THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the three and nine month periods

ended September 30, 2011. The Company's unaudited condensed financial statements

have been prepared in accordance with International Financial Reporting

Standards ("IFRS"), including restatement of prior year results for comparative

purposes.

The Company reported a profit of $304,596 ($0.012 per basic share) for the three

months ended September 30, 2011 compared to a profit of $66,015 ($0.003 per

basic share) for the same three-month period last year. Profit for the nine

months ended September 30, 2011 was $394,057 ($0.016 per basic share) compared

to a profit of $74,403 for the nine months ended September 30, 2010.

On a comparative basis, profit improved in each of the three and nine month

periods ended September 30, 2011 due to higher margins resulting from the sales

and services mix achieved, partially offset by higher income tax expense and

administration expenses. Profit for the three months ended September 30, 2011

further benefited from the net foreign exchange gains recorded compared to the

net foreign exchange losses in the same period of 2010. Other non-recurring

revenue arising in second quarter 2011 further contributed to the positive

profit variance for the nine months ended September 30, 2011.

Financial Highlights Summary

(Stated in Canadian dollars except per share amounts)

For the three months ended September 30

-----------------------------------------------

Increase

2011 2010 (decrease)

----------------------------------------------------------------------------

Revenue(1) 1,583,571 1,987,106 (403,535)

Gross profit(2) 802,243 422,512 379,731

EBITDA(2) 605,795 162,209 443,586

Profit 304,596 66,015 238,581

Cash generated from

operations before

movements in working

capital(2) 412,240 198,143 214,097

Total assets 7,818,476 7,388,720 429,756

Non-current liabilities 226,539 108,287 118,252

Shares outstanding(3)

Basic 24,712,261 24,331,283 380,978

Diluted 24,812,335 24,461,645 350,690

Earnings per share - Basic

and diluted 0.012 0.003 0.009

----------------------------------------------------------------------------

For the nine months ended September 30

--------------------------------------------------

Increase

2011 2010 (decrease)

----------------------------------------------------------------------------

Revenue(1) 3,780,828 3,637,937 142,891

Gross profit(2) 1,338,413 1,039,092 299,321

EBITDA(2) 808,730 288,299 520,431

Profit 394,057 74,403 319,654

Cash generated from

operations before

movements in working

capital(2) 352,283 237,991 114,292

Total assets 7,818,476 7,388,720 429,756

Non-current liabilities 226,539 108,287 118,252

Shares outstanding(3)

Basic 24,709,018 24,137,223 571,795

Diluted 24,753,921 24,359,365 394,556

Earnings per share - Basic

and diluted 0.016 0.003 0.013

----------------------------------------------------------------------------

1. Includes net gain (loss) on disposal of property and equipment and other

revenue.

2. Non-IFRS financial measure. Please see discussion in the Non-IFRS

Financial Measures section of the Company's Management's Discussion and

Analysis for the three and six month periods ended September 30, 2011.

3. Weighted average.

"Profit increased by $319,654, or over 400 percent, in the first nine months of

2011 compared to the same period last year," said Audrey Mascarenhas, President

and Chief Executive Officer. "A key contributor to these favourable results is

the marked increase in rental incinerator revenue and related services due to

higher utilization of the existing fleet and deployment of $431,297 of new

equipment added to the fleet in the second and third quarters of 2011.

Approximately 80 percent of Questor's rental incinerator fleet is committed

under term contracts to the end of the year and, of that, approximately 40

percent of our fleet is operating in the United States primarily to assist with

well testing in shale plays."

"Questor currently has confirmed incinerator sales orders of $1.9 million for

which the revenue will be recognized when the product is delivered. Based on the

current customer-specified schedule, approximately $1.6 million of this revenue

will be recorded in fourth quarter 2011 and the balance in the first quarter

2012. The majority of these sales orders are destined for the United States

where the oil and gas industry is preparing for compliance with new air

emissions regulation effective 2012. Questor's clean combustion technology is

recognized as a cost effective solution to meet the new regulations. To enhance

our ability to capture these opportunities, we are currently evaluating an

increased presence in the United States and the viability of fabrication closer

to these markets," concluded Ms. Mascarenhas.

