UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16

OR 15d-16 UNDER

THE SECURITIES EXCHANGE

ACT OF 1934

For the month of January, 2025.

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its

charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

Banco Santander, S.A.

TABLE OF CONTENTS

|

Item |

|

| |

|

| 1 |

Press Release dated January 15, 2025 |

| |

|

| 2 |

Report of Other Relevant Information dated January 15, 2025 |

Item 1

Santander Announces

Results of Offers to Purchase Certain of its Outstanding Debt Securities and Waiver of Maximum Purchase Consideration Condition

Madrid,

January 15, 2025 – Banco Santander, S.A. (“Santander”) announced today the results, as of 5:00 p.m. (New York

City time) on January 14, 2025 (the “Expiration Time”), of its previously announced offers to purchase for cash (the “Offers”)

its outstanding 3.496% Senior Preferred Fixed Rate Notes due 2025, 2.746% Senior Non Preferred Fixed Rate Notes due 2025, 5.147% Senior

Non Preferred Fixed Rate Notes due 2025 and 1.849% Senior Non Preferred Fixed Rate Notes due 2026 (collectively, the “Notes”)

and that it has waived the maximum purchase consideration condition of $2,000,000,000. The Offers were made upon the terms and subject

to the conditions set forth in the offer to purchase dated January 7, 2025 (the “Offer to Purchase”) and the related notice

of guaranteed delivery (the “Notice of Guaranteed Delivery” and, together with the Offer to Purchase, the “Offer Documents”).

The following table sets forth the aggregate

principal amount of Notes validly tendered and not withdrawn in the Offers at or prior to the Expiration Time:

| Acceptance

Priority Level |

Description

of the Notes |

CUSIP/ISIN |

Principal

Amount Outstanding |

Aggregate

Principal Amount Tendered(1) |

Aggregate

Principal Amount Accepted(1) |

Principal

Amount Reflected in Notices of Guaranteed Delivery |

| 1 |

3.496%

Senior Preferred Fixed Rate Notes due 2025 |

05964HAP0/

US05964HAP01 |

$1,250,000,000 |

$585,400,000 |

$585,400,000 |

$1,000,000 |

| 2 |

2.746%

Senior Non Preferred Fixed Rate Notes due 2025 |

05971KAE9/

US05971KAE91 |

$1,500,000,000 |

$916,400,000 |

$916,400,000 |

$1,200,000 |

| 3 |

5.147%

Senior Non Preferred Fixed Rate Notes due 2025 |

05964HAR6/

US05964HAR66 |

$1,750,000,000 |

$972,000,000 |

$972,000,000 |

— |

| 4 |

1.849%

Senior Non Preferred Fixed Rate Notes due 2026 |

05964HAL9/

US05964HAL96 |

$1,500,000,000 |

$976,800,000 |

$976,800,000 |

$200,000 |

| (1) | Excluding principal amounts of Notes

tendered using guaranteed delivery procedures. |

In addition to the previously announced consideration

(the “Consideration”), the Notes validly tendered and accepted for purchase and payment pursuant to the Offers will be entitled

to accrued and unpaid interest up to, but not including, the settlement date (the “Accrued Interest”).

In total, $3,450,600,000 aggregate principal amount

of Notes have been accepted for purchase (excluding Notes delivered using the guaranteed delivery procedures). Santander expects to pay

the Consideration plus Accrued Interest for all Notes validly tendered prior to the Expiration Time and accepted for purchase, including

any Notes validly tendered at or prior to 5:00 p.m. (New York City time) on January 16, 2025 using the guaranteed delivery procedures

and accepted for purchase, on the settlement date, which is expected to be on or around January 17, 2025.

