Southern Silver Announces Updated PEA on Cerro

Las Minitas: US$501M After-tax NPV5%; 21% IRR; 48 Month

payback

Vancouver, British Columbia -- June 11th, 2024

-- InvestorsHub NewsWire -- Southern Silver Exploration Corp.

(TSX.V:SSV) ("Southern Silver") reports results from

its Preliminary Economic Assessment ('PEA") on its 100% owned Cerro

Las Minitas project ("CLM").

PEA Highlights (all figures in $US

unless otherwise noted):

-

Robust Project

Economics – Base Case1:

after-tax NPV5%

of $501M

(C$682M) and IRR

of 21.2%

with a 48-month

payback;

-

Excellent Silver and

Zinc Price Leverage - Base-case + 20% Metal

Prices2:

after-tax NPV5%

of $876M

(C$1,193M) and

IRR

of 30.1%

with a 37-month

payback;

-

Base Case Metal Prices: Ag- $23.00/oz, Au - $1850/oz, Cu –

$4.00/lb, Pb – $1.00/lb and Zn - $1.25/lb

-

Base Case +20% metal prices: Ag- $27.60/oz, Au - $2220/oz, Cu –

$4.80/lb, Pb – $1.20/lb and Zn - $1.50/lb

The 2024 Preliminary Economic Assessment features:

-

A Large-Scale

Underground Mining Operation with a

17-year mine

life and an annual average plant feed of

14.3 Mozs

AgEq3

(inc. 5.8 Mozs Ag) and life-of-mine (LOM)

feed totalling 243.2 Mozs

AgEq3; (inc. 98.6 Mozs Ag). LOM product

sales total 194.3Mozs

AgEq3

at an AISC

of $13.23/oz

AgEq3

sold;

-

A High-Revenue

Project with gross revenues

totalling $4.47B

with silver and gold representing 45% of

revenues, and zinc representing 35% of projected revenues. The

project has an Initial CapEx of

$388M, an NPV5%-to-CapEx

ratio of 1.3X

and a paydown of 48 months on a post-tax

basis; and

-

A Well-Located

Project in a mining friendly jurisdiction with

excellent infrastructure in southeast Durango state,

Mexico;

-

AgEq is calculated on a (contained metal x metal price)/ Ag price

basis

In comparison to the earlier 2022 economic model, the updated PEA

now:

-

Increases the Life of Mine (LOM) production

by 5Mt, representing an approximate 20%

increase;

-

Increases daily mine production capacity

to 5300 tonnes per day

("tpd"), representing an approximate 18%

increase;

-

Extends the mine life by

2.6yrs;

-

Increases the LOM Revenue by

$765M, representing an approximate 17%

increase in revenues.

-

Increases the after-tax NPV5% by 45%

to $501M; and

-

Similarly, increases the post-tax IRR by 3.3%

to 21.2%

Lawrence Page. K. C. President, said: "This latest

economic update of Cerro Las Minitas represents a new milestone in

the ongoing evolution and development of the project which is the

culmination of a number of smaller technical improvements,

developed over the last 18 months, which together result in a

significant increase in the value of the Cerro Las Minitas asset.

This includes the addition of new mineral resources from the North

Felsite zone as first reported in March 2023; the standardization

of the metallurgical recoveries and charges across each of the

deposits, including the addition of gold revenues into the project

cash-flow; improvements in the mine scheduling and optimization

both the Operating and Capital costs of the project."

"Since acquisition of the property in 2010 and

subsequent identification of the mineral resources, a very

profitable and valuable mine has been modelled in the results of

the PEA disclosed today. Total acquisition, exploration and

development costs are approximately US$28 million and

significantly, the property is not burdened with royalties,

presenting potential financing opportunities for additional

drilling and development work on the property. This presentation of

the results of the PEA marks a significant milestone in the

development of the property and the best is yet to come."

PEA SUMMARY:

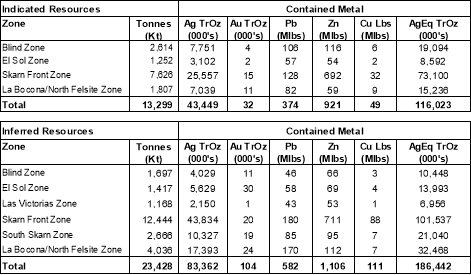

Study support

-

The study is based on an updated Mineral

Resource ("Resource") by KGL, as of March

20th

2024, using a $60NSR/t cut-off:

-

Indicated –

13.3Mt averaging 102g/t Ag, 0.07g/t Au,

0.17% Cu 1.3% Pb, and

3.1% Zn

totaling 43.4Moz Ag, 32Koz Au, 49Mlb

Cu, 374Mlb Pb and 921Mlb Zn;

and

-

Inferred –

23.4Mt averaging 111g/t Ag, 0.14g/t Au,

0.21% Cu, 1.1% Pb and

2.1% Zn

totaling 83.4Moz Ag, 104koz Au,

111Mlb Cu, 582Mlb Pb and 1,106Mlb Zn.

(see Appendices for Resource details, price and recovery

assumptions)

-

The PEA project team included Kirkham

Geosciences Ltd. ("KGL"), Ausenco Engineering USA South Inc and

Ausenco Sustainability ULC. ("Ausenco"), Entech Mining Limited

("Entech"), and MPC Metallurgical Process Consultants Limited

("MPC");

-

PEA metal price assumptions: Ag = $23.00/oz,

Au = $1850, Cu = $4.00/lb, Pb = $1.00/lb, Zn= $1.25/lb;

-

Terms: Net Present Value at a 5% discount

("NPV5%"); Internal Rate of Return ("IRR"); Operating Costs

("OpEx"); and Capital Costs ("CapEx"), All-in Sustaining Costs

("AISC")

Cautionary Statement

The PEA is preliminary in nature, it may

include mineral resources that are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves, and

there is no certainty that the PEA will be realized. Mineral

resources that are not mineral reserves have not demonstrated

economic viability. The mineral resources may be affected by

subsequent assessment of mining, environmental, processing,

permitting, taxation, socio-economic, and other factors.

Project Economics

The CLM project demonstrates robust LOM revenues over 17 years of

production and after-tax NPV5% of $501M. Total Capital Expenditure

for the project is $565M which requires $388M of initial capital

expenditure and $177M in sustaining and closure capital. The

project payback is 48 months.

