NetworkNewsWire Editorial

Coverage: The video games market is a

unique one in that the success of individual companies is primarily

driven by the release of hit games, leading to significant ebb and

flow as new games are either embraced or panned by players. For

this reason, many have long considered mobile gaming companies to

be poor candidates for venture capital funding. However, there are

always exceptions, and various mobile gaming stocks have proven

their strength and longevity in the marketplace. Players like

Tapinator, Inc. (OTCQB: TAPM) (Tapinator

Profile), Nintendo Co., Ltd. (ADR) (OTC:

NTDOY), Zynga, Inc. (NASDAQ: ZNGA),

Glu Mobile, Inc. (NASDAQ: GLUU) and

Electronic Arts, Inc. (NASDAQ: EA) have shown

their staying power and are among standout public companies gaining

market share within the videogame industry. Each of these entities

is currently gearing up to once again raise investor interest with

highly anticipated new game releases coming down the pipe.

In the mobile games industry, it is quality rather than quantity

that drives the potential of profitability, as evidenced by the

huge success of entities like Finnish game developer Supercell.

Tencent Holdings (OTC: TCEHY) purchased an 84-percent stake in

Supercell in 2016 for $8.6 billion. At that time, the transaction

valued Supercell at a whopping $10.2 billion (http://nnw.fm/t2Bal). Incredibly, Supercell only has

four games in the marketplace. Nevertheless, it is a giant in the

mobile gaming industry due to the success of those titles, which

have produced a lifetime average of $1.15 billion in revenue solely

on the iOS platform, as reported by VentureBeat (http://nnw.fm/lNO37).

Other companies are similarly striving to find success with

well-designed, user-hooking mobile games that cater the modern

gamer. For Tapinator

(TAPM), the upcoming releases of “ColorFill,” a unique

puzzle game which is set to launch in December 2017, and other new

titles are set to arouse interest among both gamers and

investors.

Tapinator is a leading developer and publisher of mobile games

on the iOS, Google Play and Amazon platforms, engaging millions of

players worldwide with its portfolio of more than 300 mobile games.

Again, quantity doesn’t always equate to success, but it’s

important to note that Tapinator’s games have collectively amassed

more than 400 million player downloads and counting.

Most recently the company announced (http://nnw.fm/kuhL5) its partnership with Hanover,

Germany-based development studio Robot Cake Games. Through this

partnership, Tapinator has acquired the rights to publish

“ColorFill,” a distinctive puzzle game aimed at attracting fans of

games like Minesweeper, Sudoku and other popular puzzle titles.

The partnership also gives Tapinator the right to publish future

Robot Cake titles for a period of at least one year, with

“ColorFill” being among the first to roll-out under the Tapinator

banner. “ColorFill” is currently being soft launched in Canada and

Australia, and the game is slated to hit the global landscape on

December 7, 2017, just in time for the holiday shopping season.

"We have known the team at Robot Cake for several years and have

been highly impressed with their hard work, creativity and the

quality of their products. We are excited to announce the beginning

of a long-term partnership that we believe will result in future

successful, top grossing game launches,” Tapinator CEO Ilya

Nikolayev said in announcing the partnership with Robot Cakes. “We

at Tapinator are fans of ‘ColorFill's’ innovative gameplay and are

excited to partner with Robot Cake to bring this unique title to

millions of app store players. ‘ColorFill’ is our first release

with Robot Cake and we expect that it will be the first of many. We

look forward to providing updates on other scheduled releases from

this partnership in early 2018.”

Other new Tapinator titles coming up during Q4 2017 and Q1 2018

include “Divide & Conquer” and “Fusion Heroes.” The company

also recently released two new Full-Featured Games, “Big Sport

Fishing 2017” and “Dice Mage 2.” “Big Sport Fishing 2017” scored

over 520,000 player downloads within the first week of its

worldwide release, and both it and “Dice Mage 2” were distinguished

as “New Games We Love” on the Apple iOS platform (http://nnw.fm/Xy3V5).

Tapinator has been hailed as “One to Watch” (http://nnw.fm/Hv38g) within the mobile gaming market,

garnering considerable notice with hundreds of thousands of daily

downloads on the iOS, Google Play and Amazon platforms. Through

consumer app store transactions and the sale of branded

advertisements, the company continues generating attractive and

predictable returns.

Tapinator’s business strategy includes the creation of

best-in-segment Full-Featured Games that garner long-term player

retention and produce higher ROIs—games like “ROCKYTM”

and “Solitaire Dash.” Employing this Full-Featured Games model, the

company is able to create sustainable, franchise-esque games with

the potential of bringing in $100 million+ each and boasting

product life spans of five years or greater. Tapinator uses a set

of proprietary dynamic development and marketing processes that are

factored on gaming category, estimated player retention and

projected player profitability.