Any requests for information in relation to the

Offers should be directed to Santander US Capital Markets LLC, the Dealer Manager, or D.F. King & Co., Inc., the Information and Tender

Agent, whose contact details are listed below:

| Santander US Capital Markets LLC |

D.F. King & Co., Inc. |

| 437 Madison Avenue, 10th Floor |

48 Wall Street, 22nd Floor |

| New York, NY 10022 |

New York, New York 10005 |

| United States |

Toll-Free: +1 (877) 783-5524 |

| Tel (U.S. Toll Free): +1 (855) 404-3636 |

Banks and Brokers Only: +1 (212) 269-5550 |

| Tel (U.S. collect): +1 (212) 350-0660 |

Attention: Michael Horthman |

| Attn: Liability Management Team |

Email: SAN@dfking.com |

| Email: AmericasLM@santander.us |

Website: https://clients.dfkingltd.com/santander |

About Santander

Banco Santander (SAN SM) is a leading commercial

bank, founded in 1857 and headquartered in Spain and one of the largest banks in the world by market capitalization. The group’s

activities are consolidated into five global businesses: Retail & Commercial Banking, Digital Consumer Bank, Corporate & Investment

Banking (CIB), Wealth Management & Insurance and Payments (PagoNxt and Cards). This operating model allows the bank to better leverage

its unique combination of global scale and local leadership. Santander aims to be the best open financial services platform providing

services to individuals, SMEs, corporates, financial institutions and governments. The bank’s purpose is to help people and businesses

prosper in a simple, personal and fair way. Santander is building a more responsible bank and has made a number of commitments to support

this objective, including raising €220 billion in green financing between 2019 and 2030. At the end of the third quarter of 2024,

Banco Santander had €1.3 trillion in total funds, 171 million customers, 8,100 branches and 208,000 employees.

Cautionary Statement Regarding Forward-Looking Statements

This press release includes statements that constitute

forward-looking statements. Such statements can be understood through words and expressions like “will,” “expect,”

“project,” “anticipate,” “should,” “intend,” “probability,” “risk,”

“target,” “goal,” “objective,” “estimate,” “future,” “commitment,”

“commit,” “focus,” “pledge” and similar expressions. They include, but are not limited to, statements

regarding the timing and settlement of the Offers. However, risks, uncertainties and other important factors may lead to developments

and results that differ materially from those anticipated, expected, projected or assumed in forward-looking statements, including those

discussed in the Offer to Purchase under the heading “Risk Factors” and under similar headings in other documents that are

incorporated by reference into the Offer to Purchase. Readers are cautioned not to place undue reliance on forward-looking statements,

which speak only as of the date of this press release, and Santander undertakes no obligation to update or revise any forward-looking

statements, regardless of new information, future events or otherwise, except as required by applicable law.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION

IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN ANY JURISDICTION WHERE OR TO WHOM IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE

THIS ANNOUNCEMENT.

Disclaimer

This press release is neither an offer to purchase

nor a solicitation of an offer to sell any securities. The Offers were made only by, and pursuant to the terms of, the Offer Documents.

The Offers were not made in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities,

blue sky or other laws of such jurisdiction. In any jurisdiction where the laws require the Offers to be made by a licensed broker or

dealer, the Offers were made by the Dealer Manager on behalf of Santander. None of Santander, the Dealer Manager or the Information and

Tender Agent or any of their respective directors, employees, officers, agents or affiliates has expressed any opinion about the merits

of the Offers or has made any recommendation as to whether or not any qualifying holder should offer to sell its Notes, and no one has

been authorized by Santander, the Dealer Manager or the Information and Tender Agent to make any such recommendation.

Investor Contact

Gema Navamuel

Director, Investor Relations

investor@gruposantander.com

Corporate Communications

Ciudad Grupo Santander,

edificio Arrecife, planta 2

28660 Boadilla del

Monte (Madrid)

comunicacion@gruposantander.com

www.santander.com

– X: @bancosantander

Item 2

Banco Santander, S.A., (“Santander”

or the “Offeror”) in accordance with the provisions of the securities market legislation, communicates the following:

OTHER RELEVANT INFORMATION

Further to the other relevant information

communication made on 7 January 2025 (registered under number 32007) regarding the launch by Santander of four concurrent and separate

offers to purchase for cash (the “Offers”) its outstanding 3.496% Senior Preferred Fixed Rate Notes due 2025 (ISIN:

