Wescan Anounces 2012 Drilling Results on the Jojay Gold Property & Engagement of Aca Howe International Limited to Carry Out Pr

May 20 2012 - 5:34PM

PR Newswire (Canada)

Stock Symbol: WGF: TSX-V SASKATOON, May 22, 2012 /CNW/ - Wescan

Goldfield Inc. ("Wescan" or "the Company") is pleased to announce

the results from the 2012 winter drill program on its 100 percent

owned Jojay Gold Property, located 135 kilometers north of La Ronge

Saskatchewan. This program was carried out following

recommendations included in the Jojay Property Technical Report

completed by A.C.A. Howe International Limited dated February 4,

2010 (the "Howe Report"). The Howe Report included a NI

43-101 compliant Indicated Mineral Resource of 420,000 tonnes at a

grade of 3.7 g/tonne Au and an Inferred Mineral Resource of 630,000

tonnes grading 4.3 g/tonne Au. The 2012 winter drill program

included a total of 1,903 metres of diamond drilling over 8 holes

and was completed during the first quarter of 2012. The program was

designed to infill areas of the Mineral Resource base within the

known mineralized zones as well as to test for further

mineralization in areas of the Jojay Gold deposit considered

"highly prospective". Three (3) holes (JJ12-003, -004 and -005)

were drilled outside the current Mineral Resource shells with

JJ12-004 confirming significant mineralization of 11.92 g/t over

6.00m along strike to the North of the current Mineral Resource

shell. Drill holes JJ12-001, -002, -006, -007, and -008 were infill

holes drilled within the current Indicated and Inferred Mineral

Resource shells with all holes reporting significant gold

intersections, highlighted by an interval of 2.31 g/t Au over

36.19m and 63.12 g/t Au over 1.56m in hole JJ12-001. Gold

intersection highlights are summarized in the table below:

___________________________________________________ |Drill

Hole|From (m)|To (m)|Core Length (m)|Au (g/t)|

|__________|________|______|_______________|________| |JJ12-001 |

52.28 |53.84 | 1.56* | 63.12 |

|__________|________|______|_______________|________| | including|

52.28 |52.84 | 0.56 | 160.60 |

|__________|________|______|_______________|________| |JJ12-001 |

87.00 |123.19| 36.19* | 2.31 |

|__________|________|______|_______________|________| | including|

87.00 |89.00 | 2.00* | 3.71 |

|__________|________|______|_______________|________| | and| 107.81

|123.19| 15.38* | 3.99 |

|__________|________|______|_______________|________| | and| 107.81

|113.81| 6.00* | 5.65 |

|__________|________|______|_______________|________| |JJ12-002 |

135.41 |135.91| 0.50 | 33.10 |

|__________|________|______|_______________|________| |JJ12-002 |

150.50 |153.86| 3.36* | 3.78 |

|__________|________|______|_______________|________| |JJ12-004 |

150.80 |156.80| 6.00* | 11.92 |

|__________|________|______|_______________|________| | including|

152.80 |156.80| 4.00* | 16.91 |

|__________|________|______|_______________|________| |JJ12-006 |

224.00 |235.50| 11.50* | 1.58 |

|__________|________|______|_______________|________| | including|

224.00 |227.00| 3.00* | 3.80 |

|__________|________|______|_______________|________| |JJ12-007 |

281.50 |283.30| 1.80* | 2.12 |

|__________|________|______|_______________|________| |JJ12-008 |

277.00 |278.00| 1.00 | 13.60 |

|__________|________|______|_______________|________| |JJ12-008 |

333.00 |343.00| 10.00* | 2.34 |

|__________|________|______|_______________|________| | including|

333.00 |340.00| 7.00* | 3.03 |

|__________|________|______|_______________|________| *Indicates

composite interval Mr. Darren Anderson, President of Wescan stated,

"We are very excited with the results from the 2012 Jojay winter

drill program as the new drilling results have the potential of

expanding the existing Mineral Resource base". Wescan has engaged

A.C.A Howe International Limited to conduct a Preliminary Economic

Assessment (PEA), which will include an updated National Instrument

43-101 compliant Technical Report and Mineral Resource estimate.

