TIDMAEET

RNS Number : 9688X

Aquila Energy Efficiency Trust PLC

02 May 2023

LEI Number: 213800AJ3TY3OJCQQC53Aquila Energy Efficiency

Trust

AQUILA ENERGY EFFICIENCY TRUST PLC

Aquila Energy Efficiency Trust Plc (the "Company" or "AEET") is

pleased to announce its audited results for the year ended 31

December 2022.

Investment Objective

The Company seeks to generate attractive returns, principally in

the form of income distributions by investing in a diversified

portfolio of energy efficiency investments.

Highlights (Consolidated figures(1) )

As at 31 December As at 31 December

Financial information 2022 2021

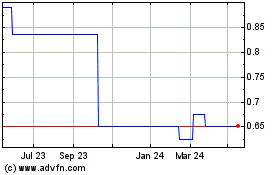

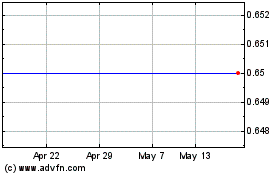

NAV per Ordinary Share (pence)(2) 95.23 97.38

Ordinary Share price (pence) 71.00 95.75

Ordinary Share price discount

to NAV(2) (%) (25.4) (1.7)

Dividends per Ordinary Share

(pence)(3) 3.5 -

Net assets (in GBP million) 95.23 97.38

Ongoing charges(2) (%) 2.6 0.9

Performance summary % change % change

NAV total return per Ordinary

Share(2) 0.1 (0.6)

Share price total return per

Ordinary Share(2) (23.5) (4.3)

1 During the year under review, as a result of the development

of the portfolio of investments, the actual investments made and

the structure of those investments, many of which were receivables

purchase investments with fixed rates of return, the Committee

determined that this required judgement and re-assessment of the

Company's investment entity status for the year ended 31 December

2022. As a result of this re-assessment, which identified that

fixed rate of return investments constituted a substantial

proportion of the pipeline of investments and resultant actual

investments, the Committee determined that as from 1 January 2022

the Company was no longer an investment entity. Accordingly, the

Company consolidates its subsidiaries at 31 December 2022. For more

information, please see note 2 of the financial statements. The

Company and its subsidiaries are together referred to as the

"Group" in this report.

2 These are Alternative Performance Measures ("APMs") for the

year ended 31 December 2022. Definitions of these APMs and other

performance measures used, together with how these measures have

been calculated can be found at the end of this announcement.

(3) Dividends declared relating to the year under review. Two

dividends were paid during 2022 and a third one was paid in 2023

(in respect of the period from 1 October 2022 to 31 December 2022)

of 1.25 pence per Ordinary Share.

CHAIR'S STATEMENT

On behalf of the Board, I am pleased to present the annual

report (the "Annual Report") for Aquila Energy Efficiency Trust plc

for the year ended 31 December 2022.

Investment Performance

The Company's NAV as at 31 December 2022 was GBP95.23m

(GBP97.38m as at 31 December 2021). The principal contributor to

the decrease in NAV was the payment of GBP2.25m in respect of two

dividends in the six months ended 31 December 2022. These payments

were not fully covered by earnings and were partly paid out of

distributable reserves. The Company's share price has recorded

total returns of minus 23.5% in sterling terms. The disappointing

share price performance has yet to reflect the increasing level of

commitments that has been achieved. The Company's share price has

been at a significant discount to NAV since January last year with

the discount widening with the impact of a higher interest rate

environment.

Changes following the investment strategy review

The Board instigated a number of actions, following the

investment strategy review in April 2022, to provide additional

assurance to investors that measures were in place to support an

accelerated pace of commitments and deployment of capital. A

greater focus was placed on a smaller number of geographies, larger

transactions, the establishment of partner relationships with a

number of Energy Service Companies ("ESCOs") and an increase in

dedicated resources by the Investment Adviser.

As part of this strategic review, it was agreed that a

continuation vote would be put to Shareholders at a general meeting

of the Company. This was held on 28 February 2023 (as further

detailed below).

The Investment Adviser also agreed, as a result of the strategy

review, to amend the original Investment Advisory Agreement such

that any advisory fees payable to the Investment Adviser would be

calculated on committed capital (funds contractually committed for

deployment) rather than on the Net Asset Value of the Company, in

order to ensure greater alignment of incentives for deployment.

This revised fee basis was applied to all fees charged by the

Investment Adviser from the date of the Company's Initial Public

Offering ("IPO") in June 2021. This has had the effect of lowering

the investment advisory fees by GBP0.3 million for the period from

IPO to 31 December 2022.

Update on Deployment

As at 31 May 2022, GBP19.7 million of the Company's IPO proceeds

had been committed for investment and approximately GBP15.7 million

had been deployed, as disclosed in the Company's annual report for

the period ended 31 December 2021. As at 31 December 2022, the

total amounts committed and deployed were GBP96.7 million and

GBP61.2 million respectively. Additional commitments of GBP7.3

million were made in the period up to 28 February 2023. However,

the total amount committed as at 31 March 2023 was GBP98.7 million,

a net increase of GBP2.0 million because the Company was able to

withdraw from certain commitments. Amounts deployed as at 31 March

2023 increased to GBP62.2 million(1) . Since the date of the

Continuation Vote, the Company has not entered into any new

commitments and its investing activity is solely in respect of

funding legal commitments to existing investments, with the aim of

protecting the future returns from those existing investments and

realisations.

Dividends

The Company targeted and paid a dividend of 3.5 pence per

Ordinary Share for the year to 31 December 2022. Following

consultation with Shareholders undertaken in April 2022, it was

decided to pay this dividend largely out of capital. For the year

to 31 December 2023, the Board was targeting a dividend of 5.0

pence per Ordinary Share. However, following the failure of the

Continuation Vote, the Board has reviewed the dividend policy of

the Company and future dividends will only be paid from net income,

and after reviewing cash flow forecasts, and only in respect of six

month periods not quarterly periods. Therefore, the next dividend

declaration will be in respect of the six month period ended 30

June 2023.

General Meeting held in February 2023

The consultation with Shareholders in April 2022 indicated that

the majority of Shareholders were supportive of the continuation of

the Company. However, in order to provide Shareholders with the

opportunity to review performance on commitments and deployment, it

was agreed to hold a Continuation Vote in February 2023. Although

the IPO proceeds had been substantially committed at that point,

the continuation resolution proposed at the meeting on 28 February

2023 failed to pass, primarily, the Board understands, because of

the relatively small size of the Company (and consequential lack of

liquidity in the shares) and the discount to Net Asset Value at

which the Company's shares trade.

A special resolution had been proposed to amend the Company's

articles of association (the "Articles"), to revise the date of the

subsequent continuation vote, which otherwise was and is required

to be held by 30 June 2023. This vote required the support of 75%

of those voting but was also not approved by Shareholders. As such,

and in accordance with the Company's Articles, a further

continuation vote is required to be held at the Company's Annual

General Meeting ("AGM") in June 2023.

In response to the failed Continuation Vote, the Board is also

proposing, at the AGM, along with the subsequent continuation vote,

an amendment to the Company's Investment Policy whereby the Company

is placed into a managed run-off (the "Managed Run-Off"). This

resolution (the "Continuation Managed Run-Off Resolution") seeks to

acknowledge and reflect the views expressed by Shareholders in the

February 2023 Continuation Vote, whilst the Board continues to

consider strategic solutions in respect of the Company's assets to

realise maximum value for Shareholders in the shortest possible

time, recognising the inherent difficulties in the construct of the

portfolio, including the number of individual investments, multiple

geographies and long tenors. The Continuation Managed Run-Off

Resolution is described in greater detail in the Notice of Annual

General Meeting, which can be found on the Company's website.

