TIDMVTY

RNS Number : 0473N

Vistry Group PLC

18 January 2023

18 January 2023

Vistry Group PLC

Trading update

Vistry Group PLC ("Vistry" or the "Group") announces a scheduled

trading update for the year ended 31 December 2022, ahead of the

publication of its full year results on 22 March 2023.

Greg Fitzgerald, Chief Executive, commented:

"2022 was another year of excellent progress for Vistry, and

despite the more challenging market conditions following the

September mini-budget, profits are in-line with expectations and

ahead of where we were at the start of the year. I would like to

thank all of our employees and subcontractors for their continued

hard work and dedication.

"The combination with Countryside Partnerships in November

provided a transformative opportunity for the Group to accelerate

its strategy of rapidly growing its high return, less cyclical

revenues, and has firmly positioned Vistry as a leading provider of

affordable homes. The integration process is making excellent

progress and I am confident that with the combined expertise, track

record and assets, we are extremely well positioned to maximise the

opportunities from the continued strong demand for affordable

housing across the country.

"We start this year focused on maximising Vistry's unique

capability as a leading housebuilder and partnerships business to

increase the delivery of high quality housing across all tenures.

The Group's forward sales position totals an encouraging GBP4.6bn

and we have a strong pipeline of new opportunities within

Partnerships. It is too early in the current year to predict the

outturn for private sales, however I remain cautiously optimistic

that buyer sentiment will improve over the coming months."

Full year highlights

-- Transformational acquisition of Countryside Partnerships

("Countryside") completed on 11 November 2022, with integration

making excellent progress and strong cultural alignment

across the enlarged Partnerships business

-- Confident of delivering at least GBP50m synergies from

the combination and in excess of our target of GBP19m

synergies in FY23

-- Expect FY22 adjusted profit before tax [1] to increase

by c. 21% to c. GBP418m (FY21: GBP346.0m), in-line with

our expectations

-- Group net cash position is ahead of expectations at c.

GBP115m (31 December 2021: GBP234.5m), following the payment

of GBP300m cash as part of the consideration for Countryside

and GBP35m share buy-back

-- Excellent full year performance for Housebuilding with

completions [2] increasing by 3% to 6,774 units (FY21:

6,551), and adjusted gross margin [3] expected to increase

to at least 23% (FY21: 22.3%)

-- Partnerships continues to deliver excellent growth in

higher margin mixed tenure revenues, with mixed tenure

completions(2) up 17.6% to 2,455 units (FY21: 2,088) and

adjusted operating margin expected to increase to at least

10% (FY21: 9.2%)

-- Continued delivery of high quality build and customer

service, with a step up in construction quality awards

and sustained HBF 5-star customer satisfaction rating

-- Successful year in the land market with Group well positioned

on land and planning for FY23

Current trading and outlook

-- The Group starts the year with forward sales totalling

GBP4.6bn (31 Dec 2021: GBP2.7bn) including GBP3.6bn for

the enlarged Partnerships business

-- We are seeing a sustained level of demand across Partnerships

from Housing Associations, Local Authorities and the private

rented sector, with a strong Q1 pipeline

-- We believe the Partnerships model is resilient and are

confident that there is clear potential to generate material

value with enhanced scale and superior returns over the

medium-term

-- Housebuilding forward sales totals GBP1.0bn (31 December

2021: GBP1.3bn), an encouraging position given the challenging

market conditions and significant step-down in private

sales rates in Q4 22

-- Our two businesses are firmly focused on cost reduction

opportunities within our supply chain, including synergistic

benefits, and optimising work in progress

-- The Group has a strong pipeline of land for FY23 and will

continue to secure land on a selective basis

-- We will continue to ensure the Group has a healthy and

resilient balance sheet

-- A fuller outlook for FY23 will be provided with our FY22

results announcement in March

Operational update

The Group delivered a strong operational performance in FY22

with good progress made across all business areas.

We saw a very strong start to 2022 with high levels of demand

resulting in increased sales rates and higher house prices. This

trend continued throughout the first half and the Group reported an

average weekly private sales rate per outlet in H1 22 of 0.84 (H1

21: 0.76), up 11% on the prior year. Our sales performance remained

robust during the summer months. In the fourth quarter we saw

demand for private sales reduce significantly reflecting the

heightened level of macro uncertainty and step-up in mortgage

costs. The Group achieved a weekly private sales rate per outlet[4]

of 0.46 in the fourth quarter, and 0.71 (FY21: 0.76) for the full

year. Our pricing remained firm in final quarter of FY22, and this

has continued in FY23 to date.