In relation to the Company's market awareness and brand recognition initiatives,

Ms. Mascarenhas presented at the following events in recent weeks:

-- Global Methane Initiative All-Partnership Meeting in Krakow, Poland on

October 13, 2011 on the topic of "Heat to Power";

-- Global Clean Energy Congress in Calgary, Alberta, Canada on November 2,

2011 on the topic of "Solutions Powered by Clean Combustion";

-- Canadian Launch Pad in Denver, Colorado, USA on November 7, 2011 on the

topic of "Clearing the Air! Safely, Economically and Efficiently"; and

-- Canadian Unconventional Resources Conference in Calgary, Alberta, Canada

on November 15, 2011 on the topic of "Community Engagement" in relation

to its importance to the success of unconventional reserves development.

Copies of these presentations are available on the Company's website.

The Company is pleased to announce that Ms. Mascarenhas was the recipient of the

Ernst & Young Entrepreneur Of The Year 2011 Prairies Award for the Cleantech and

Environmental Services category. She was also selected by the national judging

panel to receive a special citation in honour of Values-Based Innovation.

Entrepreneur Of The Year recognizes the spirit and contribution of entrepreneurs

here and around the world. The Canadian program is in its 18th year of honouring

the country's most impressive entrepreneurs from all areas of business who drive

growth, build communities and transform industries.

Questor's unaudited condensed financial statements and notes thereto and

management's discussion and analysis for the three and nine month periods ended

September 30, 2011 will be available shortly on the Company's website at

www.questortech.com and through SEDAR at www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield service company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta, Canada. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases which ensures regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

While the Company's current customer base is primarily in the oil and gas

industry, this technology is applicable to other industries such as landfills,

water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

Stated in Canadian dollars except per share data

(unaudited)

For the three months ended For the nine months ended

September 30 September 30

-------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

Revenue $ 1,580,395 $ 1,955,081 $ 3,297,752 $ 3,603,768

Cost of sales (778,152) (1,532,569) (1,959,339) (2,564,676)

----------------------------------------------------------------------------

Gross profit 802,243 422,512 1,338,413 1,039,092

Administration

expenses (354,330) (280,670) (1,143,448) (892,074)

Net foreign exchange

gains (losses) 102,755 (38,434) 23,723 12,495

Research and

development costs 2,887 (17,392) (28,810) (37,607)

Depreciation of

property and

equipment (10,922) (3,359) (21,958) (9,680)

Amortization of

intangible assets (305) (305) (914) (4,619)

Net gain (loss) on

disposal of

property and

equipment (13,340) - 188,199 -

Finance costs - (4) - (1,012)

Other revenue 16,516 32,025 294,877 34,169

----------------------------------------------------------------------------

Profit before tax 545,504 114,373 650,082 140,764

Income tax expense (240,908) (48,358) (256,025) (66,361)

----------------------------------------------------------------------------

Profit and

comprehensive

income $ 304,596 $ 66,015 $ 394,057 $ 74,403

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings per share

Basic and diluted $ 0.012 $ 0.003 $ 0.016 $ 0.003

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENT OF FINANCIAL POSITION

Stated in Canadian dollars

(unaudited)

September 30 December 31

As at 2011 2010

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 3,156,806 $ 3,995,669

Trade and other receivables 1,947,954 1,873,636

Current tax assets 10,178 362

Inventories 539,239 313,567

Prepaid expenses and deposits 116,485 107,467

----------------------------------------------------------------------------

Total current assets 5,770,662 6,290,701

----------------------------------------------------------------------------

Non-current assets

Property and equipment 1,990,986 1,037,565

Intangible assets 9,845 10,759

Deferred tax assets 46,983 49,695

----------------------------------------------------------------------------

Total non-current assets 2,047,814 1,098,019

----------------------------------------------------------------------------

Total assets $ 7,818,476 $ 7,388,720

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND EQUITY

Current liabilities

Trade payables, accrued liabilities and

provisions $ 774,138 $ 852,821

Current tax liabilities 79,898 230,746

Deferred revenue and deposits 221,361 146,485

----------------------------------------------------------------------------

Total current liabilities 1,075,397 1,230,052

----------------------------------------------------------------------------

Non-current liabilities

Deferred tax liabilities 188,352 108,287

Other non-current liabilities 38,187 -

----------------------------------------------------------------------------

Total non-current liabilities 226,539 108,287

----------------------------------------------------------------------------

Total liabilities 1,301,936 1,338,339

----------------------------------------------------------------------------

Capital and reserves

Issued capital 5,458,215 5,404,966

Reserves 612,797 593,944

Retained earnings 445,528 51,471

----------------------------------------------------------------------------

Total equity 6,516,540 6,050,381

----------------------------------------------------------------------------

Total liabilities and equity $ 7,818,476 $ 7,388,720

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENT OF CHANGES IN EQUITY

Stated in Canadian dollars

(unaudited)

