TIDMCML

RNS Number : 1261H

CML Microsystems PLC

22 November 2022

22 November 2022

CML Microsystems Plc

("CML", the "Company" or the "Group")

Half Year Results

CML Microsystems Plc which develops mixed-signal, RF and

microwave semiconductors for global communications markets, today

announces its unaudited results for the six months ended 30

September 2022.

Financial Highlights

-- Revenue increased by 22% to GBP10.05m (H1 FY22: GBP8.26m)

-- Profit from operations increased to GBP1.75m (H1 FY22: GBP0.53m)

-- Profit before taxation improved by 81% to GBP1.83m (H1 FY22:

GBP1.01m)

-- Diluted EPS increased to 11.58p (H1 FY22: 4.80p)

-- Cash balances at period end of GBP22.67m (31 March 2022: net

cash of GBP25.04m) following significant share buyback, investments

in R&D and dividend payments, together totalling GBP6.84m

-- Recommended half year dividend of 5p per share (H1 FY22: 4.0p

per share)

Operational Highlights

-- Revenues ahead of both management and market expectations

-- Fourth consecutive six-month period of revenue growth for

continuing business

-- Recovery in existing markets, driving growth

-- Strong order book stretching beyond 12 months

-- Expanding product range significantly increases total addressable

market

-- New product developments show early signs of success

Chris Gurry, Managing Director of CML Microsystems Plc,

commented on the results:

"The results achieved for the opening six months have been

strong in absolute terms with the Board now expecting trading for

the full year to be ahead of market expectations.

"This positive performance has been made possible through a

clear strategy for growth which has built upon the strong

foundations laid during previous years. Achieving these results in

the current macroeconomic environment validates our strategy and

business model whilst highlighting the dedication and determination

of our staff.

"The strong progress made in the six months to 30 September

2022, coupled with the increasing opportunities within the market

for organic and acquisitive growth, gives the Board a great deal of

confidence as we continue to deliver value to our

shareholders."

Enquiries:

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Managing Director Tel: +44 (0) 1621 875 500

Nigel Clark, Executive Chairman

Shore Capital (Nominated Adviser Tel: +44 (0) 20 7408 4090

and Broker)

Toby Gibbs

James Thomas

John More

Alma PR Tel: +44 (0)20 3405 0205

Josh Royston

Andy Bryant

Robyn Fisher

Matthew Young

About CML Microsystems PLC

CML develops mixed-signal, RF and microwave semiconductors for

global communications markets. The Group utilises a combination of

outsourced manufacturing and in-house testing with trading

operations in the UK, Asia and USA. CML targets sub-segments within

Communication markets with strong growth profiles and high barriers

to entry. It has secured a diverse, blue chip customer base,

including some of the world's leading commercial and industrial

product manufacturers.

The spread of its customers and diversity of the product range

largely protects the business from the cyclicality usually

associated with the semiconductor industry. Growth in its end

markets is being driven by factors such as the appetite for data to

be transmitted faster and more securely, the upgrading of telecoms

infrastructure around the world and the growing prevalence of

private commercial wireless networks for voice and/or data

communications linked to the industrial internet of things

(IIoT).

The Group is cash-generative, has no debt and is dividend

paying.

Chairman's statement

Introduction

Given the current macroeconomic environment, I can only say how

pleased I am with the exceptionally strong first half results that

we have reported. CML continues to execute on our defined strategy

which has proven to be successful despite the general economic

conditions. However, a degree of prudence and caution needs to be

followed as it may be some time before the global situation

improves.

Against this backdrop, we continue to see opportunities both for

growing organically and by selective acquisition. We are

maintaining a strong focus on R&D in order to capitalise on

existing and new market opportunities that we can see. The

prospects are good but the headwinds strong.

Results and trading

The reported comparative figures for H1 FY22 have been restated

to reflect the presentational changes made in the year end 31 March

2022 Annual Report, although these changes do not alter the profit

before taxation, profit after taxation or the net asset values and

are purely changes to the presentation of the financials.

Although growth at the pre-tax level is very important, this

does capture the benefits from one-off gains and does not reflect

the underlying performance of the business. Our long-term focus has

been to grow profitability at the operational level and this is now

beginning to show through.

The financial performance for the six months to 30 September

2022 was very strong and is well ahead of the comparative period

(April to September 2021). Even though good growth was expected

this year, revenues were driven further ahead of management's

original expectations due to the strength of the US Dollar. This

has had a positive effect through the income statement but to a

much lesser extent below the revenue line as we incur significant

costs denominated in other currencies.

Revenue for the six months increased by just under 22% to

GBP10.05m compared to the prior year (H1 FY22: GBP8.26m). This

increase in revenues coupled with a slight improvement in margins

and tight cost control led to the significant improvement in profit

from operations of 230% to GBP1.75m (H1 FY22: GBP0.53m). With no

material one-off non-recurring items the profit before tax improved

by 81% to GBP1.83m (H1 FY22: GBP1.01m) which, after an income tax

credit, results in a 131% increase in profit after tax to GBP1.87m

(H1 FY22: GBP0.81m). EBITDA improved 54% to GBP3.25m (H1 FY22:

GBP2.12m) and diluted EPS increased 141% to 11.58p (H1 FY22:

4.80p). Cash balances at the end of the period stood at GBP22.67m

(31 March 22: GBP25.04m) following significant share buyback and

dividend payments.

The share buyback programme that resulted in GBP3m of shares

being purchased at the start of the year was re-introduced at the

start of October to a lesser extent and has resulted in a small

number of shares being repurchased on a regular basis since the

half year end.

Dividend

The Board is recommending a half year dividend of 5.0p per share

(H1 FY22: 4.0p per share), payable on 16 December 2022 to

shareholders on the Register on 2 December 2022.

