As filed with the

Securities and Exchange Commission on January 24, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

SunHydrogen, Inc.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of

incorporation or organization)

26-4298300

I.R.S. Employer Identification Number

BioVentures Center,

2500 Crosspark Road,

Coralville, IA 52241

(805) 966-6566

(Address, including zip code, and telephone number,

including area code of registrant’s principal executive offices)

Timothy Young

Chief Executive Officer

SunHydrogen, Inc.

BioVentures Center

2500 Crosspark Road

Coralville, IA 52241

(805) 966-6566

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Gregory Sichenzia, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 31st Floor

New York, New York 10036

Phone: 212-930-9700

Approximate date of commencement of proposed sale to the public: From

time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection

with dividend or interest reinvestment plants, check the following box: ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the

Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth

company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of Securities Act. ☐

The information in this prospectus is

not complete and may be changed. We may not sell these securities until the registration statement relating to these securities that

has been filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any State where the offer or sale is not permitted.

(Subject to Completion,

Dated January 24, 2024)

PROSPECTUS

$100,000,000

SunHydrogen, Inc.

Common Stock

Preferred Stock

Warrants

Units

We may from time to time, in one or more offerings

at prices and on terms that we will determine at the time of each offering, sell common stock, preferred stock, warrants, or a combination

of these securities, or units, for an aggregate initial offering price of up to $100,000,000. This prospectus describes the general manner

in which our securities may be offered using this prospectus. Each time we offer and sell securities, we will provide you with a prospectus

supplement that will contain specific information about the terms of that offering. Any prospectus supplement may also add, update, or

change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement as

well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of the securities

offered hereby.

This prospectus may not be used to offer and sell

securities unless accompanied by a prospectus supplement.

Our common stock is currently traded on the OTCQB

under the symbol “HYSR.” On January 23, 2024, the last reported sales price for our common stock was $0.0120 per share. The

prospectus supplement will contain information, where applicable, as to any other listing of the securities on the OTCQB or any other

securities market or exchange covered by the prospectus supplement.

The securities offered by this prospectus involve

a high degree of risk. See “Risk Factors” beginning on page 3, in addition to Risk Factors contained in the applicable prospectus

supplement.

Neither the Securities and Exchange Commission

nor any State securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

We may offer the securities directly or through

agents or to or through underwriters or dealers. If any agents or underwriters are involved in the sale of the securities their names,

and any applicable purchase price, fee, commission or discount arrangement between or among them, will be set forth, or will be calculable

from the information set forth, in an accompanying prospectus supplement. We can sell the securities through agents, underwriters or dealers

only with delivery of a prospectus supplement describing the method and terms of the offering of such securities. See “Plan of Distribution.”

This prospectus is dated , 2024

Table of Contents

You should rely only on the information contained

or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information

different from that contained or incorporated by reference into this prospectus. If any person does provide you with information that

differs from what is contained or incorporated by reference in this prospectus, you should not rely on it. No dealer, salesperson or other

person is authorized to give any information or to represent anything not contained in this prospectus. You should assume that the information

contained in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information

contained in any document we have incorporated by reference is accurate only as of the date of the document incorporated by reference,

regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not

an offer to sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this shelf

registration process, we may sell any combination of the securities described in this prospectus in one of more offerings up to a total

dollar amount of proceeds of $100,000,000. This prospectus describes the general manner in which our securities may be offered by this

prospectus. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms

of that offering. The prospectus supplement may also add, update or change information contained in this prospectus or in documents incorporated

by reference in this prospectus. The prospectus supplement that contains specific information about the terms of the securities being

offered may also include a discussion of certain U.S. Federal income tax consequences and any risk factors or other special considerations

applicable to those securities. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements

made in this prospectus or in documents incorporated by reference in this prospectus, you should rely on the information in the prospectus

supplement. You should carefully read both this prospectus and any prospectus supplement together with the additional information described

under “Where You Can Find More Information” before buying any securities in this offering.

The terms “SunHydrogen,” the “Company,”

“we,” “our” or “us” in this prospectus refer to SunHydrogen, Inc., unless the context suggests otherwise.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and the documents and information

incorporated by reference in this prospectus include forward-looking statements. These forward-looking statements involve risks and uncertainties,

including statements regarding our capital needs, business strategy and expectations. Any statements that are not of historical fact may

be deemed to be forward-looking statements. In some cases you can identify forward-looking statements by terminology such as “may,”

“will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,”

“estimate,” “predict,” “potential,” or “continue”, the negative of the terms or other

comparable terminology. Actual events or results may differ materially from the anticipated results or other expectations expressed in

the forward-looking statements. In evaluating these statements, you should consider various factors, including the risks set forth under

“Risk Factors” herein and in the documents incorporated herein by reference. These factors may cause our actual results to

differ materially from any forward-looking statements. We disclaim any obligation to publicly update these statements, or disclose any

difference between actual results and those reflected in these statements, except as may be required under applicable law.

ABOUT SUNHYDROGEN

At SunHydrogen, our goal

is to replace fossil fuels with clean, renewable hydrogen.

Hydrogen is the most abundant

chemical element in the universe. When hydrogen fuel is used to power transportation and industry, the only byproduct left behind is pure

water, unlike hydrocarbon fuels such as oil, coal and natural gas that emit carbon dioxide and other harmful pollutants into the atmosphere.

However, naturally occurring elemental hydrogen is rare – so rare, in fact, that today about 95% of all hydrogen is produced from

steam reforming of natural gas (Source: US Department of Energy, Hydrogen Fuel Basics). This process is both economically

and environmentally unsound.

