Bluefield Solar Income Fund Limited Director Appointment (9018T)

November 20 2023 - 1:00AM

UK Regulatory

TIDMBSIF

RNS Number : 9018T

Bluefield Solar Income Fund Limited

20 November 2023

20 November 2023

Bluefield Solar Income Fund Limited

('Bluefield Solar' or the 'Company')

Director Appointment

Bluefield Solar (LON: BSIF), the London listed UK income fund

focused primarily on acquiring and managing solar energy assets, is

pleased to announce the appointment of Mr Christopher Waldron as an

independent non-executive director with effect from 1 December

2023. Mr Waldron's appointment follows an externally facilitated

selection process.

Chris Waldron has over 35 years' experience as an investment

manager, specialising in fixed income, hedging strategies and

alternative investment mandates; until 2013 he was Chief Executive

of the Edmond de Rothschild Group in the Channel Islands. Prior to

joining the Edmond de Rothschild Group in 1999, Mr Waldron held

investment management positions with the Bank of Bermuda, the

Jardine Matheson Group and Fortis, but since 2013 he had been

primarily an independent non-executive director of a number of

listed funds and investment companies. From 2014 to 2020 he was a

member of the States of Guernsey's Investment and Bond

Sub-Committee, overseeing the management of the island's c.GBP3bn

investment reserves. He is a Fellow of the Chartered Institute of

Securities and Investment and is a resident of Guernsey.

Pursuant to Listing Rule 9.6.13, the Company notes that Mr

Waldron is currently the non-executive chair of Crystal Amber Fund

Limited which is listed on the Alternative Investment Market on the

London Stock Exchange. In the previous 5 years, Mr Waldron was a

non-executive chair of UK Mortgages Limited and a non-executive

director of JZ Capital Partners Limited, both listed on the London

Stock Exchange. Mr Waldron currently holds 30,000 ordinary shares

in the Company.

John Scott, Chairman of Bluefield Solar, said:

"I am delighted to welcome Chris to the Bluefield Solar board.

His appointment comes at an important point in the Company's

development, with Bluefield having identified a significant

proprietary pipeline of new build solar PV opportunities that will

play a key role in the next phase of growth in the UK's solar

market, alongside complementary opportunities in wind and

storage.

"Chris brings to our Board extensive experience in investment

markets and is well placed to provide the risk management and

financial expertise that is essential for AIFMD compliant

funds."

- Ends -

For further information:

Bluefield Partners LLP (Company Investment Tel: +44 (0) 20 7078

Adviser) 0020

James Armstrong / Neil Wood / Giovanni www.bluefieldllp.com

Terranova

Deutsche Numis (Company Broker) Tel: +44 (0) 20 7260

Tod Davis / David Benda / Matt Goss 1000

www.dbnumis.com

Ocorian Tel: +44 (0) 1481

(Company Secretary & Administrator) 742 742

Chezi Hanford www.ocorian.com

Media enquiries: Tel: +44 (0) 20 7466

Buchanan (PR Adviser) 5000

Henry Harrison-Topham / Henry Wilson www.buchanan.uk.com

BSIF@buchanan.uk.com

For further information:

About Bluefield Solar

Bluefield Solar is a London listed income fund focused primarily

on acquiring and managing solar energy assets. Not less than 75% of

the Company's gross assets will be invested into UK solar assets.

The Company can also invest up to 25% of its gross assets into

other technologies, such as wind and storage. Bluefield Solar owns

and operates a UK portfolio of 812MW, comprising 754MW of solar and

58MW of onshore wind.

Further information can be viewed at www.bluefieldsif.com

About Bluefield Partners

Bluefield Partners LLP was established in 2009 and is an

investment adviser to companies and funds investing in renewable

energy infrastructure. It has a proven record in the selection,

acquisition and supervision of large-scale energy assets in the UK

and Europe. The team has been involved in over GBP6.5 billion

renewable funds and/or transactions in both the UK and Europe,

including over GBP1 billion in the UK since December 2011.

Bluefield Partners LLP has led the acquisitions of, and

currently advises on, over 100 UK based solar PV assets that are

agriculturally, commercially or industrially situated. Based in its

London office, it is supported by a dedicated and experienced team

of investment, legal and portfolio executives. Bluefield Partners

LLP was appointed Investment Adviser to Bluefield Solar in June

2013.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOABLBBTMTMBBTJ

(END) Dow Jones Newswires

November 20, 2023 02:00 ET (07:00 GMT)

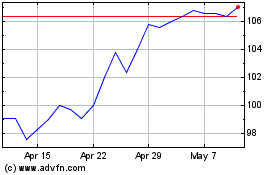

Bluefield Solar Income (LSE:BSIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

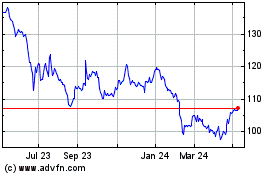

Bluefield Solar Income (LSE:BSIF)

Historical Stock Chart

From Apr 2023 to Apr 2024