Property

As I stated at the time of the year end results and further

enlarged upon within the RNS announcement made on 26 September

2022, we have applied to commercially develop the excess land at

Oval Park with contracts signed to sell some of this land to third

parties, subject to a successful planning application. This is

progressing, but slowly, and I now believe the application will be

considered by Maldon District Council during the first calendar

half of 2023. The Group also has one further property in Hampshire

that it no longer trades from and so is held for sale. Discussions

are progressing with relevant parties but again, until contracts

are exchanged uncertainty exists. The disposal of the Group's

property interests will be cash generative and will assist our

growth objectives. That said, I must stress they are one-off

transactions and below the operating profit line.

Employees

The key to any successful business is the employees and without

them the Group cannot achieve the success it strives for. We are

very lucky in having a dedicated, highly talented and hardworking

team at multiple locations throughout the world, and on behalf of

the Board I wish to thank them all.

Prospects and outlook

We are expecting a further improvement in revenues for the

second half year although with inflationary pressures the

distribution and administration expenses are expected to increase.

That said, a meaningful full year uplift in both operating and

pre-tax profitability is expected meaning that current market

expectations should be surpassed.

For the longer term, exciting opportunities continue to be

worked in all of the market areas being addressed and they are

expected to provide strong organic growth along with potential

inorganic additions to the Group's existing capabilities.

In summary, despite the challenging times, I feel your Company

is well placed to make significant progress forward over the

remainder of the year.

Nigel Clark

Executive Chairman

22 November 2022

Operational and financial review

Introduction

The Group entered the current financial year on a positive

footing, backed by a recovery in the traditional end markets for

wireless voice and data communications along with a strong order

book stretching beyond twelve months. Our established markets have

continued to recover whilst the expansion into wider application

areas through higher frequency semiconductor developments is

gathering pace.

In conjunction with the operational advances being made, i t is

pleasing to report revenues ahead of original management and market

expectations at the halfway stage, despite a backdrop of selected

raw material supply chain issues, particularly within China, which

continues to suffer from pandemic related rolling lockdowns.

Investments made over recent years into new product developments

and related activities are bearing fruit and are expected to drive

meaningful growth in the future. Coupled with the now entrenched

strategy being followed, this positions the Group well to take

advantage of the increasing number of opportunities being

presented.

Strategy

The Group's vision is to be the first-choice semiconductor

partner to technology innovators, together transforming how the

world communicates.

We are focused on our customers' success by delivering

advantages through the improved functionality and performance of

class leading Integrated Circuit ("IC") solutions. R&D activity

is targeted at developing the product portfolio to support emerging

and evolving customer requirements for size, cost and performance

whilst striving to remain each customer's first choice supplier

within their advanced communication platforms.

A more connected world is fuelling the insatiable appetite for

data consumption - driving growth across communications markets

globally. As a result of focused market and customer intelligence

activities, our new product development teams are supporting the

expansion of our total addressable market to include applications

within 5G, Satellite and the Industrial Internet of Things

("IIoT"). This complements the existing markets of public safety,

maritime and mission critical wireless voice and data

communications, leveraging our systems knowledge, semiconductor

engineering capabilities and routes to market.

Markets and operations

For the comparable prior year period (April to September 2021

inclusive), revenues from voice-centric wireless applications had

started to improve, with the situation across a wide range of

data-centric IIoT customers faring somewhat better. Fast forward to

the end of September 2022 and the progress has been more

pronounced, with the level of new order bookings and product

shipments delivering a fourth consecutive six-month period of

revenue growth for the continuing business (excluding revenues from

the sale of the Storage Division in March 2021).

This improved performance was driven by our disciplined

execution of a clearly defined strategy to take market share and

widen the addressable market. Sales grew 22% on a year-over-year

basis and 15% sequentially. Geographically, sales into Asia grew by

21% whilst revenue from the Americas almost doubled. Conditions

within Europe were a little tougher due to the impact of lower

demand from one of the Group's significant voice communications

customers. At the period end, our total order book had advanced

once again, despite demand fluctuations that typically occur

following the supply chain disruptions that have been a feature of

the semiconductor industry over the last 18-24 months.

The global communications markets addressed by the Group are

exhibiting a number of growth areas. Within the Land Mobile

Radio/Private Mobile Radio arena (LMR/PMR), systems are constantly

evolving from analogue to digital with some customers focusing on

new products to integrate with LTE technology. Public safety

agencies prefer the spectrum efficiency associated with digital

networks and the ease with which communications can be encrypted

for security purposes. Interoperability has become a key success

factor, with P25 the dominant standard in North America and TETRA

the leading standard in Europe and some other regions. DMR is a

global private industry version of a digital standard where the

radios of multiple suppliers designed using the DMR standard can be

used in conjunction with each other. The Group is an established

supplier to a number of the major equipment manufacturers

throughout the world and continues to take market share through

product evolution and function integration.

For data-centric markets, 'smart everything' is driving data

throughput increases within industry verticals such as agriculture,

construction and smart grid/city. The use of established

geostationary satellite networks and more recently deployed

low-earth orbit networks is another important wireless medium being

used to satisfy the requirement to connect to everything from

anywhere. Whether the transmission technology is terrestrial, via

space or a combination of both, semiconductor needs vary according

to frequency range, channel bandwidth, power requirements and other

key technical performance characteristics. CML is positioning

itself to be a significant player in each of the chosen

end-application areas and possesses the people and the know-how to

succeed.

