CHAR Technologies Closes Private Placement

November 01 2024 - 7:00AM

CHAR Technologies Ltd. (“CHAR Technologies” or the “Company”) (TSX

Venture Exchange: YES) is pleased to announce that it has completed

the non-brokered private placement (the “Offering”) described in

its news releases of October 21, 2024 and October 25, 2024. In

connection with the closing of the Offering, the Company issued an

aggregate of 16,359,451 units (the “Units”) at a price of CDN$0.20

per Unit for gross proceeds of CDN$3,271,890. Each Unit consists of

one common share in the capital of the Company (a “Share”) and

one-half of one non-transferable common share purchase warrant

(each whole common share purchase warrant, a “Warrant”). Each whole

Warrant is exercisable to acquire one Share at an exercise price of

CDN$0.30 per Share until October 31, 2026 which is 24 months from

the date of issuance.

Insiders of the Company acquired an aggregate of

729,410 Units in the Offering, which participation constituted a

“related party transaction” as defined under Multilateral

Instrument 61-101 Protection of Minority Security Holders in

Special Transactions (“MI 61-101”). Such participation is exempt

from the formal valuation and minority shareholder approval

requirements of MI 61-101 as neither the fair market value of the

Units acquired by the insiders, nor the consideration for the Units

paid by such insiders, exceed 25% of the Company's market

capitalization. As required by MI 61-101, the Company advises that

it expects to file a material change report relating to the

Offering less than 21 days before completion of the Offering, which

is necessary to complete the Offering in an expeditious manner and

is reasonable in the circumstances.

CHAR Technologies intends to use the net proceeds

of the Offering for general working capital and supporting the

progression of the Thorold Project to biocarbon production

The Company will pay aggregate finder’s fees of

CDN$155,100.00 and 775,500 Share purchase warrants (the “Finder’s

Warrants”) in connection with subscriptions from subscribers

introduced to the Offering by Leede Financial Inc. Each Finder’s

Warrant is exercisable to acquire one Share in the capital of the

Company at an exercise price of CDN$0.30 per Share until October

30, 2026, which is 24 months from the date of issuance.

The Offering remains subject to final approval of

the TSX Venture Exchange.

The securities issued under the Offering, and any

Shares that may be issuable on exercise of any such securities,

will be subject to a statutory hold period expiring four months and

one day from the date of issuance of such securities.

About CHAR TechCHAR Tech

(TSXV:YES) first-in-kind high temperature pyrolysis (HTP)

technology processes unmerchantable wood and organic wastes to

simultaneously generate two renewable energy revenue streams,

renewable natural gas (RNG) or green hydrogen and a solid biocarbon

that is a carbon neutral drop-in replacement for metallurgical

steel making coal.

CHAR’s HTP is an ideal waste to energy solution

that aligns with the global green energy transition by diverting

waste from landfills and generating sustainable clean energy to

decarbonize heavy industry.

Raquel InsaChief Financial OfficerCHAR Technologies

Ltd.rinsa@chartechnologies.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as the term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy of this news release.

This news release does not constitute an offer to sell or a

solicitation of an offer to buy any of the securities in the United

States. The securities have not been and will not be registered

under the United States Securities Act of 1933, as amended (the

“U.S. Securities Act”), or any state securities laws and may not be

offered or sold within the United States or to U.S. Persons unless

registered under the U.S. Securities Act and applicable state

securities laws or an exemption from such registration is

available.

Forward-Looking

StatementsStatements contained in this press release

contain “forward-looking information” within the meaning of

Canadian securities laws (“forward-looking statements”) about CHAR

and its business and operations. The words “may”, “would”, "will”,

“intend”, “anticipate”, “expect” and similar expressions as they

relate to CHAR, are intended to identify forward-looking

information. Forward-looking statements include, but are not

limited to, statements relating to the Offering, the anticipated

benefits of, and rationale for, the Offering, statements regarding

the intended use of proceeds of the Offering, expectations

regarding the offtake agreement, future plans, operations and

activities, expectations regarding the scale up of production, the

anticipated development of additional project sites on an expedited

basis, and other statements that are not historical facts. Such

statements reflect CHAR’s current views and intentions with

respect to future events, and current information available to

CHAR, and are subject to certain risks, uncertainties and

assumptions, including, among others, the timing and ability of

CHAR to obtain final approval of the Offering from the TSX Venture

Exchange and those risk factors discussed or referred to in CHAR’s

disclosure documents filed with the securities regulatory

authorities in certain provinces of Canada, including the

Management Discussion & Analysis dated August 28th, 2024 for

the quarter ended June 30th, 2024, and available under CHAR’s

profile on www.sedar.com. Any such forward-looking information

is expressly qualified in its entirety by this cautionary

statement. Moreover, CHAR does not assume responsibility for the

accuracy or completeness of such forward-looking information. The

forward-looking information included in this press release is made

as of the date of this press release and CHAR undertakes no

obligation to publicly update or revise any forward-looking

information, other than as required by applicable law.

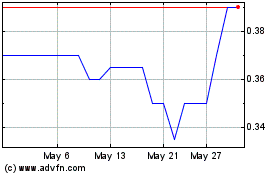

Char Technologies (TSXV:YES)

Historical Stock Chart

From Dec 2024 to Jan 2025

Char Technologies (TSXV:YES)

Historical Stock Chart

From Jan 2024 to Jan 2025