As announced on 15 March 2023, the Board appointed Stifel

Nicolaus Europe Limited ("Stifel") as sole financial adviser and

sole corporate broker, with immediate effect.

Board changes

The Board is now at full strength with the appointments of David

Fletcher and Janine Freeman. David Fletcher is a highly experienced

Non-executive Director and Audit Chair and was appointed as our new

Chair of the Audit and Risk Committee ("ARC") and as Chair of the

Remuneration Committee in April 2022. Janine Freeman is an

experienced, senior energy industry executive and Non-executive

Director with over 20 years' of involvement in the energy industry.

Janine was appointed as a member of the Company's Audit and Risk,

Nomination, Remuneration and Management Engagement Committees in

November 2022. Biographical summaries for all the Directors of the

Company can be found in the Company's Annual Report.

The need for Energy Ef ciency

The Board continues to believe that energy efficiency is the

natural partner to renewable energy in achieving the European goal

of net zero emissions by 2050. The more efficient use of energy is

one of the main pillars of the energy transition away from

fossil-based methods of energy production and consumption. The

reduction of daily energy consumption is, conceptually, Europe's

greatest energy resource. As part of the REPowerEU plan set out in

May 2022, the energy efficiency target for 2030 was increased from

9% to 13% compared to 2020 reference levels. Energy efficiency must

become part of our everyday lives, to consume less energy and

consume it better. Efficiency protects businesses and consumers

against increases in energy prices, is better for the environment

and it improves the competitiveness of our economies. Increasing

energy efficiency also ensures reduced dependence on energy

imports, thereby improving energy security.

AEET was launched in recognition of the opportunities, both

economic and social, that are available from investing in energy

efficiency. In terms of implementation to date, energy efficiency

thus far lacks the focus and attention that renewables have

received. We believe this continues to be an area with significant

growth potential and opportunities, both currently and for the

foreseeable future.

Having explained why we believe investment in energy efficiency

is important, I would like to express my thanks to my fellow

Directors and the team who have supported the Company over what has

been a challenging time since IPO in June 2021. This includes the

Investment Adviser, the AIFM and our other advisors. I would be

personally disappointed if the UK market sees the disappearance of

an investment vehicle, which was established to provide funding to

support the goal of reducing energy consumption and to play a part

in the achievement of the goal of net zero.

Annual General Meeting ("AGM")

The Company's AGM will be held on 14 June 2023 at 2.00pm at the

offices of Apex Listed Companies Services (UK) Limited located at

6th Floor, 125 London Wall, London, England, EC2Y 5AS. Further

details can be found at the AGM Notice. Shareholders are encouraged

to attend the AGM. Proxy voting figures will be made available

shortly after the AGM on the Company's website where Shareholders

can also find the Company's AGM Notice, Annual Report, factsheets

and other relevant information.

Miriam Greenwood OBE DL

Chair of the Board

30 April 2023

([1]) Reflecting 31 December 2022 valuation in local currency

(Euro), with investments at cost since then, translated into GBP,

where relevant, at EUR 0.8853: GBP 1.00. The Company's next NAV per

share will be published in respect of 30 June 2023.

INVESTMENT ADVISER'S REPORT

Investment Adviser's Background

The Company's AIFM, FundRock Management Company (Guernsey)

Limited (formerly Sanne Fund Management (Guernsey) Limited), has

appointed Aquila Capital Investmentgesellschaft mbH as the

Investment Adviser to the AIFM in respect of the Company.

The Investment Adviser offers advice on potential energy

efficiency investments in line with the Company's Investment

Policy. Aquila Capital Investmentgesellschaft mbH is part of Aquila

Group, an experienced and long-term investor in real asset

investments. Founded in 2001 by Dieter Rentsch and Roman

Rosslenbroich, Aquila Group currently manages and/or advises assets

worth around EUR14.7 billion on behalf of institutional investors

worldwide (as at 31 December 2022). Daiwa, one of Asia's largest

investors, is a minority shareholder in the Group.

By investing in clean energy and sustainable infrastructure,

Aquila Capital contributes to the global energy transition and

strengthens the world's infrastructure backbone. Aquila Capital

initiates, develops, and manages these essential assets along their

entire value chain and lifetime. Aquila Capital's primary objective

is to generate performance for its clients by managing the

complexity of essential assets.

Currently, Aquila Capital manages wind energy, solar

photovoltaics ("PV") and hydropower assets with a generating

capacity of more than 17 Gigawatts ("GWs"). Additionally, 2.0

million square metres of real estate and green logistics projects

have been completed or are under development. Aquila Capital also

invests in energy efficiency, carbon forestry and data centres.

Aquila Capital has been carbon neutral since 2006. Sustainability

has always been part of the company's value system and is an

integral part of its investment strategies, processes and the

general management of its assets. The company has around 700

employees from 56 nations, operating in 17 offices in 16 countries

worldwide.

Investment Advisory Team

Alex Betts - Senior Investment Manager: Alex Betts has over 30

years' experience in private equity and 15 years in resource

efficiency and has invested in a range of industries, geographies

and stages. Based in London, he joined Aquila Capital from Adaxia

Capital Partners ("Adaxia"). Prior to Adaxia Alex was a member of

the private equity team at Climate Change Capital ("CCC"), which

span out into Adaxia. Prior to CCC he was Head of Royal Dutch

Shell's corporate venture capital unit and a former partner of

Montagu Private Equity. He is British and graduated in Classics

from Oxford University.

Bruno Derungs - Senior Investment Manager: Bruno Derungs has

over 25 years' experience in private equity and 21 years in

resource efficiency and has invested in a range of industries,

geographies and stages. Based in Zurich, he joined Aquila Capital

from Adaxia. Bruno is a former member of the private equity team at

CCC, principal at SAM Private Equity, managing director of ATV, a

Swiss-based venture capital fund and consultant with Bain &

Company. He holds a master's degree in electrical engineering from

the ETH in Zurich and an MBA from Columbia Business School in New

York. He is Swiss and speaks English, German, Italian and

French.

Franco Hauri - Senior Investment Manager: Franco Hauri has over

20 years' of experience in private equity with 15 years in resource

efficiency of which the last five years have been focused on

investing in energy efficiency projects. Based in Zurich, he joined

Aquila Capital from Adaxia. Franco is a former member of the

private equity team at CCC, an Investment Adviser at NanoDimension,

a venture capital firm investing in nanotechnology, and a

consultant with Bain & Company. Franco holds an MBA from

Harvard Business School and a master's degree in finance,

accounting & controlling from the University of St. Gallen

(HSG). He is Swiss and speaks English, German, Italian, Spanish and

French.

Investment Activity

During 2022, the Company made substantial progress in executing

its strategy to invest in energy efficiency projects. As at the

year-end, the Company had entered into commitments to invest

GBP96.7 million of which the total deployed in investments were

GBP61.2 million. As at 31 March 2023, the total commitments had

increased to GBP98.7 million and the income generating capital

deployed since IPO increased to GBP62.2 million.

The Company's portfolio is characterised by projects with (i) a

low technology risk through the use of proven technologies; (ii)

medium to long term contracts providing for predictable cash flows;

and (iii) counterparties with good creditworthiness. As at 31 March

2023, the portfolio of 38 investments was diversified across

geographies (Italy, Spain, Germany and the United Kingdom),

technologies, counterparties and ESCO partnerships.