More recently, the Group has been releasing products to market

that are intended to capture share of the enormous revenue

opportunities within end applications that utilise microwave and

millimetre wave radio frequencies. Some of these market areas blur

the line between the Group's traditional "industrial" markets focus

and other more commercially oriented applications but the technical

requirements and quality demands to be successful play to our

strengths. These markets are many times larger than the Group's

already established markets within the sub 1GHz RF arena. In

support of this, an intensive product development roadmap and

associated release schedule is well underway. Through the first six

months of the financial year new IC's were released to market

including a 28GHz Power Amplifier product along with Positive Gain

Slope Amplifiers designed to compensate for frequency related gain

losses that occur when designing wide band wireless products.

Further new products are scheduled for release across the second

half of the year. All products operating above the frequency range

of 1GHz are marketed under the SuRF brand.

Prior to the disposal of the Storage Division in March 2021, the

Group was addressing an annual serviceable market of close to $360

million, split almost 50/50 between communication and storage

application areas. Post the disposal, under our enhanced strategy,

the addressable market has expanded to include a number of key

growth areas, including critical infrastructure, 5G and satellite

communications. As a result, the Group's annual addressable market

has increased substantially and now easily exceeds $1 billion.

For some of the newer markets we are at the early stages of a

journey to drive the business forward strongly but across the whole

product portfolio we continue to gain market share and achieve

meaningful design wins.

CML has excellent routes to market and over recent years has

invested significant effort in ensuring sales channels globally are

appropriate for the direction of travel that the business is

taking. The process is one of evolution and refinement, with

ongoing adjustments needed and, in that regard, two new

representatives were appointed, one to cover Southeast USA and one

to support our activities in South Africa.

Our people represent our single biggest asset and without them

we could not achieve the results being delivered. Our average

length of service is 19 years, with 40% of our team having worked

for our businesses for over 10 years. Importantly, we remain

focused on attracting new talent into the Company to ensure both

continuity and expansion of our capabilities over time. It is

therefore pleasing to see we are being successful with our

recruitment programmes across the business in several areas

including engineering, operations and sales.

Outlook

The financial year commenced with the business positioned nicely

to grow well, despite the various macroeconomic headwinds that have

been a feature of the last two years. The results achieved for the

opening six months have been strong in absolute terms, delivered

through a clear strategy for growth and backed by a disciplined and

determined workforce.

The effort being expended towards capturing the organic growth

opportunities in front of us is delivering tangible results, both

operationally and financially. Opportunities exist to accelerate

delivery of our objectives via complementary acquisitions and

management continue to devote an appropriate amount of time towards

exploring them.

The good progress being made is built upon strong foundations

laid during previous years. This, coupled with the energy and

enthusiasm to succeed and a clear strategy for growth, enables the

Board to have confidence that continuing progress will be made

through the second half year period, delivering a very positive

outcome for the year as a whole.

Financial review

Total revenues for the first six months of the financial year

increased by a very healthy 22% over the comparative half year

period, totalling GBP10.05m (H1 FY22: GBP8.26m). The improvement

was broad-based across the customer base and driven by strong

growth in Asia and the Americas from a regional perspective.

The higher revenue drove a 24% uplift in gross profitability to

GBP7.62m (H1 FY22: GBP6.15m). Gross margin as a percentage improved

slightly due to product mix and the Group's prior decision to

increase inventory levels against an extended order book. Having

said that, cost of sale pressures remain due to ongoing raw

material price increases from a selection of our third-party

suppliers.

Distribution and administration expenses were slightly up at

GBP5.77m (H1 FY22: GBP5.61m) although it is noteworthy that the

prior year comparison included one-off costs associated with the

move to an AIM listing (GBP0.25m).

Profit from operations improved threefold to GBP1.75m (H1 FY22:

GBP0.53m) and, after accounting for net finance income, the Group

recorded a profit before tax of GBP1.83m, against GBP1.01m for the

prior year first half.

A marginal income tax credit of GBP0.04m was recorded compared

to a charge of GBP0.20m for the comparable period, leading to a

diluted earnings per share figure of 11.58p against 4.80p for the

prior year.

Adjusted EBITDA came in at GBP3.25m (H1 FY22: GBP2.12m).

In line with the previously communicated policy, inventory

levels increased significantly. This strategy continues to help

minimise the impact our customers feel from ongoing supply issues

within the global semiconductor supply chain. Delays do remain and

capacity constraints are expected to start to ease over the next

six-months. At 30 September 2022 inventory levels were GBP2.30m

(H1FY22: GBP1.53m).

The Group has no debt and cash balances stood at GBP22.67m at 30

September 2022 (31 March 2022: net cash of GBP25.04m). The cash

levels are particularly pleasing given the Company had a net spend

of GBP3.30m on share buybacks, invested GBP2.74m in research and

development activities and paid a dividend of GBP0.80m during

August.

Chris Gurry

Group Managing Director

22 November 2022

Condensed consolidated income statement

for the six months ended 30 September 2022

Unaudited

Unaudited 6 months Audited

end

6 months 30/09/21 year end

end Restated 31/03/22

30/09/22

GBP'000 GBP'000 GBP'000

----------------------------------------------------------------------------- --------- --------- ---------

Continuing operations

Revenue 10,045 8,256 16,964

Cost of sales (2,423) (2,107) (4,169)

----------------------------------------------------------------------------- --------- --------- ---------

Gross profit 7,622 6,149 12,795

Distribution and administration costs (5,765) (5,611) (11,562)

Share-based payments (137) (45) (98)

----------------------------------------------------------------------------- --------- --------- ---------

1,720 493 1,135

Other operating income 30 37 79

----------------------------------------------------------------------------- --------- --------- ---------

Profit from operations 1,750 530 1,214

Other income 4 437 500

Loss on sale of investment property - - (50)

Finance income 97 57 106

Finance expense (21) (13) (33)

----------------------------------------------------------------------------- --------- --------- ---------

Profit before taxation 1,830 1,011 1,737

Income tax credit/(charge) 35 (202) (499)

----------------------------------------------------------------------------- --------- --------- ---------

Profit after taxation for period attributable to equity owners of the parent 1,865 809 1,238

----------------------------------------------------------------------------- --------- --------- ---------

The condensed consolidated income statement has been restated for

unaudited six months ended 30 September 2021. See note 13 for further

details.

