true

0001064722

POS AM

http://fasb.org/us-gaap/2023#LeaseholdImprovementsMember

http://fasb.org/us-gaap/2023#LeaseholdImprovementsMember

0001064722

2023-01-01

2023-09-30

0001064722

dei:BusinessContactMember

2023-01-01

2023-09-30

0001064722

2023-09-30

0001064722

2022-12-31

0001064722

us-gaap:RelatedPartyMember

2023-09-30

0001064722

us-gaap:RelatedPartyMember

2022-12-31

0001064722

2021-12-31

0001064722

us-gaap:RelatedPartyMember

2021-12-31

0001064722

2023-07-01

2023-09-30

0001064722

2022-07-01

2022-09-30

0001064722

2022-01-01

2022-09-30

0001064722

2022-01-01

2022-12-31

0001064722

2021-01-01

2021-12-31

0001064722

us-gaap:PreferredStockMember

2019-06-30

0001064722

us-gaap:CommonStockMember

2019-06-30

0001064722

us-gaap:AdditionalPaidInCapitalMember

2019-06-30

0001064722

us-gaap:RetainedEarningsMember

2019-06-30

0001064722

us-gaap:NoncontrollingInterestMember

2019-06-30

0001064722

2019-06-30

0001064722

us-gaap:PreferredStockMember

2019-12-31

0001064722

us-gaap:CommonStockMember

2019-12-31

0001064722

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001064722

us-gaap:RetainedEarningsMember

2019-12-31

0001064722

us-gaap:NoncontrollingInterestMember

2019-12-31

0001064722

2019-12-31

0001064722

us-gaap:PreferredStockMember

2020-12-31

0001064722

us-gaap:CommonStockMember

2020-12-31

0001064722

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001064722

us-gaap:RetainedEarningsMember

2020-12-31

0001064722

us-gaap:NoncontrollingInterestMember

2020-12-31

0001064722

2020-12-31

0001064722

us-gaap:PreferredStockMember

2021-12-31

0001064722

us-gaap:CommonStockMember

2021-12-31

0001064722

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001064722

us-gaap:RetainedEarningsMember

2021-12-31

0001064722

us-gaap:NoncontrollingInterestMember

2021-12-31

0001064722

us-gaap:PreferredStockMember

2022-12-31

0001064722

us-gaap:CommonStockMember

2022-12-31

0001064722

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001064722

us-gaap:RetainedEarningsMember

2022-12-31

0001064722

us-gaap:NoncontrollingInterestMember

2022-12-31

0001064722

us-gaap:PreferredStockMember

2018-12-31

0001064722

us-gaap:CommonStockMember

2018-12-31

0001064722

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0001064722

us-gaap:RetainedEarningsMember

2018-12-31

0001064722

us-gaap:NoncontrollingInterestMember

2018-12-31

0001064722

2018-12-31

0001064722

us-gaap:PreferredStockMember

2019-07-01

2019-12-31

0001064722

us-gaap:CommonStockMember

2019-07-01

2019-12-31

0001064722

us-gaap:AdditionalPaidInCapitalMember

2019-07-01

2019-12-31

0001064722

us-gaap:RetainedEarningsMember

2019-07-01

2019-12-31

0001064722

us-gaap:NoncontrollingInterestMember

2019-07-01

2019-12-31

0001064722

2019-07-01

2019-12-31

0001064722

us-gaap:PreferredStockMember

2020-01-01

2020-12-31

0001064722

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001064722

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001064722

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001064722

us-gaap:NoncontrollingInterestMember

2020-01-01

2020-12-31

0001064722

2020-01-01

2020-12-31

0001064722

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001064722

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001064722

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001064722

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001064722

us-gaap:NoncontrollingInterestMember

2021-01-01

2021-12-31

0001064722

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001064722

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001064722

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001064722

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001064722

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-12-31

0001064722

us-gaap:PreferredStockMember

2023-01-01

2023-09-30

0001064722

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001064722

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-09-30

0001064722

us-gaap:RetainedEarningsMember

2023-01-01

2023-09-30

0001064722

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-09-30

0001064722

us-gaap:PreferredStockMember

2019-01-01

2019-12-31

0001064722

us-gaap:CommonStockMember

2019-01-01

2019-12-31

0001064722

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-12-31

0001064722

us-gaap:RetainedEarningsMember

2019-01-01

2019-12-31

0001064722

us-gaap:NoncontrollingInterestMember

2019-01-01

2019-12-31

0001064722

2019-01-01

2019-12-31

0001064722

us-gaap:PreferredStockMember

2023-09-30

0001064722

us-gaap:CommonStockMember

2023-09-30

0001064722

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001064722

us-gaap:RetainedEarningsMember

2023-09-30

0001064722

us-gaap:NoncontrollingInterestMember

2023-09-30

0001064722

2022-09-30

0001064722

us-gaap:SeriesAPreferredStockMember

GMPW:GoldsteinFranklinIncMember

2019-12-29

2019-12-31

0001064722

us-gaap:SeriesAPreferredStockMember

GMPW:GoldsteinFranklinIncMember

2019-12-31

0001064722

GMPW:KidCastleEducationalCorporationMember

2020-09-15

2020-09-16

0001064722

GMPW:CannabinoidBiosciencesIncMember

2020-09-15

2020-09-16

0001064722

2020-09-15

2020-09-16

0001064722

GMPW:PremierInformationManagementIncMember

2021-04-20

2021-04-21

0001064722

GMPW:KidCastleEducationalCorporationMember

us-gaap:PreferredStockMember

2021-04-20

2021-04-21

0001064722

GMPW:KidCastleEducationalCorporationMember

us-gaap:CommonStockMember

2021-04-20

2021-04-21

0001064722

GMPW:KidCastleEducationalCorporationMember

2021-04-20

2021-04-21

0001064722

GMPW:KidCastleEducationalCorporationMember

2021-12-29

2021-12-30

0001064722

us-gaap:SeriesAPreferredStockMember

GMPW:GoldsteinFranklinIncMember

2019-12-28

2019-12-31

0001064722

us-gaap:SeriesAPreferredStockMember

GMPW:GoldsteinFranklinIncMember

2019-12-31

0001064722

srt:MinimumMember

GMPW:OwnershipMember

2023-09-30

0001064722

srt:MaximumMember

GMPW:OwnershipMember

2023-09-30

0001064722

us-gaap:RealEstateMember

2023-01-01

2023-09-30

0001064722

us-gaap:RealEstateMember

2022-01-01

2022-09-30

0001064722

2019-12-31

2019-12-31

0001064722

GMPW:MarginalLoanPayableMember

2023-09-30

0001064722

us-gaap:RealEstateMember

srt:MinimumMember

2023-09-30

0001064722

us-gaap:RealEstateMember

srt:MaximumMember

2023-09-30

0001064722

srt:MinimumMember

GMPW:OwnershipMember

2022-12-31

0001064722

srt:MaximumMember

GMPW:OwnershipMember

2022-12-31

0001064722

GMPW:SalesOfInvestmentUnderPropertyMember

2022-01-01

2022-12-31

0001064722

GMPW:SalesOfInvestmentUnderPropertyMember

2021-01-01

2021-12-31

0001064722