Table 1: CLM Project Economics

|

Item

|

Units

|

Base Case

|

|

Revenue

|

US $M

|

$4,470

|

|

EBITDA

|

US $M

|

$2,076

|

|

LOM pre-tax

cash flow

|

US $M

|

$1,512

|

|

LOM

after-tax cash flow

|

US $M

|

$923

|

|

|

|

|

|

NPV pre-tax

(5% Discount)

|

US $M

|

$887

|

|

NPV pre-tax

(8% Discount)

|

US $M

|

$648

|

|

NPV pre-tax

(10% Discount)

|

US $M

|

$525

|

|

IRR

pre-tax

|

%

|

30.0%

|

|

|

|

|

|

NPV

after-tax (5% Discount)

|

US $M

|

$501

|

|

NPV

after-tax (8% Discount)

|

US $M

|

$340

|

|

NPV

after-tax (10% Discount)

|

US $M

|

$258

|

|

IRR After

Tax

|

%

|

21.2%

|

|

|

|

|

|

Initial

Capital Expenditures

|

US $M

|

$388

|

|

|

|

|

|

Payback

(discounted, after-tax)

|

months

|

48

|

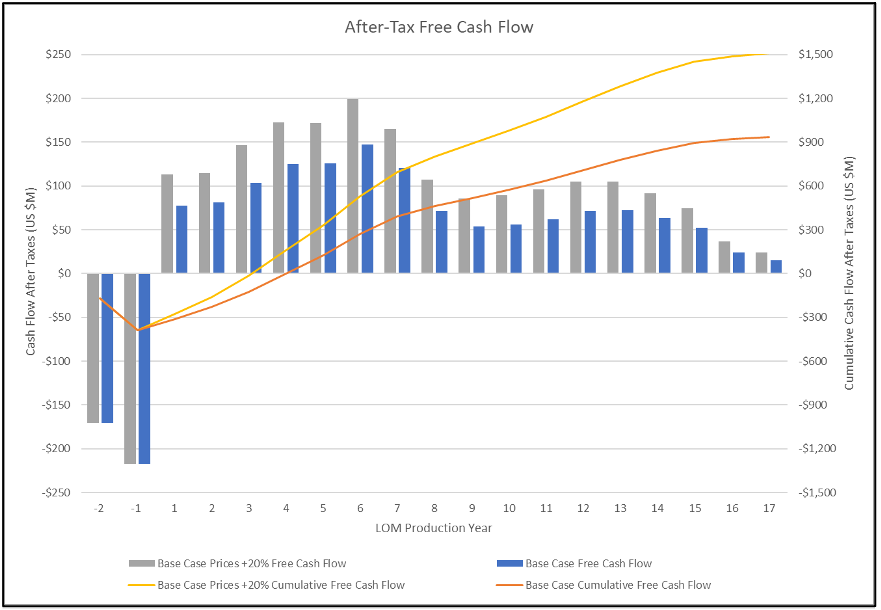

After-Tax, Free Cash Flow

Figure 1 illustrates the estimated annual and cumulative after-tax

cash flow over the life-of-mine for both the Base Case (blue) and

the Base Case +20% metal values (grey). Mine scheduling targets

higher margin mineralization in the first eight years of production

resulting in a more aggressive paydown of capital and improved

economics with an annual average After-tax Free-cashflow of $107M

in the first eight years of production and $78M over the

life-of-Mine.

Figure 1: Annual and LOM cashflow

Economic Sensitivities

The Project's gross revenues, NPV5% and IRR shows greatest

sensitivity to metal prices.

Table 2: Gross Revenue, NPV5% and IRR

sensitivity at base-case +/- 20% and current pricing

|

All Metal Price (Ag, Au, Cu, Pb,

Zn) Sensitivity

|

|

Metal Price

|

Revenue (US$M)

|

NPV, after tax @ 0%

(US$M)

|

NPV, after tax @ 5%

(US$M)

|

IRR, after Tax

|

|

Spot

|

$5,493

|

$1,583

|

$931

|

31.4%

|

|

+20%

|

$5,364

|

$1,501

|

$876

|

30.1%

|

|

Base Case

|

$4,470

|

$923

|

$501

|

21.2%

|

|

-20%

|

$3,576

|

$339

|

$122

|

9.9%

|

Note: Base Case price assumes Ag = $23.00/oz,

Au = $1850/oz, Cu = $4.00/lb, Pb = $1.00/lb, Zn = $1.25/lb

"Spot" assumes May 29 2024

prices: Ag = $31.53/oz, Au

= $2332/oz, Cu = $4.69/lb, Pb = $1.05/lb, Zn = $1.41/lb

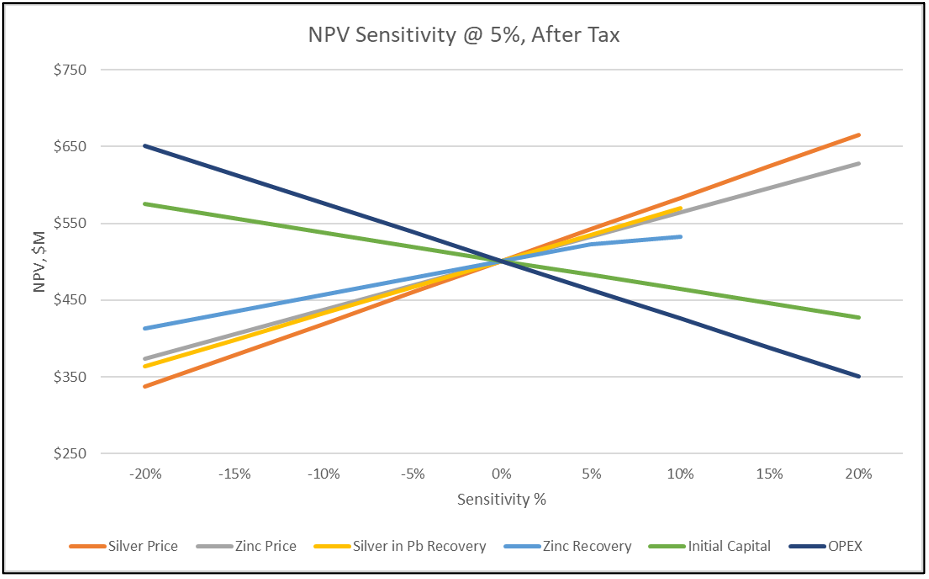

Other factors that may impact the NPV sensitivity include changes

in Operating Costs ("OpEx") and Initial Capital. These relative

impacts together with changes in silver and zinc prices are shown

in Table 3 and Figure 2.

Table 3: NPV sensitivity as a function of

select metals prices, recoveries, CapEx and OpEx:

|

Sensitivity

NPV @ 5%, after Tax (US$M)

|

|

Sensitivity

|

Silver

Price

|

Zinc

Price

|

Silver in Pb

Recovery

|

Zinc

Recovery

|

Initial

Capital

|

OPEX

|

|

20%

|

$665

|

$628

|

|

|

$427

|

$351

|

|

15%

|

$624

|

$596

|

|

|

$446

|

$388

|

|

10%

|

$583

|

$565

|

$570

|

$533

|

$464

|

$426

|

|

5%

|

$542

|

$533

|

$535

|

$523

|

$483

|

$464

|

|

0%

|

$501

|

$501

|

$501

|

$501

|

$501

|

$501

|

|

-5%

|

$460

|

$469

|

$467

|

$479

|

$520

|

$539

|

|

-10%

|

$419

|

$437

|

$433

|

$457

|

$538

|

$576

|

|

-15%

|

$378

|

$405

|

$398

|

$435

|

$556

|

$613

|

|

-20%

|

$337

|

$373

|

$364

|

$413

|

$575

|

$650

|

Note: +15% and +20% Silver and Zn recoveries

are not applicable

Figure 2: After-tax NPV5%

sensitivities

Production and Costs:

Annual mine production is estimated to deliver 14.3 Moz AgEq

(includes 5.8 Mozs Ag) to the processing facility averaged over a

17-year period. Potential annual product of sales (net deductions,

treatment and refining) averaging 11.4 Moz AgEq (includes 4.9 Mozs

Ag).