The majority of the Company's forecast project cash flows,

approximately 69%, are investment grade, as assessed by using both

the Investment Adviser's credit analysis and external agencies. In

projects which are non-investment grade, there are typically

additional protections; these include the ability to export power

to a grid and to extend the maturity of a contract with the ESCOs

in question and the underlying counterparty to recover missed

payments. The latter is possible because the Company's financing

agreements are of a shorter duration than the useful life of

equipment installed and, in many cases, of a shorter duration than

the contract between the ESCO and the counterparty.

The Company's portfolio also benefits from a combination of

fixed and variable return payments. While approximately 67% of the

total investment value provides a fixed rate of return from

contractual cash flows, approximately 33% by investment value has

variable cash flows linked to power production and power prices, or

inflation indexation. In many cases, these variable return

investments have downside protections, for example, minimum

contractual returns, which reduce the risk of lower than forecast

cash flows.

This portfolio of investments is forecast to achieve an

unleveraged, average yield of 8% per annum, which the Board

believes is attractive given the credit quality of the

portfolio.

The Company's investments provide funding to third parties to

enable capital expenditure for energy efficiency projects. Rather

than owning the assets installed in these projects, the Company has

structured its investments as purchases of receivables, largely

from contracted cash flows. The Investment Adviser has recommended

this approach to reduce the costs of managing numerous special

purpose vehicle ("SPVs") companies. Accordingly, the assets are

owned by SPVs of the ESCOs that develop the projects. These SPVs

contract to provide energy efficiency services to clients and

receivables from these contracts are transferred to the Company,

which takes a security interest in the assets together with

undertakings and performance guarantees from the ESCOs

themselves.

In Italy and Germany, the Company and its subsidiary, Attika

Holdings Limited ("AHL" or "Attika"), purchases notes, which

entitle the noteholders to the receivables, while in Spain and the

United Kingdom, Attika purchases receivables from the projects

direct. The use of notes is driven by the respective legal and

regulatory frameworks in Italy and Germany.

All of the investments in Italy have been made by the Company

through purchasing notes issued by an Italian special purpose

vehicle ("SPV") established under securitisation laws in Italy.

This SPV has made the respective capital investments in energy

efficiency projects in consideration return for which receivables

have been transferred to it. The receivables are the payments due

from the purchase of tax credits in the case of the Superbonus

investments and from operating leases and energy services

agreements in the case of the investments developed by Noleggio

Energia and CO-VER. The notes issued by the SPV entitle the Company

to the economic return from the receivables and are structured to

provide a fixed interest rate amounting to a 3% p.a. return on

capital and variable interest to capture the return above 3%

p.a.

In Germany, Attika has purchased notes issued by special purpose

subsidiaries of the four ESCOs with which Attika has invested.

These notes provide for a fixed rate of interest, repayment of

capital and, in certain cases, a variable rate of interest, which

provides the economic return from the receivables.

Investments in Italy

Investments in Italian "Superbonus" projects

In December 2021, the Company entered into commitments to

finance two clusters of "Superbonus" energy efficiency projects for

apartments and other residential buildings in Italy amounting to

GBP16.8 million. "Superbonus" is an incentive measure introduced by

the Italian government through Decree "Rilancio Nr. 34" on 19 May

2020, which aims to make residential buildings (condominiums and

single houses) more energy efficient through improvements to

thermal insulation and heating systems. When qualifying measures

are completed, ESCOs delivering the measures are awarded a tax

credit equal to 110% of the cost of the measures. These tax credits

can then be sold to banks, insurance companies and other

corporations and, thus, projects can be financed without the need

for a financial contribution from landlords.

The projects which the Company committed to finance in 2021 are

being managed by two ESCOs, Enerstreet and Enerqos Energy

Solutions, and entail commitments of GBP10.7 million and GBP6.1

million respectively. The projects involve a range of energy

efficiency measures including insulation, the replacement of

heating systems with more efficient solutions, and energy efficient

windows.

During 2022 the Company entered into three other commitments,

totalling GBP16.7 million, to finance Superbonus projects, another

GBP8.71 million project with Enerqos Energy Solutions and two

projects, totalling GBP7.95 million, with Sol Lucet, an Italian

ESCO. These investments are structured in a very similar way to the

first Superbonus investments, using almost identical documentation,

to provide for a contractual return of 8% p.a. These projects are

being managed by Sol Lucet S.r.l., an energy services company

which, since 2013, has successfully installed renewable energy

plants with a generating capacity of 17.0 Megawatts peak ("MWp") as

well as Combined Heat and Power ("CHP") plants producing 3.2

Megawatts electric (" MWe"). Sol Lucet is currently managing solar

PV plants with a generating capacity of 14.0 MWp. The tax credits,

which these projects are designed to generate, will be acquired by

Credit Agricole, which has a short-term rating of A+ from S&P

("Standard & Poor's").

As at 31 December 2022, GBP32.95 million had been committed to

Superbonus projects and were earning a contracted rate of return.

Of this, GBP24.28 million had been deployed in cash. The balance of

the commitments is forecast to be deployed before the end of

October 2023. These projects, which are being delivered in a series

of stages, generate tax credits which exceed the cost of the

Company's investments. Six companies have agreed to purchase these

tax credits, including four banks: BNP Paribas, Credit Agricole,

Intesa Sanpaolo and Monte dei Paschi di Siena along with

Assicurazioni Generali, one of the largest global insurance

companies and Enel X, a subsidiary of Enel, Italy's largest utility

company. The purchasers of the tax credits have S&P credit

ratings of A+, AA-, BBB, B+, A+ and BBB+ respectively, with the

lower rated bank being majority owned by the Italian state. The

proceeds from the sale of the tax credits are forecast to redeem

these investments before the end of January 2024. The investments

are structured to deliver contracted returns of 8-9% per annum from

the expected project start dates. This means that the investment

commitments become income generating from the dates set out in the

investment documentation and not from the date of cash

deployment.

Solar PV Investments for self-consumption in Italy

The Company has committed GBP3.6 million to six rooftop Solar PV

projects in Italy with an aggregate capacity of 3.6MWp. As at 31

December 2022, GBP2.5m had been deployed into four operational

projects. The balance of the commitment will be deployed when the

two other plants have become operational, which is expected to be

achieved by the end of May 2023. These projects enable companies to

reduce their energy expenses and CO(2) emissions and avoid grid

losses through the self-consumption of the electricity

produced.

Projects with Noleggio Energia

Five projects in which the Company has invested have been

developed by the ESCO, Noleggio Energia, which was established in

2017 and is an Italian company that specialises in providing

operating leases for energy efficiency and renewable energy

projects for commercial and industrial clients in Italy . These

projects are all structured as the purchase of receivables from

operating leases with maturities of seven or ten years and all use

very similar documentation. Noleggio Energia has transferred to SPV

the monthly receivables from these operating lease agreements,

which provide for fixed rates of return ranging between 7.2% p.a.

and 9.4% p.a.

The first investment of GBP0.31 million which the Company made

in Italy was completed at the end of June 2021 to finance a rooftop

solar PV project with a capacity of 238 kilowatt peak ("kWp")

located in Lombardy for the Italian food product manufacturer

Galletti di Galletti Aurelio e C. snc ("Acetificio Galletti").

Acetificio Galletti is a family-owned business founded in 1871 and

is a renowned producer of vinegars, dressings, pickles, and other

food products. It has an investment grade credit rating (B1.2/BBB)

from the credit ratings agency Cerved.

The second investment of GBP0.12 million was completed at the

end of December 2021 to finance a rooftop solar PV project with a

capacity of 127 kWp in Veneto for Enofrigo SpA. Enofrigo SpA,

founded in 1978, is an Italian designer and manufacturer of wine

cabinets and both hot and cold food display units for bars,

restaurants, small supermarkets, and larger retail chain stores.