GMPW:GoldsteinFranklinIncMember

2019-12-29

2019-12-31

0001064722

GMPW:MarginalLoanPayableMember

2022-12-31

0001064722

us-gaap:RealEstateMember

srt:MinimumMember

2022-12-31

0001064722

us-gaap:RealEstateMember

srt:MaximumMember

2022-12-31

0001064722

GMPW:BuildingsMember

srt:MinimumMember

2023-09-30

0001064722

GMPW:BuildingsMember

srt:MaximumMember

2023-09-30

0001064722

GMPW:PermanentInstallationsMember

srt:MinimumMember

2023-09-30

0001064722

GMPW:PermanentInstallationsMember

srt:MaximumMember

2023-09-30

0001064722

us-gaap:MachineryAndEquipmentMember

srt:MinimumMember

2023-09-30

0001064722

us-gaap:MachineryAndEquipmentMember

srt:MaximumMember

2023-09-30

0001064722

GMPW:FurnitureFixturesEquipmentAndVehiclesMember

srt:MinimumMember

2023-09-30

0001064722

GMPW:FurnitureFixturesEquipmentAndVehiclesMember

srt:MaximumMember

2023-09-30

0001064722

GMPW:BuildingsMember

srt:MinimumMember

2022-12-31

0001064722

GMPW:BuildingsMember

srt:MaximumMember

2022-12-31

0001064722

GMPW:PermanentInstallationsMember

srt:MinimumMember

2022-12-31

0001064722

GMPW:PermanentInstallationsMember

srt:MaximumMember

2022-12-31

0001064722

us-gaap:MachineryAndEquipmentMember

srt:MinimumMember

2022-12-31

0001064722

us-gaap:MachineryAndEquipmentMember

srt:MaximumMember

2022-12-31

0001064722

GMPW:FurnitureFixturesEquipmentAndVehiclesMember

srt:MinimumMember

2022-12-31

0001064722

GMPW:FurnitureFixturesEquipmentAndVehiclesMember

srt:MaximumMember

2022-12-31

0001064722

srt:AffiliatedEntityMember

GMPW:AlpharidgeCapitalMember

2023-09-30

0001064722

srt:AffiliatedEntityMember

GMPW:AlpharidgeCapitalMember

2022-12-31

0001064722

srt:AffiliatedEntityMember

2023-09-30

0001064722

srt:AffiliatedEntityMember

2022-12-31

0001064722

GMPW:AlpharidgeCapitalMember

2022-12-31

0001064722

GMPW:AlpharidgeCapitalMember

2021-12-31

0001064722

GMPW:TaxAssetEstimatesMember

2023-01-01

2023-09-30

0001064722

us-gaap:DomesticCountryMember

2023-09-30

0001064722

us-gaap:DomesticCountryMember

2022-12-31

0001064722

GMPW:TaxAssetEstimatesMember

2022-01-01

2022-12-31

0001064722

us-gaap:DomesticCountryMember

2021-12-31

0001064722

srt:MinimumMember

2023-01-01

2023-09-30

0001064722

srt:MaximumMember

2023-01-01

2023-09-30

0001064722

GMPW:LineOfCreditAgreementMember

GMPW:GoldsteinFranklinMember

2019-09-15

0001064722

GMPW:LineOfCreditAgreementMember

GMPW:GoldsteinFranklinMember

2019-09-14

2019-09-15

0001064722

GMPW:LineOfCreditAgreementMember

GMPW:GoldsteinFranklinMember

GMPW:LineOfCreditAgreementAmendmentMember

2019-09-15

0001064722

GMPW:LineOfCreditAgreementMember

GMPW:GoldsteinFranklinMember

GMPW:LineOfCreditAgreementAmendmentMember

2019-09-14

2019-09-15

0001064722

GMPW:LineOfCreditAgreementMember

GMPW:GoldsteinFranklinMember

2020-05-04

2020-05-05

0001064722

us-gaap:LineOfCreditMember

2022-12-31

0001064722

us-gaap:LineOfCreditMember

2021-12-31

0001064722

srt:MinimumMember

2022-01-01

2022-12-31

0001064722

srt:MaximumMember

2022-01-01

2022-12-31

0001064722

GMPW:MayTwentyTwoThousandTwentyMember

2023-09-30

0001064722

GMPW:MayTwentyTwoThousandTwentyMember

2022-12-31

0001064722

GMPW:OtherMember

2023-09-30

0001064722

GMPW:OtherMember

2022-12-31

0001064722

GMPW:SeptemberTwoThousandNineteenMember

2022-12-31

0001064722

GMPW:SeptemberTwoThousandNineteenMember

2021-12-31

0001064722

GMPW:MayTwentyTwoThousandTwentyMember

2021-12-31

0001064722

GMPW:OtherMember

2021-12-31

0001064722

GMPW:MayTwentyTwoThousandTwentyMember

2023-01-01

2023-09-30

0001064722

GMPW:MayTwentyTwoThousandTwentyMember

2022-01-01

2022-12-31

0001064722

GMPW:SeptemberTwoThousandNineteenMember

2022-01-01

2022-12-31

0001064722

GMPW:GoldsteinFranklinMember

GMPW:LineOfCreditAgreementAmendmentMember

2020-02-28

0001064722

GMPW:GoldsteinFranklinMember

GMPW:LineOfCreditAgreementAmendmentMember

2020-02-27

2020-02-28

0001064722

GMPW:LineOfCreditAgreementAmendmentMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Registration

No. 333-252208

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

POST-EFFECTIVE

AMENDMENT

NO. 1

TO

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

GIVEMEPOWER

CORPORATION

(Exact

name of registrant as specified in its charter)

| Nevada |

|

7389 |

|

87-0291528 |

| (State

or other jurisdiction of |

|

(Primary

Standard Industrial |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Classification

Code Number) |

|

Identification

Number) |

370 Amapola Ave., Suite 200-A

Torrance, CA 90501

(310) 895-1839

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Frank

I Igwealor

Chairman,

CEO

GiveMePower

Corporation

370

Amapola Ave., Suite 200-A

Torrance,

CA 90501

Email:

blkbnknf@gmail.com

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Alpha Advocate Law Group PC

11432 South Street, #373

Cerritos, CA 90703

562-219-0089

Approximate

date of commencement of proposed sale to the public:

As

soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act, check the following box. ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and emerging growth company in Rule 12b-2 of the Exchange Act:

| |

|

|

|

|

|

| Large

accelerated filer |

☐ |

|

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☐ |

(Do

not check if a smaller reporting company) |

|

Smaller

reporting company |

☒ |

| Emerging

growth company |

☒ |

|

|

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This

Post-Effective Amendment No. 1 to Form S-1 contains an updated prospectus related to the increase in the number of Common Stock previously

registered from 5,000,000 to 505,000,000 and the reduction of the previously shares of the Company’s Class B stocks from 1,000,

to 1,000, representing 500,000,000 shares of Common Stock and 1,000 shares of the Class B to be sold by the Company, and 5,000,000 shares

of Common Stock by the Selling Stockholders identified in this prospectus or their permitted transferees, all of which were initially

registered on our registration statement on Form S-1 (File No. 333-252208) (the “Registration Statement”) declared effective

by the SEC on August 11, 2021. This Post-Effective Amendment No. 1 to Form S-1 is being filed to update the Registration Statement and

to reduce the number of the previously registered Class B from 1,000,000 to 1,000 and increase the number of the previously registered

Common Stocks from 5,000,000 to 505,000,000 shares of our ordinary Common Stock. All filing fees payable in connection with the shares

of Common Stock covered by this Registration Statement were paid by the Registrant at the time of the initial filing of the Registration

Statement.

