Parkit Closes Private Placement

May 05 2014 - 2:23PM

Marketwired

Parkit Closes Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 5, 2014) -

Parkit Enterprise Inc. ("Parkit" or the "Company")

(TSX-VENTURE:PKT) is pleased to announce that further to its news

release dated March 21, 2014, the Company has closed its financing

with a further $1,005,700 or 3,352,333 units at a price of $0.30

per unit ("Unit") in the second tranche for an aggregate amount of

$2,335,225 between its first and second closings.

Each Unit consists of one common share and one half-share

purchase Warrant, each whole Warrant entitling the holder to

purchase one common share for the price of $0.50 per share for a

period of 24 months following the date of issuance. The Warrants

will be subject to an acceleration provision such that if the

closing price of the Company's shares is equal or greater to $0.95

per share for 20 consecutive trading days at any time following

four months after issuance, the Company may, by notice to the

Warrant holders, reduce the remaining exercise period of the

Warrants to not less than 30 days following the date of such

notice.

Finder's fees of $8,400 cash, 28,000 broker warrants at $0.50,

and 14,700 common shares were paid in connection with the second

tranche closing of the private placement.

The securities issued in relation to the second tranche closing

are subject to a regulatory four-month hold period expiring

September 3, 2014, in addition to such other restrictions as may

apply under applicable securities laws in jurisdictions outside of

Canada.

Use of proceeds is for the parking acquisition fund (the "Fund")

and Company infrastructure growth. The Fund has contracted to

acquire its first US$18,500,000 off-airport parking facility (see

news dated April 7, 2014).

An additional six assets will form part of the first-close

portfolio identified for acquisition by the Fund. Parkit will earn

fee income and a carried equity interest in the assets as

co-general partner.

ON BEHALF OF THE BOARD

Rick Baxter, President and CEO

About

Parkit:

Parkit Enterprise Inc. is a listed private equity real estate

company that acquires and aggregates income-producing real estate

in the parking sector.

www.parkitenterprise.com & www.canopyairportparking.com

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

Disclaimer for Forward-Looking Information

Certain statements in this release are forward-looking

statements. Forward-looking statements consist of statements that

are not purely historical, including any statements regarding

beliefs, plans, expectations or intentions regarding the future.

Such statements are subject to risks and uncertainties that may

cause actual results, performance or developments to differ

materially from those contained in the statements. No assurance can

be given that any of the events anticipated by the forward-looking

statements will occur or, if they do occur, what benefits the

Company will obtain from them.

Parkit Enterprise Inc.John LaGourgue(604)

424-8701info@parkitenterprise.comwww.parkitenterprise.comwww.canopyairportparking.com

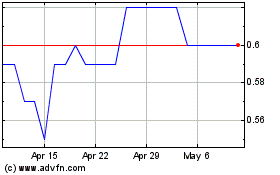

Parkit Enterprise (TSXV:PKT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Parkit Enterprise (TSXV:PKT)

Historical Stock Chart

From Jan 2024 to Jan 2025