TIDMDBOX

RNS Number : 5880N

Digitalbox PLC

26 September 2023

26 September 2023

Digitalbox plc

("Digitalbox", the "Group" or the "Company")

Unaudited interim results for the six months ended 30 June

2023

Digitalbox plc, the mobile-first digital media business, which

owns leading websites Entertainment Daily, The Daily Mash, The Tab

and The Poke, today publishes its unaudited interim results for six

months to 30 June 2023 (the "First Half", the "Period", or "H1

2023").

Financial Highlights

H1 2023 H1 2022 Var

GBPm GBPm

Group revenues 1.2 1.9 -34.0%

Gross profit 1.0 1.6 -41.8%

Adjusted EBITDA* -0.1 0.7 -121.0%

Cash generated from

operations -0.1 0.7 -111.4%

Gross cash balance 2.6 2.8 -8.1%

Net cash balance 2.3 2.4 -4.7%

Gross margin % 77% 87% -10 ppts

Adjusted EBITDA* margin

% -11% 35% -46 ppts

"Adjusted EBITDA" being operating profit/loss before exceptional

charges, share based payment charge, amortisation and

depreciation

Operational Highlights

-- H1 2023 performance ahead of the Board's expectations

-- Graphene Ad Stack driving Digitalbox session values ahead of the market

-- The Tab session values up 5% year on year

-- The Daily Mash Premium content continues to grow direct consumer revenue

-- The Poke delivered operating profit during the period, repaying 25% of its acquisition cost

-- Traffic sourcing challenges experienced across the market impacted total sessions by 36m

-- Entertainment Daily session values returned to year-on-year growth at the end of H1

-- Tests of AI assisted content creation for on-platform distribution showed strong potential

-- Net cash at 30 June 2023 of GBP2.3m

Post-period Highlights:

-- Daily Mash metered paywall grows subscriber base by 100%

-- Acquisition of assets from Social Chain, doubling

Digitalbox's social media audience to over 20m

Outlook:

-- Global advertising revenues expected to improve as confidence

in macro-economic conditions returns towards 2024.

-- The Board is confident that despite the headwinds many

digital media businesses have faced in the first half of the year,

particularly around traffic sourcing, Digitalbox expects to trade

positively in the all-important Q4 2023.

-- The Company expects to achieve full year 2023 revenue of

approximately GBP2.8m and remain EBITDA (adjusted) positive.

James Carter, CEO, Digitalbox plc, said: "We continue to see

gains being delivered by Digitalbox's highly-optimised Graphene Ad

Stack. The technology has enabled us to outperform the digital

programmatic ad market. Despite the first half seeing an

advertising downturn across the UK, our brands delivered session

value trends ahead of these conditions. Pleasingly, we have seen

The Poke evolve to a position where it is making a strong financial

contribution each month. While we have been impacted by a Google

algorithm change blocking Entertainment Daily from the Discover

feed we have performed increasingly well in our social channels.

This powerful engagement is what stimulated the Social Chain

transaction which we expect will bring wider distribution benefits

to both Entertainment Daily and The Tab as industry-wide traffic

sourcing remains a challenge. Looking ahead, while we remain

vigilant of the disruptive forces that AI-assisted content might

create, we are confident our agile approach positions us well to

capitalise on the opportunities it also presents."

Commenting on the Group's performance and prospects for the

year, Chairman Marcus Rich said: "It is well known that there are

significant audience challenges across the industry with other

companies in the sector reporting traffic reductions from Facebook,

and Digitalbox has not been immune to this. We envisage that

publisher operating models will change significantly as we move to

a future where AI technology increasingly impacts the media space.

The team have already started harnessing the power of these tools

to deliver greater efficiency in production and greater reach

through on-platform distribution. Through our existing social

follower bases and those made available through other deals like

our acquisition of assets from Social Chain, we remain confident we

have a route to a significant on-platform existence."

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014) ("MAR") prior to its release as part

of this announcement and is disclosed in accordance with the

Company's obligations under Article 17 of MAR. The person

responsible for arranging for the release of this announcement on

behalf of the Company is James Carter, CEO.

Enquiries:

Digitalbox c/o SEC Newgate

James Carter, CEO

Panmure Gordon Tel: 020 7886 2500

(Nominated Adviser, Financial Adviser

& Joint Broker )

James Sinclair-Ford / Ivo Macdonald (Corporate

Advisory)

Rupert Dearden (Corporate Broking)

Leander Capital Partners (Joint Broker) Tel: 020 7195 1400

Alex Davies / Hugh Kingsmill Moore

SEC Newgate (Financial Communications) Tel: 07970 664807

Robin Tozer / Moly Gretton digitalbox@secnewgate.co.uk

About Digitalbox plc

Based in the UK, Digitalbox is a 'pure-play' digital media

business with the aim of profitable publishing at scale on mobile

platforms.

Digitalbox operates the trading brands of "Entertainment Daily",

"The Daily Mash", "The Tab", and "The Poke".