Enofrigo SpA now serves more than 5,000 clients in more than 100

countries. Its Cerved credit rating is B2.1, equivalent to BB+.

The third investment of GBP1.32 million was committed to at the

end of March 2022 to finance a 1MWp rooftop solar PV project in

Lombardy for the engineering company, Tecnocryo SpA. The project,

which included the refurbishment of the roof, was completed in

August 2022 and is operational. T ecnocryo has been trading since

1992 and focuses on the design and realisation of machines for

handling cryogenic fluids. The company has a Cerved credit rating

of B2.1, equivalent to BB+, which is just below investment

grade.

The other two projects with Noleggio Energia are under

construction. In September 2022, the Company committed GBP0.35

million to a 443 kWp rooftop Solar PV project installed on the

production facilities of Ali Group, a foodservice equipment

manufacturer in Veneto, Northern Italy. Ali Group is an Italian

corporation that was founded in 1963, it is one of the largest and

most diversified global leaders in the food service equipment

industry. The company has a Cerved credit rating of A2.1,

equivalent to A+. In December 2022 the Company committed GBP0.82

million to an 876 kWp rooftop Solar PV project installed on the

production facilities of Orlandi, a nonwovens manufacturer in

Lombardy, Northern Italy. Since its establishment, the company has

expanded its product offering, which now includes applications for

a wide variety of sectors including medical, hygiene, home

furnishing, industrial/household wipes and more. The company has a

Cerved credit rating of B1.1, equivalent to BBB+/BBB-.

Project with CO-VER Power Technologies

In January 2022, the Company refinanced the acquisition of an

existing rooftop solar PV plant in Ascoli Piceno (Central Italy)

with a generating capacity of 902 kWp. The investment is based on

the purchase of receivables generated by an energy service contract

between the leading Italian engineering firm CO-VER Power

Technologies ("CO-VER") and its subsidiary Futura APV S.r.l.

("Futura"). The contract governs the management of an operating

roof-mounted solar PV plant until April 2028. Thereafter, the

investment is based on a feed-in-tariff for an additional six

years, aggregating to a 12-year tenor. The investment is forecast

to generate a return ranging between 7.0% and 7.3% p.a.

CO-VER has a successful 20-year history in developing industrial

projects in the areas of energy storage systems, co/tri-generation

plants and renewable energies. Futura, which was established in

1981, specialises in the design and construction of overhead and

floor conveyors and is the owner of the PV plant, which benefits

from feed in tariffs payable by Gestore dei Servizi Energetici

("GSE"). GSE is a joint stock company managed by the Italian

government which is responsible for promoting and developing the

growth of renewable assets in Italy. GSE has a credit rating of

BBB+ from the Italian government.

Investments in Spain

In line with its pan-European investment strategy, the Company,

through its wholly owned subsidiary, Attika, had as at 31 December

2022 committed GBP32.6 million across ten Spanish projects, nine of

which are Solar PV projects and one of which is a buildings energy

efficiency project. The capital deployed as at 31 December 2022 was

GBP4.9 million. Since 31 December 2022, the Company has committed

to a further three projects with three new project developers. Due

to various changes, including a withdrawal from one commitment, the

Company's total commitments to investments in Spain as at 31 March

2023 were GBP31.5 million of which GBP6.0 million had been

deployed. The balance of the commitments is expected to be largely

deployed during 2023 at construction completion of relevant

projects.

Solar PV investments in Spain

The market in Spain presents continuing and favourable

prospects, particularly in the solar photovoltaic sector. The

Company has committed capital to finance the development of ten

solar PV installation projects throughout Spain with eleven project

developers. Most of these projects have been structured under Power

Purchase Agreements ("PPA") with maturities of up to 18 years and

have variable revenues, which are often subject to production risk,

power price fluctuation or inflation. In addition, excess

production beyond the on-site demand may be injected into the grid.

These variable revenue risks are mitigated by conducting technical

due diligence prior to making commitments and by contracted prices

within the PPAs.

Notable investments include:

-- GBP9.6m commitment for a group of five Solar PV installations

with a total capacity of 12MWp, three of which are ground mounted,

for a major battery manufacturer and other industrial businesses,

which have a blended S&P equivalent rating of BBB+/ BBB-;

-- GBP6.2m commitment to finance an 8MWp ground-mounted solar PV

project, with revenues generated through off-site Power Purchase

Agreements to commercial clients around Borja (Zaragoza), which

have a blended S&P equivalent rating of BB-;

-- GBP2.9m for a 3.83MWp roof mounted solar PV plant for an

insulation material manufacturer located near Tarragona, which has

a S&P equivalent rating of BBB+/ BBB-;

-- GBP1.7m commitment to finance Solar PV plant and battery

projects developed by a major European technology manufacturer and

to be deployed at sites of the leading owner and operator of

wellness centres in Spain, which has a S&P equivalent rating of

BBB+/ BBB-; and

-- GBP0.9m commitment to fund a Solar PV project for

self-consumption, developed by a Valencia based ESCO, for a leading

Spanish ceramic tiles manufacturer, which has a S&P equivalent

rating of BBB+/ BBB-.

Since 31 December 2022, the Company has successfully completed a

GBP3.5 million commitment to invest in ground mounted solar PV

plants for self-consumption for four farms operated by a Spanish

agricultural company with a capacity of approximately 4MWp. In

addition, two smaller commitments of GBP0.7 million and GBP0.6

million were completed to finance groups of projects across Spain.

Both transactions mark the start of new relationships with the

respective project developers.

The credit ratings of the counterparties of the Spanish Solar PV

investments have been rated as the S&P equivalent of between BB

and BBB+/BBB-. These investments also have, in many cases, the

benefit of being able to generate revenues from selling power to

the grid if there are payment issues with the counterparty.

Buildings Energy Efficiency investments in Spain

The Spanish Government has established incentive schemes to

promote buildings energy efficiency measures, including the

"Programa de Rehabilitacion Energetica de Edificios" ("PREE"). PREE

is a EUR402.5 million incentive scheme across the Spanish

jurisdiction and is designated to promote and reward energy

efficiency improvements for condominiums and buildings improving

their energy rating by at least one energy class. Under this scheme

the Company has committed GBP4.2 million to fund the refurbishment

of condominiums, which is being managed by a leading ESCO

specialised in designing and implementing energy efficiency and

renewable energy projects in Spain. The investment cash flows are

based on the purchase of receivables generated by the underlying

energy saving contracts between the ESCO and the so-called

"Comunidad de Proprietarios", the legal entities which represent

each of the owners of the apartments in a residential building. The

receivables have been rated as the S&P equivalent of A+/A.

Investments in Germany

As at 31 December 2022 the Company, through Attika, had made

four investments in Germany through note subscriptions for a total

commitment of GBP23.4 million of which GBP19.4 million had been

deployed, across a variety of four technologies including smart

metering technologies, water management solutions, heat pumps and

Bio-LNG.

GBP1.8 million Investment in Comgy GmbH & Co KG

("Comgy")

In April 2022, the Company purchased a note for GBP1.8 million

with a tenor of ten years issued by Comgy. The note is structured

to provide a fixed return of in excess of 10% p.a. through a fixed

interest rate of 6.5% p.a., repayments and a variable interest

component, which takes account of the contracted cash flows through

to the maturity of the investment. Comgy is a wholly owned

subsidiary of Comgy GmbH, active in the German sub-metering market.

Comgy provides metering equipment, billing and Operations and

Maintenance ("O&M") services mainly to housing companies with

an average rating comparable to an S&P rating of BBB+/BBB. The

note is secured on sub-metering contracts, including equipment

rental and billing as well O&M services with tenors of between

five and ten years.

