TIDMBSIF

RNS Number : 9532U

Bluefield Solar Income Fund Limited

28 November 2023

28 November 2023

Bluefield Solar Income Fund Limited

('Bluefield Solar' or the 'Company')

Result of Annual General Meeting

Bluefield Solar (LON: BSIF), the London listed UK income fund

focused primarily on acquiring and managing solar energy assets,

announces that at the Annual General Meeting ("AGM") of the Company

held at 10.00 am on 28 November 2023, Ordinary Resolutions 1 to 12

and Special Resolutions 14 and 15 were passed without amendment.

Ordinary Resolution 13 did not pass.

The voting breakdown of all resolutions follow:

Resolution Votes For** Votes Against Votes Withheld*

1 - Ordinary 337,555,008 99.99% 38,590 0.01% 12,013

------------ -------- ------------ ------- ----------------

2 - Ordinary 319,616,841 94.72% 17,819,263 5.28% 169,507

------------ -------- ------------ ------- ----------------

3 - Ordinary 334,145,478 98.99% 3,404,454 1.01% 55,679

------------ -------- ------------ ------- ----------------

4 - Ordinary 330,128,407 98.97% 3,445,731 1.03% 4,031,473

------------ -------- ------------ ------- ----------------

5 - Ordinary 292,343,939 86.64% 45,069,084 13.36% 192,588

------------ -------- ------------ ------- ----------------

6 - Ordinary 334,148,826 99.00% 3,391,926 1.00% 64,859

------------ -------- ------------ ------- ----------------

7 - Ordinary 315,265,337 93.40% 22,276,819 6.60% 63,455

------------ -------- ------------ ------- ----------------

8 - Ordinary 315,454,750 94.65% 17,839,621 5.35% 4,311,240

------------ -------- ------------ ------- ----------------

9 - Ordinary 337,499,502 99.98% 65,399 0.02% 40,710

------------ -------- ------------ ------- ----------------

10 - Ordinary 337,583,645 100.00% 9,953 0.00% 12,013

------------ -------- ------------ ------- ----------------

11 - Ordinary 334,977,404 99.23% 2,612,874 0.77% 13,833

------------ -------- ------------ ------- ----------------

12 - Ordinary 332,798,910 98.58% 4,782,510 1.42% 22,691

------------ -------- ------------ ------- ----------------

13 - Ordinary 140,900,541 41.74% 196,644,593 58.26% 58,977

------------ -------- ------------ ------- ----------------

14 - Special 331,944,511 98.35% 5,579,893 1.65% 79,707

------------ -------- ------------ ------- ----------------

15 - Special 330,810,329 98.01% 6,708,580 1.99% 85,202

------------ -------- ------------ ------- ----------------

*A vote withheld is not a vote in law and is therefore not

counted towards the proportion of votes "for" or "against" the

Resolution.

** including discretionary votes.

The Company notes that the quantum and duration of the authority

to allot an unlimited number of shares sought under Resolution 13

is outside of acceptable norms for shareholders, and noting the

significant number of votes received against it, commits to seeking

an appropriate level of authority at the next AGM.

The full text of the Special Resolutions is noted below:

Resolution 14

That, in substitution for any existing disapplication authority

in force as at the date of this Annual General Meeting, the

Directors be and are hereby generally and unconditionally

authorised to allot, issue and/or sell equity securities for cash

as if article 6.2 of the Articles of Incorporation did not apply to

any such allotment, issue and/or sale, provided that this power

shall be limited to the allotment, issue and/or sale of up to 10

per cent. of the Ordinary Shares in issue as at the date of this

Annual General Meeting for the period expiring at the date falling

15 months after the date of the passing of this resolution or the

conclusion of the next annual general meeting of the Company,

whichever is earlier (unless previously renewed, varied or revoked

by the Company in a general meeting), save that the Company shall

be entitled to make offers or agreements before the expiry of such

power which would or might require equity securities to be allotted

and issued after such expiry and the Directors shall be entitled to

allot and issue equity securities pursuant to any such offer or

agreement as if the power conferred hereby had not expired.

Resolution 15

That, in addition to any existing authorities granted to the

Directors, the Directors be, and hereby are, empowered to allot,

issue and/or sell equity securities for cash as if article 6.2 of

the Articles of Incorporation did not apply to any such allotment,

issue and/or sale, provided that this power shall be limited to the

allotment, issue and/or sale of up to an additional 10 per cent. of

the Ordinary Shares in issue as at the date of this Annual General

Meeting for the period expiring at the date falling 15 months after

the date of the passing of this resolution or the conclusion of the

next annual general meeting of the Company, whichever is earlier

(unless previously renewed, varied or revoked by the Company in

general meeting), save that the Company shall be entitled to make

offers or agreements before the expiry of such power which would or

might require equity securities to be allotted and issued after

such expiry and the Directors shall be entitled to allot and issue

equity securities pursuant to any such offer or agreement as if the

power conferred hereby had not expired.

For further information:

Bluefield Partners LLP (Company Investment Tel: +44 (0) 20 7078 0020

Adviser) www.bluefieldllp.com

James Armstrong / Neil Wood / Giovanni

Terranova

Deutsche Numis (Company Broker) Tel: +44 (0) 20 7260 1000

Tod Davis / David Benda / Matt Goss www.dbnumis.com

Ocorian Administration (Guernsey) Limited Tel: +44 (0) 1481 742 742

(Company Secretary & Administrator) www.ocorian.com

Chezi Hanford

Media enquiries: Tel: +44 (0) 20 7466 5000

Buchanan (PR Adviser) www.buchanan.uk.com

Henry Harrison-Topham / Henry Wilson BSIF@buchanan.uk.com

About Bluefield Solar

Bluefield Solar is a London listed income fund focused primarily

on acquiring and managing solar energy assets. Not less than 75% of

the Company's gross assets will be invested into UK solar assets.

The Company can also invest up to 25% of its gross assets into

other technologies, such as wind and storage. Bluefield Solar owns

and operates a UK portfolio of 812MW, comprising 754MW of solar and

58MW of onshore wind.

Further information can be viewed at www.bluefieldsif.com

About Bluefield Partners

Bluefield Partners LLP was established in 2009 and is an

investment adviser to companies and funds investing in renewable

energy infrastructure. It has a proven record in the selection,

acquisition and supervision of large-scale energy assets in the UK

and Europe. The team has been involved in over GBP6.5 billion

renewable funds and/or transactions in both the UK and Europe,

including over GBP1 billion in the UK since December 2011.

Bluefield Partners LLP has led the acquisitions of, and

currently advises on, over 100 UK based solar PV assets that are

agriculturally, commercially or industrially situated. Based in its

London office, it is supported by a dedicated and experienced team

of investment, legal and portfolio executives. Bluefield Partners

LLP was appointed Investment Adviser to Bluefield Solar in June

2013.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGFEDFIAEDSEIF

(END) Dow Jones Newswires

November 28, 2023 10:55 ET (15:55 GMT)

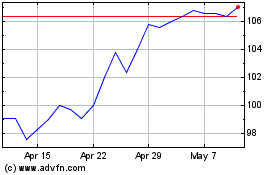

Bluefield Solar Income (LSE:BSIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

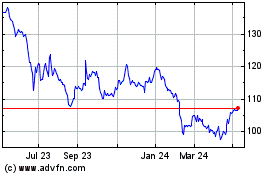

Bluefield Solar Income (LSE:BSIF)

Historical Stock Chart

From Apr 2023 to Apr 2024