwest Chihuahua, Mexico.

The Project is located in the Santo Tomas Porphyry District, which

extends from Santo Tomas northward to the Jinchuan Group’s

Bahuerachi Project located approximately 14 km to the

north-northeast. The PEA was conducted using data (including 27,382

Cu assays) from 68 diamond drill holes (43,063 m) drilled by the

Company and 90 legacy reverse circulation and diamond drill holes

(21,075 m, for a total of 64,138 m in 158 drill holes) in the

Project’s North Zone and South Zone. The data from the seven

exploration diamond drill holes in Brasiles Zone and the single

geotechnical hole (GT001) drilled by the Company were excluded from

consideration in the MRE and PEA. Oroco’s entire updated drill hole

database (including PEA excluded holes) contains 166 new and legacy

drill holes totaling 69,556 m with lithological logging data and

29,992 Cu assays.

The commodity price assumptions for the

Discounted Cash Flow (“DCF”) analysis are presented in Table

1. Key results from the DCF analysis prepared by Ausenco are

presented in Tables 2 & 3.

Table 1:

DCF Price Assumptions

| Commodity |

Unit |

Price* |

| Cu |

US $ / lb |

4.00 |

| Mo |

US $ / lb |

15.00 |

| Au |

US $ / t.oz |

1,900 |

| Ag |

US $ / t.oz |

24.00 |

*Cash flow model assumptions only.

Cautionary Note to Investors

The reader is cautioned that the PEA is

preliminary in nature, and that it includes inferred mineral

resources that are considered too speculative geologically to have

the economic considerations applied to them that would enable them

to be categorized as mineral reserves, and there is no certainty

that the preliminary economic assessment will be realized.

Table 2:

Mining and Production – Key Results

| Key

Assumptions |

Unit |

LOM |

| Exchange

Rate |

MXN /

US$ |

19.76 |

| Fuel

Price |

MXN /

L |

20.41

(US$1.03) |

|

Production Profile |

Unit |

LOM |

| Total Open

Pit Tonnage |

Mt |

1,964.9 |

| Total Open

Pit Mineralized Material Mined |

Mt |

825.5 |

| Open Pit

Strip Ratio |

Waste

: mill feed |

1.38 |

| Daily

Throughput (Year 1 // Year 8 on) |

kt/d |

60 //

120 |

| LOM

(concentrate production) |

Years |

22.6 |

| Copper in

Mill Feed |

M lb |

5,916 |

| Molybdenum

in Mill Feed |

M lb |

138.7 |

| Gold in Mill

Feed |

koz |

753.4 |

| Silver in

Mill Feed |

koz |

55,200 |

| LOM mill

feed (Indicated // Inferred) |

Mt |

388 //

460 |

| Average Cu

payable / year – LOM |

M lb |

207.5 |

| Average Cu

payable / year – First 5 Years (1) |

M lb |

167.5 |

| Payable (2)

Copper LOM (in concentrate) |

M lb |

4,774 |

| Payable

Molybdenum LOM (in concentrate) |

M lb |

80.8 |

| Payable

Silver LOM (min 30 g/t payable in Cu Concentrate) |

koz |

26,673 |

| Payable Gold

LOM (min 1 g/t payable in Cu Concentrate) |

koz |

300.2 |

| Operating

Costs (US$/lb.) |

Unit |

LOM |

| C1 Cash

Costs Copper (By-Product Basis) (3) |

US$/lb |

1.54 |

| C3 Cash

Costs Copper (By-Product Basis) (4) |

US$/lb |

2.00 |

| Capital

Expenditures (5) |

Unit |

LOM |

| Initial

Capital (6) |

US$M |

1,103.5 |

| Sustaining

and Expansion Capital (6, 7) |

US$M |

1,734.1 |

| Closure

Costs (5 years, year 22 - 27) |

US$M |

209.2 |

| Estimated

Salvage Value |

US$M |

0 |

Notes: (1) First 5 Years at full

production, starting year 2. (2) Payable metals consider

mining dilution, concentrator recoveries and Treatment

Charges/Refining Charges (TC/RC). (3) C1 Cash Costs

consist of mining costs, processing costs, mine-level G&A and

transportation costs net of by-product credits. (4) C3

Cash Costs includes C1 Cash Costs plus sustaining and expansion

capital, royalties, and closure costs. (5) All capital

expenditures are inclusive of contingency provisions to allow for

uncertain cost elements, which are predicted to occur but are not

included in the cost estimate. (6) Net of leasing capital

deferment and leasing costs. (7) Sum of expansion and

sustaining capital.

