Amended Annual Report (10-k/a)

December 14 2021 - 2:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K/A

(Amendment No.2)

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the fiscal year ended June 30, 2021

|

or

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the transition period from _______ to ____________

|

Commission file number: 000-53314

|

Luvu Brands, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Florida

|

|

59-3581576

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(IRS Employer Identification No.)

|

|

2745 Bankers Industrial Drive, Atlanta, Georgia

|

|

30360

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (770) 246-6400

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.01 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ YES ☒ NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ YES ☒ NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ YES ☐ NO

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding twelve months (or for such shorter period that the registrant was required to submit such files) ☒ YES ☐ NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," “non-accelerated filer,” "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicated by check mark whether the registrant has filed a report on or attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ YES ☒ NO

The aggregate market value of the voting and non-voting common equity held by non−affiliates computed by reference to the price at which the common equity was last sold, or the average of the bid and asked price of such common equity, on December 31, 2020, the last trading day of the registrant’s most recently completed second fiscal quarter, was $5,237,829.

The number of shares of Common Stock, $.01 par value, outstanding as of the close of business on September 24, 2021 was 75,037,890.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

EXPLANATORY NOTE

We filed our Annual Report on Form 10-K for the fiscal year ended June 30, 2021 on September 28, 2021 and Amendment No. 1 to our Annual Report on Form 10-K for the fiscal year ended June 30, 2021 on September 28, 2021 (collectively, the “Original Filing”). This Amendment No. 2 to our Annual Report on Form 10-K for the fiscal year ended June 30, 2021 (the “Amendment”) is being filed solely for the purpose of filing as Exhibit 23.1 hereto the Independent Auditors Consent of Liggett & Webb, P.A., our independent auditors. The Independent Auditors Consent attached hereto as Exhibit 23.1, was accidently omitted from the Original Filing. The purpose of this Amendment is to correct the inadvertent failure to include Liggett & Webb, P.A.’s consent to incorporate by reference its September 28, 2021 report into the Company’s existing Registration Statement on Form S-8 (Registration No. 333-218942).

No attempt has been made in this Amendment to otherwise modify or amend disclosures contained in the Original Filing or to modify or update for events which occurred subsequent to the Original Filing. This Amendment does not change any previously reported financial results of operations or any disclosures contained in the Original Filing.

PART IV

ITEM 15. Exhibits, Financial Statement Schedules.

(a) Financial Statements; Schedules

Our consolidated financial statements for the fiscal years ended June 30, 2021 and 2020 begin on page F-1 of this annual report. We are not required to file any financial statement schedules.

(b) Exhibits.

|

|

|

|

|

Incorporated by Reference

|

|

Filed or

Furnished

Herewith

|

|

No.

|

|

Exhibit Description

|

|

Form

|

|

Date Filed

|

|

Number

|

|

|

2.1

|

|

Merger and Recapitalization Agreement between WES Consulting, Inc., the majority shareholder of WES Consulting, Inc., Luvu Brands, Inc., and the majority shareholder of Luvu Brands, Inc., dated as of October 19, 2009

|

|

8-K

|

|

10/22/09

|

|

2.1

|

|

|

|

2.2

|

|

Stock Purchase and Recapitalization Agreement between OneUp Acquisition, Inc., Remark Enterprises, Inc., OneUp Innovations, Inc., and Louis S. Friedman, dated March 31, 2009 and fully executed on April 3, 2009

|

|

8-K/A

|

|

3/24/10

|

|

2.2

|

|

|

|

2.3

|

|

Amendment No. 1 to Stock Purchase and Recapitalization Agreement, dated June 22, 2009

|

|

8-K/A

|

|

3/24/10

|

|

2.3

|

|

|

|

3.1

|

|

Amended and Restated Articles of Incorporation

|

|

SB-2

|

|

3/2/07

|

|

3i

|

|

|

|

3.2

|

|

Bylaws

|

|

SB-2

|

|

3/2/07

|

|

3ii

|

|

|

|

3.3

|

|

Articles of Amendment to the Amended and Restated Articles of Incorporation

|

|

8-K

|

|

2/23/11

|

|

3.1

|

|

|

|

3.4

|

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, effective February 28, 2011

|

|

8-K

|

|

3/3/11

|

|

3.1

|

|

|

|

4.1

|

|

Designation of Rights and Preferences of Series A Convertible Preferred Stock of WES Consulting, Inc.

