Prime Restaurants Royalty Income Fund (the "Fund") (TSX:EAT.UN) today reported

results for the three months and year ended December 31, 2009.

Gross revenue reported by the royalty pooled restaurants in the fourth quarter

of 2009 was $82.4 million compared to $82.1 million for the same period last

year. For the year ended December 31, 2009, gross revenues were $333.1 million

compared to $340.6 million in 2008. There are 161 royalty pooled restaurants in

2009 compared to 155 royalty pooled restaurants in 2008. For the three months

and year ended December 31, 2009, royalty income from royalty pooled restaurants

was $1.5 million and $9.6 million respectively, compared to $2.7 million and

$11.1 million for the same periods last year.

Distributable cash available to Unitholders was $0.8 million and $6.3 million

for the three months and year ended December 31, 2009. The Fund declared cash

distributions of $0.8 million or $0.12 per unit in the quarter and $6.3 million

or $0.97 per unit for the year, compared to $1.7 million or $0.28 per unit and

$6.9 million or $1.13 per unit for the same periods in 2008.

Sales for the royalty pooled restaurants in 2009 have been affected by intense

competition and the negative impact of the current economic recession on

consumer's discretionary spending and the casual dining sector. As a result,

while the decline in same store sales in the fourth quarter was less than the

second and third quarters of the year, compared to the prior year's fourth

quarter same store sales declined by 4.4%. By brand, Casey's and East Side

Mario's posted same store sales declines of 0.8% and 6.3%, respectively in the

quarter, while the Prime pubs posted flat same store sales growth ("SSSG"). On a

regional basis, Western Canada, Ontario, Quebec, and Atlantic Canada posted same

store sales declines of 7.3%, 4.4%, 3.0%, and 0.5% respectively in the fourth

quarter of 2009. For 2009, same store sales declined by 6.5% compared to the

prior year. SSSG at Casey's, East Side Mario's, and the Prime Pubs were down

4.9%, 7.5%, and 2.6%, respectively. For the year ended December 31, 2009,

Western Canada, Ontario, Quebec, and Atlantic Canada posted negative SSSG of

11.9%, 6.0%, 6.1%, and 0.8% respectively.

"While 2009 was one of the most difficult periods in our 29 year history, we

were able to take a number of positive steps to mitigate the impact of the

challenging economy and, as a result, experienced an improving trend in same

store sales through the fourth quarter," commented John Rothschild, Chairman and

CEO of Prime Restaurants of Canada Inc. ("PRC") "Looking ahead, we believe these

initiatives, combined with our multi-brand approach covering all segments of the

casual dining and pubs business, position us strongly for solid growth as the

economy recovers."

During the year, the Fund determined that its investment in PRC Trademarks Inc.

("TradeMarkCo") was impaired and, accordingly, the investment carrying amount

has been reduced to an estimated realizable amount of $46,947,070. The estimated

realizable amount was determined by discounting the expected future cash flows

on the TradeMarkCo Notes at their original effective interest rate. An allowance

for loan impairment of $16,255,560 has been established against the TradeMarkCo

Note at year-end with a corresponding impairment charge recorded in the

statement of earnings (loss) for the year. The CICA Handbook Section 3025,

Impaired Loans, requires that an impairment loss be recognized as events or

conditions indicating impairment occur. An impairment loss would occur if the

Fund no longer has reasonable assurance of timely collection of the full amount

of principal and interest on its investment in TradeMarkCo. The royalty deferral

for PRC and the interest deferral for TradeMarkCo as announced in previous new

releases, are still in effect. The impairment allowance is a non-cash

transaction and will not have any impact on the Fund's cash flow.

Operational Review

Four restaurants were closed during the quarter; three East Side Mario's located

in Ontario and one in Alberta.

