TIDMBSE

AIM and Media Release

31 October 2023

Base Resources Limited

Quarterly Activities Report - September 2023

African mineral sands producer, Base Resources Limited (ASX & AIM: BSE) (Base

Resources or the Company) is pleased to provide an operational, development and

corporate update for the quarter ended 30 September 2023.

Key Points

· Prices for ilmenite and rutile improved, while zircon prices softened on

sluggish demand.

· Mineral separation plant transitioned from continuous operation to campaign

processing, as planned, to ensure optimum product recoveries are maintained as

lower ore grades over the remainder of Kwale Operations' mine life constrain HMC

production.

· Kwale East Phase 2 air core drilling program was discontinued after an

evaluation of the drill results to date concluded there is unlikely to be

sufficient volume or heavy mineral grade to support an economically viable

mining development.

· A new Mining Code has come into effect in Madagascar with fiscal provisions

not materially out of step with Toliara Project DFS assumptions.

· Engagement with the Government on Toliara Project fiscal terms and lifting

of the project's on-ground suspension has been limited, principally due to

preparations for the upcoming Presidential elections. The incumbent President

has declared his candidacy and officially resigned on 9 September 2023.

KWALE OPERATIONS

Operational performance

The Kwale South and North Dunes continued to be mined concurrently during the

quarter, with two hydraulic mining units operating in each area. Mined tonnage

was steady at 4.1 million tonnes (Mt) (last quarter: 4.1Mt). Mining rates in

the North Dune improved during the quarter after the water pressure for one of

the hydraulic mining units was boosted from the standard 25 bar to 32 bar. A

second higher pressure hydraulic mining unit will be commissioned when mining

commences on the Bumamani deposit in the March quarter of 2024. Consistent with

mine plan, the heavy mineral (HM) grade of ore mined in the quarter was lower

than last quarter at 2.5% (last quarter: 3.0%), and consequently, heavy mineral

concentrate (HMC) production was lower at 84.8kt (last quarter: 103.2kt).

As ore grades and HMC production will be lower for the remainder of Kwale

Operations' mine life, the mineral separation plant (MSP) was transitioned, as

planned, from continuous operations to campaign processing to ensure optimum

product recoveries are maintained, with extended shuts between campaigns to

allow HMC stocks to rebuild. The combination of lower HMC production and MSP

shuts reduced the HMC fed to the MSP in the quarter to 71.6kt (last quarter:

106.1kt), resulting in a corresponding fall in production for all products.

Deposition of sand tails into the mined out North Dune pit P199 commenced in the

quarter, with sand tails also continuing to be deposited on the mined-out

Central Dune area. To aid water retention and subsequent rehabilitation, the

sand tails are capped with a co-disposed slimes/sand layer. Rehabilitation

activities on the Central Dune, South Dune and North Dune proceeded to plan.

SUMMARY BY QUARTER FY23 FY24

SEP DEC MAR JUN SEP

Mining (million tonnes)

Ore mined 4.4 4.5 3.3 4.1 4.1

HM % 3.8 4.0 3.9 3.0 2.5

VHM % 2.9 3.1 3.1 2.3 1.9

Production (thousand tonnes)

Ilmenite 86.0 84.5 71.6 55.5 38.8

Rutile 18.9 19.5 16.6 13.8 9.6

Zircon 6.6 7.4 6.4 5.5 3.8

Low grade products1 5.7 5.2 4.1 3.4 2.0

SUMMARY BY QUARTER FY23 FY24

SEP DEC MAR JUN SEP

US$ per tonne

Sales revenue $714 $651 $637 $695 $1,029

Operating costs $154 $165 $190 $240 $343

Cost of goods sold $200 $191 $195 $263 $442

Revenue: Cost ratio 3.6 3.4 3.3 2.6 2.3

Sales (thousand tonnes)

Ilmenite 62.6 74.1 86.2 74.6 11.1

Rutile 14.2 14.7 15.2 19.6 5.5

Zircon 6.2 5.0 7.4 6.6 3.9

Low grade products1 4.5 4.7 5.3 3.2 2.0

[Note (1): Low grade products are a combination of low-grade zircon and low

-grade rutile which are sold separately at a discount to standard grade

products.]