Table

3:

Key Financial Results and Costs

| Economics |

Unit |

LOM |

| IRR (pre-tax // post-tax) |

% |

30.3 //

22.2 |

| Payback (pre-tax // post-tax) |

Years |

2.9 //

3.8 |

| Revenue over LOM |

US$M |

21,517 |

| Initial Capital |

| Mining Pre-Stripping (Capitalized OPEX) |

US$M |

75.5 |

| Mining Capital Equipment (1) |

US$M |

89.4 |

| Total Mining (1) |

US$M |

164.9 |

| Processing |

US$M |

938.7 |

| Total Initial Capital (1) |

US$M |

1,103.6 |

| Sustaining Capital |

| Mining Equipment |

US$M |

952.4 |

| Processing |

US$M |

94.6 |

| Total Sustaining Capital |

US$M |

1,047.0 |

| Expansion Capital – Processing (year 7) |

US$M |

687.2 |

| Average LOM Operating Costs |

| Mining Cost per tonne mined (2) |

US$ /

t |

2.04 |

| Mining Cost per tonne milled (2) |

US$ /

t |

4.78 |

| Mining Equipment Leasing Cost per tonne milled |

US$ /

t |

0.06 |

| Processing Cost per tonne milled |

US$ /

t |

4.04 |

| G&A Cost per tonne milled |

US$ /

t |

0.65 |

| Total Operating Cost per tonne milled (2) |

US$ /

t |

9.53 |

Notes:

(1) Includes leasing costs and deferral of capital

associated with lease payments. Supplier-sourced leasing terms from

October 2023 are used in the mine fleet cost calculations that

include a 5-year lease period with 10.3% interest, 0.5% upfront

fee, and no residual payment. (2) Excludes leasing

costs.

Economic Sensitivities

Project economics and cash flows are most

sensitive to changes in the price of copper (Figure 2) providing

the highest potential for change in economics. However, mined grade

and recovery sensitivity are also high and future studies will seek

to optimize these parameters.

Figure 2: Post-Tax NPV and IRR Sensitivity Plots

Source: Ausenco 2024

Mineral Resource Estimate

The MRE was prepared in accordance with the

Canadian Institute of Mining, Metallurgy, and Petroleum

(“CIM”) Definition Standards (the “CIM Standards”)

incorporated by reference in National Instrument 43-101 (“NI

43-101”), with an effective date of July 23, 2024. The

Technical Report will be released by the Company and available at

www.orocoresourcecorp.com and on SEDAR (www.sedarplus.ca) under the

Company’s profile shortly.

The MRE includes the two primary mineralization

zones identified at Santo Tomas: North Zone and South Zone. These

zones display similar mineralization styles but are physically

separated by localized post-mineralization faults and material

currently defined as waste due to a lack of drilling. Consistent

with the previous study, the MRE is not constrained by the location

of the Huites Reservoir. Mineral resources are reported above an

effective cut-off grade (CoG) of 0.15% Cu and constrained by an

economic pit shell (see Table 4).

Table

4:

Mineral Resource Statement for the Santo Tomas Project, effective

July 23, 2024.

