Petro-Reef Resources Ltd. (TSX VENTURE:PER) ("Petro-Reef" or the

"Company") has released its third quarter 2011 results. Full

financial details are contained in the financial statements and

management's discussion and analysis filed on SEDAR.

Production volumes and prices

For the three months ended September 30, 2011, the Company

produced an average of 605 barrels of oil equivalent per day

(boe/d) comprising 187 bbl/d of oil and natural gas liquids and

2,508 mcf/d per day of natural gas. The Company received an average

of $67.73 per barrel for oil and $3.95 per thousand cubic feet for

natural gas.

----------------------------------------------------------------------------

Three months ended September 30 2011 2010 % Change

----------------------------------------------------------------------------

Daily production

---------------------------------------------

Crude Oil and NGLs (bbl/d) 187 109 71.6

Natural Gas (mcf/d) 2,508 3,334 (24.8)

----------------------------------------------------------------------------

Oil equivalent (boe/d @ 6:1) 605 665 (9.0)

----------------------------------------------------------------------------

Realized commodity prices

---------------------------------------------

Crude Oil and NGLs (bbl) 67.73 70.02 (3.3)

Natural Gas (mcf) 3.95 3.39 16.5

----------------------------------------------------------------------------

Oil equivalent (boe @ 6:1) 37.34 28.47 31.2

----------------------------------------------------------------------------

For the nine months ended September 30, 2011, the Company

produced an average of 666 barrels of oil equivalent per day

(boe/d) comprising 215 bbl/d of oil and natural gas liquids and

2,707 mcf/d per day of natural gas. The Company received an average

of $78.18 per barrel for oil and $3.87 per thousand cubic feet for

natural gas.

----------------------------------------------------------------------------

Nine months ended September 30 2011 2010 % Change

----------------------------------------------------------------------------

Daily production

---------------------------------------------

Crude Oil and NGLs (bbl/d) 215 122 76.2

Natural Gas (mcf/d) 2,707 4,130 (34.5)

----------------------------------------------------------------------------

Oil equivalent (boe/d @ 6:1) 666 811 (17.9)

----------------------------------------------------------------------------

Realized commodity prices

---------------------------------------------

Crude Oil and NGLs (bbl) 78.18 74.06 5.6

Natural Gas (mcf) 3.87 4.15 (6.7)

----------------------------------------------------------------------------

Oil equivalent (boe @ 6:1) 40.96 32.29 26.9

----------------------------------------------------------------------------

Cash flow and earnings

Total revenue increased 19.5% to $2,079,442 for the three month

period ended September 30, 2011 compared to $1,740,840 for the same

period ended in 2010. As a result of a 71.6% increase in oil

volumes over Q3 2010, Petro-Reef realized a combined price per boe

for the three month period ended September 30, 2011 of $37.34

representing a 31.2% increase compared to the realized price per

unit of production of $28.47 for the same period in 2010.

For the three month period ended September 30, 2011, Petro-Reef

generated cash flows from operations of $597,981 an increase of

9.9% compared to $544,140 for the three month period ended

September 30, 2010.

----------------------------------------------------------------------------

Three months ended

September 30 2011 2010 % Change 2011 2010

----------------------------------------------------------------------------

($ / boe) ($ / boe)

----------------------------------------------------------------------------

Gross revenue 2,079,442 1,740,840 19.5 37.34 28.47

Realized gain (loss)

on risk management

contracts (87,337) 417,704 - (1.57) 6.83

Royalties (277,493) (307,934) (9.9) (4.98) (5.04)

----------------------------------------------------------------------------

Revenue after

royalties 1,714,612 1,850,610 (7.3) 30.79 30.26

Operating expenses 729,330 721,091 1.1 13.10 11.79

General &

administrative

expenses 276,278 370,835 (25.5) 4.96 6.06

Interest expense 111,023 214,544 (48.3) 1.99 3.51

----------------------------------------------------------------------------

Cash flow 597,981 544,140 9.9 10.74 8.90

Unrealized gain on

risk management

contracts 649,420 28,413 2,185.6 11.66 0.46

Other income 142,611 - - 2.56 -

Stock based

compensation 242,431 25,056 867.6 4.35 0.41

Accretion 18,108 17,206 5.2 0.33 0.28

Depletion and

depreciation 1,118,518 1,349,326 (17.1) 20.09 22.07

----------------------------------------------------------------------------

Net Income (loss)

before income taxes 10,955 (819,035) (101.3) 0.20 (13.39)

Deferred income tax

(recovery) (160,727) (186,192) (13.7) (2.89) (3.04)

----------------------------------------------------------------------------

Net Income (loss) 171,682 (632,843) (127.1) 3.08 (10.35)

Per Share - Basic and

diluted 0.00 (0.02)

----------------------------------------------------------------------------

Total revenue increased 4.3% to $7,451,193 for the nine month

period ended September 30, 2011 compared to $7,142,624 for the same

period in 2010. As a result of a 76.2% increase in oil volumes over

2010, Petro-Reef realized a combined price per boe for the nine

month period ended September 30, 2011 of $40.96 representing a

26.9% increase compared to the realized price per unit of

production of $32.29 for the same period in 2010.