We are developing a technology

that we believe has the potential to offer an efficient and cost-effective way to produce truly green hydrogen using sunlight and

any source of water. Just like a solar panel is comprised of multiple cells that generate electricity, our hydrogen panel

encases multiple hydrogen generators immersed in water. Each hydrogen generator contains billions of electroplated nanoparticles, autonomously

splitting water into hydrogen and oxygen. Our technology has the potential to be one of – if not the most – economical green

hydrogen solutions: Unlike traditional water electrolysis for hydrogen, our process requires no external power other than sunlight and

uses efficient and low-cost materials.

We believe renewable hydrogen

has already proven itself to be a key solution in helping the world meet climate targets, and we believe our technology potentially offers

solutions to the challenges that the hydrogen future presents, including cost of production and transportation. Many of today’s

green hydrogen producers transport their product over long distances, so although the hydrogen itself is green, the delivery and transport

infrastructure comes with a high carbon footprint and a significant capital investment. The SunHydrogen solution is fully self-contained,

offering on-site solar hydrogen generation and local distribution to eliminate carbon footprint altogether and significantly reduce capital

investments for transport and delivery.

Additionally, because

our process directly uses the electrical charges created by sunlight to generate hydrogen, our nanoparticle technology does not rely on

grid power or require the costly power electronics that conventional electrolyzers do.

With a target cost of

$2.50/kg., we believe our solution has the potential to clear a path for green hydrogen to compete with natural gas hydrogen and gain

mass market acceptance as a true replacement for fossil fuels.

Our technology is primarily

developed at our independent laboratory in Coralville, Iowa. Development efforts are also aided by our sponsored research agreements with

the University of Iowa and the University of Michigan, and by our relationships with specialized industry partners.

Our principal executive offices are located at

BioVentures Center, 2500 Crosspark Road, Coralville, IA 52241. Our telephone number is (805) 966-6566. We maintain an Internet website

at www.sunhydrogen.com. The information contained on, connected to or that can be accessed via our website is not part of this prospectus.

We have included our website address in this prospectus as an inactive textual reference only and not as an active hyperlink.

RISK FACTORS

Investing in our securities involves a high degree

of risk. Before making an investment decision, you should consider carefully the risks, uncertainties and other factors described in our

most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports on Form 10-Q and current reports on

Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this prospectus.

Our business, affairs, prospects, assets, financial

condition, results of operations and cash flows could be materially and adversely affected by these risks. For more information about

our SEC filings, please see “Where You Can Find More Information”.

USE OF PROCEEDS

Unless otherwise indicated in a prospectus supplement,

we intend to use the net proceeds from the sale of the securities under this prospectus for general corporate purposes, including working

capital.

DESCRIPTION OF COMMON STOCK

General

We are authorized to issue 10,000,000,000 shares

of common stock, $0.001 par value per share.

Holders of the Company’s common stock are

entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting

rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors

to our board of directors. Holders of the Company’s common stock representing a majority of the voting power of the Company’s

common stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any

meeting of stockholders. A vote by the holders of a majority of the Company’s outstanding shares is required to effectuate certain

fundamental corporate changes such as a liquidation, merger or an amendment to the Company’s articles of incorporation

Subject to the rights of preferred stockholders

(if any), holders of the Company’s common stock are entitled to share in all dividends that the Board of Directors, in its discretion,

declares from legally available funds. In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder

to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having

preference over the common stock. The Company’s common stock has no pre-emptive rights, no conversion rights, and there are no redemption

provisions applicable to the Company’s common stock.

Transfer Agent and Registrar

The transfer agent and registrar for our common

stock is Worldwide Stock Transfer, LLC.

Listing

Our common stock is currently traded on the OTCQB

under the symbol “HYSR”.

DESCRIPTION OF PREFERRED STOCK

We are authorized to issue up to 5,000,000 shares

of preferred stock, par value $0.001 per share, from time to time, in one or more series. We do not have any outstanding shares of preferred

stock.

Our articles of incorporation authorizes our board

of directors to issue preferred stock from time to time with such designations, preferences, conversion or other rights, voting powers,

restrictions, dividends or limitations as to dividends or other distributions, qualifications or terms or conditions of redemption as

shall be determined by the board of directors for each class or series of stock. Preferred stock is available for possible future financings

or acquisitions and for general corporate purposes without further authorization of stockholders unless such authorization is required

by applicable law, or any securities exchange or market on which our stock is then listed or admitted to trading.

Our board of directors may authorize the issuance

of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of common

stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes

could, under some circumstances, have the effect of delaying, deferring or preventing a change-in-control of the Company.

A prospectus supplement relating to any series

of preferred stock being offered will include specific terms relating to the offering. Such prospectus supplement will include:

| |

● |

the title and stated or par value of the preferred stock; |

| |

● |

the number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred stock; |

| |

● |

the dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable to the preferred stock; |

| |

● |

whether dividends shall be cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred stock shall accumulate; |

| |

● |

the provisions for a sinking fund, if any, for the preferred stock; |

| |

● |

any voting rights of the preferred stock; |

| |

● |

the provisions for redemption, if applicable, of the preferred stock; |

| |

● |

any listing of the preferred stock on any securities exchange; |

| |

● |

the terms and conditions, if applicable, upon which the preferred stock will be convertible into our common stock, including the conversion price or the manner of calculating the conversion price and conversion period; |

| |

● |

if appropriate, a discussion of Federal income tax consequences applicable to the preferred stock; and |

| |

● |

any other specific terms, preferences, rights, limitations or restrictions of the preferred stock. |

The terms, if any, on which the preferred stock

may be convertible into or exchangeable for our common stock will also be stated in the preferred stock prospectus supplement. The terms

will include provisions as to whether conversion or exchange is mandatory, at the option of the holder or at our option, and may include

provisions pursuant to which the number of shares of our common stock to be received by the holders of preferred stock would be subject

to adjustment.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of preferred

stock or common stock. Warrants may be issued independently or together with any preferred stock or common stock, and may be attached

to or separate from any offered securities. Each series of warrants will be issued under a separate warrant agreement to be entered into

between a warrant agent specified in the agreement and us. The warrant agent will act solely as our agent in connection with the warrants

of that series and will not assume any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants.