Earnings per share from total operations attributable to the ordinary equity

holders of the Company:

----------------------------------------------------------------------------- --------- --------- ---------

Basic earnings per share 11.72p 4.87p 7.45p

Diluted earnings per share 11.58p 4.80p 7.35p

----------------------------------------------------------------------------- --------- --------- ---------

The following measure is considered an alternative performance

measure, not a generally accepted accounting principle. This ratio

is useful to ensure that the level of borrowings in the business

can be supported by the cash flow in the business. For definition

and reconciliation see note 10.

Adjusted EBITDA 3,252 2,118 4,308

---------------- ----- ----- -----

Condensed consolidated statement of total comprehensive

income

for the six months ended 30 September 2022

Unaudited

Unaudited 6 months Audited

end

6 months 30/09/21 year end

end

30/09/22 Restated 31/03/22

GBP'000 GBP'000 GBP'000

---------------------------------------------------------------------- --------- --------- --------

Profit for the period 1,865 809 1,238

Other comprehensive income/(expense):

Items that will not be reclassified subsequently to profit or loss:

Re-measurement of benefit obligation - - 3,307

Deferred tax on actuarial loss - - (827)

---------------------------------------------------------------------- --------- --------- --------

Change in deferred tax rate on defined benefit obligation - - 345

Items reclassified subsequently to profit or loss upon derecognition:

Foreign exchange differences 829 410 880

---------------------------------------------------------------------- --------- --------- --------

Other comprehensive income for the period

net of taxation attributable to the equity holders of the parent 829 410 3,705

---------------------------------------------------------------------- --------- --------- --------

Total comprehensive income for the period

attributable to the equity holders of the parent 2,694 1,219 4,943

---------------------------------------------------------------------- --------- --------- --------

Condensed consolidated statement of financial position

as at 30 September 2022

Unaudited

Unaudited 30/09/21 Audited

30/09/22 Restated 31/03/22

GBP'000 GBP'000 GBP'000

----------------------------------------------------------------- --------- --------- ---------

Assets

Non-current assets

Goodwill 7,861 7,282 7,531

Other intangible assets 1,107 1,198 1,119

Development costs 12,738 10,727 11,197

Property, plant and equipment 5,479 5,576 5,593

Right-of-use assets 338 524 458

Investment properties - 3,775 -

Deferred tax assets 2,605 1,822 1,550

----------------------------------------------------------------- --------- --------- ---------

30,128 30,904 27,448

----------------------------------------------------------------- --------- --------- ---------

Current assets

Investment properties - held for sale 1,975 - 1,975

Inventories 2,302 1,532 2,258

Trade receivables and prepayments 2,156 2,433 2,199

Current tax assets - 1,479 409

Cash and cash equivalents 20,005 11,227 19,084

Short term cash deposits 2,663 11,360 5,958

----------------------------------------------------------------- --------- --------- ---------

29,101 28,031 31,883

----------------------------------------------------------------- --------- --------- ---------

Total assets 59,229 58,935 59,331

----------------------------------------------------------------- --------- --------- ---------

Liabilities

Current liabilities

Trade and other payables 3,665 3,122 2,827

Lease liabilities 133 174 230

Current tax liabilities 96 42 42

----------------------------------------------------------------- --------- --------- ---------

3,894 3,338 3,099

----------------------------------------------------------------- --------- --------- ---------

Non-current liabilities

Deferred tax liabilities 4,103 3,207 3,702

Lease liabilities 229 220 238

Retirement benefit obligation 2,439 5,570 2,439

----------------------------------------------------------------- --------- --------- ---------

6,771 8,997 6,379

----------------------------------------------------------------- --------- --------- ---------

Total liabilities 10,665 12,335 9,478

----------------------------------------------------------------- --------- --------- ---------

Net assets 48,564 46,600 49,853

----------------------------------------------------------------- --------- --------- ---------

Capital and reserves attributable to equity owners of the parent

Share capital 796 863 865

Share premium 2,462 1,222 1,362

Capital redemption reserve 8,372 8,285 8,285

Treasury shares - own share reserve - (1,670) (1,670)

Share-based payments reserve 395 497 490

Foreign exchange reserve 2,011 712 1,182

Retained earnings 34,528 36,691 39,339

----------------------------------------------------------------- --------- --------- ---------

Total shareholders' equity 48,564 46,600 49,853

----------------------------------------------------------------- --------- --------- ---------

Condensed consolidated cash flow statement

for the six months ended 30 September 2022

Unaudited

Unaudited 6 months Audited

end

6 months 30/09/21 year end

end

30/09/22 Restated 31/03/22

GBP'000 GBP'000 GBP'000

--------------------------------------------------------------------------- --------- --------- --------

Operating activities

Profit for the period before taxation - continuing operations 1,830 1,011 1,737

Adjustments for:

Depreciation - on property, plant and equipment 219 171 375

Depreciation - on right-of-use assets 142 126 258

Impairment of development costs - - 123

Amortisation of development costs 831 673 1,507

Amortisation of intangibles recognised on acquisition and purchased 169 136 283

Loss on disposal of investment properties - - 50

Rental income - (157) (215)

Forgiveness US PPP loan _ _ (284)