| Category |

Zone |

Tonnes Mt |

Average Grade |

In-situ Metal3 |

|

| |

|

CuEq10 |

Cu |

Mo |

Au |

Ag |

CuEq10 |

Cu 11 |

Mo 11 |

Au 11 |

Ag 11 |

|

|

| % |

% |

% |

g/t |

g/t |

M lb |

M lb |

M lb |

koz |

koz |

|

|

|

Indicated |

North Zone

pit - sulphide |

540.6 |

0.37 |

0.33 |

0.008 |

0.028 |

2.1 |

4,465 |

3,976 |

95.4 |

483.4 |

36,524 |

|

|

| Total

Indicated |

540.6 |

0.37 |

0.33 |

0.008 |

0.028 |

2.1 |

4,465 |

3,976 |

95.4 |

483.4 |

36,524 |

|

|

|

Inferred |

North Zone

pit - sulphide |

90.0 |

0.34 |

0.31 |

0.005 |

0.021 |

1.7 |

679 |

620 |

10.2 |

61.4 |

4,949 |

|

|

| North Zone

pit - oxide |

4.4 |

0.31 |

0.31 |

0.002 |

0.053 |

1.6 |

29 |

29 |

0.2 |

7.4 |

228 |

|

|

| South Zone

pit - sulphide |

399.2 |

0.36 |

0.32 |

0.008 |

0.023 |

2.0 |

3,132 |

2,789 |

71.2 |

294.4 |

26,200 |

|

|

| South Zone

pit - oxide |

36.7 |

0.27 |

0.27 |

0.004 |

0.020 |

1.6 |

218 |

218 |

2.8 |

23.8 |

1,851 |

|

|

| Total

Inferred |

530.3 |

0.35 |

0.31 |

0.007 |

0.023 |

1.9 |

4,058 |

3,657 |

84.4 |

387.1 |

33,229 |

|

|

Notes:

-

Mineral resources are not mineral reserves and do not have

demonstrated economic viability.

-

Abbreviations used in the table above include: Mt = million metric

tonnes, % = percent, g/t = grams per metric tonne, M lb = million

pounds, and k oz = thousand troy ounces.

- All

figures are rounded to reflect the relative accuracy of the

estimates. Totals in Table may not sum or recalculate from related

values in the table due to rounding of values in the table,

reflecting fewer significant digits than were carried in the

original calculations.

- Metal

assays are capped where appropriate. At this stage of the project,

it is the Company’s opinion that all the elements included in the

metal equivalents calculation have a reasonable potential to be

recovered and sold.

- All

dollar amounts are presented in US dollars.

- Bulk

density is estimated on a block basis using specific gravity data

collected on diamond drill core.

-

Economic pit constrained resource with reasonable prospects of

eventual economic extraction (“RPEEE”) were based on a copper price

of $4.00/lb, molybdenum price of $13.50/lb, a gold price of

$1,700/oz, and a silver price of $22.50/oz. Metal recovery factors

of 83.7% for copper, 66% for molybdenum, 53% for gold and 53% for

silver have been applied. Selling costs are $0.56/lb copper,

$1.69/lb molybdenum, $191.71/oz gold and $2.94/oz silver. Slope

angles varied by pit sector and range from 40 degrees to 49

degrees.

- The

in-situ economic copper (CoG) was calculated resulting in a 0.15%

Cu CoG.

- CoG

assumptions include: a copper price of $4.00/lb, molybdenum price

of $13.50/lb, gold price of $1,700/oz, and silver price of

$22.50/oz. Suitable benchmarked technical and economic parameters

for open pit mining, including a 98% mining recovery and costs of

mining at $2.40/t, processing at $4.79/t, G&A at $0.67/t, with

Private Royalties at 1.5% for molybdenum, gold, silver, and copper,

have been applied in consideration of the RPEEE. Recoveries are

applied as listed in Note 7.

-

Equivalent Copper (CuEq) percent is calculated with the formula

CuEq% = ((Cu grade * Cu recovery [83.7% sulphide or 75.0% oxide] *

Cu price) + (Mo grade * Mo recovery [59%] * Mo price) + (Au grade *

Au recovery [53%] * Au price) + (Ag grade * Ag recovery [53%] * Ag

price)) / (Cu price * Cu recovery [83.7% sulphide or 75.0% oxide]).

It assumed that the Santo Tomás Project will produce a conventional

(flotation) copper concentrate product based on metal recoveries at

83.7% Cu (sulphide) or 75% Cu (oxide), 59% Mo, 53% Au, and 53% Ag

based on initial preliminary metallurgical test work.

- Reported

contained individual metals in Table represent in-situ metal,

calculated on a 100% recovery basis, except for CuEq% (see Note

10).

The mineral resource estimation process includes

updated structural, lithologic, and mineralization models not

materially changed from the previous study, effective April 27,

2023. No additional drilling has been added and the estimation

methodology remains unchanged from the methodology used in the.