Preliminary

Prospectus

The

information contained in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities

until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell

these securities and neither we nor the selling stockholders are soliciting offers to buy these securities in any jurisdiction where

the offer or sale is not permitted.

Subject

to Completion, dated _______, 2024

Up

to 505,001,000 Shares of

GiveMePower

Corporation

Common

Stock

GiveMePower

Corporation (the “Company,” “GMPW”) is offering to the public on a self-underwritten, best-efforts basis a total

of 1,000 shares of its $0.001 par Class B, Common Stock (the “Offering”), with an aggregate public offering price of approximately

$1,000, and 500,000,000 shares of our common stock with an aggregate public offering price of approximately $10,000,000. There is no

minimum number of shares of Class B or the Common Stock required in order to close the Offering. The selling stockholder identified in

this prospectus is offering 5,000,000 shares of our common stock with an aggregate public offering price of approximately $100,000. We

will not receive any proceeds from the sale of any shares by the selling stockholders. The offering price for the shares will be $0.02

per share. We anticipate that the initial public offering price will be about $0.02 per share. The Selling Security Holders may offer

and sell their shares at $0.02 per share until the common stock becomes quoted on the OTC Bulletin Board, the OTCQX, the OTCQB or listed

on a securities exchange and thereafter at prevailing market prices or privately negotiated prices.

The

Selling Security Holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission

is effective. We will not receive any proceeds from the sale of any of the shares held by the Selling Security Holders. The shares being

sold by the Selling Security Holders were issued to them in private placement transactions which were exempt from the registration and

prospectus delivery requirements of the Securities Act. Our common stock is more fully described in “Description of Securities.”

The

selling stockholders and any other person participating in such distribution will be subject to applicable provisions of the Securities

Act of 1933, as amended (the “Act”), and the rules and regulations thereunder, including, without limitation, the safe harbor

provisions of Rule 144. The selling stockholders and any other person participating in such distribution will also be subject to applicable

provisions of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations thereunder,

including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares

of our common stock by the selling stockholders and any other participating person.

The

offering will conclude on the earlier of when all 1,000 shares of the Class B and 500,000,000 of our common stock registered in this

statement by the Company and the 5,000,000 registered for the Selling Security Holders have been sold, or 180 days after this registration

statement becomes effective with the Securities and Exchange Commission. We may, at our discretion, extend the offering for an additional

180 days.

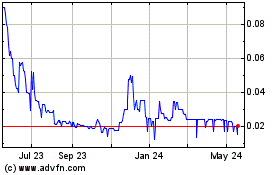

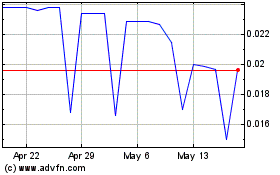

Our

common stock, par value $0.001 (the “Common Stock”) is currently subject to quotation on the OTC Market, with the trading

symbol “GMPW.” As of December 12, 2023, the last sale price of our common stock as reported on OTC Market was $0.029 per

share. There is a limited public trading market for our common stock. We have assumed a public offering price of $0.02, which represents

the last reported closing price of our common stock as reported on the OTC Market on December 12, 2023. The final public offering price

will be determined through negotiation and the assumed public offering price used throughout this prospectus may not be indicative of

the actual offering price.

There

is no established trading market for the Class B par value $0.001 (the “Class B”) Common Stock, nor can there be any assurance

that a trading market will develop or be sustained for the shares of the Class B commons stock subject to the Offering. Subject to the

successful completion of the Offering and the issuance of the shares of our Class B par $0.001 Common Stock, we may apply to NASDAQ to

have our Common Stock and our Class B listed on the NASDAQ Capital Market. We may also determine to apply of listing on NASDAQ if we

raise sufficient proceeds from the Offering together with revenues from operations that we qualify for NASDAQ Listing for both our Common

Stock and our Class B Stock, as discussed below. Reference is also made to the disclosure under “Use of Proceeds” and “Plan

of Distribution” below. We believe that upon completion of the offering contemplated by this prospectus, we will meet the standards

for listing on the Nasdaq Capital Market. We cannot guarantee that we will be successful in listing our common stock on the Nasdaq Capital

Market.

The

offering is being conducted on a self-underwritten, best-efforts basis, which means our President, Frank Igwealor, will attempt to sell

the 1,000 shares of the Class B par value $0.001 and the 500,000,000 shares of common stock that the company is offering. This Prospectus

will permit our President to sell the shares directly to the public, with no commission or other remuneration payable to him for any

shares he may sell. In offering the securities on our behalf, he will rely on the safe harbor from broker-dealer registration set out

in Rule 3a4-1 under the Securities and Exchange Act of 1934. The intended methods of communication include, without limitation, telephone

and personal contact.

We

also contemplate utilizing the services of one or more placement agents (collectively, the “Placement Agents”), which means

our management and Placement Agent(s) will attempt to sell the Class B and the Common Stock being offered hereby on behalf of the Company.

There is no underwriter for this Offering. To date, we have not yet retained any Placement Agent nor are we in negotiations with any

Placement Agent but expect that we will utilize one or more Placement Agent(s) and expect that will enter into a Placement Agent Agreement

in the form attached as Exhibit 10.4 hereto prior to the commencement of the Offering. Reference is also made to the disclosure under

“The Offering” and “Plan of Distribution”.

Pursuant

to the terms of the Placement Agent Agreement, we will pay the Placement Agents a cash fee equal to 7% of the gross proceeds received

by the Company from qualified investors from such closing of the sale of Class B and Ordinary Common Stock as a direct result of the

selling efforts and introductions of each respective Placement Agent.

Any

Placement Agent(s) that we engage will not have any obligation to buy the Class B and Ordinary Common Stock subject to this Offering

from us or to arrange for the purchase or sale of any specific number or dollar amount of the Class B and Ordinary Common Stock . If

we sell all 1,000 shares of Class B and Ordinary Common Stock subject to the Offering pursuant to this prospectus, at the Offering price

of $1.00 per share, and the and 500,000,000 Common Stock subject to the Offering pursuant to this prospectus, at the Offering price of

$0.02 per share, we will receive approximately $10,001,000 in gross proceeds and approximately $9,001,000 in net proceeds, after deducting

placement agent fees of $722,400 and estimated offering expenses of $277,600 payable by us, assuming all of the 1,000 shares of the Class

B and 500,000,000 Common Stock are sold through the direct efforts of Placement Agents, and estimated offering expenses payable by us.

| | |

Per Share | | |

Total | |

| Public offering price (Class B) | |

$ | 1.00 | | |

$ | 1,000 | |

| Public offering price (Common Stock) | |

$ | 0.02 | | |

$ | 10,100,000 | |

| Private placement expenses (1) | |

$ | 0 | | |

$ | 1,000,000 | |

| Proceeds, before expenses, to us | |

$ | | | |

$ | 9,001,000 | |

| Proceeds, before expenses, to Selling Stockholders | |

$ | | | |

$ | 100,000 | |

| (1) |

See

“Plan of Distribution” for a description of the compensation payable to any participating Placement Agent, including

cash fees and Placement Agent Warrants. |

As

of December 12, 2023, the executive officers and directors beneficially control 69.88% of the outstanding voting shares as follows: (a)

the executive officers and directors beneficially own 10,812,082 of the outstanding shares of our Common Stock, representing approximately

9.88% of the outstanding voting shares; (b) Goldstein Franklin Inc, a company that is 100% controlled by the executive officers and directors

beneficially own 1 Special Series A Preferred (convertible into 100,000,000 shares of Common Stock), the Special Series A Preferred controls

approximately 60% of the total votes of all outstanding voting shares.

