Braveheart Investment Group plc Partial Disposal of Investment in Gyrometric (3556Y)

August 21 2018 - 1:00AM

UK Regulatory

TIDMBRH

RNS Number : 3556Y

Braveheart Investment Group plc

21 August 2018

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR")

21 August 2018

Braveheart Investment Group plc

("Braveheart" or the "Company")

Partial investment disposal and share exchange with Strat Aero

plc

Braveheart Investment Group plc (AIM:BRH), the fund management

and strategic investor group, is pleased to report that agreement

has been reached to exchange part of its holding in GyroMetric

Systems Limited ("GyroMetric") in return for the issue of ordinary

shares in Strat Aero plc ("Strat Aero"). This agreement is subject

to approval of all the GyroMetric shareholders and the pre-emption

rights of minority shareholders, which could result in Braveheart

receiving payment from minority shareholders in cash for up to 22

per cent. of the consideration receivable, thus reducing the

consideration and number of shares receivable from Strat Aero.

Under the agreement, Strat Aero, which already has a holding of

33.7 per cent. of the fully diluted of GyroMetric, has agreed to

acquire 228,000 shares in GyroMetric from Braveheart, for a

consideration of GBP273,600 satisfied by the issue of 23,791,304

new shares in Strat Aero ("Strat Aero Consideration Shares"). As a

result, Braveheart's holding in GyroMetric will reduce from a fully

diluted 37.3 per cent. (fully diluted for "in the money" options)

to a fully diluted 18.2 per cent. and Braveheart will hold an

interest in Strat Aero of approximately 7 per cent. of the enlarged

issued share capital of Strat Aero. As a result of the transaction

Strat Aero's holding in GyroMetric could increase up to 52.8 per

cent. of the fully diluted share capital of Gyrometric, dependent

on the level of take-up of pre-emption rights by minority

shareholders in GyroMetric.

Trevor Brown, the Chief Executive of Braveheart is a director of

Strat Aero and together with the other directors of Strat Aero hold

more than 30 per cent. of the shares in Strat Aero. Accordingly,

Strat Aero is treated as a related party under the AIM Rules.

The independent Directors (which excludes Trevor Brown) ("the

Independent Directors") believe that this transaction will provide

greater liquidity over a part of its investment portfolio and

enable GyroMetric to take advantage of synergies with Geocurve

Limited ("Geocurve"), a wholly owned subsidiary of Strat Aero, and

thereby improve GyroMetric's long term prospects and ultimately the

value of Braveheart's remaining holding.

The Independent Directors consider, having consulted with

Allenby Capital Limited, the Company's Nominated Adviser, that the

terms of the sale of the holding in GyroMetric are fair and

reasonable insofar as the shareholders of Braveheart are

concerned.

This transaction is also subject to admission to trading on the

AIM market of the Strat Aero Consideration Shares, which is

expected to take place soon after the necessary approval from

GyroMetric shareholders are obtained.

At 31 March 2018, the 228,000 shares in GyroMetric had a book

value of GBP120,156. On ultimate sale, Braveheart has an obligation

to share part of the profits arising on the sale of the GyroMetric

and Strat Aero holdings with the prior owners of the GyroMetric

shares, which it estimates to amount, at the above valuations, to

approximately GBP100,000.

A further announcement will be made in due course.

Viv Hallam, Executive Director of Braveheart, said: "Braveheart

will continue to be closely involved in the development of the

Gyrometric business and retains an 18% holding. We believe that

closer working with Geocurve will be highly beneficial to

Gyrometric. This transaction, at a premium to GyroMetric's most

recent investment round provides liquidity to our investment

portfolio and enhances the prospects for GyroMetric, where we are

pleased to continue to be closely involved through our

holding."

For further information:

Braveheart Investment Group plc Tel: 01738 587555

Viv Hallam, Executive Director

Allenby Capital Limited (Nominated Adviser Tel: 020 3328 5656

and Joint Broker)

David Worlidge / Nicholas Chambers

Peterhouse Capital Limited (Joint Broker) Tel: 020 7469 0936

Heena Karani / Lucy Williams

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLLFFTTFIIFIT

(END) Dow Jones Newswires

August 21, 2018 02:00 ET (06:00 GMT)

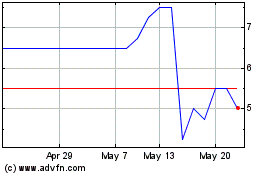

Braveheart Investment (LSE:BRH)

Historical Stock Chart

From Apr 2024 to May 2024

Braveheart Investment (LSE:BRH)

Historical Stock Chart

From May 2023 to May 2024