This summary of some provisions of the warrants is not complete. You should refer to the warrant agreement, including the forms of warrant

certificate representing the warrants, relating to the specific warrants being offered for the complete terms of the warrant agreement

and the warrants. The warrant agreement, together with the terms of the warrant certificate and warrants, will be filed with the SEC in

connection with the offering of the specific warrants.

The applicable prospectus supplement will describe

the following terms, where applicable, of the warrants in respect of which this prospectus is being delivered:

| |

● |

the title of the warrants; |

| |

● |

the aggregate number of the warrants; |

| |

● |

the price or prices at which the warrants will be issued; |

| |

● |

the designation, amount and terms of the offered securities purchasable upon exercise of the warrants; |

| |

● |

if applicable, the date on and after which the warrants and the offered securities purchasable upon exercise of the warrants will be separately transferable; |

| |

● |

the terms of the securities purchasable upon exercise of such warrants and the procedures and conditions relating to the exercise of such warrants; |

| |

● |

any provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price of the warrants; |

| |

● |

the price or prices at which and currency or currencies in which the offered securities purchasable upon exercise of the warrants may be purchased; |

| |

● |

the date on which the right to exercise the warrants shall commence and the date on which the right shall expire; |

| |

● |

the minimum or maximum amount of the warrants that may be exercised at any one time; |

| |

● |

information with respect to book-entry procedures, if any; |

| |

● |

if appropriate, a discussion of Federal income tax consequences; and |

| |

● |

any other material terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants. |

Warrants for the purchase of common stock or preferred

stock will be offered and exercisable for U.S. dollars only. Warrants will be issued in registered form only.

Upon receipt of payment and the warrant certificate

properly completed and duly executed at the corporate trust office of the warrant agent or any other office indicated in the applicable

prospectus supplement, we will, as soon as practicable, forward the purchased securities. If less than all of the warrants represented

by the warrant certificate are exercised, a new warrant certificate will be issued for the remaining warrants.

Prior to the exercise of any warrants to purchase

preferred stock or common stock, holders of the warrants will not have any of the rights of holders of the common stock or preferred stock

purchasable upon exercise, including in the case of warrants for the purchase of common stock or preferred stock, the right to vote or

to receive any payments of dividends on the preferred stock or common stock purchasable upon exercise.

DESCRIPTION OF UNITS

As may specified in the applicable prospectus supplement,

we may issue units consisting of shares of common stock, shares of preferred stock or warrants or any combination of such securities.

The applicable prospectus supplement will specify

the following terms of any units in respect of which this prospectus is being delivered:

| |

● |

the terms of the units and of any of the common stock, preferred stock and warrants comprising the units, including whether and under what circumstances the securities comprising the units may be traded separately; |

| |

● |

a description of the terms of any unit agreement governing the units; and |

| |

● |

a description of the provisions for the payment, settlement, transfer or exchange of the units. |

PLAN OF DISTRIBUTION

We may sell the securities offered through this

prospectus (i) to or through underwriters or dealers, (ii) directly to purchasers, including our affiliates, (iii) through agents, (iv)

directly to our stockholders, including as a dividend or distribution or in a subscription rights offering; (v) in “at the market” offerings,

within the meaning of Rule 415(a)(4) under the Securities Act, to or through a market maker or into an existing trading

market on an exchange or otherwise; or (vi) through a combination of any these methods.

The securities may be distributed at a fixed price

or prices, which may be changed, market prices prevailing at the time of sale, prices related to the prevailing market prices, or negotiated

prices. The prospectus supplement will include the following information:

| |

● |

the terms of the offering; |

| |

● |

the names of any underwriters or agents; |

| |

● |

the name or names of any managing underwriter or underwriters; |

| |

● |

the purchase price of the securities; |

| |

● |

any over-allotment options under which underwriters may purchase additional securities from us; |

| |

● |

the net proceeds from the sale of the securities; |

| |

● |

any delayed delivery arrangements; |

| |

● |

any underwriting discounts, commissions and other items constituting underwriters’ compensation; |

| |

● |

any initial public offering price; |

| |

● |

any discounts or concessions allowed or reallowed or paid to dealers; |

| |

● |

any commissions paid to agents; and |

| |

● |

any securities exchange or market on which the securities may be listed. |

Sale Through Underwriters or Dealers

Only underwriters named in the prospectus supplement

are underwriters of the securities offered by the prospectus supplement.

If underwriters are used in the sale, the underwriters

will acquire the securities for their own account, including through underwriting, purchase, security lending or repurchase agreements

with us. The underwriters may resell the securities from time to time in one or more transactions, including negotiated transactions.

Underwriters may sell the securities in order to facilitate transactions in any of our other securities (described in this prospectus

or otherwise), including other public or private transactions and short sales. Underwriters may offer securities to the public either

through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting as underwriters.

Unless otherwise indicated in the prospectus supplement, the obligations of the underwriters to purchase the securities will be subject

to certain conditions, and the underwriters will be obligated to purchase all the offered securities if they purchase any of them. The

underwriters may change from time to time any initial public offering price and any discounts or concessions allowed or reallowed or paid

to dealers.