FINANCIAL HIGHLIGHTS OF THE FUND:

----------------------------------------------------------------------------

($000's, except per

unit data) Three months Three months Year ended Year ended

ended ended December 31, December 31,

December 31, December 31, 2009 2008

2009 2008

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Interest and dividend

income $ 1,294 $ 1,779 $ 7,369 $ 7,049

Net earnings (15,629) 1,749 (10,157) 6,931

Total assets 42,579 57,009 42,579 57,009

Distributions to

Unitholders 785 1,723 6,316 6,892

----------------------------------------------------------------------------

Trust units -

outstanding 6,538,174 6,110,000 6,538,174 6,110,000

----------------------------------------------------------------------------

Trust units - diluted 9,749,794 9,321,620 9,749,794 9,321,620

----------------------------------------------------------------------------

Basic earnings per

Trust Unit ($ 2.38) $ 0.28 ($ 1.55) $ 1.13

Diluted earnings per

Trust Unit ($ 2.38) $ 0.28 ($ 1.55) $ 1.13

Distributions paid

per Trust Unit $ 0.12 $ 0.28 $ 0.97 $ 1.13

----------------------------------------------------------------------------

SELECTIVE YEAR-TO-DATE TRADEMARKCO FINANCIAL HIGHLIGHTS:

----------------------------------------------------------------------------

($000's except # of Royalty Pooled 2009 2008

Restaurants)

----------------------------------------------------------------------------

# of Royalty Pooled Restaurants 161 155

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gross Revenue Royalty Pooled Restaurants $ 333,093 $ 340,552

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Royalty Income 9,643 11,068

Operating Expenses 733 585

Impairment Provision (39,626)(i) -

Dividends accrued on Class A and Class B shares 3,613 3,613

Interest Expense 7,110 6,892

----------------------------------------------------------------------------

(i) In accordance with CICA Handbook Section 3064.64, TradeMarkCo is

required to perform an annual test for impairment of the Trademarks, an

intangible asset that is not subject to amortization, held by the

Company. Impairment would be recognized when the estimated fair value of

the Trademarks is lower than the carrying value. Management has

determined that an impairment of the Trademarks has occurred in the

current year, as it appears that there is a permanent reduction in the

estimated fair value of the Trademarks. Accordingly, an impairment

provision of $39.6 million has been recorded against the Trademarks

asset with a corresponding impairment charge recorded in the statement

of earnings (loss) for the year. However, on consolidation with PRC,

there is no impact of this impairment on the audited consolidated

financial statements of PRC.

The Fund's financial statements and Management's Discussion and Analysis

("MD&A") for the three months and year ended December 31, 2009 are available at

www.primeincomefund.ca and www.sedar.com. Prime Restaurants of Canada Inc.

("PRC") consolidated financial statements, notes and MD&A can also be accessed

at www.sedar.com under the "financial statements of operating entity" and

"other" document types for the Fund.

Combination Agreement

As previously announced on February 26, 2009, the Fund has signed a definitive

agreement with PRC, Prime Restaurant Holdings Inc ("PRH"), PRC's sole

shareholder, and TradeMarkCo regarding the terms of a transaction to combine and

form a new publicly-traded corporation to be named Prime Restaurants Inc. The

Trustees of the Fund have unanimously recommended the transaction to the Fund's

Unitholders, which will be submitted for approval by the Fund's Unitholders at a

special meeting currently scheduled for March 30, 2010. An information circular

is expected to be mailed to the Fund's Unitholders in early March 2010

containing the details of the transaction.

About Prime Restaurants Royalty Income Fund

The Fund, through TradeMarkCo, is entitled to receive top-line royalties of

3.25% of the gross food and beverage revenue from pooled restaurants under the

terms of a 99-year licence agreement between TradeMarkCo and PRC.

About PRC and the Fund

PRC operates and franchises a diversified portfolio of leading brands of casual

dining restaurants and premium pubs in Canada. As a pioneer in the Canadian

casual dining industry since 1980, it is considered an important innovator in

the development of strong brands, and today has three core brands: East Side

Mario's, Casey's and Fionn MacCool's. PRC and its franchisees employ

approximately 12,000 people across the country.