We

believe that we will qualify for the listing of both our Common Stock and the Class B and Ordinary Common Stock upon the successful sale

of all of the shares of the Class B and Ordinary Common Stock that are the subject of the Offering. We do not intend to close the Offering

(the “Closing”) until the earlier of: (i) the sale of a sufficient number of the Common Stock necessary for us to meet the

listing requirements for the NASDAQ Capital Markets for both our Common Stock and the Class B and Ordinary Common Stock ; (ii) the sale

of a sufficient number of shares of the Common Stock together with the revenues we generate from our operations necessary for us to meet

the listing requirements for the NASDAQ Capital Markets for both our Common Stock and the Class B and Ordinary Common Stock ; or (iii)

as noted above, on a date 180 days after the effective date of this registration statement, subject to one or more extensions of up to

180 additional days.

Through

this Offering and the resultant acquisition, GiveMePower Corporation (“GMPW”) seeks to become a financial technology company

(FINTEC) with business interests that comprise: (1) one-to-four branch federally licensed bank in each jurisdiction, (2) a machine learning

(ML) and artificial intelligence (AI) enabled loan and insurance underwriting platform, (3) blockchain-powered transaction processing

and payment systems, (4) cryptocurrency transaction processing platform, and (5) boost our affordable housing portfolio with acquisition

of select multi-family properties; giving access to the unbanked, underserved residents of majorly black communities across the United

State. This is the fulfillment of mission of operating and managing a portfolio of real estate and financial services assets and operations

to empower black persons in the United States through financial tools and resources, with a primary focused on: (1) creating and empowering

local black businesses in urban America; and (2) creating real estate properties and businesses in opportunity zones and other distressed

neighborhood across America.

The

purpose of the Offering therefore, is to use the proceeds to acquire: (1) a one-to-four branch bank that is federally licensed in each

jurisdiction; (2) a machine learning (ML) and artificial intelligence (Ai) enabled loan and insurance underwriting platform; (3) blockchain-powered

transaction processing and payment systems; (4) cryptocurrency transaction processing platform; and (5) boost our affordable housing

portfolio with acquisition of select multi-family properties;; a combination of three of which would connects consumers, banks, institutional

investors, and ensure access to the unbanked and underserved residents of majorly black communities across the United State of America.

The purpose of this offering could be achieve with the receipt of sufficient Offering Proceeds from the issuance and sale of the Class

B and Ordinary Common Stock subject to this Offering. Our plan is to place the Offering Proceeds in an account established for the purpose

of the holding the proceeds from the sale of the Class B and Ordinary Common Stock pursuant to this Offering, whether in an escrow, trust

or similar account, until we finalize an acquisition agreement and use the proceeds to acquire: (1) a one-to-four branch bank that is

federally licensed in each jurisdiction; (2) a machine learning (ML) and artificial intelligence (Ai) enabled loan and insurance underwriting

platform; (3) blockchain-powered transaction processing and payment systems; (4) cryptocurrency transaction processing platform; and

(5) boost our affordable housing portfolio with acquisition of select multi-family properties; to connects consumers, banks, institutional

investors, and ensure access to the unbanked and underserved residents of majorly black communities across the United State of America.

Although there can be no assurance, at which time the Offering Proceeds will be released to the Company and the Closing of the Offering

will occur.

See

“Use of Proceeds” in this prospectus. We expect the Common Stock will be ready for delivery in book-entry form through The

Depositary Trust Company on or about_______, 2024.

Investing

in any class of our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion

of material risks of investing in our common stock in “Risk factors” beginning on page 36 of this

prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is _____________, 2024

TABLE

OF CONTENTS

No

action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or

distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the

United States are required to inform themselves about and to observe any restrictions as to this public offering and the distribution

of this prospectus applicable to that jurisdiction.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, including the sections entitled “Prospectus Summary,” “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements within the meaning

of the federal securities laws. These statements relate to anticipated future events, future results of operations or future financial

performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,”

“will,” “should,” “intends,” “expects,” “plans,” “goals,” “projects,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue”

or the negative of these terms or other comparable terminology.

These

forward-looking statements are only predictions, are uncertain and involve substantial known and unknown risks, uncertainties and other

factors which may cause our (or our industry’s) actual results, levels of activity or performance to be materially different from

any future results, levels of activity or performance expressed or implied by these forward-looking statements. The “Risk Factors”

section of this prospectus sets forth detailed risks, uncertainties and cautionary statements regarding our business and these forward-looking

statements. Moreover, we operate in a very competitive and rapidly changing regulatory environment. New risks and uncertainties emerge

from time to time, and it is not possible for us to predict all of the risks and uncertainties that could have an impact on the forward-looking

statements contained in this prospectus.

We

cannot guarantee future results, levels of activity or performance. You should not place undue reliance on these forward-looking statements,

which speak only as of the date of this prospectus. These cautionary statements should be considered with any written or oral forward-looking

statements that we may issue in the future. Except as required by applicable law, including the securities laws of the U.S., we do not

intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances

or to reflect the occurrence of unanticipated events. Our forward-looking statements do not reflect the potential impact of any future

acquisitions, mergers, dispositions, joint ventures or other investments or strategic transactions we may engage in.

THE

OFFERING

The

following summary contains basic terms about this Offering and the Class B and Ordinary Common Stock and is not intended to be complete.

It may not contain all of the information that is important to you. For a more complete description of the terms of the Class B and Ordinary

Common Stock , see “Description of the Class B and Ordinary Common Stock .”

| Issuer |

|

GiveMePower Corporation |

| The Class B and Ordinary Common Stock to be outstanding after this Offering if the maximum number of shares are sold by the Corporation. |

|

1,000 shares of the Class B and Ordinary Common Stock (or “The Class B Stock “) |

| |

|

|

| Offering Price |

|

$1.00 per share of The Class B and Ordinary Common Stock |

| |

|

|

| Common Stock outstanding before this Offering |

|

43,792,804 shares of Common Stock (or “Common Stock”) |

| |

|

|

| Common Stock to be outstanding after this Offering if the maximum number of shares are sold by the Selling Shareholder. |

|

543,792,804 shares of Common Stock (or “Common Stock”) |

| |

|

|

| Offering Price |

|

$0.02 per share of the Common Stock |

| |

|

|

| Use of Proceeds: |

|

We intend to use no less than 90% of the net proceeds from this offering to acquire: (1) a one-to-four branch bank that is federally licensed in each jurisdiction; (2) a machine learning (ML) and artificial intelligence (Ai) enabled loan and insurance underwriting platform; (3) blockchain-powered transaction processing and payment systems; (4) cryptocurrency transaction processing platform; and (5) boost our affordable housing portfolio with acquisition of select multi-family properties; a combination of three of which would connects consumers, banks, institutional investors, and ensure access to the unbanked and underserved residents of majorly black communities across the United State of America. |

| |

|

|

| Minimum number of shares to be sold in this Offering: |

|

None |

| |

|

|

| Offering Period: |

|

The offering will conclude when all 1,000 shares of the Class B and and 505,000,000 common stocks have been sold, or 180 days after this registration statement becomes effective with the Securities and Exchange Commission. |

| Offering

Proceeds to be Held in Trust or Escrow Account Until a Bank, Fintec or Digital Currency transaction processing business Acquisition