GBP8.3 million for the purchase and upgrade of a biogas plant in

Northern Germany

In October 2022, the Company made an GBP8.3 million commitment

to fund the acquisition of a biogas plant and an investment into

liquefaction equipment by one of Germany's leading biogas

development companies with more than 20 years' experience in the

sector. The investment is structured as a note purchase. The terms

of the note provide for the payment of interest at a fixed rate of

5% p.a. plus a variable return, which is equivalent to 8% of

revenue generated by the asset company, capped at EUR1.3 million

across eight years. Liquefaction of the biogas produced makes the

resulting Bio-LNG eligible for greenhouse gas certificates under

German energy law. These certificates are frequently resold on the

secondary market to companies within carbon-intense industries

under pressure to comply with emission regulations and as a result

Bio-LNG is gaining popularity in the transportation market. The

structure of this investment benefits from an extensive security

package including a pledge over the assets and land, a parent

company guarantee and step-in rights. The parent company was deemed

to have an S&P rating of BB-. However, once the plant becomes

operational, scheduled in September 2023, the underlying credit

risk will shift to the counterparties purchasing the Bio-LNG and

associated carbon credits, which are likely to be more highly rated

businesses.

GBP11.0 million investment for water management solutions

In December 2022, the Company invested GBP11.0 million to

acquire receivables due under water management service agreements

for condominiums and multi-family homes in Germany, mainly managed

by large property managers. As with the Company's other German

investments, the investment is structured through a note purchase

which provides for a fixed interest rate of 8% p.a., to be paid out

on a quarterly basis over a ten year period. The developer's water

management solutions consist of hardware and software detecting

user behaviour and optimizing the temperature management of the

house or condominium's waterflow, resulting in significant energy

cost reductions for tenants. The counterparties comprise a large

number of property management companies and have been evaluated

with a weighted average S&P equivalent rating of BBB+.

GBP2.2 million junior loan purchase

The Company has purchased a subordinated note from a SPV set up

by one of Germany's fast-growing heat pump companies. The note

investment was purchased in December 2022 for a total price of

GBP2.2 million, and is structured to pay a fixed annual interest

rate of 7.5% p.a. The proceeds from this investment are being

applied by the developer in its roll out of heat pumps across

Germany. The note is subordinated to a loan from a large German

Bank and consists of approximately 11% of the total loans issued by

the SPV. The investment has a planned maturity of 15 years and

benefits from a first rank guarantee from the SPV's parent company

up to the nominal amount of the loan and includes covenants related

to the minimum cash balance of the SPV as an additional security

buffer. The cash flows due to the SPV are from German households,

who are deemed to have an S&P equivalent rating of A+/A.

Investments in the United Kingdom

As at 31 December 2022 the Company, through Attika, had

committed and deployed GBP4.1 million and GBP3.6 million

respectively into investments in the United Kingdom comprising

investments in CHP, Lighting and Wind Power projects. These

investments were made with five different ESCOs.

CHP Investments

The Company has invested in CHP projects in the UK for a total

investment value of GBP1.9 million developed by three separate

ESCOs. The CHP projects are with a major convention centre, a hotel

and a food producer, Vale of Mowbray. The convention centre and

hotel have credit ratings of S&P equivalents of BBB+/BBB- and

BB+/BB respectively. The Vale of Mowbray project is on hold because

the company has entered into administration. The amount of GBP0.9

million has been invested in the project with the majority of the

capital applied to acquire the CHP equipment, which is not yet

onsite. The result of the administration is that the site was

acquired in March 2023 by a cold storage logistics business with

whom discussions are due to be held regarding utilisation of CHP at

the site. Ega Energy, the ESCO developing the Vale of Mowbray

project, has identified other clients who may use the CHP

equipment. The Investment Adviser believes that its contractual

arrangements with Ega Energy protect the value of the investment

made to date.

Wind Power Investments

The Company has invested GBP2.0 million (GBP1.6 million at 31

December 2022) in five operational small wind farms in the UK,

managed by a UK ESCO, which benefit from feed-in and export tariffs

and provide onsite power for self-consumption. The Company's

investments are structured to receive an agreed share of net

revenues from these projects, which have remaining lives of

approximately 10 years. The Company's investment income is

dependent on the levels of power production, feed in tariff rates,

which benefit from Retail Price Index ("RPI") indexation, and

export tariff rates which are typically renegotiated annually, less

direct operating costs such as rent, insurance and operational

& maintenance costs, which are managed by the ESCO. The

weighted average credit rating of the revenue streams for these

projects are S&P equivalent ratings of BBB+/BBB- with the feed

in tariff revenues being deemed to be UK Government risk, rated AA,

and export tariffs payable by the utilities currently contracted

being deemed to be sub-investment grade. However, it would be

possible to replace the current utilities should they fail to pay

amounts due.

Lighting Investments

Following an investment of GBP0.3 million in December 2021, the

Company has invested an additional GBP0.1 million in operational

lighting projects developed by a Northern Ireland based lighting

services company, Lumenstream Limited. The Company's investments

are structured as purchases of receivables under five-year lighting

contracts with industrial companies and a leisure business. The

weighted average credit rating of the receivables in this portfolio

of projects is rated at an S&P equivalent of BBB+/BBB-.

Since 31 December 2022, the Company has committed and invested

GBP0.9 million across two projects with two additional ESCOs

providing lighting as a service for a variety of counterparties

with contract maturities of up to ten years. These counterparties

have a weighted average credit rating of an S&P equivalent of

BBB+/BBB-.

Investments completed after 31 December 2022

A summary of the investments the Company has made since the

year-end is set out below:

Description Receivables Term Technology Status Country Committed Deployed

Weighted years

Avg. Credit

rating GBP'000 GBP'000

Purchase of receivables

generated by an operating

lease linked to a solar

PV in self-consumption

installation for a

Spanish agricultural Solar

company BBB+ / BBB- 10 PV Construction Spain 3,490 -

-------------------------------- ------------- ----- ----------- ------------ --------- --------- --------

Purchase of receivables

from PPA agreements

for two solar PV plants

in self-consumption 14 Solar

in Spain BB+ / BB- / 15 PV Operating Spain 616 605

-------------------------------- ------------- ----- ----------- ------------ --------- --------- --------

Purchase of receivables

generated from grid

sales and PPA agreements

by financing four solar

PV plants in self-consumption Solar

in Spain. BBB+ / BBB- 18 PV Construction Spain 725 142

-------------------------------- ------------- ----- ----------- ------------ --------- --------- --------

Acquisition of receivables

of FiTs and export

tariffs generated from

an operating wind turbine United

in Scotland. BBB+ / BBB- 12 Wind Operating Kingdom 331 331

-------------------------------- ------------- ----- ----------- ------------ --------- --------- --------

Purchase of receivables

generated from the

installation and operation

of metering and LED

projects with eleven

different counterparties Lighting United

in the UK. BBB+ / BBB- 5-7 / Metering Construction Kingdom 457 404

-------------------------------- ------------- ----- ----------- ------------ --------- --------- --------

Financing the installation

of a roof mounted solar

PV plant for self-consumption Solar

in Central Italy. BB+ / BB 10 PV Construction Italy 857 -

-------------------------------- ------------- ----- ----------- ------------ --------- --------- --------

Purchase of receivables

generated from the

installation of a roof

mounted solar PV plant

for self-consumption Solar

in Northern Italy. A- 5 PV Construction Italy 513 -

-------------------------------- ------------- ----- ----------- ------------ --------- --------- --------