If dealers are used in the sale of securities offered

through this prospectus, we will sell the securities to them as principals. They may then resell those securities to the public at varying

prices determined by the dealers at the time of resale. The prospectus supplement will include the names of the dealers and the terms

of the transaction.

Direct Sales and Sales Through Agents

We may sell the securities offered through this

prospectus directly. In this case, no underwriters or agents would be involved. Such securities may also be sold through agents designated

from time to time. The prospectus supplement will name any agent involved in the offer or sale of the offered securities and will describe

any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement, any agent will agree to use its reasonable

best efforts to solicit purchases for the period of its appointment.

We may sell the securities directly to institutional

investors or others who may be deemed to be underwriters within the meaning of the Securities Act with respect to any sale of those securities.

The terms of any such sales will be described in the prospectus supplement.

Delayed Delivery Contracts

If the prospectus supplement indicates, we may

authorize agents, underwriters or dealers to solicit offers from certain types of institutions to purchase securities at the public offering

price under delayed delivery contracts. These contracts would provide for payment and delivery on a specified date in the future. The

contracts would be subject only to those conditions described in the prospectus supplement. The applicable prospectus supplement will

describe the commission payable for solicitation of those contracts.

Continuous Offering Program

Without limiting the generality of the foregoing,

we may enter into a continuous offering program equity distribution agreement with a broker-dealer, under which we may offer and sell

shares of our common stock from time to time through a broker-dealer as our sales agent. If we enter into such a program, sales of the

shares of common stock, if any, will be made by means of ordinary brokers’ transactions on the OTCQB or other market on which are

shares may then trade at market prices, block transactions and such other transactions as agreed upon by us and the broker-dealer. Under

the terms of such a program, we also may sell shares of common stock to the broker-dealer, as principal for its own account at a price

agreed upon at the time of sale. If we sell shares of common stock to such broker-dealer as principal, we will enter into a separate terms

agreement with such broker-dealer, and we will describe this agreement in a separate prospectus supplement or pricing supplement.

Market Making, Stabilization and Other Transactions

Unless the applicable prospectus supplement states

otherwise, other than our common stock, all securities we offer under this prospectus will be a new issue and will have no established

trading market. We may elect to list offered securities on an exchange or in the over-the-counter market. Any underwriters that we use

in the sale of offered securities may make a market in such securities, but may discontinue such market making at any time without notice.

Therefore, we cannot assure you that the securities will have a liquid trading market.

Any underwriter may also engage in stabilizing

transactions, syndicate covering transactions and penalty bids in accordance with Rule 104 under the Securities Exchange Act. Stabilizing

transactions involve bids to purchase the underlying security in the open market for the purpose of pegging, fixing or maintaining the

price of the securities. Syndicate covering transactions involve purchases of the securities in the open market after the distribution

has been completed in order to cover syndicate short positions.

Penalty bids permit the underwriters to reclaim

a selling concession from a syndicate member when the securities originally sold by the syndicate member are purchased in a syndicate

covering transaction to cover syndicate short positions. Stabilizing transactions, syndicate covering transactions and penalty bids may

cause the price of the securities to be higher than it would be in the absence of the transactions. The underwriters may, if they commence

these transactions, discontinue them at any time.

General Information

Agents, underwriters, and dealers may be entitled,

under agreements entered into with us, to indemnification by us against certain liabilities, including liabilities under the Securities

Act. Our agents, underwriters, and dealers, or their affiliates, may be customers of, engage in transactions with or perform services

for us, in the ordinary course of business.

LEGAL MATTERS

The validity of the issuance of the securities

offered by this prospectus will be passed upon for us by Sichenzia Ross Ference Carmel LLP, New York, New York.

EXPERTS

The financial statements of SunHydrogen, Inc. as

of and for the year ended June 30, 2023 and 2022 appearing in SunHydrogen, Inc.’s Annual Report on Form 10-K for the year ended

June 30, 2023, have been audited by M&K CPAS, PLLC, as set forth in its report thereon, included therein, and incorporated herein

by reference. Such financial statements are incorporated herein by reference in reliance upon such report given on the authority of such

firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and special reports,

along with other information with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements,

and other information regarding issuers that file electronically with the SEC. Our SEC filings are available to the public over the Internet

at the SEC’s website at http://www.sec.gov.

This prospectus is part of a registration statement

on Form S-3 that we filed with the SEC to register the securities offered hereby under the Securities Act of 1933, as amended. This prospectus

does not contain all of the information included in the registration statement, including certain exhibits and schedules. You may obtain

the registration statement and exhibits to the registration statement from the SEC’s internet site.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

This prospectus is part of a registration statement

filed with the SEC. The SEC allows us to “incorporate by reference” into this prospectus the information that we file with

them, which means that we can disclose important information to you by referring you to those documents. The information incorporated

by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and

supersede this information. The following documents are incorporated by reference and made a part of this prospectus:

| |

● |

our Annual Report on Form 10-K for the year ended June 30, 2023 filed with the SEC on September

29, 2023; |

| |

● |

our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023 filed with

the SEC on November 13, 2023; |

| |

● |

our Current Reports on Form 8-K filed with the SEC on August 29, 2023; and |

| |

● |

the description of our common stock contained in the our Registration Statement on Form 8-A filed with the SEC on June 14, 2011 (File No. 000-54437), including any amendment or report filed for the purpose of updating such description. |

All documents that we file with the SEC pursuant

to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act subsequent to the date of this registration statement and prior to the filing

of a post-effective amendment to this registration statement that indicates that all securities offered under this prospectus have been

sold, or that deregisters all securities then remaining unsold, will be deemed to be incorporated in this registration statement by reference

and to be a part hereof from the date of filing of such documents.. Nothing in this prospectus shall be deemed to incorporate information

furnished but not filed with the SEC (including without limitation, information furnished under Item 2.02 or Item 7.01 of Form 8-K, and

any exhibits relating to such information).