The combination of wider macro uncertainty and uncertainty

around the Government's Social Housing rent ceiling generated

hesitancy amongst housing providers during the fourth quarter which

is now dissipating.

Delivering high quality new homes and excellent customer

satisfaction remained our top priority in 2022. We are pleased to

report the continuation of an improving trend for our HBF customer

satisfaction survey which is sent out 9 months after completions

and a sustained HBF 5-star customer satisfaction rating for our 8

week survey.

Our sites have operated well during the year, and we were

delighted to have achieved our highest number of NHBC Pride in the

Job Quality Awards this year, totalling 34 for the enlarged Group.

We have seen good labour availability throughout the year and more

recently some reduction in labour costs, a trend which we expect to

continue in 2023.

We continue our constructive engagement with the Department for

Levelling Up, Housing and Communities in relation to the legal

agreement to codify the principles of the Building Safety

Pledge.

Housebuilding(4)

Housebuilding delivered 6,774 units (FY21: 6,551) in FY22,

including 1,348 (FY21: 1,287) from JVs. Private units in the year

totalled 5,184 (FY21: 4,891) with 1,600 (FY21: 1,590) affordable

units.

Total Housebuilding average selling price for FY22 increased by

c. 6% to c. GBP324k (FY21: GBP305k), reflecting changes in mix and

house price inflation across the year. Housebuilding's private

average selling price increased to c. GBP376k (FY21: GBP356k) and

affordable average selling price increased to c. GBP163k (FY21:

GBP158k). Housebuilding operated from an average of 142 (FY21: 143)

active sites in FY22 and we expect this to be at a similar level in

FY23.

The business made further progress with its strategy of

delivering controlled volume growth and significant margin

progression, with adjusted gross margin expected to increase to at

least 23% (FY 21: 22.3%) in FY22.

Vistry Partnerships(4)

Vistry Partnerships made excellent progress in the year with its

strategy of rapidly growing higher margin mixed tenure revenues,

with mixed tenure completions up by 17.6% to 2,455 (FY21: 2,088)

units including 938 (FY21: 904) from JVs. The average selling price

of mixed tenure units in the year was c. GBP256k (FY21: GBP237k)

and Partnerships operated from an average of 28 (FY21: 33) active

mixed tenure sites in FY22.

Vistry Partnerships continued to drive its operating margin

through increasing the proportion of higher margin mixed tenure

revenues and expects FY22 adjusted operating margin to be at least

10% (FY21: 9.2%).

Countryside Partnerships

The Group completed the acquisition of Countryside Partnerships

on 11 November 2022 forming one of the country's leading

homebuilders. The integration process is making excellent progress,

with the new organisational structure established and effective

since the start of January.

The majority of the acquired business is merging with the Vistry

Partnerships business and is already operating under the single

Countryside Partnerships brand. We are pleased to see strong

support for the combined business from our Partnerships' clients

who value the opportunity to work with a leading provider.

Certain acquired sites which have characteristics more akin to

housebuilding are being transferred from Countryside Partnerships

to Housebuilding and will be reported within this segment from

2023.

We have made good progress in reviewing the cost base and

engaging with suppliers of the enlarged business and have increased

confidence in delivering at least GBP50m synergies from the

combination, and in excess of our GBP19m target for synergies in

FY23.

For the short stub period between 11 November and 31 December

2022, Countryside Partnerships has continued to perform in line

with our expectations during what is typically a low volume period

of the year for the business.

Land(4)

The Group has a high quality, deliverable land bank reflecting a

successful year in the land market.

Housebuilding secured 5,352 (FY21: 7,667) plots across 30 (FY21:

38) developments. The rate of land acquisition in Housebuilding

consciously slowed in the fourth quarter reflecting the increased

level of uncertainty in the housing market. The business continues

to progress land opportunities on a selective basis and has a

strong deliverable land pipeline for FY23 completions.

Vistry Partnerships grew the size of its owned land bank in FY22

to support continued strong growth in mixed tenure completions, and

in the year secured 3,061 (FY21: 4,131) plots on 17 (FY21: 23)

sites for mixed tenure development, significantly ahead of

replacement level. The business has a strong pipeline of

development opportunities, in particular working alongside Housing

Associations and Local Authorities.