For the nine month period ended September 30, 2011, Petro-Reef

generated cash flows from operations of $3,185,377 an increase of

7.3% compared to $2,968,875 for the nine month period ended

September 30, 2010.

----------------------------------------------------------------------------

Nine months ended

September 30 2011 2010 % Change 2011 2010

----------------------------------------------------------------------------

($ / boe) ($ / boe)

----------------------------------------------------------------------------

Gross revenue 7,451,193 7,142,624 4.3 40.96 32.29

Realized gain on risk

management contracts 392,617 545,188 (28.0) 2.16 2.46

Royalties (1,160,450) (942,824) 23.1 (6.38) (4.26)

----------------------------------------------------------------------------

Revenue after

royalties 6,683,360 6,744,988 (0.9) 36.73 30.49

Operating expenses 2,407,057 2,171,154 10.9 13.23 9.81

General &

administrative

expenses 784,154 1,143,307 (31.4) 4.31 5.17

Interest expense 306,772 461,652 (33.5) 1.69 2.09

----------------------------------------------------------------------------

Cash flow 3,185,377 2,968,875 7.3 17.51 13.42

Unrealized gain on

risk management

contracts 140,630 954,139 (85.3) 0.77 4.31

Other income 393,530 173,663 126.6 2.16 0.79

Stock based

compensation 575,684 128,815 346.9 3.16 0.58

Accretion 52,437 49,993 4.9 0.29 0.23

Depletion and

depreciation 3,985,968 4,740,098 (15.9) 21.91 21.43

----------------------------------------------------------------------------

Loss before income

taxes (894,552) (822,229) 8.8 (4.92) (3.72)

Deferred income tax

expense (recovery) (14,002) 277,226 (105.1) (0.08) 1.25

----------------------------------------------------------------------------

Net loss (880,550)(1,099,455) (19.9) (4.84) (4.97)

Per Share - Basic and

diluted (0.02) (0.03)

----------------------------------------------------------------------------

Financial

Effective September 30, 2011 the Petro-Reef renewed its loan

facilities with a Canadian Chartered Bank. Facility A is a

revolving operating demand loan with a maximum limit of

$14,000,000. Facility B is a non-revolving acquisition/development

demand loan that provides an additional $6,000,000 of financing.

Interest is at prime plus 1.0% per annum for Facility A and prime

plus 1.5% per annum for Facility B. Petro-Reef has the ability to

borrow by way of Bankers Acceptances.

At September 30, 2011 the balance owing on Facility A was

$11,334,128 (December 31, 2010 - $9,627,691). At September 30, 2011

the balance owing on Facility B was $nil (December 31, 2010 -

$nil).

The Company has the ability to draw on the development loan for

the drilling of new wells subject to certain working capital ratio

restrictions.

In August, 2011 Petro-Reef Resources Ltd. closed a private

placement financing of Flow -through Shares for gross proceeds of

$2,391,200. Pursuant to the offering, Petro-Reef issued 5,978,000

common shares on a flow-through basis at a purchase price of 40

cents per common share.

About Petro-Reef Resources Ltd.

Petro-Reef Resources Ltd. is a Calgary-based crude oil and

natural gas exploration and production company with producing

properties in Alberta, Canada.

Additional information about the Company is available under

Petro-Reef's profile on SEDAR at www.sedar.com.

BOE Reference

Reference is made to barrels of oil equivalent ("BOE"). BOE may

be misleading, particularly if used in isolation. In accordance

with National Instrument 51-101, a BOE conversion ratio of six mcf

of natural gas to one bbl of oil has been used, which is based on

an energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contacts: Petro-Reef Resources Ltd. Hugh M. Thomson

Vice-President Finance & CFO (403) 523-2505 (403) 264-1348

(FAX) Petro-Reef Resources Ltd. 970, 10655 Southport Road S.W.

Calgary, Alberta T2W 4Y1info@petro-reef.cawww.petro-reef.ca

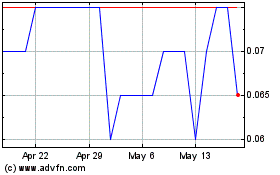

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Apr 2024 to May 2024

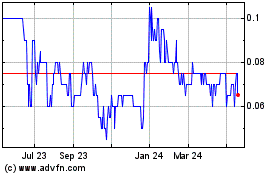

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From May 2023 to May 2024