Differences in the MRE shown in Table 4 from the previous MRE are

due to: 1) inclusion of oxidized mineralization in the North Zone

pit (the “North Pit”) and South Zone pit (the “South

Pit”); and 2) updated economic and pit slope assumptions based

on the updated PEA study. The resource estimation methodology

involved the following procedures:

-

Database compilation and verification,

-

Construction of wireframe models for the major structures,

lithotypes, and controls on mineralization,

-

Definition of resource domains using a combination of lithotypes,

structure, oxidation, and mineralization grade shells,

- Data

conditioning (compositing and capping) for statistical and

geostatistical analyses,

-

Determination of spatial continuity through variography within the

estimation domains,

- Block

modeling and grade interpolation for all key economic variables

(Cu, Mo, Ag, Au, and Sulfur [S]) and secondary variables (arsenic

[As], calcium [Ca], potassium [K], lead [Pb], and zinc [Zn]),

- Block

model validation,

-

Resource classification,

-

Assessment of “reasonable prospects for eventual economic

extraction” (“RPEEE”) using a constraining economic pit shell and

selection of an effective cut-off grade (“CoG”), and

-

Preparation of the updated mineral resource statement.

SRK undertook the geological modeling and

mineral resource estimate using Seequent Leapfrog Geo and Leapfrog

Edge, respectively. The procedure involved construction of

wireframe models for structural geology controls, key geological

and mineralization domains, data conditioning (compositing and

capping) for statistical analysis, variography, block modeling and

grade interpolation followed by block model validation. Grade was

estimated using a combination of ordinary kriging and inverse

distance weighting cubed estimates for copper, molybdenum, gold,

and silver. Sulfur grades are estimated using inverse distance

weighting squared (“IDW2”) and bulk density is estimated

using a combination of simple kriging and IDW2. Grade estimation

was based on block dimensions of 50 m x 50 m x 10 m for the PEA

model (unchanged from previous studies). The block size reflects

current data spacing across the Project while considering a likely

open pit mining method. Classification of mineral resources

considers the geological complexity (structure, lithology,

alteration, and mineralization), spatial continuity of

mineralization, data quality, and spatial distribution of drilling

conducted at the Project.

The MRE is supported by 64,138 m of drilling in

158 holes. The drilling data represents a combination of holes

completed by Oroco from 2021 to 2023 and historical drill holes but

excludes drilling at Brasiles Zone (outside current project scope)

and one geotechnical hole (due to lack of assay data).

Mineralization has been identified outside

the current economic pit shell. The PEA highlights the

potential to define additional mineral resources on the property.

There is identified exploration potential for additional

mineralization in the southeastern and southwestern portions of the

South Zone based on observations from drilling and surface outcrops

in the area.

Mine Design

The mine design re-worked previous phase designs

to increase the number of pit phases from 4 to 20. Initial phases

are smaller to reduce waste stripping and allow for faster access

to higher grade mill feed, resulting in an average 0.51% CuEq ore

grade for the first 7 years of production. These smaller phases

have narrower access roads that require the use of small-scale haul

trucks (72 t capacity). Later in the mine life, the pit phases are

typically larger and will allow for the use of large-scale haul

trucks (240 t capacity). Over the life of the project, including

the pre-production waste mining year, 80% of the tonnes mined will

be with the large-scale equipment fleet.

The final pit design ensures no incursion upon

the Huites Reservoir, remaining outside of CONAGUA’s (Mexican water

authority) jurisdiction boundary (the “CONAGUA limit”).

Slope constraints derived from geotechnical domains were defined

from Phase 1 drilling on the Project.

Table 5 shows mineral inventory within the

ultimate pit design for this PEA.

Table

5:

Pit Constrained Resource

| Mill

Feed |

Waste

Material |

Strip

Ratio |

Total

Material |

|

Tonnes(Mt) |

Cu

(%) |

Mo(%) |

Au(g/t) |

Ag(g/t) |

CuEq(%) |

Tonnes(Mt) |

Waste/Mill |

Tonnes(Mt) |

|

825.5 |

0.325 |

0.008 |

0.028 |

2.080 |

0.365 |

1,139.4 |

1.38 |

1,964.9 |

The proposed mining method is conventional open

pit truck and shovel operation with 10-meter bench intervals. Haul

trucks will be used for hauling mineralized material to the

crushing plant, long-term stockpile facilities, and waste to the

waste rock storage facilities (“WRSFs”).