Any statement contained in this prospectus or in

a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for

purposes of this prospectus to the extent that a statement contained herein or in the applicable prospectus supplement or in any other

subsequently filed document which also is or is deemed to be incorporated by reference modifies or supersedes the statement. Any statement

so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

The information about us contained in this prospectus

should be read together with the information in the documents incorporated by reference. You may request a copy of any or all of these

filings, at no cost, by writing or telephoning us at: Timothy Young, BioVentures Center, 2500 Crosspark Road, Coralville IA, 52241 (805)

966-6566.

$100,000,000

Common Stock

Preferred Stock

Warrants

Units

SunHydrogen, Inc.

Prospectus

, 2024

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the costs and expenses

payable by the Registrant in connection with this offering, other than underwriting commissions and discounts, all of which are estimated

except for the SEC registration fee.

| SEC registration fee | |

$ | 14,760 | |

| Printing | |

$ | * | |

| Legal fees and expenses | |

$ | * | |

| Accounting fees and expenses | |

$ | * | |

| Warrant Agent Fees and Expenses | |

$ | * | |

| Miscellaneous | |

$ | * | |

| Total | |

$ | * | |

| * |

These fees are calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time. The applicable prospectus supplement will set forth the estimated amount of expenses of any offering of securities. |

Item 15. Indemnification of Directors and Officers.

Neither our Articles of Incorporation nor Bylaws

prevent us from indemnifying our officers, directors and agents to the extent permitted under the Nevada Revised Statute (“NRS”).

NRS Section 78.7502 provides that a corporation shall indemnify any director, officer, employee or agent of a corporation against expenses,

including attorneys’ fees, actually and reasonably incurred by him in connection with any defense to the extent that a director,

officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding

referred to in Section 78.7502(1) or 78.7502(2), or in defense of any claim, issue or matter therein.

NRS 78.7502(1) provides that a corporation may

indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or

proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason

of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation

as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses,

including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection

with the action, suit or proceeding if he: (a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner which

he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding,

had no reasonable cause to believe his conduct was unlawful.

NRS Section 78.7502(2) provides that a corporation

may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit

by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director, officer,

employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent

of another corporation, partnership, joint venture, trust or other enterprise against expenses, including amounts paid in settlement and

attorneys’ fees actually and reasonably incurred by him in connection with the defense or settlement of the action or suit if he:

(a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner which he reasonably believed to be in or not opposed

to the best interests of the corporation. Indemnification may not be made for any claim, issue or matter as to which such a person has

been adjudged by a court of competent jurisdiction, after exhaustion of all appeals there from, to be liable to the corporation or for

amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought or

other court of competent jurisdiction determines upon application that in view of all the circumstances of the case, the person is fairly

and reasonably entitled to indemnity for such expenses as the court deems proper.

NRS Section 78.747 provides that except as otherwise

provided by specific statute, no director or officer of a corporation is individually liable for a debt or liability of the corporation,

unless the director or officer acts as the alter ego of the corporation. The court as a matter of law must determine the question of whether

a director or officer acts as the alter ego of a corporation.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have

been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is

therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant

of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit

or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will,

unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by us is against public policy as expressed hereby in the Securities Act and we will be governed

by the final adjudication of such issue.

Item 16. Exhibits.

| Exhibit |

|

|

| Number |

|

Description of Document |

| 1.1 |

|

Form of Underwriting Agreement.* |

| 4.1 |

|

Articles of Incorporation of filed with the Nevada Secretary of State on February 18, 2009 (incorporated by reference to Form S-1 filed on February 5, 2010) |

| 4.2 |

|

Articles of Amendment of Articles of Incorporation filed with the Nevada Secretary of State on September 11, 2009 (incorporated by reference to Form S-1 filed on February 5, 2010) |

| 4.3 |

|

Articles of Amendment of Articles of Incorporation of filed with the Nevada Secretary of State on November 21, 2013 (incorporated by reference to Form 8-K filed on November 21, 2013) |

| 4.4 |

|

Articles of Amendment of Articles of Incorporation filed with the Nevada Secretary of State on September 13, 2018. (incorporated by reference to the Company’s annual report on Form 10-K filed with the Securities and Exchange Commission on September 25, 2018) |

| 4.5 |

|

Certificate of Designation of Series A Preferred Stock (incorporated by reference to the Company’s Form 8-K filed on February 2, 2022) |

| 4.6 |

|

Certificate of Designation of Series B Preferred Stock (incorporated by reference to 8-K filed November 26, 2019) |

| 4.7 |

|

Certificate of Designation of Series C Preferred Stock (incorporated

by reference to the Company’s Form 8-K filed on December 17, 2021) |

| 4.8 |

|

Certificate of Amendment to Articles of Incorporation (incorporated by reference to Form 8-K filed January 3, 2020) |

| 4.9 |

|

Articles of Merger (incorporated by reference to Form 8-K filed June 15, 2020) |

| 4.10 |

|

Amended and Restated Bylaws (incorporated by reference to Form 8-K filed February 2, 2022) |

| 4.11 |

|

Form of Certificate of Designation.* |

| 4.12 |

|

Form of Preferred Stock Certificate.* |

| 4.13 |

|

Form of Warrant Agreement.* |

| 4.14 |

|

Form of Warrant Certificate.* |

| 4.15 |

|

Form of Stock Purchase Agreement.* |

| 4.16 |

|

Form of Unit Agreement.* |

| 5.1 |

|

Opinion of Sichenzia Ross Ference Carmel LLP |

| 23.1 |

|

Consent of M&K CPAS, PLLC |

| 23.2 |

|

Consent of Sichenzia Ross Ference Carmel LLP (contained in Exhibit 5.1) |

| 107 |

|

Filing Fee Table |

| * |

To be filed by amendment or by a Current Report on Form 8-K and incorporated by reference herein. |

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made,

a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities

Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after

the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate,

represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase

or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered)

and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with

the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the

maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement.