The Fund is a limited purpose trust authorised to issue an unlimited number of

Trust Units and established to invest in TradeMarkCo. The source of revenue for

the Fund is through its ownership in, and debt instrument issued by,

TradeMarkCo. The Fund receives interest income on the TradeMarkCo Note which it

distributes to its Unitholders. TradeMarkCo owns certain trade-marks and

licenses their use to PRC which operates and franchises the restaurant and bar

business. In return, TradeMarkCo receives royalty income from the royalty pooled

restaurants operated and franchised by PRC. Additional information relating to

the Fund, including the Fund's financial statements, the Annual Information Form

of the Fund and PRC's MD&A and consolidated financial statements can be found at

www.sedar.com and the Fund's website at www.primeincomefund.ca

Forward-Looking Statements

The public communications of the Fund often include written or oral

forward-looking statements. Statements of this type are included in this new

release, and may be included in filings with Canadian securities regulators, or

in other communications. Forward-looking statements may involve, but are not

limited to, comments with respect to our objectives for 2009 and beyond, our and

PRC's strategies or planned future actions, our and PRC's targets or

expectations for our financial performance and condition, PRC's ability to pay

the Royalty and our ability to pay the distributions. All statements, other than

statements of historical fact, contained in this new release are forward-looking

statements, including, without limitation, statements regarding the future

financial position and operations (including estimated revenue from Royalty

Pooled Restaurants and the estimated administrative and other operating expenses

of the Fund), business strategy, distributions, plans and objectives of or

involving the Fund and PRC. Readers can identify many of these statements by

looking for words such as "believe", "expects", "will", "intends", "projects",

"anticipates", "estimates", "continues" and similar words or the negative

thereof. Although management of the Fund and PRC believe that the expectations

represented in such forward- looking statements are reasonable, there can be no

assurance that such expectations will prove to be correct.

By their nature, forward-looking statements require us to make assumptions and

are subject to inherent risks and uncertainties including those discussed in the

Fund's MD&A and the Fund's annual information form dated March 11, 2009, (the

"AIF") under "Narrative Description of the Business - Risk Factors" which are

available at www.sedar.com. There is significant risk that predictions and other

forward-looking statements will not prove to be accurate. We caution readers of

this news release not to place undue reliance on our forward-looking statements

because a number of factors could cause actual future results, conditions,

actions or events to differ materially from the targets, expectations, estimates

or intentions expressed in the forward-looking statements.

Assumptions and analysis about the performance of the Fund and PRC and the

markets in which they operate are considered in forecasting the Fund's and PRC's

expected financial results, PRC's ability to pay the Royalty and the Fund's

ability to pay distributions and in making related forward-looking statements.

The key assumption in respect of the Fund's level of distributions is that the

cumulative distributable cash will be able to support the Fund's current level

of distributions. The Fund receives the cash it distributes from TradeMarkCo.

TradeMarkCo receives all of the cash it pays to the Fund through a royalty from

PRC. Accordingly, the ability of the Fund to pay its distributions depends on

PRC's financial performance and ability to pay the royalty. In respect of the

ability to maintain and grow the royalty pooled revenue and PRC's financial

performance, key assumptions include those relating to the demand for the goods

and services under the Prime Marks and in respect of the Canadian markets in

which the Royalty Pooled Restaurants operate. Should any of these factors or

assumptions vary, actual results may differ materially from the forward-looking

statements.

The information set forth in the MD&A and AIF identifies factors that could

affect the operating results and performance of the Fund and PRC. We caution

that the list of factors discussed in the MD&A and the AIF is not exhaustive,

and that, when relying on forward-looking statements to make decisions with

respect to the Fund, investors and others should carefully consider the factors

discussed, as well as other uncertainties and potential events, and the inherent

risks and uncertainties of forward-looking statements.

The forward-looking statements contained herein are expressly qualified in their

entirety by this cautionary statement. The forward-looking statements included

in this news release are made as of the date of this news release. Except as

required by applicable securities laws, the Fund does not undertake to update

any forward-looking statement, whether written or oral, that it may make or that

may be made, from time to time, on its behalf.

Definition of Distributable Cash and Non-GAAP Measures

Management views Distributable Cash as a useful supplemental measure of

operating performance that provides investors with an indication of cash

available for distribution. Management calculates Distributable cash as

operating cash flows for the Fund (net earnings adjusted for non-cash items such

as deferred revenue). Distributable Cash is not an earnings measure recognized

under GAAP and does not have a standardized meaning prescribed by GAAP.

Therefore, Distributable Cash may not be comparable with similar measures

presented by other entities.

For further information visit our web sites: www.primeincomefund.ca and

www.primerestaurants.com.

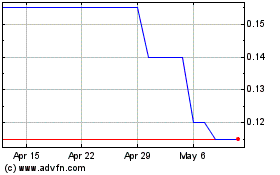

Pearl River (TSXV:PRH)

Historical Stock Chart

From Apr 2024 to May 2024

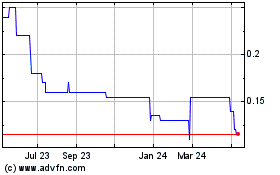

Pearl River (TSXV:PRH)

Historical Stock Chart

From May 2023 to May 2024