Agreement is Finalized |

|

Our

Board-imposed rule, which is similar to the rules of NASDAQ, provides that at least 90% of the gross proceeds from this offering

be deposited in an account until we finalize an acquisition agreement to use the proceeds to acquire: (1) a one-to-four branch bank

that is federally licensed in each jurisdiction; (2) a machine learning (ML) and artificial intelligence (Ai) enabled loan and insurance

underwriting platform; (3) blockchain-powered transaction processing and payment systems; (4) cryptocurrency transaction processing

platform; and (5) boost our affordable housing portfolio with acquisition of select multi-family properties; a combination of three

of which would connects consumers, banks, institutional investors, and ensure access to the unbanked and underserved residents of

majorly black communities across the United State of America. The purpose of this offering could be achieve whether as a result of:

(i) the receipt of sufficient Offering Proceeds from the issuance and sale of the Class B and Ordinary Common Stock subject to this

Offering; or (ii) receipt of Offering Proceeds together with revenues from our other operations, our plan is to place the Offering

Proceeds in an account established for the purpose of the holding the proceeds from the sale of the Class B and Ordinary Common Stock

pursuant to this Offering, whether in an escrow, trust or similar account, until we finalize an acquisition agreement to use the

proceeds to acquire: (1) a one-to-four branch bank that is federally licensed in each jurisdiction; (2) a machine learning (ML) and

artificial intelligence (Ai) enabled loan and insurance underwriting platform; (3) blockchain-powered transaction processing and

payment systems; (4) cryptocurrency transaction processing platform; and (5) boost our affordable housing portfolio with acquisition

of select multi-family properties; a combination of three of which would connects consumers, banks, institutional investors, and

ensure access to the unbanked and underserved residents of majorly black communities across the United State of America. All five

division of our FINTEC would be cross-integrated to become a modern digitized banking and financial services, and digital currency

exchange platform focusing on connecting and giving access to black entrepreneurs, black borrowers, consumers, banks, and institutional

investors, of which there can be no assurance, at which time the Offering Proceeds will be released to the Company and the Closing

of the Offering will occur. Of the net proceeds we will receive from this offering described in this prospectus, $9,001,000, will

be deposited into a segregated trust account located in the United States and $1.0 million will be used to pay expenses in connection

with the closing of this offering and for working capital following this offering. |

| |

|

|

| Placement

Agent Agreement |

|

The

Offering will be made using the services of our management, who will not be compensated for their services and efforts related to

the Offering of our Common Stock. We also contemplate utilizing the services of one or more placement agents (collectively, the “Placement

Agents”), which means our management and Placement Agent(s) will attempt to sell the Common Stock being offered hereby on behalf

of the Company. There is no underwriter for this Offering. To date, we have not yet retained any Placement Agent nor are we in negotiations

with any Placement Agent but expect that we will utilize one or more Placement Agent(s) and expect that will enter into a Placement

Agent Agreement in the form attached as Exhibit 10.4 hereto prior to the commencement of the Offering. Reference is also made to

the disclosure under “The Offering” and “Plan of Distribution” below.

Pursuant

to the terms of the Placement Agent Agreement, we will pay the Placement Agents a cash fee equal to 7% of the gross proceeds received

by the Company from qualified investors from such closing of the sale of The Common Stock as a direct result of the selling efforts

and introductions of each respective Placement Agent. |

| |

|

|

| Information

Rights |

|

During

any period in which we are not subject to Section 13 or 15(d) of the Exchange Act and any shares of The Common Stock are outstanding,

we will use our best efforts to (i) transmit by mail (or other permissible means under the Exchange Act) to all holders of The Common

Stock , as their names and addresses appear on our record books and without cost to such holders, copies of the Annual Reports on

Form 10-K and Quarterly Reports on Form 10-Q that we would have been required to file with the SEC pursuant to Section 13 or 15(d)

of the Exchange Act if we were subject thereto (other than any exhibits that would have been required) and (ii) promptly, upon request,

supply copies of such reports to any holders or prospective holder of The Common Stock , subject to certain exceptions described

in this prospectus. We will use our best efforts to mail (or otherwise provide) the information to the holders of the Common Stock

within 15 days after the respective dates by which a periodic report on Form 10-K or Form 10-Q, as the case may be, in respect of

such information would have been required to be filed with the SEC, if we were subject to Section 13 or 15(d) of the Exchange Act,

in each case, based on the dates on which we would be required to file such periodic reports if we were a “non-accelerated

filer” within the meaning of the Exchange Act. |

| |

|

|

| Quotation |

|

Our

Common Stock is currently subject to quotation on the OTC Market under the symbol “GMPW.” We intend to apply for listing

on the NASDAQ Capital Markets (“NASDAQ Listing”) of our Common Stock and The Common Stock upon the earlier of: (i) receipt

of sufficient proceeds from the Offering of The Common Stock; or (ii) receipt to sufficient proceeds from the Offering together with

revenues from operations that we qualify for NASDAQ Listing. |

| Risk

Factors |

|

Please

read the section entitled “Risk Factors” beginning on page 36 for a discussion of some of the factors you should carefully

consider before deciding to invest in our The Common Stock. |

| |

|

|

| Transfer

Agent |

|

The

transfer agent for our capital stock is Pacific Stock Transfer, with an address of 6725 Via Austi Pkwy Ste 300, Las Vegas, NV 89119-3553,

with a telephone of 702-361-3033. |

| |

|

|

| Material

U.S. Federal Income Tax Considerations |

|

For

a discussion of the federal income tax consequences of purchasing, owning and disposing of the Common Stock, please see the section

entitled “Material U.S. Federal Income Tax Considerations.” You should consult your tax advisor with respect to the U.S.

federal income tax consequences of owning the Common Stock in light of your own particular situation and with respect to any tax

consequences arising under the laws of any state, local, foreign or other taxing jurisdiction. |

| |

|

|

| Book

Entry and Form |

|

The

Common Stock will be represented by one or more global certificates in definitive, fully registered form deposited with a custodian

for, and registered in the name of, a nominee of The Depository Trust Company (“DTC”). |

SUMMARY

OF FINANCIAL INFORMATION

The

following table sets forth a summary of financial information derived from our financial statements for the periods stated. The accompanying

notes are an integral part of these financial statements and should be read in conjunction with the financial statements, related notes

thereto and other financial information included elsewhere in this prospectus.

We

derived the balance sheet data and operating data for the year ended December 31, 2022, from our audited consolidated financial statements

included elsewhere in this prospectus. The balance sheet data and operating data for the nine months ended September 30, 2023, have been

derived from our unaudited financial statements included elsewhere in this prospectus. We have prepared the unaudited financial statements

on the same basis as the audited consolidated financial statements and have included all adjustments, consisting only of normal recurring

adjustments that, in our opinion, are necessary to state fairly the financial information set forth in those statements. Our historical

results are not necessarily indicative of the results we expect in the future, and our interim results should not necessarily be considered

indicative of results we expect for the full year or any other period.

