TIDMBUR

RNS Number : 2369J

Burford Capital Limited

15 August 2019

This announcement contains inside information.

15 August 2019

BURFORD CAPITAL ANNOUNCES GOVERNANCE CHANGES

Burford Capital Limited ("Burford Capital" or "Burford" or "the

Company"), the leading global finance and investment management

firm focused on law, today issued the following statement regarding

the evolution of its corporate governance.

Burford's Listing

Burford has made it clear for some time that it is considering

an expansion of its stock market listing and that it is exploring a

dual listing in the US.

Investors have asked for more clarity and granularity around our

plans. Investors have also made it clear that they do not support

Burford remaining solely AIM listed. We have listened and, while we

were already taking action, as reflected in past disclosure, we set

out here our plans and our commitments.

Burford has concluded that it will endeavour to procure a second

listing on either NASDAQ or the NYSE as a first choice. We believe

that the deep liquidity in those markets, as well as the

opportunity to access a broad pool of US investors who do not today

invest in litigation finance but are generally familiar with US

litigation, makes a US listing commercially attractive as an

alternative to moving Burford's current listing to the LSE Main

Market. A US listing would come with applicable disclosure and

governance obligations.

We are in fact already engaged in the early stages of the

process to seek a US listing, and have been since well before

recent events. There are some preliminary legal matters to resolve,

given that there has never been a litigation finance provider

listed in the US, and that process may take several months.

Thereafter, the usual SEC registration statement process will need

to be completed. Our hope would be that we could complete the

process by the end of the first quarter of 2020 or as soon as

reasonably practicable thereafter, although that timetable cannot

be assured.

If we determine that there is an insuperable challenge with

achieving a US listing, then we intend to pursue a premium listing

on the LSE Main Market.

Burford's Board of Directors

Burford's Board is comprised of four directors who have served

in those roles since Burford's IPO in 2009. Collectively, they

represent an enormous wealth of talent and experience both in the

intersection of law and finance, and in the development of the

litigation finance industry, and we believe that they serve the

interests of shareholders well.

However, we have listened and defer to the wishes of our

shareholders and therefore we are taking the following initial

steps with respect to the Board.

We are commencing a formal search to add two new independent

directors to the Board as rapidly as possible.

Once those new directors are in place, we will operate a period

of overlap with the existing directors. Then, David Lowe will leave

the board at the next AGM and Sir Peter Middleton will leave the

board at the following AGM. We also intend that in terms of

management representation, at least the Chief Executive Officer

("CEO") will join the board in due course.

We anticipate further evolution of the Board but the specifics

of that evolution are bound up with the ultimate listing

destination and its governance rules, and we will report further on

the next step in Board evolution as appropriate.

Burford's Chief Financial Officer

Concern has been raised about the fact that Burford's CEO and

Chief Financial Officer ("CFO") are married. We believe that

concern is unjustified given Burford's control structure and

ignores Burford's finance and accounting structure.

Nevertheless, it is clear that investors would prefer an

alternative CFO, and thus Burford announces that, with immediate

effect, Jim Kilman will take on the role of CFO to buttress

confidence in Burford's financial disclosures and to guide the

Company through the change in its listing discussed above. Mr.

Kilman was most recently Vice Chairman of Morgan Stanley Investment

Banking and has spent his career in the specialty finance industry.

Mr. Kilman knows Burford well, having been its principal investment

banker at Morgan Stanley, and has been serving as a senior adviser

to Burford since his departure from Morgan Stanley in 2016 among

numerous other activities. Mr. Kilman has agreed to serve for up to

two years as CFO and the Board, once reconstituted as discussed

above, will take up succession planning for the CFO role as a

priority.

Charles Utley will continue to serve as Burford's Chief

Accounting Officer. Mr. Utley is an English accountant with a

long-standing career, most recently from Barclays, where he spent

11 years in senior technical accounting roles including with

respect to the valuation of illiquid assets and before that spent

eight years at PwC, and he has key involvement in the preparation

of Burford's accounts (including its investment valuation process)

and engagement with Burford's auditors.

Ms. O'Connell will become Burford's Chief Strategy Officer so

that Burford can continue to benefit from her long and deep

knowledge of the business and the Board expresses its gratitude to

her for her service and her flexibility. Ms. O'Connell will be

fully available to assist Mr. Kilman as he assumes the CFO

role.

Sir Peter Middleton GCB, Chairman of Burford, commented:

"Companies are owned by their shareholders, and when the

shareholders speak, it is the role of boards and management to

listen. While we may take a different view on some of these points,

shareholders have clearly spoken and we have listened, just as

Burford has throughout its existence. We trust that these

governance enhancements operate to bolster investor confidence in

Burford as it enters its next era of growth and success."

The person responsible for arranging for the release of this

announcement on behalf of the Company is Christopher Bogart, Chief

Executive Officer.

For further information, please contact:

Burford Capital Limited

Christopher Bogart, Chief Executive Officer +1 212 235 6825

Macquarie Capital (Europe) Limited - NOMAD +44 (0)20 3037

and Joint Broker 2000

Jonny Allison

Alex Reynolds

+44 (0)20 3100

Liberum Capital Limited - Joint Broker 2222

Richard Crawley

Jamie Richards

+44 (0)20 7260

Numis Securities Limited - Joint Broker 1000

Charlie Farquhar

Jonathan Abbott

Montfort Communications Limited - Financial +44 (0)20 3770

Communications 7908

Robert Bailhache - email

About Burford Capital

Burford Capital is the leading global finance and investment

management firm focused on law. Its businesses include litigation

finance and risk management, asset recovery and a wide range of

legal finance and advisory activities. Burford is publicly traded

on the London Stock Exchange, and it works with law firms and

clients around the world from its principal offices in New York,

London, Chicago, Washington, Singapore and Sydney.

For more information about Burford: www.burfordcapital.com

This release does not constitute an offer of any Burford fund.

Burford Capital Investment Management LLC ("BCIM"), which acts as

the fund manager of all Burford funds, is registered as an

investment adviser with the U.S. Securities and Exchange

Commission. The information provided herein is for informational

purposes only. Past performance is not indicative of future

results. The information contained herein is not, and should not be

construed as, an offer to sell or the solicitation of an offer to

buy any securities (including, without limitation, interests or

shares in the funds). Any such offer or solicitation may be made

only by means of a final confidential Private Placement Memorandum

and other offering documents.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

STRPAMITMBJBBFL

(END) Dow Jones Newswires

August 15, 2019 10:38 ET (14:38 GMT)

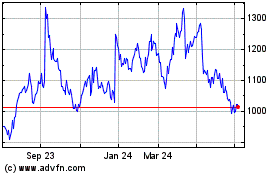

Burford Capital (LSE:BUR)

Historical Stock Chart

From Nov 2024 to Dec 2024

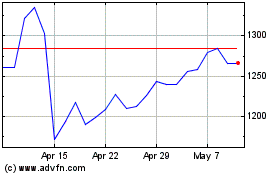

Burford Capital (LSE:BUR)

Historical Stock Chart

From Dec 2023 to Dec 2024