|

|

8-K

|

|

2/23/11

|

|

4.1

|

|

|

|

10.1

|

|

Receivables Financing Agreement between One Up Innovations, Inc. and Advance Financial Corporation, dated May 24, 2011

|

|

10-K

|

|

10/12/11

|

|

10.17

|

|

|

|

10.2

|

|

Guarantee between Luvu Brands, Inc. and Advance Financial Corporation, dated May 24, 2011

|

|

10-K

|

|

10/12/11

|

|

10.18

|

|

|

|

10.3

|

|

Guarantee between Foam Labs, Inc. and Advance Financial Corporation, dated May 24, 2011

|

|

10-K

|

|

10/12/11

|

|

10.20

|

|

|

|

10.4

|

|

Guarantee between Louis S. Friedman and Advance Financial Corporation, dated May 24, 2011

|

|

10-K

|

|

10/12/11

|

|

10.21

|

|

|

|

10.5

|

|

Amended and Restated Receivable Financing Agreement between One Up Innovations, Inc. and Advance Financial Corporation, dated September 4, 2013

|

|

10-K

|

|

9/30/13

|

|

10.8

|

|

|

|

10.6

|

|

Form of promissory note

|

|

10-K

|

|

10/11/19

|

|

10.11

|

|

|

|

10.7

|

|

Employment Agreement between the Company and Louis Friedman dated January 27, 2021

|

|

8-K

|

|

2/2/11

|

|

10.3

|

|

|

|

10.8

|

|

2015 Equity Incentive Plan

|

|

DEF14C

|

|

10/9/15

|

|

B

|

|

|

|

10.9

|

|

U.S. Small Business Administration Note by One Up Innovations, Inc. in favor of Ameris Bank

|

|

8-K

|

|

4/28/20

|

|

10.1

|

|

|

|

21.1

|

|

Subsidiaries

|

|

10-K

|

|

9/29/14

|

|

21.1

|

|

|

|

23.1

|

|

Consent of Liggett & Webb P.A. independent registered public accounting firm

|

|

|

|

|

|

|

|

Filed

|

|

31.1

|

|

Section 302 Certificate of Chief Executive Officer

|

|

|

|

|

|

|

|

Filed

|

|

31.2

|

|

Section 302 Certificate of Chief Financial Officer

|

|

|

|

|

|

|

|

Filed

|

|

32.1

|

|

Section 906 Certificate of Chief Executive Officer

|

|

|

|

|

|

|

|

Filed

|

|

32.2

|

|

Section 906 Certificate of Chief Financial Officer

|

|

|

|

|

|

|

|

Filed

|

|

101.INS

|

|

XBRL Instance Document

|

|

10-K

|

|

9/28/21

|

|

|

|

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document

|

|

10-K

|

|

9/28/21

|

|

|

|

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

10-K

|

|

9/28/21

|

|

|

|

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

10-K

|

|

9/28/21

|

|

|

|

|

|

101.LAB

|

|

XBRL Taxonomy Extension Labels Linkbase Document

|

|

10-K

|

|

9/28/21

|

|

|

|

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

|

10-K

|

|

9/28/21

|

|

|

|

|

ITEM 16. Form 10-K Summary.

The Company elected not to provide the summary information.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

LUVU BRANDS, INC.

|

|

|

|

|

|

|

|

Date: December 14, 2021

|

By:

|

/s/ Louis S. Friedman

|

|

|

|

|

Louis S. Friedman, Chief Executive Officer and President

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

NAME

|

|

TITLE

|

|

DATE

|

|

|

|

|

|

|

|

/s/ Louis S. Friedman

|

|

Chairman of the Board, Chief Executive Officer,

|

|

December 14, 2021

|

|

Louis S. Friedman

|

|

and President (Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Ronald P. Scott

|

|

Chief Financial Officer (Principal Financial and

|

|

December 14, 2021

|

|

Ronald P. Scott

|

|

Accounting Officer), Secretary, and Director

|

|

|

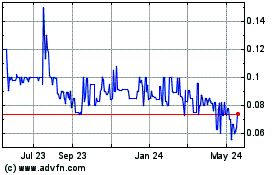

Luvu Brands (QB) (USOTC:LUVU)

Historical Stock Chart

From Oct 2024 to Nov 2024

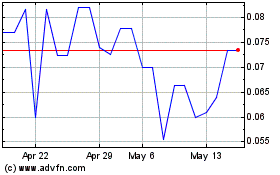

Luvu Brands (QB) (USOTC:LUVU)

Historical Stock Chart

From Nov 2023 to Nov 2024