| Balance

Sheet Data: | |

Year

ended December 31, | | |

Nine

Months ended September 30 | |

| | |

2022 | | |

2023 | |

| Current

assets | |

$ | 44,592 | | |

$ | 957 | |

| Total

assets | |

$ | 44,592 | | |

$ | 957 | |

| | |

| | | |

| | |

| Current

liabilities | |

$ | 3,476 | | |

$ | 8,904 | |

| Total

liabilities | |

$ | 241,379 | | |

$ | 217,250 | |

| Shareholders’ equity | |

$ | (196,787 | ) | |

$ | (216,250 | ) |

| Operating

Data: | |

Year ended December

31, | | |

Nine

Months ended September 30 | |

| | |

2022 | | |

2023 | |

| Revenues | |

$ | 490,000 | | |

$ | 0.00 | |

| Operating expenses | |

$ | 56,117 | | |

$ | 19,506 | |

| Net Income / loss | |

$ | (111,426 | ) | |

$ | (19,506 | ) |

| Net loss per share per common

share – basic and diluted | |

$ | (0.0025 | ) | |

$ | (0.0004 | ) |

| Weighted average number of shares outstanding –

basic and diluted | |

| 43,792,804 | | |

| 43,792,804 | |

Important

Information – No Required Minimum Amount of Shares Must be Sold

There

is no required minimum number of Shares that must be sold in this offering. As a result, potential investors will not know how many Shares

will ultimately be sold and the amount of proceeds we will receive from this offering. If we sell only a few Shares, potential investors

may end up holding shares in a company that:

| |

● |

has not received

enough proceeds from the offering to start/sustain private equity operations; and |

| |

|

|

| |

● |

has none, limited, volatile,

and sporadic trading market for its common stock. |

This

should be considered a substantial risk of investment, taken together with the “Risk Factors”

section presented in this prospectus starting on page 36.

Rule

419 – “Blank Check Company”

We

are not a “blank check company” as defined by Rule 419 of the Securities Act of 1933, as amended, and therefore the registration

statement need not comply with the requirements of Rule 419. Rule 419 defines a “blank check company” as a company that:

(1)

is a development stage company that has no specific business plan or purpose or has indicated that its business plan is to engage in

a merger or acquisition with an unidentified company or companies, or other entity or person; and

(2)

is issuing “penny stock,” as defined in Rule 3a51-1 under the Securities Exchange Act of 1934.

Under

the first test, we could not be classified as a “blank check company” we have a very specific business purpose and a bona

fide business operation with significant revenue. E.g., from January 1, 2021 through December 31, 2022 we generated $1,190,385 in revenue

notwithstanding the Covid-19 shutdown and disruptions. From August 30, 2019 to present, GiveMePower Corporation operated and managed

a portfolio of real estate and financial services assets and operations to empower black persons in the United States through financial

tools and resources. GiveMePower’s business purpose is primarily focused on: (1) creating and empowering local black businesses

in urban America; and (2) creating real estate properties and businesses in distressed neighborhoods across America. As at the date of

this filing, except for the financial services division, all of our businesses are up and running resulting in revenue of $1,190,385

in the two years ended December 31, 2022, a feat which was achieved in spite of the Covid-19 related shutdowns and business disruptions.

This Offering would be used to boost our affordable housing portfolio and also capitalize the commencement of the Banking and financial

services division of our business. Our business operation owns and holds properties, assets and investments that generate ongoing revenue

from the operation. We currently (1) acquire, rehabilitating and re-utilizing dilapidated or abandoned properties; (2) acquire and restructure

troubled businesses; and (3) conduct job-creating and community-empowering entrepreneurship training and investments that empower black

person/low-income persons to become self-sufficient.

Thus,

we are not a blank check company because we have an operating business with significant operating revenue, that has been thriving even

under the harsh conditions of Covid-19 restriction, GiveMePower Corporation failed the first of the “blank check company”

test of having no specific business plan or purpose.

Moreover,

our business will continue to generate revenue from operations even if this offering fails. Since there can be no assurance that we will

be able to raise the capital necessary to acquire, own or hold the financial services business that we have identified.

Furthermore,

we have identified four income-producing multi-family real estate properties that fit our criteria for acquisition: (1) 1317 N Pennsylvania

Ave, Colton, CA 92324, a 4-units multifamily property costing $992,000 and producing 56,220 in annual net income. (2) 494 E Sunset St,

Long Beach, CA 90805, a 4-units multifamily property costing $825,000 and producing 44,512 in annual net income. (3) 2203 4th Ave, Los

Angeles, CA 90018, an 8-units multifamily property costing $2,925,000 and producing 186,537 in annual net income. (4) 2402 Malabar St,

Los Angeles, CA 90033, an 8-units multifamily property costing $1,499,000 and producing 78,241 in annual net income. We have not drawn

up a purchase contract with the seller because we could not show a proof of fund which is the seller’s condition to enter into

any contract. We therefore decided to wait on contracting for now until we could arrange for the financing. Notwithstanding our progress

in negotiating the possible acquisition of these four income-producing properties identified above, there can be no assurance that we

will be able to raise the capital necessary to acquire, own or hold the properties that we have identified above.

Lastly,

at this time and immediately after this offering, we do not have any plans or intentions to engage in a merger or acquisition with an

unidentified company or companies or other entity or person. .

We

are not s Special Purpose Acquisition Company, we do not Offer Redemption Rights Protection to Investors.

We

and the Offering is not a Special Purpose Acquisition Company and so, investors will not be entitled to protections normally afforded

to investors in special purpose acquisition company offerings, including redemption rights.

This

Offering does not include a redemption right or any other protection that is normally afforded to investors in special purpose acquisition

company offerings, even though GMPW has a Board-imposed rule, which is similar to the rules of NASDAQ, that provides that at least 90%

of the gross proceeds from this offering be deposited in a trust or escrow account. Until we finalize an acquisition agreement to use

the proceeds to acquire: (1) a one-to-four branch bank that is federally licensed in each jurisdiction; (2) a machine learning (ML) and

artificial intelligence (Ai) enabled loan and insurance underwriting platform; (3) blockchain-powered transaction processing and payment

systems; (4) cryptocurrency transaction processing platform; and (5) boost our affordable housing portfolio with acquisition of select

multi-family properties; a combination of three of which would connects consumers, banks, institutional investors, and ensure access

to the unbanked and underserved residents of majorly black communities across the United State of America.

PROSPECTUS

SUMMARY

This

prospectus summary highlights certain information appearing elsewhere in this prospectus. As this is a summary, it does not contain all

of the information that you should consider in making an investment decision. You should read the entire prospectus carefully, including

the information under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and our financial statements and the related notes thereto included in this prospectus, before investing. This prospectus

includes forward-looking statements that involve risks and uncertainties. See “Information regarding forward-looking statements.”

In

this prospectus, unless the context otherwise requires, the terms “GMPW,” “the Company,” “we,” “us”

and “our” refer to GiveMePower Corporation

This

prospectus includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and

trade names included in this prospectus are the property of their respective owners.

Overview

In

addition to the historical information contained herein, the discussion in this prospectus contains certain forward-looking statements,

within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. The cautionary statements

made in this prospectus should be read as applicable to all related forward-looking statements whenever they appear in this prospectus.

Our actual results could differ materially from the results discussed in the forward-looking statements. Factors that could cause or

contribute to such differences include, but are not limited to, those discussed under the section captioned “Risk Factors”

on page 36 of this prospectus as well as those cautionary statements and other factors set forth elsewhere herein.

This

Offering

Through

this Offering and the resultant acquisition, GiveMePower Corporation (“GMPW”) seeks to become a financial technology company

(FINTEC) that comprises (1) one-to-four branch federally licensed bank in each jurisdiction, (2) a machine learning (ML) and artificial

intelligence (AI) enabled loan and insurance underwriting platform, (3) blockchain-powered transaction processing and payment systems,

(4) cryptocurrency transaction processing platform, and (5) boost our affordable housing portfolio with acquisition of select multi-family

properties; giving access to the unbanked, underserved residents of majorly black communities across the United State. This is the fulfillment

of mission of operating and managing a portfolio of real estate and financial services assets and operations to empower black persons

in the United States through financial tools and resources, with a primary focused on: (1) creating and empowering local black businesses

in urban America; and (2) creating real estate properties and businesses in opportunity zones and other distressed neighborhood across

America.