Purchase of receivables

generated from refinancing

the installation of

LED lighting projects

for 15 different clients United

in the UK. BBB+ / BBB- 5-10 Lighting Operating Kingdom 456 456

-------------------------------- ------------- ----- ----------- ------------ --------- --------- --------

Summary of all Investments that have Committed Capital as at 31

March 2023

Description Receivables Term Technology Status Country Committed Deployed

Weighted years

Avg. Credit

rating GBP'000 GBP'000

Receivables

(fixed)

from a 238 kWp

rooftop Solar PV

project

installed

at the

production

facilities of a

food

manufacturer Solar

in Lombardy. B 7 PV Operating Italy 314 314

----------------- -------------------- --------- ---------------- -------------- -------------- ------------ ------ --------

Receivables

(fixed)

from a 127 kWp

Solar PV project

installed on the

production

facilities

of a

manufacturer Solar

in Veneto. BBB+ / BBB- 7 PV Operating Italy 120 120

----------------- -------------------- --------- ---------------- -------------- -------------- ------------ ------ --------

Receivables

(fixed)

from sales of

tax

credits

generated

under the

Italian

Superbonus

scheme

, which supports

the energy

efficiency

retrofits

(insulation,

more efficient

heating etc. )

of residential Building

buildings. B+ 2 Retrofit Construction Italy 6,137 4,783

----------------- -------------------- --------- ---------------- -------------- -------------- ------------ ------ --------

Receivables

(fixed)

from sales of

tax

credits

generated

under the

Italian

Superbonus

scheme

, which supports

energy

efficiency

retrofits

(insulation,

more efficient

heating etc. )

of residential Building

buildings. A 2 Retrofit Construction Italy 10,668 10,164

----------------- -------------------- --------- ---------------- -------------- -------------- ------------ ------ --------

Receivables

(fixed

with RPI) from

lighting as a

service

contracts with United

6 UK companies. BBB+ / BBB- 5 Lighting Operating Kingdom 390 390

----------------- -------------------- --------- ---------------- -------------- -------------- ------------ ------ --------

Receivables

(fixed/variable)

from a 901.6 kWp

rooftop Solar PV

project at a

site

in Ascoli Piceno Solar

(Central Italy). BBB+ / BBB- 12 PV Operating Italy 740 740

----------------- -------------------- --------- ---------------- -------------- -------------- ------------ ------ --------

Receivables

(fixed)

from sales of

tax

credits

generated

under the

Italian

Superbonus

scheme

, which supports

the energy

efficiency

retrofits

(insulation,

more efficient

heating etc. )

of residential Building

buildings. AAA / AA- 2 Retrofit Construction Italy 1,601 1,601

----------------- -------------------- --------- ---------------- -------------- -------------- ------------ ------ --------

Receivables

(fixed)

from a 1,000 kWp

rooftop Solar PV

project to be

installed

at a

manufacturer's

production

facility Solar

in Lombardy. BB+ / BB 10 PV Operating Italy 1,325 1,325

----------------- -------------------- --------- ---------------- -------------- -------------- ------------ ------ --------

Receivables (fixed)

from sub-metering

hardware and services

contracts with

landlords

of multi-occupancy BBB+ /

buildings. BBB- 9 Sub-meters Operating Germany 1,821 1,821

---------------------- -------------------- ------------- --------------- ------------------ ---------------- ------ --------

Receivables (fixed)

from CHP Energy

Services Agreement

with a major

conference BBB+ / United

centre in Wales. BBB- 6 CHP Operating Kingdom 200 200

---------------------- -------------------- ------------- --------------- ------------------ ---------------- ------ --------

Receivables (fixed)

from CHP Energy

Services Agreement

with food United

manufacturer. BB+ / BB 7 CHP Construction Kingdom 1,396 951

---------------------- -------------------- ------------- --------------- ------------------ ---------------- ------ --------

Receivables (fixed)

from sales of tax

credits generated

under the Italian

Superbonus scheme

, which supports

the energy efficiency

retrofits

(insulation,

more efficient

heating

etc ) of residential BBB+ / Building

buildings. BBB- 2 Retrofit Construction Italy 8,714 6,529

---------------------- -------------------- ------------- --------------- ------------------ ---------------- ------ --------

Receivables (PPA

with fixed price)

from a 3,830 kWp

rooftop Solar PV

project to be

installed

at a facility in

Tarragona (North BBB+ / Solar

of Spain). BBB- 15 PV Construction Spain 2,947 1,468

---------------------- -------------------- ------------- --------------- ------------------ ---------------- ------ --------

Purchase of

receivables

generated through

a PPA from three

solar PV plants

in self-consumption

for a poultry Solar

producer. BB- 15 PV Construction Spain 286 235

---------------------- -------------------- ------------- --------------- ------------------ ---------------- ------ --------

R Receivables (fixed)

from CHP Energy

Services Agreement United

with a hotel BB+ / BB 8 CHP Operating Kingdom 433 425

---------------------- -------------------- ------------- --------------- ------------------ ---------------- ------ --------

R eceivables (fixed)

from sales of tax

credits generated

under the Italian

Superbonus scheme

, which supports

the energy efficiency

retrofits

(insulation,

more efficient

heating

etc. ) of residential Building

buildings. BB+ / BB 2 Retrofit Construction Italy 6,356 6,356

---------------------- -------------------- ------------- --------------- ------------------ ---------------- ------ --------

Purchase of

receivables

from five solar

PV plants in

self-consumption

in Spain. The

revenues

are generated through

PPAs with multiple BBB+ / Solar

counterparties. BBB- 15-18 PV Construction Spain 9,605 666

---------------------- -------------------- ------------- --------------- ------------------ ---------------- ------ --------

Purchase of receivables

generated through

an off-site PPA from

a ground-mounted

solar PV plant in

Zaragoza between

a Spanish developer Solar

and different clients. BB- 15 PV Construction Spain 6,321 1,559

--------------------------- -------------------------- ------- ------------------ ---------------------- ----------- --------- -----

Purchase of receivables

(fixed) generated

by two operating

lease agreements

between a Spanish

developer and two

counterparties in 10 Solar

Spain. BB- & 12 PV Construction Spain 155 155

--------------------------- -------------------------- ------- ------------------ ---------------------- ----------- --------- -----

Receivables (fixed)

from a 443 kWp rooftop

Solar PV project

installed on the

production facilities

of a foodservice

equipment manufacturer

in Veneto, Northern Solar

Italy. A- 7 PV Construction Italy 345 345

--------------------------- -------------------------- ------- ------------------ ---------------------- ----------- --------- -----

Purchase of receivables

generated by Power

Purchase Agreements

("PPA") between a

Spanish developer

and a Spanish ceramic Solar

tiles manufacturer. BBB+ / BBB- 15 PV Construction Spain 966 764

--------------------------- -------------------------- ------- ------------------ ---------------------- ----------- --------- -----

Acquisition of receivables

of FiTs and export

tariffs generated

from 3 operating

wind turbines in

the UK, of which

the generated energy

is used for

self-consumption

& for export to the United

grid. BBB+ / BBB- 10.6 Wind Operating Kingdom 484 484

--------------------------- -------------------------- ------- ------------------ ---------------------- ----------- --------- -----

Subscription for

a note for the refinancing

of an operating bio-gas

plant in north-eastern

Germany and an upgrade

to a Bio-LNG (1)

facility. The note

provides for a fixed

return plus an agreed Operational

share of revenues Biogas (Phase 2

from the Facility. BB- 8.25 / BioLNG construction) Germany 8,283 4,440

--------------------------- -------------------------- ------- ------------------ ---------------------- ----------- --------- -----

Receivables (PPA

with fixed price)

from six rooftop

solar PV projects

used for

self-consumption,

to be installed at

six different locations

in Cordoba and Granada Solar

in Spain. BB+ / BB- 15 PV Construction Spain 324 282

--------------------------- -------------------------- ------- ------------------ ---------------------- ----------- --------- -----

1 Bio-LNG is a highly sustainable version of liquefied natural

gas (LNG), with almost the exact same chemical makeup. It is

produced during the anaerobic digestion (AD) process, which breaks

down organic matter (such as food or animal waste) in an

oxygen-free tank to produce methane-rich biogas.

