Current Report Filing (8-k)

March 18 2022 - 3:31PM

Edgar (US Regulatory)

0001421636

false

NONE

0001421636

2022-03-14

2022-03-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 14, 2022

C-Bond Systems, Inc.

(Exact name of registrant as specified in its charter)

| Colorado |

|

0-53029 |

|

26-1315585 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification Number) |

6035 South Loop East, Houston, TX 77033

(Address of principal executive offices) (zip code)

(832) 649-5658

(Registrant’s telephone number, including

area code)

(Former Name or Former Address if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Not applicable |

|

Not applicable |

|

Not applicable |

Explanatory Note

As previously disclosed in

the Current Report on Form 8-K filed on October 19, 2021 with the Securities and Exchange Commission (the “SEC”) by C-Bond

Systems, Inc. (the “Company”), on October 15, 2021, the Company entered into a Securities Purchase Agreement (the “SPA”)

with Mercer Street Global Opportunity Fund, LLC (the “Investor” and together with the Company, the “Parties”),

pursuant to which the Company received $750,000 (less $10,000 of Investor’s fees) in exchange for the issuance of a 10% Original

Issue Discount Senior Convertible Promissory Note (the “Initial Note”) in the principal amount of $825,000, and a five-year

warrant (the “Initial Warrant”) to purchase, in the aggregate, shares of the Company’s common stock at an exercise price

of $0.05 per share in an amount equal to 50% of the conversion shares to be issued. The transactions contemplated under the SPA closed

on October 18, 2021. In connection with the SPA, the Company entered into a Registration Rights Agreement dated October 15, 2021 (the

“Registration Rights Agreement”), with the Investor pursuant to which it was obligated to file a registration statement with

the SEC within 45 days after the date of the SPA to register the resale by the Investor of the conversion shares and warrant shares. Pursuant

to the SPA and related documents, including but not limited to the Registration Rights Agreement, the Company filed a Registration Statement

on Form S-1 (File No. 333-261472) (“S-1”) with the SEC on December 3, 2021. Upon effectiveness of the S-1, and pursuant to

the SPA, Investor is obligated to fund an additional $825,000 10% Original Issue Discount Senior Convertible Promissory Note (the “Second

Note,” and together with the Initial Note, the “Notes”), and a five-year warrant (the “Second Warrant,”

and together with the Initial Warrant, the “Warrants”) to purchase, in the aggregate, shares of the Company’s common

stock at an exercise price of $0.05 per share from the Company in an amount equal to 50% of the conversion shares to be issued upon the

same terms as the Initial Note and Initial Warrant (subject to there being no event of default under the Initial Note or other customary

closing conditions), within three trading days of a registration statement registering the shares of the Company’s common stock

issuable under the Notes (the “Conversion Shares”) and upon exercise of the Warrants (the “Warrant Shares”) being

declared effective by the SEC (collectively, the “Second Tranche”). As the S-1 has not been declared effective as previously

disclosed on the Current Report on Form 8-K filed with the SEC on March 11, 2022, the Second Tranche has not closed. However, the Investor

agreed to enter into a promissory note in the principal amount of $197,500 with the Company as further described below.

Item 1.01. Entry into Material Definitive Agreement

On March 14, 2022, the Parties

agreed to enter into an Original Issue Discount Promissory Note and Security Agreement (the “March 2022 Note”) in the principal

amount of $197,500. The March 2022 Note was funded on March 14, 2022. The March 2022 Note includes an Original Issue Discount of $22,500,

which includes $5,000 of the Investor’s legal fees.

The March 2022 Note matures

12 months after issuance and bears interest at a rate of 3% per annum. At any time, the Company may prepay all or any portion of the principal

amount of the March 2022 Note and any accrued and unpaid interest without penalty.

The March 2022 Note also creates

a lien on and grants a priority security interest in all of the Company’s Accounts, Goods, Inventory, Equipment, Investment Property,

General Intangibles, Instruments, Documents, and all other assets and personal property of the Company, wherever located, together with

all the proceeds now or hereafter arising in connection therewith.

The foregoing description

does not purport to be complete and is qualified in its entirety by reference to (i) the full text of the Initial Note, Initial Warrant,

SPA, and Registration Rights Agreement, filed previously as Exhibits 4.1, 4.2, 10.1, and 10.2, respectively, to the Current Report on

Form 8-K filed on October 19, 2021, and (ii) the full text of the March 2022 Note, filed as Exhibit 4.1 to this Current Report on Form

8-K.

Item 2.03. Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information regarding the March 2022 Note set forth in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference

into this Item 2.03 in its entirety.

Item 9.01. Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

C-Bond Systems, Inc. |

| |

|

|

| Date: March 18, 2022 |

By: |

/s/ Scott R. Silverman |

| |

Name: |

Scott R. Silverman |

| |

Title: |

Chief Executive Officer |

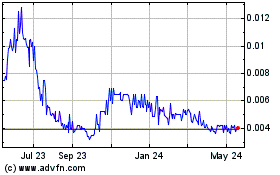

C Bond Systems (PK) (USOTC:CBNT)

Historical Stock Chart

From Feb 2025 to Mar 2025

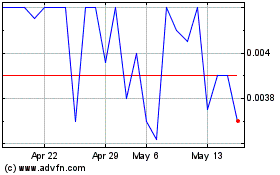

C Bond Systems (PK) (USOTC:CBNT)

Historical Stock Chart

From Mar 2024 to Mar 2025