The

purpose of the Offering therefore, is to use the proceeds to acquire: (1) a one-to-four branch bank that is federally licensed in each

jurisdiction; (2) a machine learning (ML) and artificial intelligence (Ai) enabled loan and insurance underwriting platform; (3) blockchain-powered

transaction processing and payment systems; (4) cryptocurrency transaction processing platform; and (5) boost our affordable housing

portfolio with acquisition of select multi-family properties;; a combination of three of which would connects consumers, banks, institutional

investors, and ensure access to the unbanked and underserved residents of majorly black communities across the United State of America.

The purpose of this offering could be achieve whether as a result of: (i) the receipt of sufficient Offering Proceeds from the issuance

and sale of the Class B and Ordinary Common Stock subject to this Offering; or (ii) receipt of Offering Proceeds together with revenues

from our other operations, our plan is to place the Offering Proceeds in an account established for the purpose of the holding the proceeds

from the sale of the Class B and Ordinary Common Stock pursuant to this Offering, whether in an escrow, trust or similar account, until

we finalize an acquisition agreement and use the proceeds to acquire: acquire: (1) a one-to-four branch bank that is federally licensed

in each jurisdiction; (2) a machine learning (ML) and artificial intelligence (Ai) enabled loan and insurance underwriting platform;

(3) blockchain-powered transaction processing and payment systems; (4) cryptocurrency transaction processing platform; and (5) boost

our affordable housing portfolio with acquisition of select multi-family properties; a combination of three of which would connects consumers,

banks, institutional investors, and ensure access to the unbanked and underserved residents of majorly black communities across the United

State of America, of which there can be no assurance, at which time the Offering Proceeds

will be released to the Company and the Closing of the Offering will occur.

Notwithstanding

the above plan, there is no assurance that we could complete this offering and raise the capital necessary to make these projected acquisitions.

Even if we are able to raise capital, there is no assurance that we would find and acquire the right businesses to make us a successful

FINTEC. Even if we were able to raise capital and acquire some FINTEC businesses, there is no guarantee that such acquisition would not

have an adverse effect on the shareholders due to other factors articulated in our “risk factors” section.

Business

Overview

GiveMePower

Corporation operates and manages a portfolio of real estate and financial services assets and operations to empower black persons in

the United States through financial tools and resources. GiveMePower is primarily focused on: (1) creating and empowering local black

businesses in urban America; and (2) creating real estate properties and businesses in opportunity zones and other distressed neighborhoods

across America. This Offering represents the commencement of the Banking and financial services division of our business. This Offering

will enable GMPW to become a financial technology company (FINTEC) business that (1) one-to-four branch federally licensed bank in each

jurisdiction, (2) a machine learning (ML) and artificial intelligence (AI) enabled loan and insurance underwriting platform, (3) blockchain-powered

transaction processing and payment systems, (4) cryptocurrency transaction processing platform, and (5) boost our affordable housing

portfolio with acquisition of select multi-family properties; giving access to the unbanked, underserved residents of majorly black communities

across the United State. This is the fulfillment of mission of operating and managing a portfolio of real estate and financial services

assets and operations to empower black persons in the United States through financial tools and resources, with a primary focused on:

(1) creating and empowering local black businesses in urban America; and (2) creating real estate properties and businesses in opportunity

zones and other distressed neighborhood across America. Our FINTEC operations would cover the basic areas of traditional banking-digitally

enhance, ML and AI enabled lending and insurance underwriting, areas of private equity, business lending and venture capital that invest

in young black entrepreneurs and seeding their viable business plans/ideas on block-chain-powered financial services delivery platform

that connects, black entrepreneurs, black borrowers, consumers, banks, and institutional investors.

Our real estate division invests in Opportunity Zones, Affordable Housing, and specialized real estate properties.

Corporate

History

GiveMePower

Corporation (the “PubCo” or “Company”), a Nevada corporation, was incorporated on June 7, 2001, to sell software

geared to end users and developers involved in the design, manufacture, and construction of engineered products located in Canada and

the United States. GiveMePower was originally incorporated in Alberta, Canada as GiveMePower.com Inc. on April 18, 2000, to sell software

and web-based services geared to businesses involved in the design, manufacture, and construction of engineered products throughout North

America. Effective September 15, 2000, the Company amended its Articles of Incorporation to change its corporate name to GiveMePower

Inc. The founder of the Company began the implementation of this business plan under his 100%-owned private company, Sundance Marketing

International Inc. (Sundance). Sundance has been in existence since 1991 and at one time was a market leader in the distribution of survey,

mapping and infrastructure design software in the Canadian marketplace. On April 15, 1999, Mr. Walton entered into a license agreement

with Felix Computer Aided Technologies GmbH (Felix) for the exclusive rights to distribute FCAD software in North America.

On

December 20, 2000, the Company entered into a Plan and Agreement of Reorganization to undertake a reverse merger with a National Quotation

Bureau public company called TelNet World Communications, Inc. (TelNet). TelNet was originally incorporated in the State of Utah on March

10, 1972, as Tropic Industries, Inc. (Tropic). Tropic became United Data Company, Incorporated on February 24, 1987, which became Pen

International, Inc. on March 21, 1994, and then TelNet World Communications, Inc. on March 4, 1998. TelNet had no operations nor any

working capital when the Company entered a reverse merger with it. GMP acquired the rights, title and interest to the domain name, givemepower.com

from Sundance on February 16, 2001. In addition, Sundance agreed to assign its existing customer base to GMP and further agreed that

it would terminate its license agreement with Felix immediately upon GMP securing its own agreement with Felix. GMP renegotiated the

exclusive rights to co-develop, re-brand and distribute FCAD software in North America effective February 16, 2001. Effective July 5,

2001, the Company changed the name of TelNet to GiveMePower Corporation and changed the domicile from Utah to Nevada.

The

PubCo has been dormant and non-operating since year 2009. PubCo is a public reporting company registered with the Securities Exchange

Commissioner (“SEC”). In November 2009, the Company filed Form 15D, Suspension of Duty to Report, and as a result, the Company

was not required to file any SEC forms since November 2009.

On

December 31, 2019, PubCo sold one Special 2019 series A preferred share (“Series A Share”) for $38,000 to Goldstein Franklin,

Inc. (“Goldstein”), a California corporation. One Series A Share is convertible to 100,000,000 shares of common stocks at

any time. The Series A Share also provided with 60% voting rights of the PubCo. On the same day, Goldstein sold one-member unit of Alpharidge

Capital, LLC (“Alpharidge”), a California limited liability corporation, representing 100% member owner of Alpharidge. As

a result, Alpharidge become a wholly owned subsidiary of PubCo as of December 31, 2019.

The

Company’s operating structure did not change as a result of the change of control, however, following the transaction on December

31, 2019, in which Goldstein Franklin, Inc. acquired control of the Company, Goldstein transferred one of its operating subsidiaries,

Alpharidge Capital LLC into GMPW to become one of the Company’s operating subsidiaries. As the result of above transaction, Alpharidge

Capital LLC became the Company’s wholly owned operating subsidiary of the Company.

