Third Century Bancorp (OTCBB: TDCB), the holding company of

Mutual Savings Bank, announced net income of $55,000 for the

quarter ended March 31, 2014, or $0.04 per share, compared to net

income of $60,000 for the quarter ended March 31, 2013, or $0.05

per share. The primary reason for the $5,000 decrease in net income

was a decrease of $35,000, or 3.40%, in net interest income to

$994,000 partially offset by a decrease of $22,000, or 2.01%, in

noninterest expense to $1.1 million for the quarter ended March 31,

2014 compared to the quarter ended March 31, 2013.

Net interest income was $994,000 for the first quarter of 2014

compared to $1.0 million for the first quarter of 2013. The

decrease in net interest income was primarily due to a decrease of

$112,000, or 26.43%, in interest income on commercial real estate

mortgages to $312,000 for the three months ended March 31, 2014

compared to $424,000 for the three months ended March 31, 2013. The

Bank’s average balance of commercial real estate mortgages

decreased approximately $1.3 million during the first quarter of

2014 and the average yield decreased to 4.85% from 5.64% as

compared to the prior year period.

Noninterest expense decreased $22,000 to $1.1 million for the

three months ended March 31, 2014 as compared to the same period in

2013. The decrease of $22,000 was the cumulative effect of cost

reduction measures implemented in various general and

administrative expense categories such as office supplies,

advertising, membership fees and subscriptions. In addition,

expenses incurred for real estate owned by the Bank decreased by

$7,000, or 77.78%, to $2,000 for the three months ended March 31,

2014 from $9,000 for the three months ended March 31, 2013.

The provision for loan losses decreased $6,000 to $3,000 for the

three months ended March 31, 2014 from $9,000 for the three months

ended March 31, 2013. Management considers factors such as

delinquency trends, portfolio composition, past loss experience and

other factors such as general economic conditions when determining

the provision for loan losses. Mutual Savings Bank charged-off

loans of $6,000 and collected $7,000 in recoveries for the quarter

ended March 31, 2014 compared to charged-off loans, net of

recoveries, of $268,000 for the quarter ended March 31, 2013, which

represented a decrease in the level of charge offs of $269,000, or

100.39%. At March 31, 2014, non-performing assets totaled $5.1

million, or 4.22% of total assets, and included $4.4 million of

non-performing loans. At December 31, 2013, non-performing assets

totaled $4.6 million, or 3.76% of total assets, and included $4.0

million of non-performing loans. The Bank continues to work

proactively with delinquent borrowers prior to loans becoming

non-performing. Loans are considered non-performing when one or

more of the following occur: borrowers fail to make scheduled

payments causing loans to become delinquent by 90 days or more;

borrowers default on original loan terms and the Bank restructures

such loans; or Management classifies loans as “substandard” in

regards to full repayment according to loan agreements.

Total assets decreased $1.7 million to $122.0 million at March

31, 2014 from $123.7 million at December 31, 2013, a decrease

of 1.37%. The decrease in assets was primarily due to a decrease of

$2.2 million in net loans receivable and a decrease of $696,000 in

investment securities held to maturity. The decrease in net loans

receivable was primarily due to a decrease in commercial real

estate mortgages of $1.3 million, or 3.70%, to $34.7 million at

March 31, 2014 from $36.0 million at December 31, 2013.

Deposits increased $1.2 million to $91.7 million at March 31,

2014 from $90.4 million at December 31, 2013. Demand deposits

increased $1.4 million, or 8.56%, to $17.6 million and savings, NOW

and money market savings deposits increased $510,000, or 1.09%, to

$47.4 million at March 31, 2014. Time deposits decreased $657,000,

or 2.41%, to $26.6 million at March 31, 2014.

Federal Home Loan Bank advances and other borrowings decreased

$3.0 million, or 17.14%, to $14.5 million at March 31, 2014 from

$17.5 million at December 31, 2013 due to the repayment of $3.0

million in Federal Home Loan Bank advances which matured during the

first quarter of 2014. At March 31, 2014 the weighted average rate

of all Federal Home Loan Bank advances was 1.52% compared to 1.85%

at December 31, 2013 and the weighted average maturity was 3.50

years at March 31, 2014 compared with 3.2 years at December 31,

2013.

Stockholders’ equity decreased $59,000 to $15.4 million at March

31, 2014 from $15.5 million at December 31, 2013. Stockholders’

equity decreased due to cash dividends paid of $115,000 offset in

part by net income of $55,000 for the three months ended March 31,

2014. Equity as a percentage of assets increased 0.12% to 12.63% at

March 31, 2014 compared to 12.51% at December 31, 2013.

Founded in 1890, Mutual Savings Bank is a full-service financial

institution based in Johnson County, Indiana. In addition to its

main office at 80 East Jefferson Street, Franklin, Indiana, the

bank operates branches in Franklin at 1124 North Main Street and

the Franklin United Methodist Community, as well as in Edinburgh,

Nineveh and Trafalgar, Indiana.

Selected Consolidated Financial Data

(unaudited) At March 31, At December

31, 2014 2013

Selected Consolidated Financial Condition Data:

(In

Thousands) Assets $ 121,984 $ 123,674 Loans receivable-net

93,821 96,045 Cash and cash equivalents 8,890 6,561

Interest-earning time deposits 6,176 7,169 Investment securities

6,458 7,154 Deposits 91,675 90,431 FHLB advances and other

borrowings 14,500 17,500 Stockholders’ equity-net 15,410 15,469

For the Three Months Ended March 31,

2014 2013 (Dollars In

Thousands, Except Share Data) Selected Consolidated Earnings

Data: Total interest income $ 1,137 $ 1,210 Total interest

expense

143 181

Net interest income 994 1,029 Provision for losses on loans

3 9

Net interest income after provision for

losses on loans

991 1,020 Total other income 172 175 Noninterest expense 1,073

1,095 Income tax expense

35

40 Net income

55

60 Earnings per share basic $ 0.04 $

0.05 Earnings per share diluted $ 0.04 $ 0.05

Selected

Financial Ratios and Other Data: Interest rate spread during

period 3.18 % 3.22 % Net yield on interest-earning assets 3.33 3.41

Return on average assets 0.18 0.19 Return on average equity 1.41

1.57 Equity to assets 12.63 12.23

Average interest-earning assets to average

interest-bearing liabilities

130.92 131.71 Non-performing assets to total assets 4.22 5.15

Allowance for loan losses to total loans

outstanding

2.08 2.21 Allowance for loan losses to non-performing loans 45.11

38.61

Net charge-offs to average total loans

outstanding

0.00 0.07 Noninterest expense to average assets 0.85 0.87 Effective

income tax rate 38.89 40.00 Number of full service offices 6

6 Tangible book value per share $ 12.10 $ 12.00 Market closing

price at end of quarter $ 8.00 $ 2.25 Price-to-tangible book value

66.12 % 18.75 %

Third Century BancorpRobert D. Heuchan, President and CEODavid

A. Coffey, Executive Vice President, CFO and COOTel.

317-736-7151Fax 317-736-1726

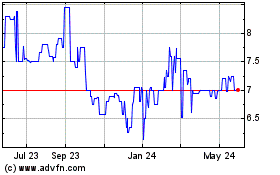

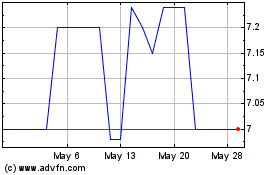

Third Century Bancorp (PK) (USOTC:TDCB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Third Century Bancorp (PK) (USOTC:TDCB)

Historical Stock Chart

From Feb 2024 to Feb 2025