Employee Retention Credit US 109 - -

Movement in non-cash items (retirement benefit

obligation) 90 (190) 176

Share-based payments 137 45 98

Finance income (97) (57) (106)

Finance expense 21 13 33

Movement in working capital 32 (286) (1,025)

--------------------------------------------------------------------------- --------- --------- --------

Cash flows from operating activities 3,483 1,485 3,010

Income tax (paid)/received (75) (118) 905

--------------------------------------------------------------------------- --------- --------- --------

Net cash flows from operating activities 3,408 1,367 3,915

--------------------------------------------------------------------------- --------- --------- --------

Investing activities

Proceeds from sale of investment properties - - 1,750

Purchase of property, plant and equipment (88) (882) (1,105)

Investment in development costs (2,291) (2,161) (3,532)

Investment in intangibles (67) - -

Repayment/(Investment) in fixed term deposits (net) 3,295 (1,210) 4,192

Repayment of investment loan note - _ 293

Rental income - 157 215

Finance income 97 57 106

--------------------------------------------------------------------------- --------- --------- --------

Net cash inflow/(outflow) investing activities 946 (4,039) 1,919

--------------------------------------------------------------------------- --------- --------- --------

Financing activities

Lease liability repayments (153) (142) (287)

Issue of ordinary shares (net of expenses) 1,118 186 329

Purchase of own shares for treasury (4,442) - -

Dividends paid to shareholders (796) (8,298) (8,964)

Finance expense - 3 -

--------------------------------------------------------------------------- --------- --------- --------

Net cash outflow from financing activities (4,273) (8,251) (8,922)

--------------------------------------------------------------------------- --------- --------- --------

Increase/(decrease) in cash, cash equivalents and short-term cash deposits 81 (10,923) (3,088)

--------------------------------------------------------------------------- --------- --------- --------

Movement in cash and cash equivalents:

At start of period/year 19,084 22,046 22,046

Increase/(decrease) in cash, cash equivalents and short-term cash deposits 81 (10,923) (3,088)

Effects of exchange rate changes 840 104 126

--------------------------------------------------------------------------- --------- --------- --------

At end of period 20,005 11,227 19,084

--------------------------------------------------------------------------- --------- --------- --------

The Consolidated cash flow statements have been restated for

unaudited six months ended 30 September 2021. See note 13 for

further details.

Cash flows presented exclude sales taxes. Further cash-related

disclosure details are provided in note 6.

Changes in liabilities arising from financing activities relate

to lease liabilities only.

Condensed consolidated statement of changes in equity

for the six months ended 30 September 2022

Capital Share- Foreign

Share Share redemption Treasury based exchange Retained

capital premium reserve shares payments reserve earnings Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

At 31 March 2021 (restated) 859 1,039 8,285 (1,670) 570 302 44,062 53,447

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Profit for period 809 809

Other comprehensive income

net of taxes

Foreign exchange differences 410 410

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total comprehensive income

for the period - - - - - 410 809 1,219

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

859 1,039 8,285 (1,670) 570 712 44,871 54,666

Transactions with owners in

their capacity as owners

Issue of ordinary shares

- exercise of share options 4 183 187

Dividend paid (8,298) (8,298)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total of transactions with owners in

their capacity as owners 4 183 - - - - (8,298) (8,111)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Share-based payment charge 45 45

Cancellation/transfer of

share-based payments (118) 118 -

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

At 30 September 2021 (unaudited) 863 1,222 8,285 (1,670) 497 712 36,691 46,600

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Profit for period 429 429

Other comprehensive income

net of taxes

Foreign exchange differences 470 470

Re-measurement of defined

benefit obligations 3,307 3,307

Deferred tax on actuarial loss (827) (827)

Change in deferred tax rate on defined

benefit obligation 345 345

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total comprehensive

income for the period - - - - - 470 3,254 3,724

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

863 1,222 8,285 (1,670) 497 1,182 39,945 50,324

Transactions with owners in

their capacity as owners

Issue of ordinary shares

- exercise of share options 2 140 142

Dividend paid (666) (666)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total of transactions with owners

in their capacity as owners 2 140 - - - - (666) (524)

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Share-based payment charge 53 53

Cancellation/transfer of

share-based payments (60) 60 -

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

At 31 March 2022 865 1,362 8,285 (1,670) 490 1,182 39,339 49,853

--------------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Capital Share- Foreign

Share Share redemption Treasury based exchange Retained

capital premium reserve shares payments reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

At 31 March 2022 865 1,362 8,285 (1,670) 490 1,182 39,339 49,853

---------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Profit for period 1,865 1,865

Other comprehensive

income net of taxes

Foreign exchange differences 829 829

---------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total comprehensive

income for the period - - - - - 829 1,865 2,694

---------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

865 1,362 8,285 (1,670) 490 2,011 41,204 52,547

Transactions with owners in

their capacity as owners

Issue of ordinary shares

- exercise of share options 18 1,100 1,118

Purchase of own shares - treasury (4,442) (4,442)

Treasury share cancellation (87) 87 6,112 (6,112) -

Dividend paid (796) (796)

---------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Total of transactions

with owners in their

capacity as owners (69) 1,100 87 1,670 - - (6,908) (4,120)

---------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Share-based payments 137 137

Cancellation/transfer of

share-based payments (232) 232 -

---------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

At 30 September 2022 796 2,462 8,372 - 395 2,011 34,528 48,564

---------------------------------- ------- ------- ---------- -------- -------- -------- -------- -------

Notes to the condensed consolidated financial statements

for the six months ended 30 September 2022

1 Segmental analysis

Reported segments and their results, in accordance with IFRS 8,

are based on internal management reporting information that is

regularly reviewed by the Chief Operating Decision Maker (Chris

Gurry). The measurement policies the Group uses for segmental

reporting under IFRS 8 are the same as those used in its financial

statements.