The company’s diversified revenue resources include 54 percent

that comes from in-game advertising and 46 percent that stems from

consumer purchases made via app stores. Within the company’s games,

advertising placement is strategically limited to appear only

between game levels, which helps bolster player retention, and

players are further enticed to participate in watching video ads on

a rewards basis.

Additionally, Tapinator is actively exploring opportunities in

virtual reality (VR) and augmented reality (AR) and has released

several prototype virtual reality games on an exploratory level in

order to gather data before pursuing a more significant product in

this area. The company further plans to pursue additional

publishing opportunities that leverage its large player network,

platform relationships and operational expertise.

Another highly anticipated mobile games release on the radar,

and one likely to generate notable investor buzz, is coming soon

from Nintendo (NTDOY). An undeniable pioneer in

the video game world, Nintendo recently made its most significant

move yet in mobile gaming with the announcement of plans to add

“Animal Crossing: Pocket Camp” as its third title for smartphones.

The game is scheduled to launch in late November and is anticipated

to be a long-term cash generator for Nintendo. It will be available

as a free download for both iOS and Android and will feature

in-game purchases.

Nintendo’s stock has climbed 80 percent during 2017, and Goldman

Sachs has estimated that an “Animal Crossing” mobile title could

bring in twice as much revenue as Nintendo’s two previous

smartphone games combined. The company has announced its intention

to launch between two and three smartphone games per year going

forward.

Meanwhile, mainstay mobile games player Zynga

(ZNGA) has commenced a soft launch of a sequel to its

hugely popular game “Words With Friends.” “Words With Friends 2”

features various updates, including new game modes and 50,000 new

words added to the game dictionary. During 2017, Zynga’s stock

price per share has risen from $2.69 in early January to $3.88 on

November 2, reflecting, at least in part, the interest generated by

this release. When “Words With Friends 2” launches worldwide,

investor attention will likely increase.

For Glu Mobile (NASDAQ: GLUU), it is hoped that

the upcoming release of “The Swift Life” – scheduled for release in

late 2017, according to company information, without a

hard-and-fast specified launch date - will generate significant

buzz and investor interest. More a social environment and digital

entertainment platform for Taylor Swift fans than an outright game,

“The Swift Life” chiefly lets fans of the Grammy winner connect and

interact with each other as well as with the star herself through

message boards, quizzes and other such features. The project marks

a departure from the format of Glu Mobile’s prior celebrity-focused

games and will actually be the company’s first pop culture

celebrity app to be unveiled in 2017, as some of its previous

celeb-game efforts didn’t fare so well. Because of Taylor Swift’s

astronomical fan following and the app’s format of being a social

network rather than a game, those in the know believe it has a very

good chance of being a successful and profitable app for Glu

Mobile.

Another hugely popular full-featured game that is currently in

soft launch is “The Sims Mobile” from Electronic Arts

(NASDAQ: EA). This mobile version of the popular life

simulation game could well prove to be—and likely will be—as

enormously successful as its full-featured counterpart. Electronic

Arts’ stock price has been steadily climbing for several years and

has continued that trend in earnest during 2017, rising from

$80.784 on January 1 to $115.21 on November 1. The release of the

wildly popular “Sims” in mobile version can only serve to bolster

that growth.

The launches of these highly anticipated mobile games are likely

to kindle significant interest among investors, proving once again

that mobile gaming stocks belong in the publicly traded arena. When

it comes to savvy and successful game launches, mobile gaming

companies like Tapinator demonstrate that they are certainly not

playing around.

For more information on Tapinator, visit

Tapinator, Inc.

(OTCQB: TAPM)

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

NetworkNewsBreaks that summarize corporate news and

information, (3) enhanced press release services, (4) social media

distribution and optimization services, and (5) a full array of

corporate communication solutions. As a multifaceted financial news

and content distribution company with an extensive team of

contributing journalists and writers, NNW is uniquely positioned to

best serve private and public companies that desire to reach a wide

audience of investors, consumers, journalists and the general

public. NNW has an ever-growing distribution network of more than

5,000 key syndication outlets across the country. By cutting

through the overload of information in today’s market, NNW brings

its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW are a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertake no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

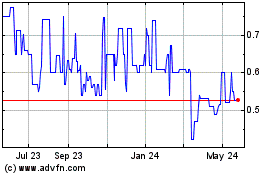

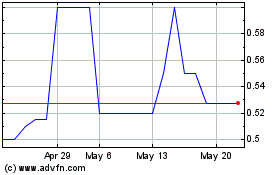

Tapinator (PK) (USOTC:TAPM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tapinator (PK) (USOTC:TAPM)

Historical Stock Chart

From Feb 2024 to Feb 2025