US05964HAP01), 2.746% Senior Non Preferred Fixed Rate Notes due 2025 (ISIN: US05971KAE91), 5.147% Senior Non Preferred Fixed Rate Notes

due 2025 (ISIN: US05964HAR66) and 1.849% Senior Non Preferred Fixed Rate Notes due 2026 (ISIN: US05964HAL96) (collectively, the “Notes”),

the Offeror now announces the results of the Offers and that it has waived the Maximum Purchase Consideration Condition of USD 2,000,000,000.

Capitalised terms used but not otherwise

defined in this announcement shall have the meaning given to them in the offer to purchase dated 7 January 2025 (the “Offer to

Purchase”) and the related notice of guaranteed delivery (the “Notice of Guaranteed Delivery” and, together

with the Offer to Purchase, the “Offer Documents”).

The Expiration Time for the Offers was

5.00 p.m. (New York city time) on 14 January 2025.

According to information provided by

the Information and Tender Agent for the Offers, (i) USD 586,400,000 aggregate principal amount of the 3.496% Senior Preferred Fixed Rate

Notes due 2025, (ii) USD 917,600,000 aggregate principal amount of the 2.746% Senior Non Preferred Fixed Rate Notes due 2025, (iii)

USD 972,000,000 aggregate principal amount of the 5.147% Senior Non Preferred Fixed Rate Notes due 2025 and (iv) USD 977,000,000 aggregate

principal amount of the 1.849% Senior Non Preferred Fixed Rate Notes due 2026 were validly tendered at or prior to the Expiration Time

and not validly withdrawn, which amounts include (i) USD 1,000,000 aggregate principal amount of the 3.496% Senior Preferred Fixed Rate

Notes due 2025, (ii) USD 1,200,000 aggregate principal amount of the 2.746% Senior Non Preferred Fixed Rate Notes due 2025 and (iii)

USD 200,000 in aggregate principal amount of the 1.849% Senior Non Preferred Fixed Rate Notes due 2026, that remain subject to the Guaranteed

Delivery Procedures described in the Offer Documents. The following table sets forth the aggregate principal amount of Notes validly tendered

and not withdrawn in the Offers at or prior to the Expiration Time:

| Acceptance

Priority Level |

Description

of the Notes |

CUSIP/ISIN |

Principal

Amount Outstanding |

Consideration

for $1,000 Principal Amount |

Aggregate

Principal Amount Tendered(1) |

Aggregate

Principal Amount Accepted(1) |

Principal

Amount Reflected in Notices of Guaranteed Delivery |

| 1 |

3.496%

Senior Preferred Fixed Rate Notes due 2025 |

05964HAP0/

US05964HAP01 |

USD

1,250,000,000 |

USD

998.20 |

USD

585,400,000 |

USD

585,400,000 |

USD

1,000,000 |

| 2 |

2.746%

Senior Non Preferred Fixed Rate Notes due 2025 |

05971KAE9/

US05971KAE91 |

USD

1,500,000,000 |

USD

993.61 |

USD

916,400,000 |

USD

916,400,000 |

USD

1,200,000 |

| 3 |

5.147%

Senior Non Preferred Fixed Rate Notes due 2025 |

05964HAR6/

US05964HAR66 |

USD

1,750,000,000 |

USD

1,003.44 |

USD

972,000,000 |

USD

972,000,000 |

— |

| 4 |

1.849%

Senior Non Preferred Fixed Rate Notes due 2026 |

05964HAL9/

US05964HAL96 |

USD

1,500,000,000 |

USD

967.86 |

USD

976,800,000 |

USD

976,800,000 |

USD

200,000 |

| (1) | Excluding principal amounts of Notes tendered

using Guaranteed Delivery Procedures. |

In addition to the Consideration, the Notes validly

tendered and accepted for purchase and payment pursuant to the Offers will be entitled to accrued and unpaid interest up to, but not including,

the Settlement Date (the “Accrued Interest”).