(iii) To include any material information with respect to the plan

of distribution not previously disclosed in the registration statement or any material change to such information in the registration

statement;

provided, however, Paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii)

of this section do not apply if the registration statement is on Form S-3 or Form F-3 and the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant

to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement,

or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities

Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment

any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities

Act of 1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3)

shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration

statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2),

(b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i),

(vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to

be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness

or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability

purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the

registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of

such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in

a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated

by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time

of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus

that was part of the registration statement or made in any such document immediately prior to such effective date; or

(5) That, for the purpose of determining liability of the registrant

under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes

that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting

method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following

communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to

such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant

relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared

by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to

the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned

registrant; and

(iv) Any other communication that is an offer in the offering made

by the undersigned registrant to the purchaser.

(b) The registrant hereby undertakes that for purposes of determining

any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section

15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant

to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities

Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or

otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against

public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Act and will be governed by the final adjudication of such issue.

(d) The registrant hereby undertakes that:

(1) For purposes of determining any liability under the Securities

Act, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained

in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to

be part of this registration statement as of the time it was declared effective.

(2) For the purpose of determining any liability under the Securities

Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Santa Barbara, State of California, on January 24, 2024.

| |

SunHydrogen, Inc. |

| |

|

|

| |

By: |

/s/ Timothy Young |

| |

|

Timothy Young |

| |

Its: |

Chief Executive Officer and

Acting Chief Financial Officer |

| |

|

(principal executive, financial and accounting officer) |

Each person whose signature appears below constitutes

and appoints Timothy Young, as his true and lawful attorney in fact and agent, with full powers of substitution and re-substitution, for

him and in his name, place and stead, in any and all capacities, to sign any or all amendments (including post effective amendments) to

the Registration Statement, and to sign any registration statement for the same offering covered by this Registration Statement that is

to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and all post effective amendments thereto,

and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorney-in-fact and agent, each acting alone, full power and authority to do and perform each and every act and thing

requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person,

hereby ratifying and confirming all that said attorney-in-fact and agent, each acting alone, or his or her substitute or substitutes,

may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed below by the following persons in the capacities and on the dates indicated.

| Name |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Timothy Young |

|

Chief Executive Officer, Acting Chief Financial Officer

and Director

(principal executive, financial and accounting officer) |

|

January 24, 2024 |

| Timothy Young |

|

|

|

| |

|

|

|

|

| /s/ Woosuk Kim |

|

Chief Operating Officer and Director |

|

January 24, 2024 |

| Woosuk Kim |

|

|

|

| |

|

|

|

|

| |

|

Director |

|

|

| Mark Richardson |

|

|

|

II-5

Exhibit 5.1

January 24, 2024

SunHydrogen Inc.

BioVentures Center, 2500 Crosspark Road

Coralville, IA 52241

Re: Registration Statement

on Form S-3

Ladies and Gentlemen:

We have acted as counsel to

SunHydrogen, Inc., a Nevada corporation (the “Company”), in connection with the registration, pursuant to a registration statement

on Form S-3 (the “Registration Statement”), filed by the Company with the Securities and Exchange Commission (the “Commission”)

under the Securities Act of 1933, as amended (the “Act”), relating to the offering and sale from time to time, as set forth

in the Registration Statement, the form of prospectus contained therein (the “Prospectus”), and one or more supplements to

the Prospectus (each, a “Prospectus Supplement”), by the Company of up to $100,000,000 aggregate initial offering price of

securities consisting of (i) shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”),

(ii) shares of the Company’s preferred stock, par value $0.001 per share (the “Preferred Stock”), (iii) warrants (“Warrants”)

to purchase Common Stock or Preferred Stock, or (iv) units consisting of Common Stock, Preferred Stock, or Warrants, or any combination

thereof, in one or more series (the “Units”). The Common Stock, Preferred Stock, Warrants and Units are collectively referred

to herein as the “Securities.”

We have examined originals

or certified copies of such corporate records of the Company and other certificates and documents of officials of the Company, public

officials and others as we have deemed appropriate for purposes of this letter. We have assumed the genuineness of all signatures, the

legal capacity of each natural person signing any document reviewed by us, the authority of each person signing in a representative capacity

(other than the Company) any document reviewed by us, the authenticity of all documents submitted to us as originals and the conformity

to authentic original documents of all copies submitted to us or filed with the Commission as conformed and certified or reproduced copies.

As to any facts material to our opinion, we have made no independent investigation of such facts and have relied, to the extent that we

deem such reliance proper, upon certificates of public officials and officers or other representatives of the Company.