The February 4, 2010 Mineral Resource estimate utilized a block

cut-off grade of 2 g/tonne. At that time the cut-off grade was

considered a reasonable, typical operating cut-off using a

gold price of $US 1,000 per ounce, an overall recovery factor of 90

%, an assay top cut of 41 g/tonne, an exchange rate of $0.94 and a

narrow, selective underground mining method. With the significant

escalation in the price of gold to over $US 1,600 per ounce, the

Company intends to continue exploration efforts on its properties

with known gold mineralization. The potential to identify

additional gold mineralization on the Jojay Project (which is open

along strike and at depth) occurs along the northern and southern

extensions of the Jojay Structural Zone for which the current

mineral resource deposit is associated with as well as a Parallel

Structural Zone (250m east). The structural zones extend at least 1

kilometer both north and south of the Jojay deposit. Both the

Jojay and Parallel Structural Zones are defined by historical

airborne and/or ground geophysics and surface geological mapping

and are coincidental to surface till gold anomalies throughout

the property. The northern and southern extensions of the Jojay

structural zone remains unexplored by drill testing and little

mineral exploration work has been done to explore the Parallel

Structural Zone. Drill core was halved and samples between

0.40 to 1.45 metres in length were submitted to SRC Laboratory in

Saskatoon, Saskatchewan. The remaining half core will be archived

at the property. Rigorous quality assurance and quality control

procedures have been implemented including the use of blanks,

standards and duplicates. Core samples were initially analyzed by

fire assay, and then all samples above 3000 ppb from fire assay

were analyzed by metallic assay. Where available; metallic assays

are reported instead of fire assay results. Composite grades are

calculated utilizing both fire assay and metallic assay results.

Holes were drilled with inclinations between -45(o) and -60(o),

approximately perpendicular to the steeply dipping known

mineralised areas. Mineralised intersections are reported as

drilled core lengths, future modeling is required to interpret true

widths of the mineralized intersections. This exploration program

was directed by Mark Shimell, Vice President Exploration of Wescan.

Daniel Leroux of A.C.A Howe International Limited, a Professional

Geoscientist in the Province of Saskatchewan is the Independent

Qualified Person, as defined by NI 43-101 standards, who reviewed

and approved the technical content of this news release. Wescan is

a Canadian-based company engaged in the acquisition, exploration

and development of mineral properties. Shares of the Company trade

on the TSX Venture Exchange under the trading symbol "WGF".

"Neither TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in the policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release." Caution Regarding Forward-Looking Statements This

news release contains forward-looking statements within the meaning

of certain securities laws, including the "safe harbour" provisions

of Canadian securities legislation and the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

information is often, but not always, identified by the use of

words such as "anticipate", "believe", "expect", "plan", "intend",

"forecast", "target", project", "guidance", "may", "will",

"should", "could", "estimate", "predict" or similar words

suggesting future outcomes or language suggesting an outlook. In

particular, statements regarding Wescan's future operations, future

exploration and development activities or other development plans

constitute forwardlooking statements. Forward-looking statements in

this press release include, but are not limited to, statements

related to anticipated exploration plans, statements related to the

Company's ability to expand and delineate mineralized zones,

identification of future drilling targets, and assumptions made

regarding the impacts of increases in the price of gold on the

Company's exploration programs. These forwardlooking statements are

based on Wescan's current beliefs as well as assumptions made by

and information currently available to Wescan. Although management

considers these assumptions to be reasonable based on information

currently available to it, they may prove to be incorrect. By their

very nature, forwardlooking statements involve inherent risks and

uncertainties, both general and specific, and risks exist that

predictions, forecasts, projections and other forward-looking

statements will not be achieved. We caution readers not to place

undue reliance on these statements as a number of important factors

could cause the actual results to differ materially from the

beliefs, plans, objectives, expectations, anticipations, estimates

and intentions expressed in such forward-looking statements. These

factors include, but are not limited to, developments in world gold

and coal markets, changes in exploration plans due to exploration

results and changing budget priorities of Wescan, the effects of

competition in the markets in which Wescan operates, the impact of

changes in the laws and regulations regulating mining exploration

and development, judicial or regulatory judgments and legal

proceedings, operational and the additional risks described in

Wescan's most recently filed Annual Information Form, annual and

interim MD&A, and Wescan's anticipation of and success in

managing the foregoing risks. Wescan cautions that the foregoing

list of factors that may affect future results is not exhaustive.

When relying on our forward-looking statements to make decisions

with respect to Wescan, investors and others should carefully

consider the foregoing factors and other uncertainties and

potential events. Unless required by applicable securities

legislation, Wescan does not undertake to update any

forward-looking statement that may be contained herein. Wescan

Goldfields Inc. CONTACT: Darren Anderson, President or Mark

Shimell, Vice President ofExploration at (306) 664-2422

Copyright

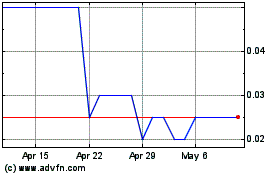

Wescan Goldfields (TSXV:WGF)

Historical Stock Chart

From Jan 2025 to Feb 2025

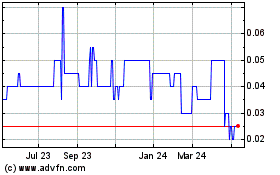

Wescan Goldfields (TSXV:WGF)

Historical Stock Chart

From Feb 2024 to Feb 2025