Peak annual Plant Feed is achieved in Year 6 with 22.3 Mozs AgEq

(includes 9.4 Moz Ag) being processed with peak annual product of

sales of 18.0 Moz AgEq (includes 7.9 Moz Ag). Table 4 summarizes

the estimated metal production from the CLM project.

Table 4: CLM LOM Production and Metal

Sales

|

|

Units

|

Y1-8

|

LOM

|

|

AgEq Plant

Feed (Yearly Average)

|

(Moz)

|

17.9

|

14.3

|

|

AgEq Product

of Sales (Yearly Average)

|

(Moz)

|

14.4

|

11.4

|

|

AgEq Plant

Feed (Total)

|

(Moz)

|

143.7

|

243.2

|

|

AgEq Product

of Sales (Total)

|

(Moz)

|

115.4

|

194.3

|

|

All-In

Sustaining Cost (AISC)

|

(US$/AgEq oz)

|

$12.23

|

$13.23

|

|

|

|

|

|

|

|

Units

|

Y1-8

|

LOM

|

|

Ag Plant

Feed (Yearly Average)

|

(Moz)

|

7.6

|

5.8

|

|

Ag Product

of Sales (Yearly Average)

|

(Moz)

|

6.5

|

4.9

|

|

Ag Plant

Feed (Total)

|

(Moz)

|

60.8

|

98.6

|

|

Ag Product

of Sales (Total)

|

(Moz)

|

51.9

|

83.9

|

Note: AgEq was determined assuming contained

metal and pricing

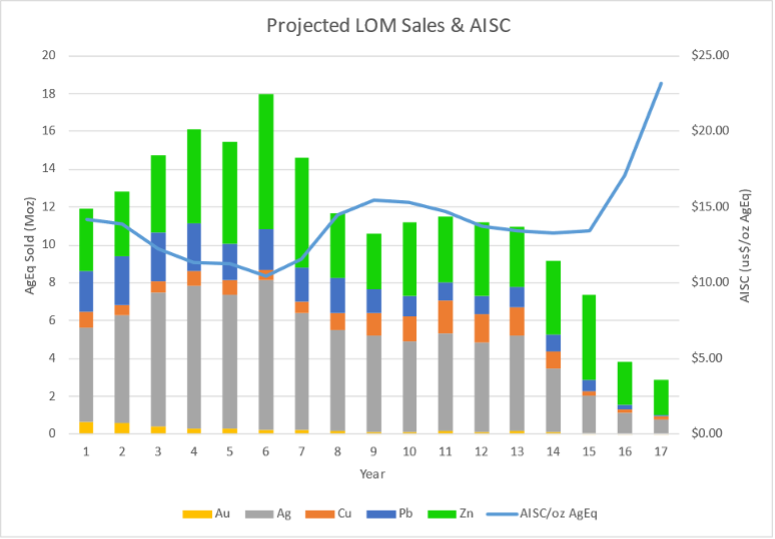

Mine Schedule and All-In-Sustaining-Cost

(AISC)

Mine scheduling targets higher value silver-lead production in the

first 8 years of mine life with lower AgEq grading material

(zinc-copper dominant) being targeted in the final 9 years. Total

plant feed (mine production) is estimated to be 243.2 Mozs AgEq

(includes 98.6 Mozs Ag) with 194.3 Moz AgEq (includes 83.9 Moz Ag)

sold. Total all-in sustaining costs ("AISC") are estimated to be

$US 2.57B averaging $US13.23/oz AgEq sold. LOM production and AISC

are illustrated in Figure 3.

Figure 3: LOM AgEq sales and AISC:

OPERATIONS:

Mining:

The mine plan was completed by Entech and incorporates longitudinal

and transverse longhole stoping methods. Two separate portals are

proposed to access the various deposits, with one portal accessing

the Blind-El Sol and Skarn Front deposits, and a second portal

accessing the La Bocona, South Skarn, and North Felsite deposits.

The process in creating the mine plan is further described

below:

-

Datamine® Mineable Stope Optimizer ("MSO")

was used to produce shapes for mine planning purposes. The Resource

model from March 22, 2023 by Kirkham Geosciences Ltd. was used for

the evaluation and MSO analyses considered a preliminary cut-off

value of $60/t NSR;

-

The Resource Model is restated with

standardized metal prices, metal recoveries and smelter terms in

this current disclosure (see Appendices);

-

MSOs considered a minimum mining width of 3.5

m (inclusive of 1.0 m width for unplanned dilution in rock), 25 m

sub-levels, and 20 m strike lengths;

-

A total of 29.5 Mt averaging $131/t NSR (104

g/t Ag, 0.11g/t Au, 0.19 % Cu, 1.06 % Pb, and 2.41 % Zn) was sent

to the processing facility, representing a conversion of

approximately 88.3% of the Resource value at a $60/t cut-off

value;

-

Depending on the width of the stope and the

strike of continuous sections of wider zones, transverse stoping

was selected and mined bottom-up. For predominately narrower zones

(typically less than 18m) longitudinal stoping was selected and

mined either top-down or bottom-up depending on location and timing

of development. Overall, the average stope width by tonnage was

16.5 m;

-

Detailed geotechnical analysis including

hydrogeological modelling is to be completed in further studies of

the deposit, however preliminary investigations have been

completed. The preliminary investigations support the selection of

longhole stoping as an appropriate method for this Preliminary

Economic Assessment. An equivalent linear overbreak slough (ELOS)

was assumed to be 1.0m (0.5m from each wall) and additional

dilution for mining of backfill was considered. Backfill dilution

was varied depending on exposure, with 0.5m considered from the

backs (top-down), 0.25m from the floor (bottom-up), 0.5m from the

far wall (longitudinal stoping), and 0.5m from one adjacent wall

(transverse stoping mined centre-out);

-

A stope recovery factor of 93% and

development recovery factor of 97% was considered.