Retained

Issued earnings

capital Reserves (deficit) Total equity

----------------------------------------------------------------------------

Balance at January

1, 2010 $ 5,265,736 $ 573,349 $ (393,589) $ 5,445,496

Profit - - 74,403 74,403

Recognition of

share-based

payments - 73,860 - 73,860

Issue of ordinary

shares under

employee share

option plan 124,312 (61,813) - 62,499

----------------------------------------------------------------------------

Balance at September

30, 2010 5,390,048 585,396 (319,186) 5,656,258

----------------------------------------------------------------------------

Profit - - 370,657 370,657

Recognition of

share-based

payments - 15,965 - 15,965

Issue of ordinary

shares under

employee share

option plan 14,918 (7,417) - 7,501

----------------------------------------------------------------------------

Balance at December

31, 2010 5,404,966 593,944 51,471 6,050,381

----------------------------------------------------------------------------

Profit - - 394,057 394,057

Recognition of

share-based

payments - 45,102 - 45,102

Issue of ordinary

shares under

employee share

option plan 53,249 (26,249) - 27,000

----------------------------------------------------------------------------

Balance at September

30, 2011 $ 5,458,215 $ 612,797 $ 445,528 $ 6,516,540

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENT OF CASH FLOWS

Stated in Canadian dollars

(unaudited)

For the nine months ended September 30 2011 2010

----------------------------------------------------------------------------

Cash flows from operating activities

Profit for the period $ 394,057 $ 74,403

Adjustments for:

Income tax expense recognized in profit 82,777 64,391

Finance costs recognized in profit - 1,012

Net gain on disposal of property and equipment (188,199) -

Depreciation of property and equipment 157,734 141,904

Amortization of intangible assets 914 4,619

Net foreign exchange gain (181,119) (124,203)

Expense recognized in respect of equity-

settled share-based payments 45,102 73,859

Office lease incentive 38,187 -

Write-downs of inventories to net realizable

value 2,830 2,006

----------------------------------------------------------------------------

352,283 237,991

Movements in working capital (182,015) 266,050

----------------------------------------------------------------------------

Cash generated from operations 170,268 504,041

Income taxes refunded (paid) (242,523) 37,453

----------------------------------------------------------------------------

Net cash generated from (used in) operating

activities (72,255) 541,494

----------------------------------------------------------------------------

Cash flows from investing activities

Movements in working capital (33,420) (1,972)

Payments for property and equipment (1,279,454) (41,802)

Proceeds from disposal of property and

equipment 389,918 -

Interest paid - (1,012)

----------------------------------------------------------------------------

Net cash used in investing activities (922,956) (44,786)

----------------------------------------------------------------------------

Cash flows from financing activities

Repayment of borrowings - (15,232)

Proceeds from issue of ordinary shares under

employee share option plan 27,000 62,500

----------------------------------------------------------------------------

Net cash provided by financing activities 27,000 47,268

----------------------------------------------------------------------------

Net increase (decrease) in cash and cash

equivalents (968,211) 543,976

Cash and cash equivalents at beginning of period 3,995,669 3,080,997

Effects of exchange rate changes on the balance

of cash held in foreign currencies 129,348 125,731

----------------------------------------------------------------------------

Cash and cash equivalents at end of period $ 3,156,806 $ 3,750,704

----------------------------------------------------------------------------

----------------------------------------------------------------------------

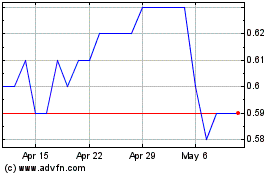

Questor Technology (TSXV:QST)

Historical Stock Chart

From Dec 2024 to Jan 2025

Questor Technology (TSXV:QST)

Historical Stock Chart

From Jan 2024 to Jan 2025