Based upon the foregoing and

subject to the assumptions, exceptions, qualifications and limitations set forth herein, we are of the opinion that:

1. With respect to Securities

constituting Common Stock to be sold by the Company, when (i) the Company has taken all necessary action to authorize and approve the

issuance of such Common Stock, the terms of the offering thereof and related matters and (ii) such Common Stock has been issued and delivered,

with certificates representing such Common Stock having been duly executed, countersigned, registered and delivered or, if uncertificated,

valid book-entry notations therefor having been made in the share register of the Company, in accordance with the terms of the applicable

definitive purchase, underwriting or similar agreement or, if such Common Stock is issuable upon the exercise of Warrants, the applicable

warrant agreement therefor, against payment (or delivery) of the consideration therefor provided for therein, such Common Stock (including

any Common Stock duly issued upon exercise of Warrants that are exercisable to purchase Common Stock) will have been duly authorized and

validly issued and will be fully paid and non-assessable.

1185 AVENUE OF THE AMERICAS

| 31ST FLOOR | NEW YORK, NY | 10036

T (212) 930-9700 | F (212) 930-9725 | WWW.SRFC.LAW

2. With respect to Securities

constituting Preferred Stock, when (i) the Company has taken all necessary action to authorize and approve the issuance and terms of the

shares of the series of such Preferred Stock, the terms of the offering thereof and related matters, including the adoption of a resolution

fixing the number of shares in any series of Preferred Stock and the designation of relative rights, preferences and limitations in any

series of Preferred Stock and the filing of a certificate of designation with respect to the series with the Secretary of State of the

State of Nevada as required by Section 78.1955 of the Nevada Revised Statutes and (ii) such Preferred Stock has been issued and delivered,

with certificates representing such Preferred Stock having been duly executed, countersigned, registered and delivered or, if uncertificated,

valid book-entry notations therefor having been made in the share register of the Company, in accordance with the terms of the applicable

definitive purchase, underwriting or similar agreement or, if such Preferred Stock is issuable upon the exercise of Warrants, the applicable

warrant agreement therefor, against payment (or delivery) of the consideration therefor provided for therein, such Preferred Stock (including

any Preferred Stock duly issued upon exercise of Warrants that are exercisable to purchase Preferred Stock) will have been duly authorized

and validly issued and will be fully paid and non-assessable.

3. With respect to the Warrants,

when (i) the Board has taken all necessary corporate action to approve the creation of and the issuance and terms of the Warrants, the

terms of the offering thereof and related matters; (ii) the warrant agreement or agreements relating to the Warrants have been duly authorized

and validly executed and delivered by the Company and the warrant agent appointed by the Company; and (iii) the Warrants or certificates

representing the Warrants have been duly executed, countersigned, registered and delivered in accordance with the appropriate warrant

agreement or agreements and the applicable definitive purchase, underwriting or similar agreement approved by the Board, upon payment

of the consideration therefor provided for therein, the Warrants will be validly issued and will be valid and binding obligations of the

Company, enforceable against the Company in accordance with their terms.

4. With respect to Securities

constituting Units, when (i) the Board has taken all necessary corporate action to approve the creation of and the issuance and terms

of the Units, terms of the offering thereof and related matters; (ii) the agreement or agreements relating to the Securities comprising

the Units have been duly authorized and validly executed and delivered by the Company; and (iii) the certificates representing the Securities

comprising the Units have been duly executed, countersigned, registered and delivered in accordance with the appropriate agreements, the

Units will be valid and binding obligations of the Company enforceable against the Company in accordance with the their terms.

The opinions and other matters

in this letter are qualified in their entirety and subject to the following:

A. With respect to the opinions

above, we have assumed that, in the case of each offering and sale of Securities, (i) the Registration Statement, and any amendments thereto

(including post-effective amendments), will have become effective under the Act and such effectiveness or qualification shall not have

been terminated or rescinded; (ii) a Prospectus Supplement will have been prepared and filed with the Commission describing such Securities;

(iii) such Securities will have been issued and sold in compliance with applicable United States federal and state securities Laws (hereinafter

defined) and pursuant to and in the manner stated in the Registration Statement and the applicable Prospectus Supplement; (iv) unless

such Securities constitute Common Stock or Preferred Stock issuable upon exchange or conversion of Securities constituting Common Stock

or Preferred Stock, or Common Stock or Preferred Stock issuable upon exercise of Warrants, a definitive purchase, underwriting or similar

agreement with respect to the issuance and sale of such Securities will have been duly authorized, executed and delivered by the Company

and the other parties thereto; (v) at the time of the issuance of such Securities, (a) the Company will validly exist and be duly qualified

and in good standing under the laws of its jurisdiction of incorporation and (b) the Company will have the necessary corporate power and

due authorization; (vi) the terms of such Securities and of their issuance and sale will have been established in conformity with and

so as not to violate, or result in a default under or breach of, the articles of incorporation and bylaws of the Company and any applicable

law or any agreement or instrument binding upon the Company and so as to comply with any requirement or restriction imposed by any court

or governmental or regulatory body having jurisdiction over the Company; (vii) if such Securities constitute Common Stock or Preferred

Stock, (a) sufficient shares of Common Stock or Preferred Stock will be authorized for issuance under the articles of incorporation of

the Company that have not otherwise been issued or reserved for issuance and (b) the consideration for the issuance and sale of such Common

Stock or Preferred Stock established by the Board and provided for in the applicable definitive purchase, underwriting or similar agreement

(or, if Common Stock or Preferred Stock is issuable upon exercise of Warrants, the applicable warrant agreement) will not be less than

the par value of such Common Stock or Preferred Stock; (viii) if such Securities constitute Common Stock or Preferred Stock issuable upon

exercise of Warrants, the action with respect to such Warrants referred to in Paragraph 3 above will have been taken; and (ix) if such

Securities constitute Warrants that are exercisable for Securities constituting Common Stock or Preferred Stock, the Company will have

then taken all necessary action to authorize and approve the issuance of such Common Stock or Preferred Stock upon exercise of such Warrants,

the terms of such exercise and related matters and to reserve such Common Stock or Preferred Stock for issuance upon such exercise.

