BlackRock Smaller Companies Trust Plc Portfolio Update

December 21 2023 - 11:10AM

UK Regulatory

TIDMBRSC

The information contained in this release was correct as at 30 November 2023.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/market-news

-home.html.

BLACKROCK SMALLER COMPANIES TRUST PLC (LEI:549300MS535KC2WH4082)

All information is at 30 November 2023 and unaudited.

Performance at month end is calculated on a Total Return basis based on NAV per

share with debt at fair value

One month Three months One Three Five

% % year years years

% % %

Net asset value 4.5 -1.8 -7.9 -2.3 15.7

Share price 13.6 4.4 -0.2 -5.0 20.9

Numis ex Inv Companies + AIM Index 5.9 -3.1 -6.0 -3.4 8.3

Sources: BlackRock and Datastream

At month end

Net asset value Capital only (debt at par value): 1,345.20p

Net asset value Capital only (debt at fair value): 1,398.13p

Net asset value incl. Income (debt at par value)1: 1,365.95p

Net asset value incl. Income (debt at fair value)1: 1,418.88p

Share price: 1,308.00p

Discount to Cum Income NAV (debt at par value): 4.2%

Discount to Cum Income NAV (debt at fair value): 7.8%

Net yield2: 3.1%

Gross assets3: £728.6m

Gearing range as a % of net assets: 0-15%

Net gearing including income (debt at par): 11.6%

Ongoing charges ratio (actual)4: 0.70%

Ordinary shares in issue5: 48,252,292

1. Includes net revenue of 20.75p

2. Yield calculations are based on dividends announced in the last 12 months as

at the date of release of this announcement and comprise the first interim

dividend of 15.00 pence per share (announced on 26 October 2023, ex-dividend on

2 November 2023, and paid on 4 December 2023) and the final dividend of 25.50

pence per share (announced on 05 May 2023, ex-date on 18 May 2023, and paid 27

June 2023).

3. Includes current year revenue.

4. The Company's ongoing charges are calculated as a percentage of average

daily net assets and using the management fee and all other operating expenses

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain non-recurring items for year ended 28

February 2023.

5. Excludes 1,741,231 ordinary shares held in treasury.

Sector Weightings % of portfolio

Industrials 33.7

Consumer Discretionary 20.7

Financials 15.0

Technology 8.2

Basic Materials 8.2

Consumer Staples 4.3

Energy 3.0

Telecommunications 2.5

Real Estate 1.6

Communication Services 1.6

Health Care 1.2

-----

Total 100.0

=====

Country Weightings % of portfolio

United Kingdom 98.3

United States 1.1

Ireland 0.6

-----

Total 100.0

=====

Ten Largest Equity Investments % of portfolio

Company

Gamma Communications 2.6

Hill & Smith 2.2

4imprint Group 2.2

Chemring Group 2.2

Workspace Group 2.2

CVS Group 2.1

Watches of Switzerland 2.1

Breedon 1.9

YouGov 1.8

Tatton Asset Management 1.8

Commenting on the markets, Roland Arnold, representing the Investment Manager

noted:

During November the Company's NAV per share rose by 4.5% to 1,418.88p on a total

return basis, while our benchmark, the Numis Smaller Companies plus AIM

(excluding Investment Companies) Index, returned 5.9%. For comparison the large

-cap FTSE 100 Index lagged small & mid-caps, returning 2.3%.

November proved a strong market for equity markets as continued falls in

inflation, combined with further normalisation in the jobs market, resulted in a

rapid and stark change in narrative from higher for longer to peak rates and an

imminent central bank pivot. Lower energy prices saw UK inflation fall sharply

to 4.6%. In addition, business activity in the country expanded for the first

time since July as the Purchasing Managers' Index climbed to 50.1. The UK market

rose during the month with Technology, Industrials and Financials as top

performing sectors, and in a stark contrast to much of the last two years, small

& mid-caps outperformed large caps.

Shares in Watches of Switzerland rallied in response to a positive Q2 trading

update which highlighted continued robust demand for luxury watches. The company

also reiterated full year guidance and updated investors on its five-year plan,

with a target to double profits by 2028. The news was taken well by the market

and helped to alleviate concerns over and potential change in strategy from

Rolex post their acquisition of Bucherer. Shares in City Pub Group rose after

Youngs, which we also own in the Trust, agreed to buy the business for £162m,

adding 50 high quality pubs to the Youngs estate. As we move into 2024 we

believe we could see a pickup in this type of strategic corporate activity,

rather than the Private Equity led transactions that we have seen so far this

year, as companies begin to leverage the strength of their own balance sheets to

enhance market positions into any recovery. YouGov continued to rise in

November, having reported in-line results in October, without the profit warning

which the market had been expecting, and reiterating full year guidance.

Shares in video game developer Team17, fell after the company issued a profit

warning during the month. This is one of the only game developers in the market

that hasn't missed on revenues. In fact, revenues came in modestly ahead of

expectations, however profits have been impacted by poor cost controls and

project overspends. We have reduced the position size in the portfolio but

retain a smaller holding as the shares now trade on less than 10x earnings. We

will be monitoring the position closely for further developments. The second

largest detractor was 4imprint, which despite confirming another upgrade to

FY23, fell on commentary that the company had noticed more volatility in order

patterns in recent weeks. While the share price reaction was disappointing, we

do not believe this is anything more than an observation from the management

team, and the long-term dynamics for this market share winner remain as

attractive as ever. Shares in Qinetiq fell in response to interim results which

showed profits in-line with expectations, however there was a slowdown in its

recently acquired US business which disappointed the market.

Since the end of 2021, rising interest rates have been weighing on the

valuations of long-duration, higher growth shares in the stock market. As a

result, UK small & mid-cap companies have continued to underperform large cap

companies and we are now in the deepest and longest cycle of underperformance in

recent history; worse than the Global Financial Crisis, COVID, Brexit, Tech sell

-off or Black Monday. Against this backdrop, the question remains, what is the

catalysts for this trend to change? Unfortunately, there is no simple answer.

While there are many headwinds to the UK SMID market; economic uncertainty,

political uncertainty, the structural flow issues in the UK market, the risk of

more pervasive inflation, to name a few, we remind ourselves and take comfort in

the fact that many of our holdings continue to deliver against their objectives.

Furthermore, we believe we are closer to the end of monetary tightening and at

some point, we are confident that investors will decide the balance of

probabilities is in favour of the opportunities, that the risks are more than

adequately priced in, and that an increased allocation to UK Small and mid-caps

is warranted.

As ever, we remain focused on the micro, industry level change and stock

specific analysis and the opportunities we are seeing today in our universe are

as exciting as ever. Historically, periods of heightened volatility have been

followed by strong returns for the strategy and presented excellent investment

opportunities.

We thank shareholders for their ongoing support.

1Source: BlackRock as at 30 November 2023

21 December 2023

ENDS

Latest information is available by typing www.blackrock.com/uk/brsc on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of any

website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

December 21, 2023 12:10 ET (17:10 GMT)

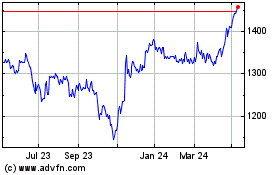

Blackrock Smaller (LSE:BRSC)

Historical Stock Chart

From Nov 2024 to Dec 2024

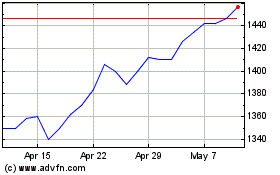

Blackrock Smaller (LSE:BRSC)

Historical Stock Chart

From Dec 2023 to Dec 2024