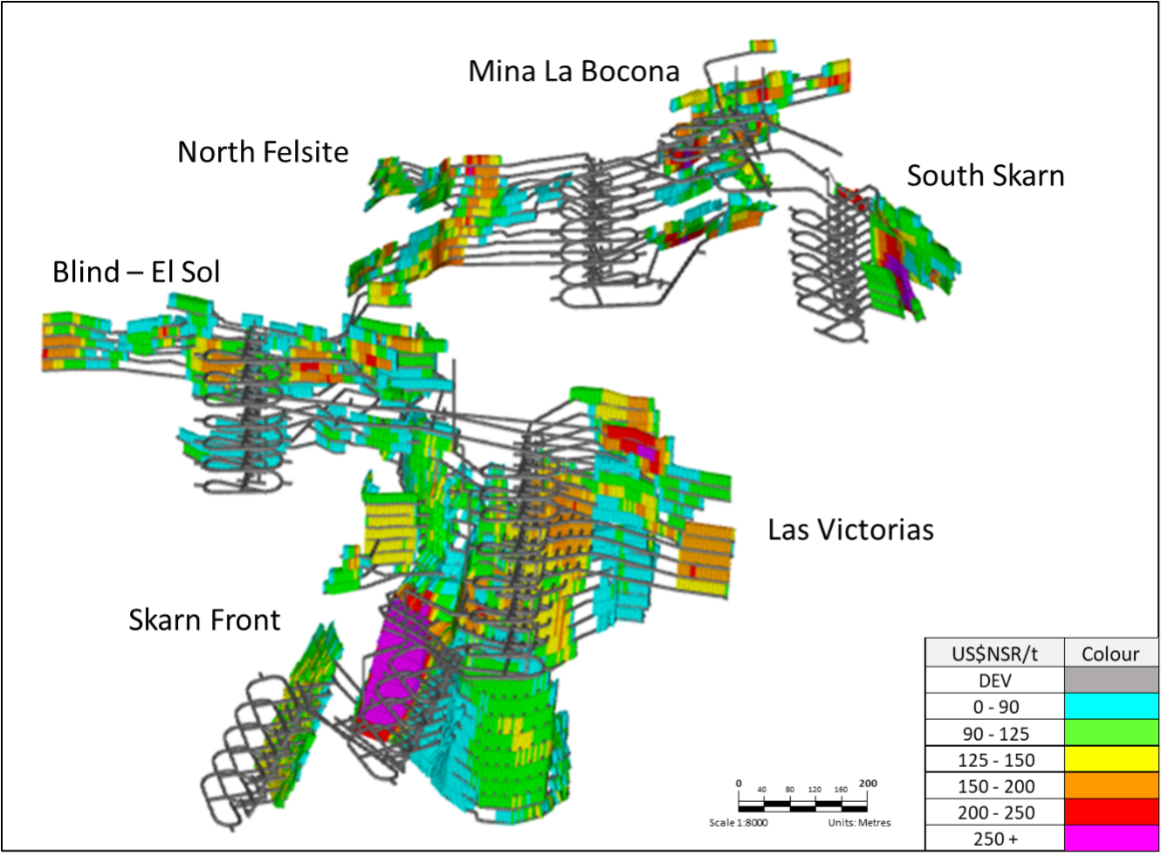

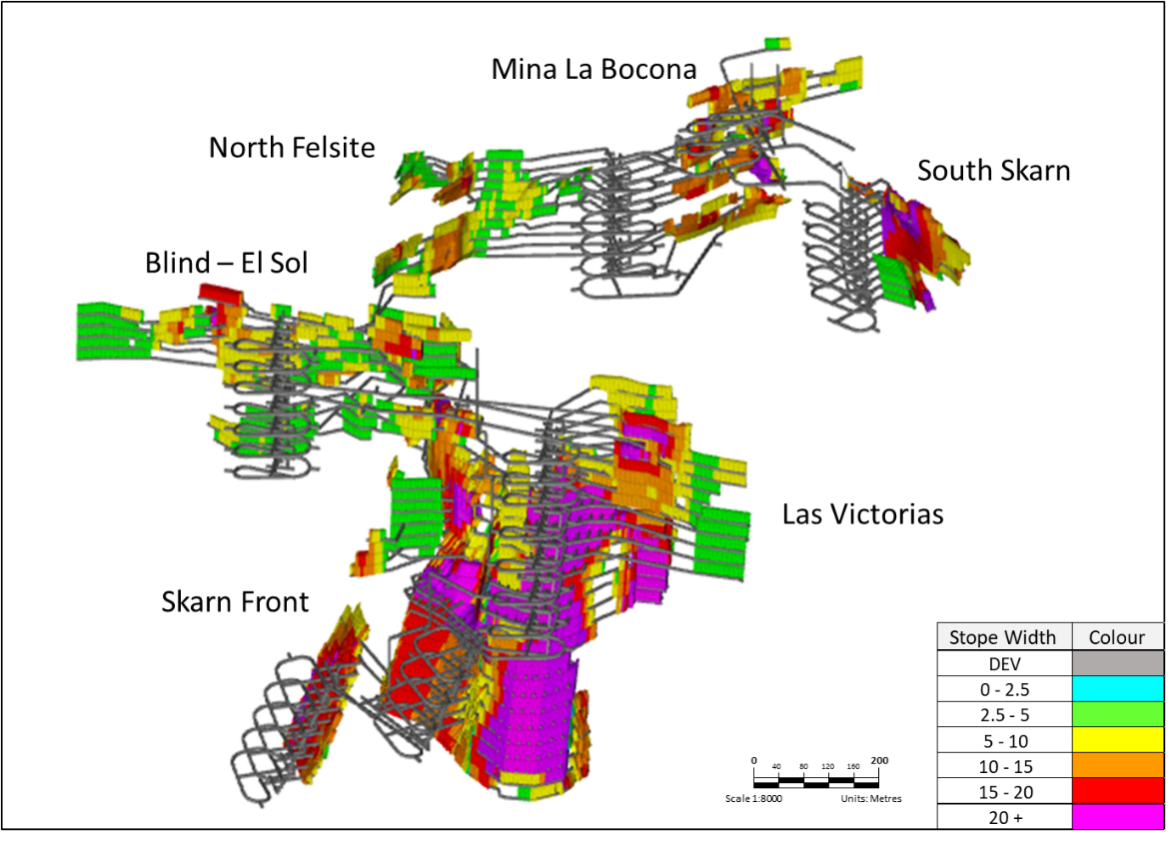

The grade and average stoping widths are illustrated in Figure 4

and Figure 5 respectively.

