TIDMBSV

RNS Number : 2903M

British Smaller Companies VCT PLC

13 September 2023

British Smaller Companies VCT plc

Interim Management Statement

For the quarter ended 30 June 2023

British Smaller Companies VCT plc (the "Company") presents its

interim management statement for the quarter ended 30 June 2023.

The statement also includes relevant financial information between

the end of the quarter and the date of this statement. A copy of

this interim management statement can be found at www.bscfunds.com

.

Overview

In the quarter to 30 June 2023, the Company's Net Asset Value

per share return was unchanged at 83.7 pence. In comparison, the

FTSE Small Cap Index fell by 0.4 per cent during the period. AIC

data ranks the Company first across all generalist VCTs when

considering a blended average performance ranking over 1, 3, 5, 7

and 10 years.

The Company's Total Return at 30 June 2023 was unchanged at

258.6 pence per ordinary share.

During the quarter, the Company invested GBP2.6 million into

Workbuzz, an employee insights and engagement settlement platform.

The Company also invested a further GBP0.8 million into Relative

Insight.

The Company realised its investment in Ncam in April, generating

initial proceeds of GBP1.4 million. There is the potential for

additional receipts of up to GBP1.2 million depending on the

achievement of certain milestones over the coming years, which

would see the Company fully recover its investment; GBP0.3 million

of deferred proceeds have been recognised at the period end.

Subsequent to the period end, the Company has made a further

investment of GBP0.3 million into Elucidat.

Performance

The table below sets out movements in key metrics for the

Company.

31 March Increase Shares Buyback Movement 30 June

2023 in Value issued of shares In Period 2023

Net Assets (GBPm) 157.0 0.4 44.4 (0.4) 44.4 201.4

------------ ---------- ----------- ----------- ----------- ------------

NAV per share

(PPS) 83.7 0.2 (0.2) - - 83.7

------------ ---------- ----------- ----------- ----------- ------------

Cumulative dividends

paid (PPS) 174.9 - - - - 174.9

------------ ---------- ----------- ----------- ----------- ------------

Total Return

(PPS) 258.6 0.2 (0.2) - - 258.6

------------ ---------- ----------- ----------- ----------- ------------

Shares in issue 187,679,279 - 53,559,905 (451,965) 53,107,940 240,787,219

------------ ---------- ----------- ----------- ----------- ------------

Cumulative dividends paid at 30 June 2023 were unchanged at

174.9 pence per ordinary share (31 March 2023: 174.9 pence per

ordinary share).

The movements in NAV and NAV per ordinary share are set out in

the table below:

GBPm Pence per

ordinary share

NAV at 31 March 2023 157.0 83.7

Increase in portfolio value 0.6 0.3

Net operating costs (0.2) (0.1)

------ ---------

0.4 0.2

Issue/buy-back of shares* 44.0 (0.2)

------ ---------

Total Return in the period 44.4 -

------ -------

NAV at 30 June 2023 201.4 83.7

------ ------ --------- -------

* The allotment of shares from the 2022/23 fundraising reduced

total return per ordinary share as the fundraising was priced at

the last reported NAV at the time of the allotment of 82.8 pence

per ordinary share, being the NAV as at 31 December 2022 of 87.3

pence per ordinary share, adjusted for the special interim dividend

of 4.5 pence per ordinary share paid on 11 January 2023.

Post-period end, on 28 July 2023, a dividend of 2.0 pence per

ordinary share for the year ending 31 March 2024 was paid,

resulting in a corresponding reduction to the 30 June 2023

unaudited NAV, to 81.7 pence per ordinary share.

Dividends and shares in issue

On 4 April 2023, the Company allotted 53,559,905 shares

following the close of its 2022/23 fundraising.

Under its standing buyback authority, on 26 June 2023 the

Company purchased 451,965 shares at 80.02 pence at a cost of

GBP0.36 million. These shares are held in treasury.

Subsequent to the quarter end, on 28 July 2023 the Company

issued 1,270,231 shares under the Company's Dividend Re-investment

Scheme (DRIS) following the payment of the interim dividend, taking

the number of shares in issue at that date to 242,057,450, with a

further 22,459,730 shares held in treasury.

Net assets

Net assets at 30 June 2023 comprised the following:

% of net

GBP000 assets

Unquoted investments at fair

value 125,850 62.5

Listed investment funds 3,745 1.9

Cash and cash equivalents 69,854 34.7

Other net assets 1,993 0.9

-------- ---------

Net assets 201,442 100.0

======== =========

Investments

The investment portfolio at 30 June 2023 comprised:

Cumulative

valuation

as a %

Valuation of net

GBP000 assets

Matillion 24,886 12.4%

Unbiased 10,511 17.6%

Displayplan 8,829 22.0%

Outpost 8,680 26.3%

Wooshii 6,981 29.7%

Elucidat 6,226 32.8%

Force24 4,758 35.2%

Vypr 4,159 37.2%

ACC Aviation 4,095 39.3%

Quality Clouds 4,032 41.3%

83,157 41.3%

Other investments 42,693 21.2%

Total investments 125,850 62.5%

========== ===========

Portfolio performance

Over the quarter to 30 June 2023, the aggregate unquoted

portfolio valuation has increased by GBP0.8 million.

Fundraising

On 4 April 2023 the Company allotted shares from its fully

subscribed 2022-23 share offer. GBP44.4 million was raised by the

Company, resulting in the allotment of 53,559,905 ordinary

shares.

On 2 August 2023, the Company announced its intention to launch

a joint offer for subscription for the 2023-24 tax year later this

year, alongside British Smaller Companies VCT2 plc. A prospectus

with full details of the proposed Offer is expected to be published

in mid-to-late September.

Outlook

Portfolio companies continue to show resilience in navigating a

challenging macro environment, charting a path that balances

continued growth with a move towards profitability. While rising

interest rates will slow economic growth, a more capital

constrained environment reduces competition and alternative funding

sources, providing opportunities for further deployment of capital

for the Company, in both new and existing portfolio companies. In

this vein, the Company continues to see a healthy pipeline of

opportunities in which to invest in fast growing British

businesses.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU No. 596/2014). Upon the

publication of this announcement via Regulatory Information Service

this inside information is now considered to be in the public

domain.

13 September 2023

For further information please contact:

David Hall YFM Private Equity Limited Tel: 0113 244 1000

Alex Collins Panmure Gordon (UK) Limited Tel: 0207 886 2767

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFEALNDFAXDEEA

(END) Dow Jones Newswires

September 13, 2023 02:00 ET (06:00 GMT)

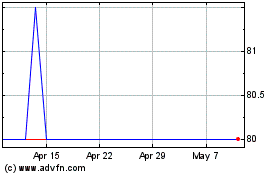

British Smaller Companie... (LSE:BSV)

Historical Stock Chart

From Apr 2024 to May 2024

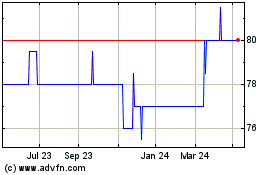

British Smaller Companie... (LSE:BSV)

Historical Stock Chart

From May 2023 to May 2024