The Group is focused for management purposes on one primary

reporting segment, being the semiconductor segment, with similar

economic characteristics, risks and returns and the Directors

therefore consider there to be one single segment, being

semiconductor components for the communications industry.

Geographical segments (by origin)

UK Americas Far East Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------- ------- -------- -------- -------

Six months ended 30 September 2022

Revenue to third parties - by origin 2,167 1,622 6,256 10,045

Property, plant and equipment 5,375 13 91 5,479

Right-of-use assets 176 17 145 338

Investment properties - held for sale 1,975 - - 1,975

Development costs 11,318 - 1,420 12,738

Intangible assets - software and intellectual property 298 - 2 300

Goodwill 1,531 - 6,330 7,861

Other intangible assets arising on acquisition 171 - 636 807

Total assets 44,315 1,043 13,871 59,229

------------------------------------------------------- ------- -------- -------- -------

UK Americas Far East Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------- ------- -------- -------- -------

Six months ended 30 September 2021

Revenue to third parties - by origin 1,837 916 5,503 8,256

Property, plant and equipment 5,475 17 84 5,576

Right-of-use assets 100 226 198 524

Investment properties 3,775 - - 3,775

Development costs 9,175 - 1,552 10,727

Intangible assets - software and intellectual property 254 - 98 352

Goodwill 1,531 - 5,751 7,282

Other intangible assets arising on acquisition 197 - 649 846

Total assets 46,109 1,606 11,220 58,935

------------------------------------------------------- ------- -------- -------- -------

UK Americas Far East Total

Audited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------- ------- -------- -------- -------

Year ended 31 March 2022

Revenue to third parties - by origin 4,569 2,572 9,823 16,964

Property, plant and equipment 5,504 12-2 77 5,593

Right-of-use assets 227 60 171 458

Investment properties - held for sale 1,975 - - 1,975

Development costs 9,714 - 1,483 11,197

Intangible assets - software and intellectual property 243 - 96 339

Goodwill 1,531 - 6,000 7,531

Other intangible assets arising on acquisition 184 - 596 780

Total assets 46,024 1,163 12,144 59,331

------------------------------------------------------- ------- -------- -------- -------

Revenue

The geographical classification of business turnover (by

destination) is as follows:

Unaudited

Unaudited 6 months Audited

end

6 months 30/09/21 year end

end

30/09/22 Restated 31/03/22

GBP'000 GBP'000 GBP'000

--------- --------- --------- --------

Europe 1,634 1,927 3,705

Far East 6,194 5,092 9,603

Americas 1,943 986 2,901

Other 274 251 755

--------- --------- --------- --------

10,045 8,256 16,964

--------- --------- --------- --------

The operational classification of business turnover (by market)

is as follows:

Unaudited

Unaudited 6 months Audited

end

6 months 30/09/21 year end

end

30/09/22 Restated 31/03/22

GBP'000 GBP'000 GBP'000

----------------------- --------- --------- --------

Semiconductor 9,595 7,907 15,909

Design and development 450 349 1,055

----------------------- --------- --------- --------

10,045 8,256 16,964

----------------------- --------- --------- --------

Semiconductor products, goods and services are transferred at a

point in time, design and development over the period of the

contract on a percentage basis of contract completion, as detailed

in the Group's revenue recognition policy within its published

Annual Report.

The Group does not have any contract assets at 30 September 2022

(GBPNil at 31 March 2022) from semiconductors as it does not fulfil

any of its performance obligations in advance of invoicing to its

customer. The Group has contract assets of GBP476,000 as at 30

September 2022 (GBP157,000 at 31 March 2022) from design and

development. The Group, however, does have contractual balances in

the form of trade receivables. See note 21 for disclosure of this

in the Annual Report and Accounts for the year ended 31 March 2022.

The Group does not have any contractual liabilities at 30 September

2022 (GBPNil at 31 March 2022).

The Group expects all contractual costs capitalised or any

outstanding performance obligations will be completed within the

next twelve months.

2 Dividend paid and interim dividend

The Board is declaring an interim dividend of 5p per ordinary

share of 5p for the half year ended 30 September 2022, payable on

16 December 2022 to shareholders on the Register on 2 December

2022.

A final dividend of 5p per ordinary share of 5p was paid on 19

August 2022 and an interim dividend of 4p per ordinary share of 5p

was paid on 17 December 2021, totalling 9p per ordinary share of 5p

paid for the year ended 31 March 2022 (2021: 52.0p per ordinary

share of 5p paid for the year ended 31 March 2021).

3 Income tax (credit)/expense

Unaudited

Unaudited 6 months Audited

end

6 months 30/09/21 year end

end

30/09/22 Restated 31/03/22

GBP'000 GBP'000 GBP'000

----------------------------------------------------------------- --------- --------- --------

Current tax

UK corporation tax on results of the year (23) (469) (415)

Adjustment in respect of previous years 366 8 (6)

----------------------------------------------------------------- --------- --------- --------

343 (461) (421)

Foreign tax on results of the year 192 89 121

----------------------------------------------------------------- --------- --------- --------

Total current tax 535 (372) (300)

----------------------------------------------------------------- --------- --------- --------

Deferred tax

Deferred tax - origination and reversal of temporary differences (99) 500 6

Change in deferred tax rate - 114 833

Adjustments to deferred tax charge in respect of previous years (471) (40) (40)

----------------------------------------------------------------- --------- --------- --------

Total deferred tax (570) 574 799

----------------------------------------------------------------- --------- --------- --------

Tax (credit)/expense on profit on ordinary activities (35) 202 499

----------------------------------------------------------------- --------- --------- --------

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of its subsidiary

undertakings and have provided on that basis.