The mine production plan contains 825.5 M tonnes

of mineralized sulfide material with an average grade of 0.37%

CuEq, and 1,139.4 M tonnes of waste material (including mineralized

oxide), resulting in a strip ratio of 1.38 over the LOM. CuEq is

calculated using the methodology described in the footnotes to

Table 4.

Mining operations will be carried out on a

24-hour per day, 365 days per year schedule. Total mined tonnes

will start at 27.2M tonnes mined during the pre-stripping year and

eventually ramp up to a maximum of 116M tonnes per annum (Mt/a) in

Year 13. The Project has a total life of 23.5 years, which includes

1 year of pre-stripping and one final year of stockpile rehandling

to the mill. Project expansion (Phase II) starts in Year 8 of

operation.

The mining sequence consists of 20 phases (10 in

the North Pit and 10 in the South Pit), which vary in minimum

mining width according to the type of equipment to be used. Early

years focus on mining the North Pit, while transitioning to larger

equipment to be used once the South Pit has opened up to wider

benches.

Mined tonnes, Mill Feed tonnes and Mineral

Inventory classification are shown in Figures 3, 4 and 5.

Figure 3: Mine Production Schedule –

Mineralized Material/Waste

Figure 4: Mill Production Schedule

Figure 5: Classification of Mineral Inventory

Process Design & Plant Infrastructure

Recent metallurgical test work results for

composite and variability drill core samples from the North and

South Zones demonstrated amenability to conventional flotation

recovery to produce a marketable copper and molybdenum concentrates

(given molybdenum levels observed in the bulk concentrate generated

during locked cycle tests). The following key metallurgical

parameters applied to develop the process design were:

- Axb

Index: 30.

- Bond

Ball Mill Work Index (75th percentile): 18.3 kWh/tonne.

- Grind

size P80 for flotation feed: 150 microns.

-

Metallurgical recoveries (over LOM): Copper 83.3%, Molybdenum

59.2%, Silver 53.9%, and Gold 53.2%.

-

Copper concentrate grade: 26.6%.

-

Molybdenum concentrate grade: 45%.

Mine haul trucks will transport plant feed

material to the dump pockets at the semi-mobile primary crushing

station which directly feeds into a large gyratory crusher. From

the primary crusher, plant feed material will be conveyed through a

tunnel to a live stockpile ahead of a processing plant containing a

secondary cone and tertiary HPGR crushing circuit. Tertiary crushed

product will feed into two twin ball mills in closed circuit with

cyclones to produce flotation feed at 80% minus 150 µm. The

flotation circuit will produce a bulk rougher concentrate that is

subsequently reground to 23 µm P80 prior to cleaner flotation

stages to produce a bulk copper-molybdenum concentrate. The bulk

cleaner concentrate advances to copper-molybdenum separation to

recover a molybdenum concentrate. Gold and silver report to the

copper concentrate. Copper and molybdenum concentrates are

dewatered prior to shipment in sealed containers to a concentrate

storage facility at the Port of Topolobampo for shipment to

overseas smelters.

The tailings are dewatered and pumped to a

cyclone sands station where coarse tailings report to build the

tailings storage facility (“TSF”) embankment and fines are

deposited within the facility. Water off the TSF is reclaimed and

recycled back through the process plant.

Figure 6 is an overall layout of the current

project site.

Figure 6: Mine Infrastructure, Pits, Process Plant Layout,

Tailings and Waste Rock Storage Facilities

Tailings and Waste Rock Storage Facilities

The storage of waste rock has been optimized and

offers the following benefits:

-

Shorter hauling distances,

- Lower

haul truck emissions, and

-

Allows for waste and mineralized material segregation.

Both the WRSFs and the TSF are designed with

ditches and berms to divert stormwater around rather than through

these facilities to minimize the volume of contact water requiring

additional processing. Contact water filtered through these

facilities will be captured and recycled back to the process

plant.

Power Infrastructure and Water Supply

The re-designed electrical supply is from a

built-for-purpose LNG combustion power plant located adjacent to

the El Encino-Topolobampo natural gas pipeline some 33 km from

site. This low carbon footprint power source option offers a cost

for power lower than the going state rate. A 115 kVA overhead power

line replaces the 230 kVA power line providing additional cost

savings.

Make-up process water supply is now sourced from

groundwater wells situated along the northern boundary of the North

Pit. This arrangement offers two key benefits not realized in the

October PEA:

-

Significant savings in the cost of piping.

