Dutton Associates Announces Investment Opinion: China Solar & Clean Energy Solutions Strong Speculative Buy Rating In Update Cov

January 11 2008 - 8:38AM

Business Wire

Dutton Associates updates its coverage of China Solar & Clean

Energy Solutions (OTCBB:CSOL) with a Strong Speculative Buy rating

and a $5.46 price target. The 11-page report by Dutton senior

analyst Paul J. Resnik, CFA is available at www.jmdutton.com as

well as from First Call, Bloomberg, Zacks, Reuters, Knobias, and

other leading financial portals. China Solar & Clean Energy

Solutions is the new name of Deli Solar USA, an established and

significant seller of solar water heaters and space-heating devices

in the People�s Republic of China (�PRC�). The name change reflects

the Company�s decision to expand into other areas of energy

conservation. The well-documented need for China to turn to

environmentally friendly energy sources to support its dramatic

economic growth forms the basis for substantial opportunities in

the alternative energy sector. China Solar�s solar water heating

business is achieving solid gains as it expands its geographic

footprint and market share in China. That market is benefiting not

only from the need for alternative energy sources but also from the

rapid growth of the middle class and a strong housing market in

China. We project 44% earnings-per-share growth in 2007, and a gain

of 53% in 2008, aided by internal growth and a recently completed

major acquisition; yet the shares trade at less than 8x estimated

2008 EPS. Longer term, we believe that the Company�s interest in

other alternative energy sectors further enhances China Solar�s

growth potential. Based on �street� estimates for S&P�s 500

earnings in 2008, the S&P 500 P/E is currently about 14.

Assigning this multiple to China Solar�s estimated 2008 EPS,

despite the Company�s prospects for above-average growth, generates

a 12-month price target of $5.46, over 55% above the current share

price. About Dutton Associates Dutton Associates is one of the

largest independent investment research firms in the U.S. Its 30

senior analysts are primarily CFAs and have expertise in many

industries. Dutton & Associates provides continuing analyst

coverage of over 140 enrolled companies, and its research,

estimates, and ratings are carried in all the major databases

serving institutions and online investors. The cost of enrollment

in our one-year continuing research program is US $35,000 prepaid

for 4 Research Reports, typically published quarterly, and

requisite Research Notes. Dutton Associates received $33,000 from

the Company for 4 Research Reports with coverage commencing on

8/29/2005. We do not accept payment of our fees in company stock.

Our principals and analysts are prohibited from owning or trading

in securities of covered companies. The views expressed in this

research report accurately reflect the analyst's personal views

about the subject securities or issuer. Neither the analyst's

compensation nor the compensation received by us is in any way

related to the specific ratings or views contained in this research

report or note. Please read full disclosures and analyst background

at www.jmdutton.com before investing.

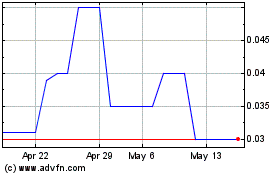

China Solar and Clean En... (PK) (USOTC:CSOL)

Historical Stock Chart

From Oct 2024 to Nov 2024

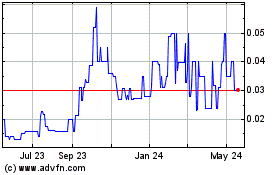

China Solar and Clean En... (PK) (USOTC:CSOL)

Historical Stock Chart

From Nov 2023 to Nov 2024