The tax charge for the six months ended 30 September 2022 has

been calculated by applying the effective tax rate which is

expected to apply to the Group for the year ended 31 March 2023,

using rates substantially enacted by 30 September 2022 as required

by IAS 34 - Interim Financial Reporting.

4 Earnings per share

Unaudited

Unaudited 6 months Audited

end

6 months 30/09/21 year end

end

30/09/22 Restated 31/03/22

GBP'000 GBP'000 GBP'000

------------------------------------------------------ --------- --------- --------

Earnings per share from total operations attributable

to the ordinary equity holders of the Company

(comparatives include discontinued operations):

Basic earnings per share 11.72p 4.87p 7.45p

Diluted earnings per share 11.58p 4.80p 7.35p

------------------------------------------------------ --------- --------- --------

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year, as

explained below:

Ordinary 5p shares

----------------------

Weighted

average Diluted

number number

----------------------------------- ---------- ----------

Six months ended 30 September 2022 15,912,744 16,111,674

Six months ended 30 September 2021 16,692,935 16,718,813

Year ended 31 March 2022 16,628,301 16,848,252

----------------------------------- ---------- ----------

5 Investment properties

Investment properties were measured at current market valuation.

No depreciation is provided on freehold investment properties or on

long leasehold investment properties. In accordance with IAS 40,

gains and losses arising on revaluation of investment properties

are shown in the income statement. The open market valuation of

investment properties recognised is GBPNil (2022: GBPNil).

Investment properties held for sale is GBP1,975,000 (GBP1,975,000

at 31 March 2022).

The investment property was reclassified on 31 March 2022 as

held for sale as the property became vacant with no prospective

tenant in place and is held based upon the current market valuation

methodology. The property is currently expected to sell within the

next twelve months.

6 Cash, cash equivalents and short-term deposits

Unaudited

Unaudited 6 months Audited

end

6 months 30/09/21 year ended

end Restated 31/03/22

30/09/22

GBP'000 GBP'000 GBP'000

------------------------- ----------- --------- ----------

Cash on deposit 14,157 5,509 10,275

Cash at bank 5,848 5,718 8,809

------------------------- ----------- --------- ----------

20,005 11,227 19,084

Short-term cash deposits 2,663 11,360 5,958

------------------------- ----------- --------- ----------

22,668 22,587 25,042

------------------------- ----------- --------- ----------

7 Retirement benefit obligations

The Directors have not obtained an actuarial IAS 19 Employee

Benefits Report in respect of the defined benefit pension scheme

for the purpose of this Half Yearly Report.

8 Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar, a decline in

this currency will have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. Additionally, though

the Group has a very diverse customer base in certain market

sectors, key customers can represent a significant amount of

revenue. Key customer relationships are closely monitored; however,

changes in buying patterns of a key customer could have an adverse

effect on the Group's performance.

Key risks of a non -- financial nature

The Group is a small player operating in a highly competitive

global market that is undergoing continual and geographical change.

The Group's ability to respond to many competitive factors

including, but not limited to, pricing, technological innovations,

product quality, customer service, raw material availabilities,

manufacturing capabilities and employment of qualified personnel

will be key in the achievement of its objectives. The Group's

ultimate success will depend on the demand for its customers'

products, since the Group is a component supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements (including

the UK's withdrawal from the European Union, or "Brexit"),

political risk, the enforceability of laws and contracts, changes

in the tax laws, terrorist activities, natural disasters or health

epidemics.

COVID-19

Following the effect of the COVID-19 pandemic, the Group

followed the guidance of the World Health Organization and other

government health agencies in safeguarding the health and wellbeing

of its employees and continue to operate a hybrid working policy.

The Group did not make use of the government's staff retention

schemes in the UK, nor make any redundancies. In the United States,

the government provided support in the form of a loan under the

Paycheck Protection Program ($388,400) which was forgiven on 23 May

2021.

There continues to be localised COVID-19 outbreaks, and the

Board closely monitors the impact taking prudent steps to mitigate

any potential impacts on our employees, customers, suppliers and

other stakeholders. The Group remains prepared to implement

appropriate mitigating strategies to minimise any potential

business disruption.

Given the nature of the markets we operate within, we anticipate

our end customers being insulated from a consumer downturn to some

extent, although the roll-out of some of the new products may be

delayed, dampening demand for our semiconductors. Even in these

difficult times, we still maintain the belief that the Group is

well placed to move positively forward in the medium to long term.

This belief is underpinned by a strong balance sheet and no debt,

along with a product portfolio that addresses markets that have a

positive outlook.

Russia and Ukraine conflict

Following Russia's invasion of Ukraine, the Group took the

decision to cease all supplies to customers based in Russia,

resulting in the non-payment of a debt totalling GBP16,000

($20,000) which has been fully provided for.

9 Directors' statement pursuant to the Disclosure and

Transparency Rules

The Directors confirm that, to the best of their knowledge:

-- the condensed set of financial statements have been prepared

in accordance with IAS 34 Interim Financial Reporting; and

-- the Chairman's Statement and Group Managing Director's

Operational and Financial Review include a fair review of the

development and performance of the business and the position of the

Company, and the undertakings included in the consolidation taken

as a whole together with a description of the principal risks and

uncertainties that they face.

The Directors are also responsible for the maintenance and

integrity of the CML Microsystems Plc website. Legislation in the

UK governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

The basis of preparation and accounting policies used in

preparation of this Half Year Report have been prepared in

accordance with the same accounting policies set out in the year

ended 31 March 2022 financial statements.