-

Groundwater pumping at this new location will mitigate seepage into

the pits reducing the volume of contact water requiring additional

processing prior to discharge.

Geology and Mineralization

Porphyry Cu (Mo‐Au‐Ag) mineralization on the

Santo Tomas property is closely associated with intrusives linked

to the Late Cretaceous to Paleocene (90 to 40 Ma) Laramide orogeny.

Santo Tomas and most of the known porphyry copper deposits in

Mexico lie along a 1,500 km‐long, NNW trending belt sub-parallel to

the west coast, extending from the southwestern United States

through to the state of Guerrero in Mexico.

In the Santo Tomas area, Mesozoic‐aged country

rocks comprising limestone, minor sandstones, conglomerates,

shales, and a thick succession of andesitic volcanics were intruded

by a range of Laramide age intrusions related to the Late

Cretaceous Sinaloa‐Sonora Batholith. Multiple phases are recognized

ranging from dioritic to monzonitic in composition.

Mineralization is strongly structurally

controlled associated with the Santo Tomas fault and fracture zone,

which provided a pathway to quartz monzonite dikes, associated

hydrothermal alteration, hydrothermal breccias, and sulfide

mineralization. Sulfide minerals are dominated by chalcopyrite,

pyrite and molybdenite with minor bornite, covellite, and

chalcocite. Sulfides occur as fracture fillings, veinlets, and fine

disseminations together with potassium feldspar, quartz, calcite,

chlorite, and locally, tourmaline. Chalcopyrite is the main copper

mineral with minor copper oxides near surface.

Community & Environmental

Oroco continues to engage with the local

community on education, ongoing employment and other opportunities

as they present themselves. Oroco strives to maintain transparent

communications with local communities and public authorities at all

levels to ensure that key stakeholders are aware of the project

status and plans including responding to community concerns and

requests in a timely and genuine manner. Oroco maintains its

exploration permits and approvals in good standing.

Further environmental baseline studies and other

socio-economic, cultural, and community engagements are planned for

future EIS preparation and permitting.

Project Enhancement Opportunities

Several further opportunities to improve the

Project have been identified during the revised PEA Study. These

include but are not limited to:

-

Infill resource drilling in the area between North and South zones:

additional resource in that area would improve optimized pit

development and reduce mining costs.

-

Acquire ROM size distribution curves and perform additional

comminution studies and variability testing to better constrain

recoveries across the full range of expected mill feed grades based

on rock and alteration types.

-

Consider a flying belt conveyor design from primary crusher to the

mill feed stockpile.

-

Investigate coarse particle flotation to reduce comminution costs

and improve factors of safety on TSF design.

- Drill

hydrogeological test wells at the north end of the North Pit to

better define seepage rates into the pit, well-field design and

permitting requirements associated with groundwater pumping.

- Drill

selected geotechnical holes to optimize pit slope angles and reduce

mining of waste.

-

Optimize heavy equipment leasing terms.

-

Initiate environmental baseline studies.

-

Complete a trade-off study to compare the operating costs

associated with electric drills and shovels to the costs to operate

diesel-powered units. Include the impact on power supply

infrastructure for the former.

- A

detailed pioneering road design to the starting benches of every

phase is recommended to better determine the number of tonnes

required to be moved using a small fleet.

-

Evaluate the trade-off between buying and maintaining a fleet of

smaller pioneering equipment and contracting all pioneering work to

a third-party.

-

One or more iterations of pit design are recommended to minimize

overall LOM stripping while still focusing on reducing the quantity

of pre-stripping required.

A geological-geochemical conceptual model will

inform the ongoing development and refinement of geochemical and

mine rock management plan for the site. The predicted occurrence of

large volumes of net neutralizing mine waste materials to be mined

in early years will be confirmed, as the buffering characteristics

of these waste materials can be effectively utilized as part of the

overall waste rock management strategy. Additional geochemical

assessment of the acid rock drainage / metal leaching risk for the

Project will be implemented to provide additional test work and

sampling coverage, and to confirm preliminary study

findings.

Cautionary Notes to Investors

PEAThe reader is cautioned that the PEA

is preliminary in nature, and that it includes inferred mineral

resources that are considered too speculative geologically to have

the economic considerations applied to them that would enable them

to be categorized as mineral reserves, and there is no certainty

that the preliminary economic assessment will be realized.