Bulk shipping operations at the Company's Likoni export facility continued to

run smoothly, albeit at significantly lower volumes with 11.0kt of bulk ilmenite

dispatched (last quarter: 89.5kt). Containerised shipments of rutile and zircon

through the Mombasa Port also proceeded to plan. Despite lower production

levels for the remainder of Kwale Operations' mine life, the Company plans to

continue bulk shipments of ilmenite (up to 54kt lots) and rutile (between 5-10kt

lots), which will result in greater volatility in quarterly sales volumes, as

illustrated by the sales volumes for this quarter.

Unit operating costs have increased to US$343 per tonne produced (rutile,

ilmenite, zircon and low-grade products) (last quarter: US$240 per tonne) due to

the lower production. Despite this, total cash operating costs of US$18.6

million were marginally lower than the prior quarter (last quarter: US$18.8

million).

Cost of goods sold increased to US$442 per tonne sold (operating costs, adjusted

for stockpile movements, and royalties) due to the higher unit operating costs

and product sales mix (last quarter: US$263 per tonne), which also drove an

increase in the average unit revenue US$1,029 per tonne (prior quarter: US$695

per tonne). Consequently, the revenue to cost of goods sold ratio for the

quarter decreased to 2.3 (last quarter: 2.6).

FY23 production and FY24 production guidance

Kwale Operations FY24 production guidance is unchanged and remains as follows2:

· Rutile - 35,000 to 41,000 tonnes.

· Ilmenite - 130,000 to 160,000 tonnes.

· Zircon - 13,000 to 16,000 tonnes.

[Note (2): Refer to Base Resources' announcement on 26 June 2023, "FY24

Production Guidance - Kwale Operations", for the assumptions upon which the

guidance is based.]

MARKETING

Market conditions became increasingly challenging through the September quarter

due to growing economic uncertainty and softening property sectors across all

key markets. However, firm demand continued for Base Resources' products

through the quarter and sales were in line with expectations. Prices held up

well for ilmenite and rutile, but zircon prices moderated due to the sluggish

conditions that emerged during the latter part of the June quarter.

Ilmenite demand and prices in China remained relatively stable through the

quarter as major Chinese pigment plants maintained high levels of production.

The domestic pigment market in China was subdued through most of the quarter but

saw a seasonal improvement towards the end of the quarter. Export opportunities

for Chinese pigment producers increased through the quarter as significant

pigment production capacity in Taiwan and Europe was closed. Chloride pigment

producers in China, which are reliant on imported ilmenite, continued to build

and ramp up new production capacity which supported demand for Base Resources'

ilmenite.

Major western pigment producers have continued to sacrifice sales volumes to

support stable prices and, as a result, production rates were well below

capacity levels to avoid a build-up of inventory and demand for high-grade

titanium dioxide feedstocks was consequently reduced. While one major high

-grade feedstock producer has suspended production of synthetic rutile for at

least four months, which will assist in offsetting the drop in demand, downward

pressure on rutile prices is expected to continue building.

Rutile demand from the smaller welding and titanium metal sectors remained firm

in the quarter. Sales into these sectors command a significant price premium

over bulk rutile for the TiO2 pigment market, but this premium is expected to

reduce as some high-grade feedstock supply to the pigment sector is re-directed

to these sectors. Base Resources is maintaining its approach of increasing the

proportion of its rutile sales to the welding sector.

The weakening conditions in the Chinese and European zircon markets towards the

end of the June quarter led to a reduction in contracted zircon prices for

September quarter. Global demand for zircon has continued to soften through the

quarter and prices will moderate further for December quarter contracts.

SUSTAINABILITY

Health and safety

There were no lost time injuries during the quarter and, with no lost time

injuries in the past 12 months, Base Resources has a lost time injury frequency

rate (LTIFR) of 0.0 per million hours worked. Compared to the Western

Australian All Mines 2020/2021 LTIFR of 2.0, this is an exceptional performance

and reflects the ongoing focus and importance placed on safety. With no medical

treatment injuries recorded in the last 12 months, Base Resources' total

recordable injury frequency rate is 0.0per million hours worked.