10 Adjusted EBITDA

Adjusted earnings before interest, tax, depreciation and

amortisation ("Adjusted EBITDA") is defined as profit from

operations before all interest, tax, depreciation and amortisation

charges and before share-based payments. The following is a

reconciliation of the Adjusted EBITDA for the three periods

presented:

Unaudited

Unaudited 6 months Audited

end

6 months 30/09/21 year end

end

30/09/22 Restated 31/03/22

GBP'000 GBP'000 GBP'000

----------------------------------------------- --------- --------- --------

Profit before taxation (earnings) 1,830 1,011 1,737

Adjustments for:

Finance income (97) (57) (106)

Finance expense 21 13 33

Depreciation 219 171 375

Depreciation - right-of-use assets 142 126 258

Impairment of development costs - - 123

Amortisation of development costs 831 673 1,507

Amortisation of intangibles of purchased and

acquired intangibles recognised on acquisition 169 136 283

Share-based payments 137 45 98

----------------------------------------------- --------- --------- --------

Adjusted EBITDA 3,252 2,118 4,308

----------------------------------------------- --------- --------- --------

11 Disposal of the Storage Division

On 10 December 2020, the Group announced it had entered into a

definitive agreement to divest its Storage Division,

Hyperstone.

Hyperstone was sold on 4 February 2021 and is reported in the

prior period as a discontinued operation. For financial information

relating to the discontinued operations. See note 13 for disclosure

of this in the Annual Report and Accounts for the year ended 31

March 2022.

12 General

Other than already stated within the Chairman's Statement and

Group Managing Director's Operational and Financial Review, there

have been no important events during the first six months of the

financial year that have impacted this Half Yearly Report.

There have been no related party transactions or changes in

related party transactions described in the latest Annual Report

that could have a material effect on the financial position or

performance of the Group in the first six months of the financial

year.

The principal risks and uncertainties within the business are

contained within this report in note 8 above.

The financial information contained in this Half Yearly Report

has been prepared in accordance with UK adopted International

Accounting Standards. This Half Yearly Report does not constitute

statutory accounts as defined by Section 434 of the Companies Act

2006. The financial information for the year ended 31 March 2022 is

based on the statutory accounts for the financial year ended 31

March 2022 that have been filed with the Registrar of Companies and

on which the auditor gave an unqualified audit opinion.

The auditor's report on those accounts did not contain a

statement under Section 498(2) or (3) of the Companies Act 2006.

This Half Yearly Report has not been audited or reviewed by the

Group auditor.

A copy of this Half Yearly Report can be viewed on the Company

website: www.cmlmicroplc.com .

13 Unaudited six months ended 30 September 2021 restatement

The Consolidated Statement of Comprehensive Income

Third-party product re-sales have been reclassified from other

operating income to revenue and presented on a gross basis to

correctly reflect the Group's role as principal in a revenue

arrangement. In the prior year, Revenue of GBP255,000 and Cost of

sales of GBP174,000 were presented net as other operating income.

This has now been correctly classified as Revenue and Cost of sales

respectively on a gross basis in the restated statement of

comprehensive income. The reclassification of these items has had

no effect on the profit before taxation or net assets.

Rental income and government grants have been reclassified as

other income to be included within profit/(loss) from operations,

having previously been incorrectly classified as other operating

income after profit/(loss) from operations. The reclassification

has resulted in a decrease in the loss on operations of

GBP437,000.

Share-based payment expense was incorrectly presented below

profit/(loss) from operations. They have been reclassified to be

included within profit/(loss) from operations to properly reflect

the nature of the expense. This has resulted in an increase in the

loss from operations of GBP45,000.

The reclassification of the rental income, government grants

income and share-based payment expenditure provides a better

measure of operating profit/(loss) in the consolidated statement of

comprehensive income. The reclassification of these items has had

no effect on the profit before taxation or net assets.

The Consolidated statement of financial position

An omission of a transfer within the statement of changes in

equity in relation to the B shares that were issued, redeemed, and

subsequently cancelled has been corrected. The adjustment

recognises a transfer of GBP8,276,000 from retained earnings to the

capital redemption reserve as required by the Companies Act 2006

and has had no effect on the profit before taxation or net

assets.

Short-term cash deposits with initial maturity of more than 3

months were incorrectly included within cash and cash equivalents.

Therefore, the short-term cash deposits of GBP11,360,000 have been

reclassified as financial assets.

The Consolidated cash flow statements

Short term cash deposits totalling GBP11,360,000 with initial

maturity of more than 3 months were incorrectly included within

cash and cash equivalents. Cash flows from investing activities

have therefore been corrected to reflect the movements in the

short-term cash deposits instead of reflecting these in cash and

cash equivalents. Cash flows from rental income have been

reclassified as investing activities from operating activities

within the Consolidated and Company cash flow statements to ensure

consistent presentation with rental income within the Consolidated

Statement of Comprehensive Income. The reclassification of these

items has had no effect on the profit before taxation or net

assets.

The Consolidated statement of changes in equity

An omission of a transfer within the statement of changes in

equity in relation to the B shares that were issued, redeemed, and

subsequently cancelled has been corrected. The adjustment

recognises a transfer of GBP8,276,000 from retained earnings to the

capital redemption reserve as required by the Companies Act 2006

and has had no effect on the profit before taxation or net

assets.

14 Approvals

The Directors approved this Half Yearly Report on 22 November

2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIBDBLBDDGDB

(END) Dow Jones Newswires

November 22, 2022 02:00 ET (07:00 GMT)

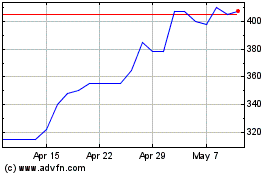

Cml Microsystems (LSE:CML)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cml Microsystems (LSE:CML)

Historical Stock Chart

From Feb 2024 to Feb 2025