Mineral Resource and Reserve Estimates

In accordance with applicable Canadian

securities laws, all Mineral Resource estimates of the Company

disclosed or referenced in this news release have been prepared in

accordance with the disclosure standards of NI 43-101 and have been

classified in accordance with the CIM Standards. Mineral

Resources that are not Mineral Reserves do not have demonstrated

economic viability. No Mineral Reserves have been estimated for

the Project. The estimate of mineral resources may be materially

affected by environmental, permitting, legal, title,

socio-political, marketing, or other relevant issues. In

particular, the quantity and grade of reported inferred mineral

resources are uncertain in nature and there has been insufficient

exploration to define these inferred mineral resources as an

indicated or measured mineral resource. It is uncertain in all

cases whether further exploration will result in upgrading the

inferred mineral resources to an indicated or measured mineral

resource category.

Qualified Persons

The updated PEA for the Project summarized in

this news release was prepared by Ausenco with input from SRK and

has been incorporated in a technical report prepared in accordance

with NI 43-101 which will be available under the Company’s SEDAR

profile at www.sedarplus.ca and on the Company’s website. The

affiliation and areas of responsibility for each of the Qualified

Persons involved in preparing the PEA, upon which the technical

report will be based, are as follows:

Table

6:

Qualified Persons for PEA

|

Qualified Persons |

Qualification |

Company (location) |

Position / Oversight |

| James Arthur

Norine |

P.E. |

Ausenco Engineering USA South Inc. |

Vice President, Southwest USA |

| Peter

Mehrfert |

P. Eng. |

Ausenco Engineering Canada ULC |

Principal Process Engineer |

| James

Millard |

M. Sc., P. Geo. |

Ausenco Sustainability ULC |

Director, Strategic Projects |

| Scott C.

Elfen |

P.E. |

Ausenco Sustainability ULC |

Global Lead Geotechnical Services |

| Andy

Thomas |

M. Eng., P.Eng. |

SRK Consulting (Canada), Inc. |

Principal Rock Mechanics Engineer |

| Fernando

Rodrigues |

BS Mining, MBA, MMSAQP |

SRK Consulting (U.S.), Inc. |

Practice Leader, Principal Consultant (Mine Plan, Mining CAPEX +

OPEX) |

| Ron

Uken |

PhD,PrSciNat |

SRK Consulting (Canada), Inc. |

Principal Structural Geologist |

| Scott

Burkett |

RM-SME B.Sc. Geology |

SRK Consulting (U.S.), Inc. |

Principal Consultant (Resource Geology) |

Each QP listed in Table 6 has reviewed and

verified the content of this news release.

Andrew Ware, RM SME and QP for Oroco has

reviewed and verified the contents of this news release and has

approved the document for public release.

About OROCO

The Company holds a net 85.5% interest in those

central concessions that comprise 1,173 hectares “the Core

Concessions” of The Santo Tomas Project, located in northwestern

Mexico. The Company also holds an 80% interest in an additional

7,861 hectares of mineral concessions surrounding and adjacent to

the Core Concessions (for a total Project area of 9,034 hectares,

or 22,324 acres). The Project is situated within the Santo

Tomas District, which extends up to the Jinchuan Group’s Bahuerachi

Project, approximately 14 km to the northeast. The Project hosts

significant copper porphyry mineralization defined by prior

exploration spanning the period from 1968 to 1994. During that

time, the Project area was tested by over 100 diamond and reverse

circulation drill holes, totalling approximately 30,000 meters.

Commencing in 2021, Oroco conducted a drill program (Phase 1) at

Santo Tomas, with a resulting total of 48,481 meters drilled in 76

diamond drill holes.

The drilling and subsequent resource estimates

and engineering studies led to an initial MRE publication (May

2023) with a PEA (including an updated MRE) being published and

filed in late 2023, with the current update work being undertaken

in 2024. The MRE released with the initial PEA in late 2023

included an Updated Mineral Resource for the North and South Zones

of the Santo Tomas Project, identifying Indicated and Inferred

resources of 561 Mt @ 0.37% CuEq and 549 Mt @ 0.34% CuEq,

respectively. The revised PEA includes a further Updated Mineral

Resource for the North and South Zones of the Santo Tomas Project,

identifying Indicated and Inferred resources of 540.6 Mt @ 0.37%

CuEq and 530.3 Mt @ 0.35% CuEq, respectively.