In total, USD 3,450,600,000 aggregate principal

amount of Notes have been accepted for purchase (excluding Notes delivered using the Guaranteed Delivery Procedures).

Notes purchased by the Offeror pursuant to the

Offers are expected to be cancelled and will no longer remain outstanding. Notes which have not been validly tendered and accepted for

purchase pursuant to the Offers will remain outstanding. Following the Settlement Date, there will be an outstanding nominal amount of:

(i) USD 663,600,000 of the 3.496% Senior Preferred Fixed Rate Notes due 2025, (ii) USD 582,400,000 of the 2.746% Senior Non

Preferred Fixed Rate Notes due 2025, (iii) USD 778,000,000 of the 5.147% Senior Non Preferred Fixed Rate Notes due 2025, and (iv)

USD 523,000,000 of the 1.849% Senior Non Preferred Fixed Rate Notes due 2026 (assuming that the Notes described in the notices of guaranteed

delivery are duly delivered at or prior to the Guaranteed Delivery Date and accepted for purchase).

The Offeror expects to pay the Consideration plus

Accrued Interest for all Notes validly tendered prior to the Expiration Time and accepted for purchase, including any Notes validly tendered

at or prior to the Guaranteed Delivery Date using the Guaranteed Delivery Procedures and accepted for purchase, on the Settlement Date,

which is expected to be on or around 17 January 2025.

Any requests for information in relation to the

Offers should be directed to the Dealer Manager or the Information and Tender Agent, whose contact details are listed below.

DEALER MANAGER

|

|

Santander US Capital Markets LLC

437 Madison Avenue, 10th Floor

New York, NY 10022

United States

Tel (U.S. Toll Free): +1 (855) 404-3636

Tel (U.S. collect): +1 (212) 350-0660

Attn: Liability Management Team

Email: AmericasLM@santander.us

|

|

INFORMATION AND TENDER AGENT

D.F. King & Co., Inc.

In New York:

48 Wall Street, 22nd Floor

New York, New York 10005

Toll-Free: +1 (877) 783-5524

Banks and Brokers Only: +1 (212) 269-5550

Attention: Michael Horthman

In London:

51 Lime Street

London, EC3M 7DQ

United Kingdom

Email: SAN@dfking.com

Website: https://clients.dfkingltd.com/santander

|

Boadilla del Monte (Madrid), 15 January 2025

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION

IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN ANY JURISDICTION WHERE OR TO WHOM IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE

THIS ANNOUNCEMENT.

DISCLAIMER

This announcement must be read in conjunction with

the Offer to Purchase. This announcement and the Offer to Purchase contain important information which should be read carefully before

any decision is made with respect to the Offers. If any holder of the Notes is in any doubt as to the contents of this announcement, the

Offer to Purchase or the action it should take, it is recommended to seek its own financial, legal, regulatory and tax advice, including

in respect of any tax consequences, immediately from its broker, bank manager, solicitor, accountant or other independent financial, tax

or legal adviser.

The distribution of this announcement and the Offer

to Purchase in certain jurisdictions may be restricted by law. Persons into whose possession this announcement and/or the Offer to Purchase

comes are required by each of the Offeror, the Dealer Manager and the Information and Tender Agent to inform themselves about, and to

observe, any such restrictions.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Banco Santander, S.A. |

| |

|

| |

|

| |

By: |

/s/ José Antonio Soler |

| |

|

Name: |

José Antonio Soler |

| |

|

Title: |

Authorized Representative |

Date: January 15, 2025

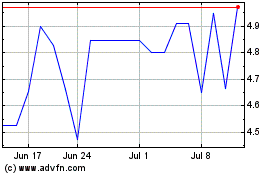

Banco Santander (PK) (USOTC:BCDRF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Banco Santander (PK) (USOTC:BCDRF)

Historical Stock Chart

From Jan 2024 to Jan 2025