Receivables (fixed)

from solar PV plant

in self-consumption

for a total installed

capacity of 875.6kWp

located at the site

of nonwovens

manufacturer

in Lombardy, Northern

Italy. BB+ / BB 10 Solar PV Construction Italy 821 -

----------------------- -------------- ------- --------------- ----------------- ----------- --------- --------

Receivables from

service

agreements related

to the water

management

between the developer

and condominiums and

multi-family homes,

mainly managed by

large property

managers BBB+ / Water

via a note structure. BBB- 10 management Operating Germany 11,067 10,989

----------------------- -------------- ------- --------------- ----------------- ----------- --------- --------

Purchase of receivables

generated by 2 Energy

Saving Contracts

("ESC")

between the developer

and five Spanish

condominiums

located in the

proximity

of Madrid, Guadalajara

and Gerona, as well

as subsidies generated

under the incentive Building

scheme. A+ / A 15 Retrofit Construction Spain 4,330 211

----------------------- -------------- ------- --------------- ----------------- ----------- --------- --------

Acquisition of

receivables

of FiTs and export

tariffs generated

from an operating

wind turbine in BBB+ / United

Scotland. BBB- 13 Wind Operating Kingdom 1,162 1,162

----------------------- -------------- ------- --------------- ----------------- ----------- --------- --------

Subscription for a

junior note issued

by largest heating

installer in Germany,

entitling the

noteholder

to receivables

generated

through service and

maintenance contracts

for heat pump systems

for the residential

sector throughout Construction

Germany. A+ / A 15 Heating & Operational Germany 2,240 2,213

----------------------- -------------- ------- --------------- ----------------- ----------- --------- --------

Purchase of receivables

(fixed) from Solar

PV and battery

installations

for a leading operator

of wellness centres BBB+ /

in Spain. BBB- 12 Various Construction Spain 1,702 -

----------------------- -------------- ------- --------------- ----------------- ----------- --------- --------

Purchase of

receivables

(fixed) from

solar

PV installations

for a leading

agricultural

business engaged

in the

cultivation

of grapevines,

cereals,

onions, olives,

almonds, and Solar

peas. BBB+ / BBB- 10 PV Construction Spain 3,490 -

----------------- -------------- -------- ----------- ------------------ ------------ ---------- --------

Purchase of

receivables

from PPA

agreements

for two solar PV

plants in

self-consumption

for a total

installed

capacity of

869kWp

located around

Alicante, 14 Solar

Spain. BB+ / BB & 15 PV Construction Spain 616 605

----------------- -------------- -------- ----------- ------------------ ------------ ---------- --------

Purchase of

receivables

generated from

grid

sales and PPA

agreements

through the

investments

financing four

solar

PV plants in

self-consumption

with combined

capacity

of 1.3MWp in Solar

Spain. BBB+ / BBB- 18 PV Construction Spain 725 142

----------------- -------------- -------- ----------- ------------------ ------------ ---------- --------

Acquisition of

receivables

of FiTs and

export

tariffs

generated

from an

operating

wind turbine in United

Scotland. BBB+ / BBB- 12.37 Wind Operating Kingdom 331 331

----------------- -------------- -------- ----------- ------------------ ------------ ---------- --------

Purchase of

receivables

(fixed)

generated

from the

installation

and operation of

metering and LED

projects with

eleven

different 5

counterparties to United

in the UK. BBB+ / BBB- 7 Various Construction Kingdom 457 404

----------------- -------------- -------- ----------- ------------------ ------------ ---------- --------

Financing (fixed

payments indexed

to CPI) the

installation

of a roof

mounted

solar PV plant

for

self-consumption

in Central

Italy,

with a total

installed

capacity of

approximately Solar

1.0 MWp. BB+/BB 10 PV Construction Italy 857 -

----------------- -------------- -------- ----------- ------------------ ------------ ---------- --------

Purchase of

receivables

(pre-determined

fixed payments)

generated from

the

installation of

a roof mounted

solar

PV plant for

self-consumption

in Northern

Italy,

with a total

installed

capacity of ca. Solar

478.8 kWp. A- 5 PV Construction Italy 513 -

----------------- -------------- -------- ----------- ------------------ ------------ ---------- --------

Purchase of

receivables

(fixed)

generated

from refinancing

the installation

of LED lighting

projects for 17

different

clients

in the UK. The

various

operating lease

agreements range

from five to ten United

years. BBB+ / BBB- 10 Lighting Operating Kingdom 456 456

----------------- -------------- -------- ----------- ------------------ ------------ ---------- --------

MARKET OUTLOOK

Electricity prices for industrial and residential customers

across Europe have increased significantly since the Company's IPO

in June 2021. Given this strong upward pressure on energy prices,

we have seen a noticeable increase in investment opportunities.

From our discussions with ESCOs and other market participants, it

is clear that higher power prices compared with those seen prior to

the Russia /Ukraine conflict, notwithstanding power prices since

retreating to pre-conflict levels are accelerating investments in

energy efficiency projects, and the Company is well positioned to

benefit from this increased demand for funding of such

projects.

Market Commentary

Introduction

The energy market crisis in 2022, caused by the Russia/Ukraine

conflict brought critical issues of energy supply security to the

fore. The European region's gas supply remains uncertain, even if

the prices are no longer at the same elevated levels. Against this

backdrop, the European Commission is deliberating on market reforms

to devise better long-term incentives to help manage price and

supply volatility. Incentives are also needed for the demand side,

essential in balancing the system. Experience shows that investment

in energy efficiency infrastructure is essential to delivering on

climate-neutral goals.

The interaction between renewable energy and energy efficiency

follows a complex relationship. The rising levels of distributed

renewable energy penetration in most of the European region

effectively displaces a proportional share of primary energy

consumption. This assumes that primary energy consumption is

measured net of distributed (or behind the meter) energy

generation. Conversely carbon-saving measures (including

electrification) enhance the scope for renewable energy. The

inverse relation is most robust in countries with a high renewable

energy share in the total energy mix. The historical trend in

primary and renewable energy consumption shows this relationship.

In this regard, the step-up in renewable energy projects

establishes a strong case for energy efficiency.

There are steeper targets to build upon the progress in

rationalising primary energy consumption. The active policy

involvement in addressing immediate energy sector challenges will

extend to hastening energy efficiency activities. Energy demand

segments such as buildings and space heating/cooling are now

attracting maximum attention for investments by public authorities

and the private sector.

Policy and Regulatory Developments

Progressively, the European region has coordinated policy and

regulatory measures for energy efficiency. Renewable energy targets

are part of this framework for the overarching goal of a

climate-neutral area by 2050. In September 2022, the European

Parliament voted on Energy Efficiency and Renewable Energy

Directives. Renewable energy-based sources are part of an envisaged

integrated system in which energy efficiency standards are supposed

to operate. The guiding principle of 'Energy Efficiency First'

reinforced its place with the recent energy sourcing and pricing

challenges. In March 2023, the European Commission approved the

provisional agreement for setting higher energy efficiency targets.

With this agreement, which requires 1.4% average annual energy

savings by member countries during 2024-2030, there is legislative

backing for reaching beyond the 'Fit for 55' plan. The annual

targets are almost twice those in the original scheme.