Community and environment - Kwale Operations

Farmers participating in the Company's agricultural livelihood programs in Kwale

County, implemented through the PAVI farmers' cooperative, commenced harvesting

of cotton and maize crops towards the end of the quarter and are also commencing

preparations for what is expected to be a successful growing season, with above

average rainfall forecast for the December quarter's `small rains' as an El Nino

weather pattern develops.

Training on business, entrepreneurship and leadership was delivered to 21

women's groups during the quarter, with the approximately 350 participants also

receiving support from the Company for various income generating initiatives.

The `long rains', which normally run April to June, extended well into the

September quarter allowing a further 30,000 trees to be planted as part of the

Company's rehabilitation efforts, bringing the total planted for the rainy

season to 80,000 trees. No instances of environmental non-compliance, major

environmental incidents or environment-related community complaints were

identified or recorded during the quarter.

Community and environment - Toliara Project

All community training programs and social infrastructure projects remain on

hold while the Toliara Project's on-ground activities are suspended.

BUSINESS DEVELOPMENT

Toliara Project development - Madagascar

Engagement with the Government of Madagascar on Toliara Project fiscal terms and

lifting of the project's on-ground suspension has been limited during the

quarter, principally due to the Government focus on preparations for the

upcoming Presidential elections.

The new Mining Code was recently passed into law and now applies to the

Company's Toliara Project. Key financial elements of the new Mining Code

relevant to the Toliara Project are:

· Increase in royalty rate from 2% to 5%. A reduction of 30% is applied to

the 5% royalty in the event the products are locally "transformed", the

definition and application of which are unclear. The Toliara Project Updated

Definitive Feasibility Study (DFS2) completed on 27 September 2021 assumed a 4%

royalty rate.

· A contribution to the "Mining Fund for Community and Social Investment"

equal to 3% of the direct investment amount. The term "direct investment" is

not defined and the applicability of this contribution requirement to the

Toliara Project is unclear. If this requirement were to apply to the Toliara

Project, based on the DFS2 Stage1 CAPEX of US$520million, this would require a

contribution of US$15.6million.3 DFS2 assumed an upfront community development

spend of US$10million.

The application of the above elements, and several other key provisions of the

new Mining Code, lack sufficient detail to fully assess their potential impact

on the Toliara Project. Other provisions that may impact the project include

any prescribed specifications (conditions) attaching to the project's

exploitation permit 37242, minimum requirements for the project's corporate

social responsibility plan (which will include social investment, infrastructure

spending and local content requirements), prescribed annual mining fees and

requirements for an environmental and rehabilitation provision.

The Government is preparing the Implementing Decree for the new Mining Code, a

draft of which should shortly be available for industry consultation. Greater

clarity on the new Mining Code and its application to the Toliara Project is

expected once the Implementing Decree is finalised together with any further

supporting regulations, orders and decrees.

Separately, the first round of the Presidential elections have been deferred by

a week to 16 November 2023, with the second round (if needed) scheduled for

20December 2023. The incumbent President has declared his candidacy and

officially resigned on 9 September 2023 to commence campaigning.

Until the full suite of Mining Code reform is completed and elections finalised,

the Company does not expect to achieve material progress in securing fiscal

terms or lifting of the project's on-ground suspension. The Company remains

ready and committed to progressing the world class Toliara Project to a final

investment decision once fiscal terms are secured and the on-ground suspension

is lifted.

The Toliara Rare Earths Pre-Feasibility Study of the economic potential of the

monazite contained in the Toliara Project's Ranobe Mineral Resources estimate

continued in the quarter and remains on track for completion in the March

quarter of 2024.

Total expenditure on the Toliara Project and Toliara Rare Earths Pre-Feasibility

Study for the quarter was US$2.4 million (last quarter: US$2.0 million).

[Note (3): For further information about DFS2, refer to Base Resources'

announcement on 27 September 2021 "DFS2 enhances scale and economics of the

Toliara Project" available at

https://baseresources.com.au/investors/announcements/. Base Resources confirms

that all the material assumptions underpinning the production information and

forecast financial information disclosed in that announcement continue to apply

and have not materially changed.]