Figure 4: US$NSR/t grade distribution of the

Cerro Las Minitas MSO model - looking northeast

Figure 5: Average Stope Width of the Cerro Las

Minitas MSO model - looking northeast

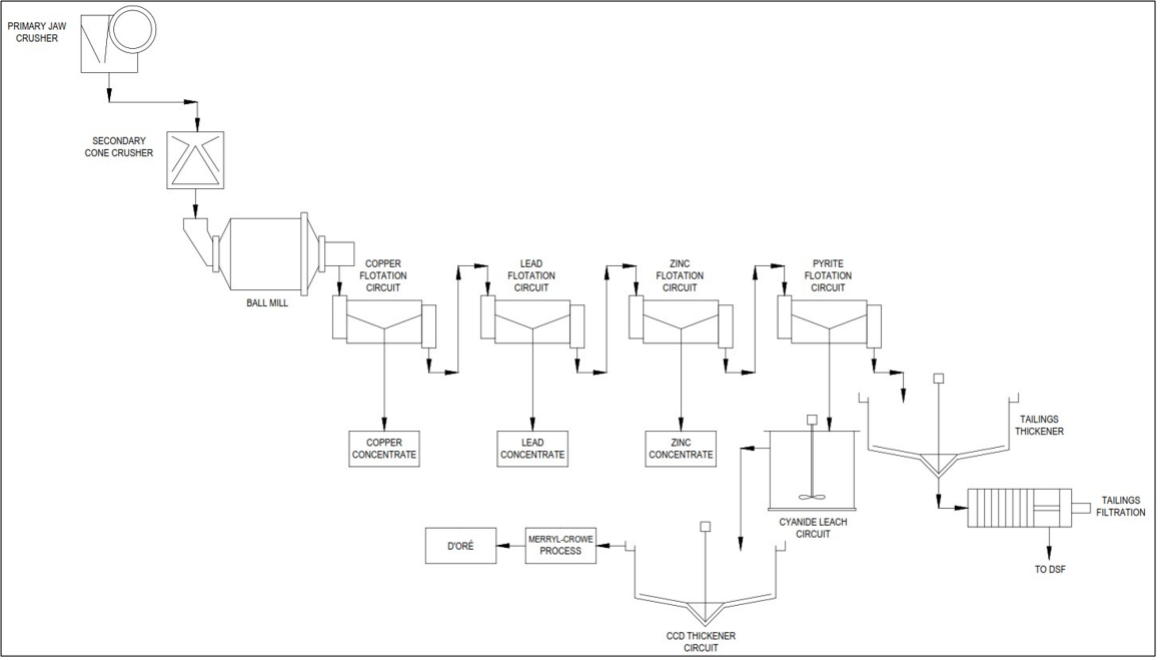

Processing:

The process plant for the PEA study is a conventional sulphide

flotation system consisting of:

-

Primary jaw crushing to a 15,000 tonnes ROM

stockpile, reclaim and secondary crushing, closed-circuit ball mill

grinding and sequential Cu-Pb-Zn (each with rougher-regrind-cleaner

stages) flotation circuit producing three filtered concentrates for

sale and a gold-bearing pyrite concentrate for

leaching.

-

The pyrite leach incorporates ultra-fine

grinding to improve conventional cyanidation and gold recovery by

Merrill-Crowe precipitation and induction melting to produce Au-Ag

doré bars.

-

Barren tailings to Paste Plant for

underground mine cement backfill with the surplus, dry-stacked to

surface

-

Design Annual Throughput of 1,935 kilo-tonnes

based on nominal 5,300 tpd throughput.

Head grades:

MSO scheduling successfully prioritized higher grade material to

the mill earlier in the mine life resulting in higher heads grades

(and associated annual revenue) in the first eight years of

production as compared to the final 10 years.

Table 5: Head grade over Yr1-8 and LOM

|

HEAD GRADES

|

Units

|

Y1-8 Average

|

LOM

|

|

Avg. Annual

Plant Feed

|

(kt)

|

1,930

|

1,930

|

|

Ag

|

(g/t)

|

119

|

104

|

|

Au

|

(g/t)

|

0.14

|

0.11

|

|

Cu

|

(%)

|

0.15

|

0.19

|

|

Pb

|

(%)

|

1.37

|

1.06

|

|

Zn

|

(%)

|

2.45

|

2.41

|

|

AgEq

|

(g/t)

|

290

|

257

|

Recoveries and Tailings:

-

A series of Batch/Locked cycle

testwork/variability testwork programs conducted between 2018 and

2023 confirmed that the Cu-Pb-Zn sequential flotation flowsheet

would be appropriate for processing all the sulphide mineralization

from the deposit.

-

Testwork conducted in 2023 indicated that

gold in oxide was readily leachable at high (>80%) recoveries,

while approximately 70% of the gold present in sulphide material

could be concentrated in the pyrite-rich concentrate while 20%

reported to the copper concentrate.

Ultra-fine grinding of the pyrite to 80%

passing 6 micron improved the extraction of Au by cyanidation from

17% to 40% while oxidative pre-treatment increased the gold

extraction to 83% but with very high oxygen and cyanide

consumption. An economic evaluation determined that the oxidation

step could not be justified.

-

Circuit design based on stainless grinding

media and optimised reagent selection for sequential flotation

which maximizes base metal grades and recoveries while minimizing

misplacement of base metals to other concentrates.

-

While mining progresses through various

geo-metallurgical ore types, the plant is designed to handle wide

variations in both grade and sulphide mass pull.

-

Non-sulphide tailings surplus to the backfill

requirements are dry stacked in a suitable area some 1000m NW of

the process plant.

Concentrate Terms:

Metal Payables

The project is expected to produce four saleable concentrates of

sufficient quality to be marketable to a variety of global

smelters.

Approximately 93% of Ag is recovered with 77 % reporting to the Pb

concentrate, 6% to the Cu concentrate, 7% to the Zn concentrate and

3% to the leach circuit.

Table 6: Metal Recoveries established for the

PEA

|

Item

|

Pb Conc.

|

Zn Conc.

|

Cu Conc.

|

Dore

|

|

Pb Recovery

|

87%

|

|

|

|

|

Zn Recovery

|

|

93%

|

|

|

|

Cu Recovery

|

|

|

70%

|

|

|

Ag Recovery

|

77%

|

7%

|

6%

|

3%

|

|

Au Recovery

|

|

|

20%

|

28.6%

|

|

Concentrate Grade (Primary Base Metal)

|

65%

|

54%

|

27%

|

|

Refining and Treatment:

Treatment and refining charges were based on consultation with

industry professionals and generated the terms indicated below:

Table 7: Refining and Treatment

|

|

Ag

|

Au

|

Cu

|

Pb

|

Zn

|

|

Cu Concentrate

|

|

|

|

|

|

|

Average

Concentrate Grade LOM

|

1,266g/t

|

4.3g/t

|

27%

|

-

|

-

|

|

Payable

Metal

|

90%

|

90%

|

97%

|

-

|

-

|

|

Minimum

Deduction

|

-

|

-

|

1 unit

|

-

|

-

|

|

Pb Concentrate

|

|

|

|

|

|

|

Average

Concentrate Grade LOM

|

5,641g/t

|

-

|

-

|

65%

|

-

|

|

Payable

Metal

|

95%

|

-

|

-

|

95%

|

-

|

|

Minimum

Deduction

|

50g/t

|

-

|

-

|

3 Units

|

-

|

|

Zn Concentrate

|

|

|

|

|

|

|

Average

Concentrate Grade LOM

|

180g/t

|

-

|

-

|

-

|

53.50%

|

|

Payable

Metal

|

70%

|

-

|

-

|

-

|

85%

|

|

Minimum

Deduction

|

3oz/t

|

-

|

-

|

-

|

8 units

|

|

Dore

|

|

|

|

|

|

|

Contained

kozs

|

2,927

|

28.9

|

-

|

-

|

-

|

|

Payable

Metal

|

99%

|

100%

|

-

|

-

|

-

|

The high Ag grade in the Pb concentrate makes it attractive to

smelters and could result in more favourable treatment terms, but

these have not been considered at the PEA level. Penalty elements

are low, with Cd (in solution with Zn) ($8.9/t conc.) being the

major contributor to Zn penalties, and Sb (in solution with Pb)

being the major source of Pb penalties ($27/t conc).