While the end-use sectors continue to be buildings, industry and

transportation, the focal points include the public sector

(regional and local levels) and the companies (energy-intensive

large entities). Also significant is the emphasis on energy

efficiency financing to enable investment mobilization - the

provisions require the promotion of financing schemes and lending

products and involve a reporting structure.

The recent developments in the European Union's policy narrative

on energy efficiency come after the collective action taken in 2022

to counter supply shocks (through price caps and windfall

taxation). The measures also involved voluntary curtailment, most

of which was borne by the energy-intensive industrial consumers.

While the market intervention measures implemented to achieve these

one-off actions may not be required further, there is still a

strong case for continuing to reduce primary energy

consumption.

The persistent geopolitical challenges and the uncertainty

around energy security make it difficult to draw any visible signs

of stability. For this reason, in March 2023, the EU Council agreed

to a one-year extension of member states' voluntary 15% gas demand

reduction. Thus, based on the average consumption between April

2017 and March 2022, member states should reduce their annual

natural gas consumption by 15% between April 2023 and March 2024

(compared with the prior year).

Key Measures Introduced for Energy Efficiency

Date Country / region Policy / regulatory measures

March 2023 European Union

Final energy consumption target for 2030 raised to 11.7%. This is beyond

the targets in the

original 'Fit for 55' plan.

March/February 2023 UK

Energy Efficiency Taskforce launched for a 15% reduction in energy demand

by 2030. Earlier,

a GBP1.8 billion outlay was announced for energy efficiency initiatives.

October France

/December 2022 Energy Sobriety Plan (October 2022), aiming for a 10% reduction in

consumption by 2024, though

without binding targets. An enhanced outlay was provided for the

MaPrimeRénov retrofit

grant scheme due to the encouraging response.

October 2022 Germany

New energy efficiency law in discussions for binding targets at federal and

state level from

2024 onwards. Among other sectors to be potential in focus include data

centres.

May 2022 European Union

REPowerEU launched as a comprehensive policy about energy transition and

energy savings. About

30% of the estimated outlay was on energy efficiency.

==================== ================= =============================================================================

Measures introduced across these countries have varied. For most

countries, energy efficiency was an urgent requirement in the

aftermath of the Russia/Ukraine armed conflict. As a result, both

renewable energy and efficiency, in tandem, took the highest

priority. The measures so far have been a mix of incentives and

related voluntary measures for reducing demand. Progressively, the

need is for binding targets along the lines of the European Union's

recent step.

Concrete policy measures with binding targets may take more work

to implement, although efforts are underway to reach that goal. The

German example is one case in point. The country's upcoming energy

efficiency law is challenging (such as requiring new residential

heating systems to be renewable-based from 2024 onwards) and

subject to significant delays. The investor interest is high due to

the potential opportunity. In January 2021, The Canadian

infrastructure fund Brookfield acquired a majority stake in

Thermondo, a German start-up specialised in technology-enabled

space heating systems. Similar scope is observed in other markets.

In the UK, a Parliamentary report (House of Commons Committee

report) pointed out energy efficiency in buildings as among the

glaring gaps in policy implementation. Similar issues exist across

European countries regarding energy efficiency objectives against

actual implementation through policy measures.

The policy paradigm is an evolving one given the short-term

switching costs for households and businesses, e.g. to replace gas

boilers with heat pumps. The policy response in the prevailing

energy scenario is different from the one the same countries faced

earlier as the case of Italy illustrates.

In 2020, during the COVID pandemic, the Italian government

implemented the Decreto Rilancio, which introduced the Superbonus

110% scheme. This initiative aimed to stimulate the Italian economy

by encouraging property owners, tenants, and others with a legal

right to use a property to carry out anti-seismic renovations and

energy efficiency improvements on Italian properties. Qualifying

work for the Superbonus included the installation of photovoltaic

systems and electric vehicle charging stations inside a property,

among others.

The Italian Superbonus scheme provided a tax credit of up to

110% of the installation expenses for eligible renovation work. The

Legislative Decree Aiuti quater, which is set to become law soon,

reduces the Superbonus tax credit from 110% to 90% in 2023, but

extends the possibility of applying the discount to invoices or

assigning the tax credit in 10 instalments instead of 5. The

Superbonus scheme will continue into 2024 and 2025, but the tax

credit will decrease to 75% in 2024 and 65% in 2025.

However, the Italian Budget Law 2023 allows condominiums that

submitted a CILA (Comunicazione di Inizio Asseverata) before 31

December 2022, to remain eligible for the full 110% Superbonus tax

credit. Additionally, single-family properties can also qualify for

the full Superbonus tax credit if at least 30% of the renovation

work was completed by 30 September 2022, and all of the work was

finished by 31 March 2023. None of our projects should be impacted

by the change in the regulatory framework since (i) the development

of the projects is significantly prior to said change and ii) all

the projects should be completed and revised by the various

advisors (asseverazione) before the end of the current year.

As a tool, overall(2) the Italian Superbonus programme had an

important impact on the construction sector overall which in turn

stimulated GDP growth and job creation. Italy's economic output is

estimated to have grown by 3.9% in 2022, driven by domestic demand,

in particular housing investment. After contracting by 5.5% in 2020

due to the impact of COVID, investment in construction in the

country grew rapidly by 24.6% in 2021. In 2022, the industry

continued to expand by approximately 15.4%, with a significant

boost from a 25.7% increase in the home renovation sector.

According to ANCE, Italy's national builders' association,

construction investment reached an estimated EUR172bn in 2022. This

surge in activity marks a reversal of the industry's decade-long

decline, which saw a drop of almost a quarter in total construction

revenues and almost a third of workers losing their jobs between

2010 and 2020, according to the European Commission.

Investment environment

Private sector financing has yet to play a more significant role

in facilitating energy efficiency projects. Part of the reason is

the impact potential of such projects with social implications and

the return potential but the constraints to more capital allocation

remain with market fragmentation, scalability and scarcity of

dedicated players. Energy efficiency in the residential housing

segment is one such area.

There is significant scope for the deployment of private capital

in the emerging energy efficiency space. The need is to develop

innovative financing models to help adoption. There has been a rise

in funding activity in the overall Climate and Sustainability

space, with about $37 billion(1) in dry powder understood to be

available for deployment as of March 2023. Of the various

investment subsectors, an important one is the buildings sector. A

combination of distributed energy resources (such as solar) and

energy efficiency (space heating/cooling) systems present an

effective means of mitigating emissions in the buildings sector.

The investment upside is significant for the near-untapped

potential in most of the markets.

(1) The data point of $37 billion was sourced from a BCG article

dated 30 March 30 2023. BCG's article attributed this data to the

Center for Climate-Aligned Finance.

https://www.bcg.com/publications/2023/private-capital-and-climate-opportunity-europe

As of November 2022, the energy efficiency sector had seen

investment in 280 deals backed by private equity and venture

capital worth $31.79 billion. Comparatively, the total transaction

volume for 2021 stood at $16.36 billion across 307 transactions

involving companies in the energy efficiency, energy management,

innovative energy, and carbon emission sectors. Investments in this

field defied the general downward trend of private equity and

venture capital deployment in 2022, reflecting nations and

companies racing to meet carbon emission reduction targets through

sustainable energy management strategies. As VC and PE capital

continues to flow into the sector, it is critical to support this

with dedicated lending solutions for asset and working capital

finance as banks often face internal organisational issues that

limit their capacity to follow the market or increase the costs of

energy efficiency funding. These issues include the availability of

resources, the need to build capacity among loan officers and

develop innovative solutions for energy efficiency financing.