1185 AVENUE OF THE AMERICAS

| 31ST FLOOR | NEW YORK, NY | 10036

T (212) 930-9700 | F (212) 930-9725 | WWW.SRFC.LAW

B. This letter is limited

to matters governed by Chapter 78 of the Nevada Revised Statutes and by the laws of the State of New York (“Laws”).

C. This letter is limited

to the matters stated herein, and no opinion is implied or may be inferred beyond the matters expressly stated. We assume herein no obligation,

and hereby disclaim any obligation, to make any inquiry after the date hereof or to advise you of any future changes in the foregoing

or of any fact or circumstance that may hereafter come to our attention.

D. The matters expressed in

this letter are subject to and qualified and limited by (i) applicable bankruptcy, insolvency, fraudulent transfer and conveyance, reorganization,

moratorium and similar laws affecting creditors’ rights and remedies generally, and (ii) general principles of equity, including

principles of commercial reasonableness, good faith and fair dealing (regardless of whether enforcement is sought in a proceeding at law

or in equity).

We hereby consent to the filing

of this opinion as Exhibit 5.1 to the Registration Statement and to the use of our name under the caption “Legal Matters”

in the Registration Statement and in the Prospectus and in any supplement thereto. In giving this consent, we do not thereby admit that

we are within the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission

promulgated thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ Sichenzia Ross Ference Carmel LLP |

| |

|

| |

Sichenzia Ross Ference Carmel LLP |

1185 AVENUE OF THE AMERICAS

| 31ST FLOOR | NEW YORK, NY | 10036

T (212) 930-9700 | F (212) 930-9725 | WWW.SRFC.LAW

3

Exhibit 23.1

CONSENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the inclusion in this

Registration Statement on Form S-3 of our report dated September 29, 2023, of SunHydrogen, Inc. relating to the audits of the consolidated

financial statements for the periods ended June 30, 2023 and 2022 and the reference to our firm under the caption “Experts”

in the Registration Statement.

| /s/ M&K CPAS,

PLLC |

|

| The Woodlands, Texas |

|

January 24, 2024

Exhibit 107

Calculation of Filing Fee Tables

Form S-3

(Form Type)

SUNHYDROGEN, INC.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward

Securities

| |

|

Security

Type |

|

Security

Class

Title |

|

Fee

Calculation or

Carry

Forward

Rule |

|

|

Amount

Registered |

|

|

Proposed

Maximum

Offering

Price Per

Share |

|

|

Maximum

Aggregate

Offering

Price |

|

|

Fee

Rate |

|

|

Amount

of

Registration

Fee |

|

|

Carry

Forward

Form

Type |

|

|

Carry

Forward

File

Number |

|

|

Carry

Forward

Initial

effective

date |

|

|

Filing

Fee

Previously

Paid In

Connection

with

Unsold

Securities

to be

Carried

Forward |

|

| Newly

Registered Securities |

|

| Fees

previously paid |

|

Equity |

|

Common

Stock, par value $0.001 per share |

|

|

457(o) |

|

|

|

|

(1) |

|

|

|

(1) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Equity |

|

Preferred

Stock, par value $0.001 per share |

|

|

457(o) |

|

|

|

|

(1) |

|

|

|

(1) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Other |

|

Warrants |

|

|

457(o) |

|

|

|

|

(1) |

|

|

|

(1) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Other |

|

Units |

|

|

457(o) |

|

|

|

|

(1) |

|

|

|

(1) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Unallocated

(Universal) Shelf |

|

- |

|

|

457(o) |

|

|

$ |

100,000,000 |

|

|

|

- |

|

|

$ |

100,000,000 |

(2) |

|

$ |

0.00014760 |

|

|

$ |

14,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

Offering Amounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

100,000,000 |

(2) |

|

$ |

0.00014760 |

|

|

$ |

14,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

Fees Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

Fee Offsets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net

Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

14,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

An indeterminate number or aggregate principal amount, as applicable, of securities of each identified class is being registered as may from time to time be offered on a primary basis at indeterminate prices, including an indeterminate number or amount of securities that may be issued upon the exercise, settlement, exchange or conversion of securities offered hereunder. Separate consideration may or may not be received for securities that are issuable upon conversion of, or in exchange for, or upon exercise of, convertible or exchangeable securities. Pursuant to Rule 416 under the Securities Act of 1933, as amended, or the Securities Act, this registration statement shall also cover any additional securities of the registrant that become issuable by reason of any splits, dividends or similar transactions or anti-dilution adjustments. |

| (2) |

Estimated solely for the purpose of calculating the registration fee. Subject to Rule 462(b) under the Securities Act, the aggregate initial offering price of all securities issued by the registrant pursuant to this registration statement will not exceed $100,000,000. |

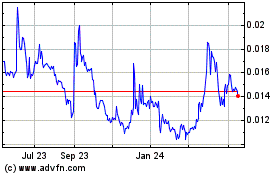

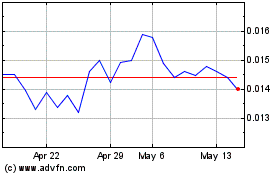

SunHydrogen (QB) (USOTC:HYSR)

Historical Stock Chart

From Jan 2025 to Feb 2025

SunHydrogen (QB) (USOTC:HYSR)

Historical Stock Chart

From Feb 2024 to Feb 2025