Concentrate Transportation:

Transportation costs assume trucking of the concentrate via

containers to the international port at Manzanillo, Colima, and

then shipping via ocean freight to Asia. Estimated transportation

costs (trucking, port handling and ocean freight) are US$96/wmt

(wet metric tonnes) for Pb concentrate and US$106/wmt for Zn

concentrate. Moisture contents are assumed to be 8.5% based on the

grind size of the final concentrates.

CAPITAL EXPENDITURES:

Total initial capital investment in the project is estimated to be

$388 million and includes $50 million contingency, which represents

the total direct and indirect cost for the development of the

project, including associated infrastructure.

Table 8: Capital Expenditure

break down.

|

Item

|

Total ($M)

|

|

Process Plant and Infrastructure

|

|

|

Project Directs including freight

|

$159.7

|

|

Project Indirects

|

$38.9

|

|

Owner Costs

|

$8.0

|

|

Contingency

|

$50.1

|

|

Sub-Total

|

$257

|

|

Mining

|

|

|

Pre-Production Capital Costs

|

$131

|

|

Total Initial Capital Costs

|

$388

|

|

Sustaining Capital and Closure Costs

|

$177

|

|

Total Capital Costs

|

$565

|

Mining Development Costs:

Mining development costs were developed by Entech considering a

mining contractor model. Total capital costs including sustaining

capital allocated to mining are approximately $US291M comprising of

the following:

Table 9: Mining Capital Breakdown

|

Item

|

Total ($M)

|

|

Capitalised

Operating Expense

|

31

|

|

Pre-Production Capital Development

|

65

|

|

Pre-Production Fixed and Mobile Plant

|

6

|

|

Pre-Production Capital Infrastructure

|

28

|

|

Pre-Production Surface Infrastructure

|

2

|

|

Total Pre-Production Mining Capital

Costs

|

131

|

|

Sustaining

Capital Development

|

114

|

|

Sustaining

Fixed and Mobile Plant

|

25

|

|

Sustaining

Capital Infrastructure

|

22

|

|

Total Mining Sustaining Capital

Costs

|

160

|

|

Total Mining Capital Costs

|

291

|

-

Initial development costs are approximately

$65M;

-

Sustaining development are approximately

$114M;

-

Reallocated operating expense of

$31M.

-

Contractor mobilization, equipment purchases

and half-life rebuilds (pumps, primary and auxiliary fans,

compressors, and substations) are approximately $30M;

-

Initial project capital expenses (portals,

primary fans, initial pump stations, refuge chambers, etc. plus a

25% contingency) are approximately $50M; and,

-

Total lateral capital development cost of

$6,594 /m and includes a reallocation of operating expense to

capital of $845 /m;

Direct costs of $4,211 /m and indirect costs of $1,538

/m.

Operating Costs

Operating costs are broken down into Mining, Processing, G&A

and Treatment and Refining costs, plus additional production

charges including government royalty, employee profit sharing and

closure expenses. Operating costs were developed by Ausenco and

Entech (Mine Operating Cost).

Table 10: Operating cost breakdown on a per

tonnage basis

|

Area

|

$/t ore processed

|

|

Mine Operating Cost

|

$41.22

|

|

Process Plant Operating Cost

|

$15.82

|

|

G & A

|

$4.33

|

|

Operating Cost

|

$61.37

|

|

Treatment & Refining Charges

|

$19.88

|

|

Sustaining Capital Costs

|

$5.43

|

|

Closure Cost

|

$0.56

|

|

Other Production Cost

|

$25.87

|

|

Total

|

$87.24

|

Mining:

The operating costs reflect a contractor mining option which defers

capital but utilizes the experience of a contractor for initial

construction and development of the mine. Mining considers a modern

and large operation using large 21-t loaders and 63-t capable

trucks targeting an average daily plant feed of approximately 5,300

tpd and 6,900 tpd when including waste development (peak of 7,800

tpd in production Year 4) as both portals are in production.

Mining costs are developed by Entech and are from Entech's cost

database which includes pricing from mining contractors.

Table 11: Production and Development

Breakdown

|

Item

|

Total ($M)

|

Total ($/t)

|

|

Development

|

$190

|

$6.45

|

|

Production

|

$1,024

|

$34.77

|

|

Total Production and Development

Costs

|

$1,214

|

$41.22

|

Operating costs are summarized as follows and are appropriate for a

Preliminary Economic Assessment:

-

Total underground mining operating costs are

approximately $1,214M at an average of $41.22/t;

-

Operating development (including non-capital

waste development) of $3,087 /m (direct costs of $2,720 /m) and

averages on a per tonne basis of $6.45 /t;

-

Production costs of $34.77 /t of which $29.54

/t are direct costs and $5.23 /t are indirect costs which includes

labour (mine management/technical services), maintenance, power,

and other costs.

Processing and General & Administration

costs ("G+A"):

The process plant is a conventional sulphide flotation system

consisting of both primary and secondary crushing, a closed-circuit

ball mill grinding and sequential Cu-Pb-Zn flotation circuit

producing three filtered concentrates for sale. A fourth pyrite

concentrate is produced for leaching.

Operating costs are as follows:

Table 12: Breakdown of Process Plant Operating

cost

|

Operating &

Maintenance

|

$/t ore processed

|

|

Labor

|

$1.40

|

|

Electrical Power

|

$4.64

|

|

Reagents

|

$5.04

|

|

Liners/Grinding Media

|

$1.94

|

|

Maintenance Parts

|

$0.95

|

|

Supplies and Services

|

$1.65

|

|

Fresh Water Supply

|

$0.19

|

|

Total (US$)

|

$15.82

|

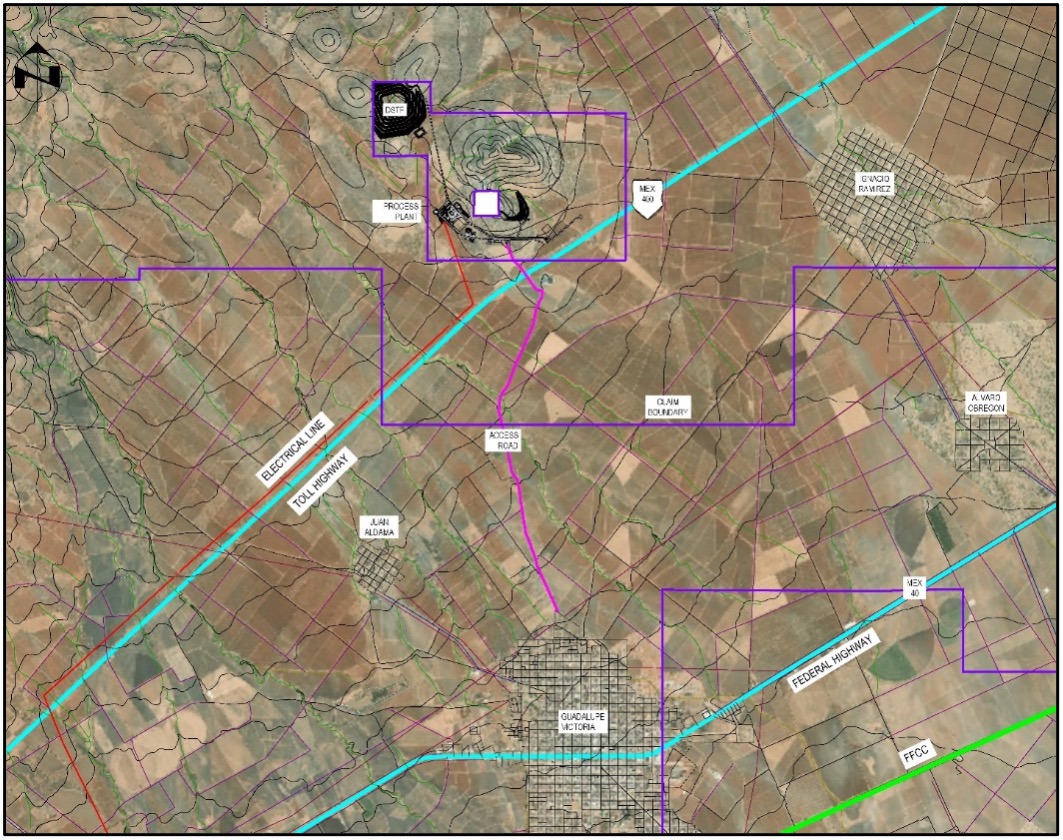

G&A costs reflect a well-located project in an area of

excellent infrastructure and immediately adjacent to the town of

Guadalupe Victoria (population: ~35,000).

Opportunities:

Mine life extension: Mineralization on

the eastern and northern sides of the Cerro remains relatively

under-drilled and several gaps occur in the current resource model

both at relatively shallow depths and down dip of several of the

main higher-grade zones. Identification of further mineralization

at relatively shallow depths would potentially add more value in

the earliest parts of the mine schedule.

Infill Drilling: Infill drilling,

specifically on the portions of the deposit that fall within the

Inferred category of classification will increase confidence in the

Mineral Resource estimate, will further de-risk the project and

potentially increase the value of the project.

Metallurgical Upside: XRT-based

preconcentration testwork showed excellent discrimination between

sulphide and oxide material enabling a 3-4x upgrade of run-of-mine

rock crushed to 80% passing 75mm with the sub-15 mm fines removed.

Pay metal retention in the sulphidic fraction exceeded 98%. This

option provides an excellent opportunity for further reductions in

project Capex and Opex should the need arise.

Technical Disclosure

-

All mineral resources have been estimated in

accordance with Canadian Institute of Mining and Metallurgy and

Petroleum (CIM) definitions, as required under

NI43-101.

-

Mineral resources reported demonstrate

reasonable prospect of eventual economic extraction, as required

under NI43-101.

-

Mineral resources are not mineral reserves

and do not have demonstrated economic viability. The mineral

resources may be materially affected by environmental, permitting,

legal, marketing, and other relevant issues.

-

The PEA is preliminary in nature, it may

include mineral resources that are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves, and

there is no certainty that the PEA will be realized.

-

An inferred mineral resource has a lower

level of confidence than that applying to an indicated mineral

resource and must not be converted to a mineral reserve. It is

reasonably expected that most of the inferred mineral resources

could be upgraded to indicated mineral resources with continued

exploration.

-

AISC is calculated as: Operating costs

(mining, processing and G&A) + Incremental PTUs + Concentrate

Transportation + Treatment & Refining Charges + Penalties +

Sustaining Capital + Closure Costs +Silver Revenue Royalty and is

reported on using a per tonne mined, AgEq plant feed and AgEq

payable basis

-

A full

technical report

will be

prepared in

accordance with

NI 43-101

and will

be filed

on SEDAR

within 45 days of this press

release.

Appendices

Appendices with the following supporting information is found at

the back of this release.

Appendix A: Sulphide Mineral Resource Estimate

Appendix B: Project location and Infrastructure

Appendix C: Simplified Process Flow Sheet

About Southern Silver Exploration

Corp.

Southern Silver Exploration Corp. is an exploration and development

company with a focus on the discovery of world-class mineral

deposits either directly or through joint-venture relationships in

mineral properties in major jurisdictions. Our specific emphasis is

the 100% owned Cerro Las Minitas silver-lead-zinc project located

in the heart of Mexico's Faja de Plata, which hosts multiple

world-class mineral deposits such as Penasquito, Los Gatos, San

Martin, Naica and Pitarrilla. We have assembled a team of highly

experienced technical, operational and transactional professionals

to support our exploration efforts in developing the Cerro Las

Minitas project into a premier, high-grade, silver-lead-zinc mine.

Our property portfolio also includes the Oro porphyry copper-gold

project and the Hermanas gold-silver vein project where permitting

applications for the conduct of a drill program is underway, both

located in southern New Mexico, USA

On behalf of the Board of Directors

"Lawrence Page"

Lawrence Page, K.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver's website at

https://www.southernsilverexploration.com

or contact us 604.641.2759 by email at corpdev@mnxltd.com.

Qualified Person

The PEA for the Cerro Las Minitas project as summarized in this

release was completed by Kirkham Geosystems Ltd. ("KGL"), Ausenco

Engineering USA South Inc. and Ausenco Sustainability ULC.

("Ausenco"), Entech Mining Limited ("Entech"), and MPC

Metallurgical Process Consultants Limited ("MPC"). A full technical

report will be prepared in accordance with NI43-101 and will be

filed on SEDAR within 45 days of this press release.

The scientific and technical content of this news release was

reviewed and approved by Robert Macdonald, MSc. P.Geo, VP.

Exploration, who is a Qualified Person as defined by National

Instrument 43-101 – Standards of Disclosure for Mineral

Projects.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This news release contains forward-looking

statements. Forward-looking statements address future events and

conditions and therefore involve inherent risks and uncertainties.