Extensional exploration - Kenya

The Company released progress results from the first phase auger drilling

program (Phase 1) at the Kwale East exploration project4 (within Prospecting

Licence 2018/0119) at the start of the quarter. A total of 1,019 holes for

11,536.5 metres was completed, with the results confirming the presence of HM,

as well as a high value mineral assemblage. A second phase air core drilling

program (Phase 2) targeting the three areas of mineralisation identified during

Phase 1 - Magaoni, Masindeni and Zigira - was also undertaken during the

quarter. In total for Phase2, 65 holes for 1,054.5 metres were completed in the

Magaoni and Zigira target area, resulting in 703 samples. The Phase 2 drilling

assay results were released subsequent to the quarter end.

Exploration activities at Kwale East have been discontinued following an

evaluation of the likely mineralisation for the three targets using the results

from both Phase1 and Phase2 drill programs and applying optimistic assumptions

on the continuity of mineralisation in the Magaoni and Zigira target areas that

were not able to be drilled. Even on these optimistic assumptions, the

evaluation concluded that there is unlikely to be sufficient volume or heavy

mineral grade to support an economically viable mining development.5

Subsequent to the quarter end, Kenya's Department of Mining announced the

partial lifting of the moratorium on issuance of mining rights for all

construction and industrial minerals, including heavy mineral sands. All other

minerals have been classified as strategic minerals and mining rights shall be

processed on a case-by-case basis in accordance with Kenyan Mining Regulations.

Base Resources is now engaging with the Kenya Department of Mining to understand

the process for progressing its eight prospecting licence applications in Kwale,

Kuranze and Lamu regions, most of which were lodged prior to the decision to

implement the moratorium in 2019.

Expenditure on exploration activities during the quarter in Kenya was US$303k

(last quarter: US$389k).

[Note (4): For further information, refer to Base Resources' announcement on 3

July 2023 "Kwale East exploration drilling update" available at

https://baseresources.com.au/investors/announcements/. Base Resources confirms

that it is not aware of any new information that materially affects the

information included in that announcement.]

[Note (5): For further information, refer to Base Resources' announcement on 30

October 2023 "Kwale East - Exploration update" available at

https://baseresources.com.au/investors/announcements/. Base Resources confirms

that it is not aware of any new information that materially affects the

information included in that announcement.]

Extensional exploration - Tanzania

The Umba South Project in northern Tanzania is located approximately 75km west

-south-west of the Company's Kwale Operations in Kenya. Exploration at Umba

South was designed to test the southern extremity of a prominent north-south

trending ridge of quartzite and gneiss that extends 35km north to the Kuranze

region of Kenya, where initial rock chip and soil sampling indicated the

presence of rutile. Exploration activity in this area has so far been confined

to areas south of the Umba River, while the Company seeks to obtain the

necessary approvals from various government departments to explore in the

Mkomazi Game Controlled Area to the north which hosts the target ridge feature

extending north to the Kenyan border.

Results from the first phase reconnaissance exploration program were released in

the June quarter6. Three primary geological domains were observed - a

soil/colluvial cover sequence, underlying saprolite material and bedrock. While

rutile mineralisation was present in each domain, factors unique to each domain

were identified which would be expected to limit any significant economic

potential.

A second phase infill program to assess the continuity of rutile mineralisation

in the saprolite layer was completed in the March quarter with 86holes for 2,128

metres drilled. Assaying of these drill samples has commenced at the Kwale

Operations laboratory and is approximately 50% complete as assay priority was

given to Kwale East exploration drill samples. The results, which are expected

in the December quarter, will assist in planning future exploration activity at

Umba South and elsewhere along the prospective geological zone, including the

Kuranze region of Kenya once necessary land access approvals are obtained.

Expenditure on exploration activities during the quarter in Tanzania was US$32k

(last quarter: US$101k).

[Note (6): For further information, refer to Base Resources' announcement on 8

May 2023 "Tanzanian exploration - Umba South Phase 1 drill results" available at

https://baseresources.com.au/investors/announcements/. Base Resources confirms

that it is not aware of any new information that materially affects the

information included in that announcement.]