Balance sheet

The Group had a net cash position of c. GBP115m as at 31

December 2022 (31 December 2021: net cash of GBP234.5m) following

the payment of GBP300m cash as part of the consideration for

Countryside and GBP35m share buy-back. This is ahead of our

expectations for the Group post acquisition and reflects stronger

cash generation in the second half at both Vistry and Countryside

Partnerships.

We will continue to ensure the Group has a healthy and resilient

balance sheet and retain the opportunity to selectively invest in

land and development opportunities as they arise.

Outlook

We start the year with forward sales totalling GBP4.6bn (31 Dec

2021: GBP2.7bn) including GBP3.6bn for the enlarged Partnerships

business. We are seeing a sustained level of demand across

Partnerships from Housing Associations, Local Authorities and the

private rented sector and with a higher level of pre-sold units and

a different portfolio of customers, the Partnerships business is

less sensitive to levels of open market demand than

Housebuilding.

Housebuilding forward sales totals GBP1.0bn (31 December 2021:

GBP1.3bn), an encouraging position given the challenging market

conditions and significant step-down in private sales rates in Q4

22.

Our two businesses are firmly focused on cost reduction

opportunities within our supply chain, including synergistic

benefits, and best managing work in progress. The Group has a

strong pipeline of land for FY23 and will continue to secure land

on a selective basis.

The combination with Countryside had a highly compelling

strategic rationale and has created a leader in the partnerships

housing sector, with the scale and expertise to accelerate

profitable growth across both Partnerships and Housebuilding, and

expand the delivery of much needed affordable housing across

England. Whilst the short term outlook for the UK housing market is

uncertain, we believe the Partnerships model is resilient and that

there is clear potential to generate material value with enhanced

scale and superior returns over the medium-term.

A fuller outlook for FY23 will be provided with our FY22 results

announcement in March 2023.

Greg Fitzgerald, Earl Sibley and Tim Lawlor will host a call for

analysts today at 8:00am. To join the call please dial: UK-Wide:

+44 (0) 33 0551 0200, UK Toll Free: 0808 109 0700. Please quote

Vistry when prompted by the operator.

For further information please contact:

Vistry Group PLC

Tim Lawlor, Chief Financial

Officer

Susie Bell, Group Investor Relations

Director 07469 287335

Powerscourt

Justin Griffiths

Nick Dibden

Victoria Heslop 020 7250 1446

Forward sales (GBPm) 31 December 2022 31 December 2021

-------------------------------- ----------------- -----------------

Housebuilding

* Private 330 554

* Private JVs (100%) 117 245

* Affordable 440 432

* Affordable JVs (100%) 85 118

Total Housebuilding 972 1,349

Vistry Partnerships

* Mixed tenure 391 309

* Mixed tenure JVs (100%) 291 282

Total mixed tenure 682 591

Total partner delivery 976 740

Total Vistry Partnerships 1,658 1,331

Total Countryside Partnerships 2,019 n/a

(inc 100% JVs)

Total Group 4,649 n/a

-------------------------------- ----------------- -----------------

Certain statements in this press release are forward looking

statements. Forward looking statements involve evaluating a number

of risks, uncertainties or assumptions that could cause actual

results to differ materially from those expressed or implied by

those statements. Forward looking statements regarding past trends,

results or activities should not be taken as representation that

such trends, results, or activities will continue in the future.

Undue reliance should not be placed on forward looking

statements.

[1] Adjusted profit before tax is stated excluding exceptional

items and amortisation of acquired intangibles

[2] Completions include 100% of JVs

[3] Adjusted basis to include the proportional contribution of

joint ventures

[4] Excludes any contribution from Countryside Partnerships

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRMBTMTJBTBJ

(END) Dow Jones Newswires

January 18, 2023 02:00 ET (07:00 GMT)

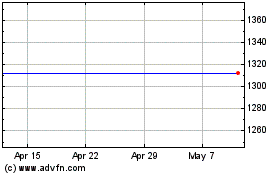

Bovis Homes (LSE:BVS)

Historical Stock Chart

From Apr 2024 to May 2024

Bovis Homes (LSE:BVS)

Historical Stock Chart

From May 2023 to May 2024