Actual results may differ materially from those currently

anticipated in such statements. Factors that could cause actual

results to differ materially from those in forward looking

statements include the timing and receipt of government and

regulatory approvals, and continued availability of capital and

financing and general economic, market or business

conditions. Southern Silver

Exploration Corp. does not assume any obligation to update or

revise its forward-looking statements, whether as a result of new

information, future events or otherwise, except to the extent

required by applicable law.

Appendix A:

Sulphide Mineral Resource Estimate as of March 20, 2024

1)

The current Resource Estimate was prepared by Garth Kirkham,

P.Geo., of Kirkham Geosystems Ltd.

2)

All mineral resources have been estimated in

accordance with Canadian Institute of Mining and Metallurgy and

Petroleum ("CIM") definitions, as required under National

Instrument 43-101 ("NI43-101").

3)

Mineral resources were constrained using continuous mining units

demonstrating reasonable prospects of eventual economic

extraction.

4)

Silver Equivalents were calculated from the interpolated block

values using relative recoveries and prices between the component

metals and silver to determine a final AgEq value. Metal

recoveries: 95%. silver, 75% gold, 70% copper, 87% lead and 93.2%

zinc.

5)

Silver Equivalents and NSR$/t values were calculated using average

long-term prices of $22.5/oz. silver, $1,850/oz. gold, $3.78/lb.

copper, $0.94/lb. lead and $1.25/lb. zinc. All prices are stated in

US$.

6)

The formula used for NSR$/t calculations was as follows - $NSR =

(Ag g/t x 0.55) + (Au g/t x 34.45) + (Cu% x 48.68) + (Pb% x 13.41)

+ (Zn% x 15.59)

7)

Mineral resources are not mineral reserves

until they have demonstrated economic viability. Mineral resource

estimates do not account for a resource's mineability, selectivity,

mining loss, or dilution.

8)

An Inferred Mineral Resource has a lower level

of confidence than that applying to an Indicated Mineral Resource

and must not be converted to a Mineral Reserve. It is reasonably

expected that the majority of Inferred Mineral Resources could be

upgraded to Indicated Mineral Resources with continued

exploration.

9)

All figures are rounded to reflect the relative

accuracy of the estimate and therefore numbers may not appear to

add precisely.

Model

Parameters for the Blind, El Sol, Skarn, South Skarn, Bocona, and

North Felsite Zones

-

The mineralized zones were initially defined

by Southern personnel and subsequently adjusted and redefined,

validated and verified by KGL. The mineralized wire frames were

defined using a combination of geological constraints and grade

boundaries in addition to consideration of potential reasonable

mining thickness. Intervals that were not sampled were assigned a

zero grade.

-

The estimates were carried out using a

separate block models constrained by 3D wireframes of the

individual mineralized zones. The chosen block size was 10 m by 10

m by 2 m, roughly reflecting the drill hole spacing (i.e., 4–6

blocks between drill holes) which is spaced at approximately 50 m

centres. Note: MineSightTM uses the centroid of the blocks as the

origin. It should be noted that the South Skarn employs

sub-blocking as opposed to partial percentage for the coding of the

block models. In this case the parent block size is 10 m X 10 m X 3

m while the sub-block size is 0.5 m X 0.5 m X 0.3 m. Grades for Ag,

Au, Cu, Pb and Zn are interpolated using Ordinary Kriging within

the Bocona/North Felsite zone and Inverse Distance to the second

power (ID2) weighting for the South Skarn and North Felsite

Hangingwall zones. The Skarn zone is interpolated using inverse

distance to the third power (ID3) with a form of dynamic

anisotropy. NSR/t, silver equivalent and zinc equivalent values

were subsequently calculated from the interpolated block

grades.

-

The interpolation was carried out in two

passes using progressively larger search radii along strike and

down dip of 60m x 60m to a maximum of 100m x 100m. Composites were

restricted to a minimum of 3 and a maximum of 9 composites, with a

maximum of 3 composites from any one drill hole.

-

Bulk densities were based on a total of 3,146

individual measurements taken by Southern Silver field personnel

from key mineralized zones. Density values ranged from 1.04 t/m3 to

5.33 t/m3 and average to 2.89 t/m3. Specific gravities were

calculated on a block-by-block basis by interpolating the SG

measurements using inverse distance to the second power and limited

within the individual mineralized zone solids. A default density of

2.85 t/m3 was assigned to any blocks that were not assigned a

calculated value.

-

Silver composite values have been capped in

order to remove the effects of potential overestimation due to

statistical outliers. The threshold chosen was 700 g/t silver for

the Bocona/North Felsite and North Felsite HW zones. In addition,

outlier values for the co-product metals were capped at the

threshold levels of 1.5 g/t gold, 2% copper, 18% lead and 10% zinc

at Bocona/North Felsite and 2 g/t gold, 0.2% copper, 3% lead and 5%

zinc for the North Felsite HW zones, respectively.

-

The high-grade outlier thresholds were chosen

by domain and are based on an analysis of the breaks in the

cumulative probability plots for each of the mineralized domains

for each of the zones.

-

Mineral resources for the Cerro Las Minitas

deposit were classified according to the CIM Definition Standards

for Mineral Resources and Mineral Reserves (2014) by Garth Kirkham,

P.Geo., an "independent qualified person" as defined by National

Instrument 43-101. Drill hole spacing in the Cerro Las Minitas

deposit is sufficient for preliminary geostatistical analysis and

evaluating spatial grade variability. Kirkham Geosystems is,

therefore, of the opinion that the amount of sample data is

adequate to demonstrate very good confidence in the grade estimates

for the deposit. The estimated blocks were classified according to

the following:

confidence in interpretation of the mineralized zones;

number of data used to estimate a block;

number of composites allowed per drill hole; and

distance to nearest composite used to estimate a block.

-

Blocks were classified as indicated if they

were within approximately 50 m of a composite and were interpolated

with a minimum of two drill holes. Note: There were no blocks

classified as Measured resources. Blocks were classified as

Inferred if the nearest composite was less than 100 m from the

block being estimated. Furthermore, an interpreted boundary was

created for the indicated and inferred threshold in order to

exclude orphans and reduce "spotted dog" effect. The remaining

blocks were unclassified and may be considered as geologic

potential for further exploration. Furthermore, in consideration

for the requirement for resources to possess a "reasonable prospect

of eventual economic extraction" (RP3E), underground mineable

shapes were created that displayed continuity based on cut-off

grades and classification. Additionally, these RP3E shapes also

took into account must-take material that may fall below cut-off

grade but will be extracted by mining in the event that adjacent

economic material is extracted making below cut-off material by

virtue of the mining costs being paid for.

-

Appendix B:

Project Location and Site Infrastructure

Appendix C:

Simplified Process Flow Sheet

The process plant for the PEA study is a conventional sulphide

flotation system consisting of both Primary and secondary crushing,

a closed-circuit ball mill grinding and sequential Cu-Pb-Zn

flotation circuit producing three filtered concentrates for sale.

A fourth pyrite concentrate will be produced and leached.