CORPORATE

Following release of the Company's full-year results for the 2023 financial year

(FY23) and disciplined application of the Company's capital management policy, a

final dividend of AUD 4.0 cents per share (unfranked) was paid to shareholders

on 28 September 2023, representing a cash payment of US$29.9 million (in

aggregate). Total dividends in respect of FY23 were AUD 6.0 cents per share

(unfranked), equal to US$45.5 million (in aggregate).

As at 30 September 2023, the Company had cash of US$77.2 million and no debt.

The Company currently has the following securities on issue:

· 1,178,011,850 fully paid ordinary shares.

· 43,327,165 performance rights issued pursuant to the terms of the Base

Resources Long Term Incentive Plan, comprising:

· 8,727,959 vested performance rights, which remain subject to exercise7; and

· 34,599,206 unvested performance rights subject to performance testing in

accordance with their terms of issue.

[Note (7): Vested performance rights have a nil cash exercise price. Unless

exercised beforehand, these rights expire five years after vesting.]

Forward looking statements

Certain statements in or in connection with this announcement contain or

comprise forward looking statements. Such statements may include, but are not

limited to, statements with regard to future production and grades, capital

cost, capacity, sales projections and financial performance and may be (but are

not necessarily) identified by the use of phrases such as "will", "expect",

"anticipate", "believe" and "envisage". By their nature, forward looking

statements involve risk and uncertainty because they relate to events and depend

on circumstances that will occur in the future and may be outside Base

Resources' control. Accordingly, results could differ materially from those set

out in the forward-looking statements as a result of, among other factors,

changes in economic and market conditions, success of business and operating

initiatives, changes in the regulatory environment and other government actions,

fluctuations in product prices and exchange rates and business and operational

risk management. Subject to any continuing obligations under applicable law or

relevant stock exchange listing rules, Base Resources undertakes no obligation

to update publicly or release any revisions to these forward-looking statements

to reflect events or circumstances after today's date or to reflect the

occurrence of unanticipated events.

ENDS.

For further information contact:

+--------------------------------+-----------------------------+

|Australian Media Relations |UK Media Relations |

+--------------------------------+-----------------------------+

|Citadel Magnus |Tavistock Communications |

+--------------------------------+-----------------------------+

|Cameron Gilenko and Michael Weir|Jos Simson and Gareth Tredway|

+--------------------------------+-----------------------------+

|Tel: +61 8 6160 4900 |Tel: +44 207 920 3150 |

+--------------------------------+-----------------------------+

This release has been authorised by the Board of Base Resources.

About Base Resources

Base Resources is an Australian based, African focused, mineral sands producer

and developer with a track record of project delivery and operational

performance. The Company operates the established Kwale Operations in Kenya and

is developing the Toliara Project in Madagascar. Base Resources is an ASX and

AIM listed company. Further details about Base Resources are available at

www.baseresources.com.au.

PRINCIPAL & REGISTERED OFFICE

Level 3, 46 Colin Street

West Perth, Western Australia, 6005

Email: info@baseresources.com.au

Phone: +61 8 9413 7400

Fax: +61 8 9322 8912

NOMINATED ADVISER & JOINT BROKER

Canaccord Genuity Limited

James Asensio / Raj Khatri / George Grainger

Phone: +44 20 7523 8000

JOINT BROKER

Berenberg

Matthew Armitt / Detlir Elezi

Phone: +44 20 3207 7800

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

October 31, 2023 03:00 ET (07:00 GMT)

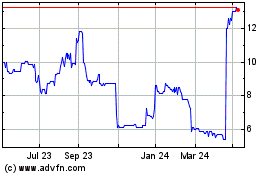

Base Resources (LSE:BSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

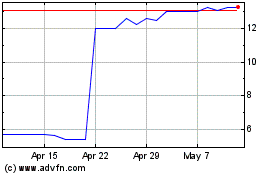

Base Resources (LSE:BSE)

Historical Stock Chart

From Apr 2023 to Apr 2024