The Project is located within 170 km of the

Pacific deep-water port at Topolobampo and is serviced via highway

and proximal rail (and parallel corridors of trunk grid power lines

and natural gas) through the city of Los Mochis to the northern

city of Choix. The property is reached, in part, by a 32 km access

road originally built to service Goldcorp’s El Sauzal Mine in

Chihuahua State.

Additional information about Oroco can be found

on its website at www.orocoresourcecorp.com and by reviewing its

profile on SEDAR at www.sedarplus.ca.

For further information, please contact:

Richard Lock, CEOOroco Resource Corp. Tel:

604-688-6200 Email: info@orocoresourcecorp.com

www.orocoresourcecorp.com

About Ausenco

Ausenco is a global company redefining what's

possible. The team is based across 26 offices in 15 countries

delivering services worldwide. Combining deep technical expertise

with a 30-year track record, Ausenco delivers innovative, value-add

consulting studies, project delivery, asset operations and

maintenance solutions to the minerals and metals and industrial

sectors (www.ausenco.com).

About SRKSRK Consulting was formed in

Johannesburg, South Africa, in 1974 as Steffen Robertson and

Kirsten. Today, SRK provides focused advice and solutions for

clients requiring specialized services, mainly in the fields of

mining, surface and underground geotechnics, water, waste

materials, process engineering, the environment, and mineral

economics. SRK employs more than 1,700 professionals

internationally and has over 45 permanently staffed offices in 20

countries on six continents (www.srk.com).

Cautionary Note Regarding Forward-Looking

Information

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation based on expectations, estimates and projections as at

the date of this news release. Forward-looking information involves

risks, uncertainties and other factors that could cause actual

events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. All statements other than statements of fact included

in this document constitute forward-looking information, including,

but not limited to, objectives, goals or future plans, statements

regarding anticipated exploration results and exploration plans,

Oroco’s expectations regarding the future potential of the Santo

Tomas deposits, its plans for additional drilling and other

exploration work on the Santo Tomas deposits and the potential to

advance or improve the PEA study.

Forward-looking information is not, and cannot

be, a guarantee of future results or events. Forward-looking

information is based on, among other things, opinions, assumptions,

estimates and analyses that, while considered reasonable by the

Corporation at the date the forward-looking information is

provided, inherently are subject to significant risks,

uncertainties, contingencies and other factors that may cause

actual results and events to be materially different from those

expressed or implied by the forward-looking information.

Factors that could cause actual results to

differ materially from such forward-looking information include,

but are not limited to, capital and operating costs varying

significantly from estimates; the preliminary nature of

metallurgical test results; delays in obtaining or failures to

obtain and comply with required governmental, environmental or

other Project approvals; uncertainties relating to the availability

and costs of financing needed in the future; changes in equity

markets; inflation; fluctuations in commodity prices; delays in the

development of the Project; COVID-19 and other pandemic risks;

those other risks involved in the mineral exploration and

development industry; and those risks set out in the Company’s

public documents filed on SEDAR at www.sedarplus.ca.

Should one or more risk, uncertainty,

contingency or other factor materialize or should any factor or

assumption prove incorrect, actual results could vary materially

from those expressed or implied in the forward-looking information.

Accordingly, you should not place undue reliance on forward-looking

information. Oroco does not assume any obligation to update or

revise any forward-looking information after the date of this news

release or to explain any material difference between subsequent

actual events and any forward-looking information, except as

required by applicable law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release. No stock exchange,

securities commission or other regulatory authority has approved or

disapproved the information contained herein.

Christy Fabros

Oroco Resource Corp.

(604) 688-6200

info@orocoresourcecorp.com

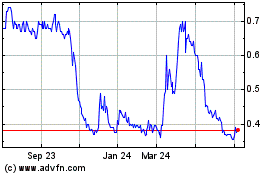

Oroco Resource (TSXV:OCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

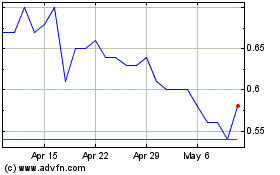

Oroco Resource (TSXV:OCO)

Historical Stock Chart

From Dec 2023 to Dec 2024