On

September 16, 2020, as part of its sales of unregistered securities to Kid Castle Educational Corporation, company related to, and controlled

by GMPW President and CEO, the Company, for $3 in cash and 1,000,000 shares of its preferred stock, acquired 100% interest in, and control

of Community Economic Development Capital, LLC (“CED Capital”), a California Limited Liability Company, and 97% of the issued

and outstanding shares of Cannabinoid Biosciences, Inc. (“CBDX”), a California corporation. This transaction was accounted

for under the Consolidation Method using the variable interest entity (VIE) model wherein the Company consolidates all investees operating

results if the Company expects to assume more than 50% of another entity’s expected losses or gains. The 1,000,000 shares of our

preferred stock sold to Kid Castle Educational Corporation gave to Kid Castle, approximately 87% voting control of Givemepower Corporation.

On

April 21, 2021, the Company sold Cannabinoid Biosciences, Inc. (“CBDX”), a California corporation, to Premier Information

Management, Inc. for $1 in cash. As further consideration pursuant to the stated sales, CBDX returned Kid Castle Educational Inc., the

parent Company of GMPW, the 100,000 shares of KDCE preferred stock and 900,000,000 shares of KDCE common stock that CBDX bought in October

of 2019. Pursuant to the April 21, 2021 transaction, CBDX ceased from being a subsidiary of GMPW, effective April 1, 2021.

On

December 30, 2021, in exchange for the 87% control block held by Kid Castle Educational Corporation, a subsidiary of Video River Networks,

Inc. both of which are publicly traded companies with ticker symbols KDCE and NIHK respectively, the Company sold Alpharidge Capital

LLC to KDCE.

The

consolidated financial statements of the Company therefore include the 12 months operating results of the all wholly owned subsidiaries

of Community Economic Development Capital, LLC. (“CED Capital”), and the balance sheet represent the financial position as

at 12/31/2022 and 9/30/2023 of the Company and subsidiaries including CED Capital. Others include subsidiaries in which GiveMePower has

a controlling voting interest and entities consolidated under the variable interest entities (“VIE”) provisions of ASC 810,

“Consolidation” (“ASC 810”), after elimination of intercompany transactions and accounts.

With

the proceeds from this Offering, we intend to actualize our banking and financial services operations goals which comprises of (1) a

one-to-four branch bank that is federally licensed in each jurisdiction; (2) a machine learning (ML) and artificial intelligence (Ai)

enabled loan and insurance underwriting platform; (3) blockchain-powered transaction processing and payment systems; (4) cryptocurrency

transaction processing platform; and (5) boost our affordable housing portfolio with acquisition of select multi-family properties; a

combination of three of which would connects consumers, banks, institutional investors, and ensure access to the unbanked and underserved

residents of majorly black communities across the United State of America. All five sub-divisions would operate together as a modern

digitized banking and financial services provider focusing to giving access to black entrepreneurs, black borrowers, consumers, banks,

and institutional investors.

General

Overview (1) - Proposed Federally licensed one-four branch bank

GMPW

intend to use part of the proceeds from this Offering to acquire and manage one-four branch bank in each of its relevant jurisdictional

in the United States. Owning/controlling a bank or banks with branches across every urban/black neighborhood in the United States is

not our goal. Rather we would be content to own a one-four branch bank in every relevant jurisdiction to allow us to initiate/conduct

ML-Ai enabled and blockchain-powered digitized banking that is accessible to all black person and businesses across the United States.

We intend to start our banking acquisition by finding targets that operate one-four branches. We intend to start with the acquisition

of one-four branch bank, whose operation and back-office would be migrated unto a Blockchain-powered platform to digitize its entire

banking operation to cover and serve all black persons in the United States. We believe that blockchain technology is one of the most

suited platforms to implement, run and manage a U.S. wide digitized banking services whose reach encompasses most black persons living

in the United States. The beauty of such a platform is that: (i) Blockchain records and validates each and every transaction; (ii) Blockchain

does not require third-party authorization; and (iii) Blockchain is decentralized.

General

Overview (2) – Proposed Cloud-Based Machine-Learning and Artificial Intelligence (AI) Lending and Insurance Underwriting Platform

The

completion of this Offering will launch the Company’s cloud-based machine learning and artificial intelligence lending platform.

It is our believe that Machine-Learning (ML) and Artificial intelligence (AI), lending and insurance underwriting platform would enable

a superior loan product with improved economics that can be shared between consumers and lenders. The proposed platform would aggregate

consumer demand for high-quality loans and connects it to our soon-to-be-build network of ML-AI-enabled investors, lenders and bank partners.

Consumers on the ML-AI platform would benefit from a highly automated, efficient, all-digital experience. Our prospective bank partners

would benefit from access to new customers, lower fraud and loss rates, and increased automation throughout the lending process.

The

ML- AI Lending Platform Opportunity

The

ML- AI lending platform and models would be central to our value proposition in the Banking and financial services industry. The models

would incorporate thousands of variables, which would be analogous to the columns in a spreadsheet. They would be trained by million

projected repayment events, analogous to rows of data in a spreadsheet. Interpreting these billions of cells of data would be a sophisticated

machine learning algorithm that enables a more predictive model.

Proposed

ML-AI Lending Platform Ecosystem

The

proposed model will connect consumers, banks and institutional investors through a shared ML-AI lending platform. Because

ML-AI is a new and disruptive technology, and banking is a traditionally conservative industry, we intend to bring the technology to

market in a way that allows us to grow rapidly and improve on the ML-ML- AI models, while allowing banks to take a prudent and responsible

approach to assessing and adopting our platform.

General

Overview (3-4) – Proposed Blockchain-Powered Digital Currency Payment and Financial Transactions Processing platform (“Blackchain”)

We

intend to use part of the proceed from this Offering to acquire an existing, or build-from-the-scratch, a Blockchain-Powered Digital

Currency Payment and Financial Transactions Processing platform (“Blackchain”), with home in the Bank alongside the ML-AI

lending platform. Blockchain-powered Payment and Financial Transactions Processing platform would also provide efficient and inexpensive

payment platform and merchant services to black businesses across the United States.

The

company would establish an exchange network called Blackchain Exchange Network (“BEN”), a Payment and Financial Transactions

Processing platform, would be a wholly owned subsidiary of the Bank. We believe Blackchain would be a leading provider of innovative

financial infrastructure solutions and services to participants in the nascent and expanding digital currency industry. Blackchain business

strategy is floating a Blackchain Exchange Network, or BEN, a virtually instantaneous payment network for participants in the digital

currency industry which would serve as a platform for the development of additional products and services. The BEN would have a network

effect that would make it valuable as participants and utilization increase, leading to good growth in BEN transaction volumes. The BEN

would enable the Bank to prioritize, build and significantly grow noninterest bearing deposit product for digital currency industry participants,

which is expected to provide most of our bank funding in the next two years from finalizing acquisition. This unique source of funding

would be a distinctive advantage over most traditional financial institutions and allows The Bank to generate revenue from a conservative

portfolio of investments in cash, short term securities and ML-Ai enabled loans that we believe generate attractive risk-adjusted returns.

In addition, use of the BEN would result in an increase in noninterest income that we believe will become a valuable source of additional

future revenue as we develop and deploy blockchain-powered, fee-based solutions in connection with our digital currency initiative. We

would also evaluate additional products or product enhancements specifically targeted at providing further financial infrastructure solutions

to our customers and strengthening BEN network effects.

Blackchain

Exchange Network

We

intend to design the BEN as a network of digital currency exchanges and digital currency investors that enables the efficient movement