Entertainment Daily produces and publishes online UK

entertainment news covering TV, showbiz and celebrity news. The

Daily Mash produces and publishes satirical news content. The Tab

is the UK's biggest youth culture site fuelled by students. The

Poke expertly curates and editorialises the funniest content from

around the web and social media.

Digitalbox primarily generates revenue from the sale of

advertising in and around the content it publishes. The Company's

optimisation for mobile enables it to achieve revenues per session

significantly ahead of market norms for publishers on mobile.

InteriM Statement

Overview

The performance of the Group in the first six months has been

marginally ahead of the Board's expectations with revenue of

GBP1.2m which is down 34% on H1 2022. This was largely the result

of better than anticipated advertising performance within a tough

market.

Importantly, Digitalbox had net cash of GBP2.3 million at 30

June 2023 which is enabling the business to secure future growth

opportunities through deals like that announced in August to

acquire the digital assets of 99 Problems, Student Problems and The

Life Network Shopping from Media Chain Group Limited.

Operating Review

The delivery of the Group's strategy has progressed well as we

continued to be acquisitive and focused on successfully integrating

The Poke.

Traffic

The well-documented issues relating to publishers sourcing

traffic from the major platforms continued during the period. As

global economic pressures impacted the big players - notably Meta

and Alphabet - the audience volumes sent to publisher websites have

been reduced.

The number of visits to the Group's websites were down year on

year, mainly due to having Digitalbox's leading brand's presence

blocked by Google's Discover feed. Fortunately, we had identified

this issue at the back end of 2022, and were able to adjust our

operating model to suit. While we anticipated advertiser demand

softening because of the cost-of-living crisis, competition for

high-quality mobile inventory in H1 2023 continued to deliver

Digitalbox session values across the period that were ahead of the

market and a testimony to the power of the Graphene Ad Stack.

We are well positioned to complete more cash acquisitions that

can help de-risk the business. For example, to reduce reliance on

the Google Discover feed, the acquisition of the digital assets of

99 Problems, 90's Life and The Life Network Shopping provides

Digitalbox with the opportunity to extend its audience reach. 99

Problems has 10m Facebook followers and 1.4m Instagram followers,

90's Life has 200k Facebook followers and The Life Shopping Network

has 1m Facebook followers. The combined follower bases will more

than double the number currently owned by Digitalbox at

approximately 8m Facebook followers.

Furthermore, the economic conditions have pushed potential

acquisition targets into the zone of being considered 'distressed',

creating more opportunities. The Digitalbox executive team has

remained considered in their approach to M&A. Acquisitions will

only be done if there is plausible turnaround opportunity to put an

asset on the path to profitability. This remains a key acquisition

criterion.

With the challenge of publishers, like Digitalbox, sourcing

traffic from the major platforms to become long-term, we are

looking to a future where our brands will increasingly exist within

the platform walled gardens alongside our websites. We have begun

planning for this pivot with the assistance of AI tools to help

generate content.

Entertainment Daily

Entertainment Daily - which is focused on TV and showbiz news -

had a challenging six months as Google blocked its presence within

their Discover feed cutting around 28m sessions from the same

period in 2022, however, it showed resilience through its social

media engagement. We have invested considerable resources following

Google's guidelines and ensuring our Core Web Vitals performance

across the portfolio is as strong as it can be to increase the

prospects of being featured within their results.

The Daily Mash

The Daily Mash strengthened its content offering through the

'Mash Premium' channel. It has diversified its revenue composition

with a new metered paywall that has doubled its subscriber base

year-on-year. As the platforms have tightened up on the amount of

traffic they are prepared to send to satire sites like The Daily

Mash, the site has been trialling a pivot to an on-platform

existence through an AI-generated video article format that is now

delivering over 20k 1-minute video views per day that we believe

will provide a platform for further video content expansion.

The Tab

The Tab has contributed a profit every month since it was

acquired in October 2020 and is beginning to see its session values

mature. The site benefited from the fact it has a strong youth

following in the US where advertising markets have been much more

buoyant than the UK, resulting in year-on-year growth of 5%. In

addition, The Tab strengthened its position within Google's

Discover feed as it grew to 5m sessions for the period while

Facebook assigned a red flag to its Holy Church of Netflix page.

This flag was imposed for reporting on Netflix's Jeffrey Dahmer

series and resulted in page reach being reduced by 95% with the

same knock-on effect on traffic being generated from this source.

This flag was raised in September 2022 and is expected to be

removed after 12 months. The Tab has continued to benefit from the

Graphene Ad Stack boosting monetisation and has provided a strong

model for the Company's approach to acquisition identification and

integration. This approach as was deployed on The Poke.

The Poke

The Poke.co.uk was acquired out of cash in December 2022. The

site has established itself as a strong companion to The Daily Mash

in the humour space and repaid 25% of its acquisition costs in H1.

Digitalbox acquired the dotcom domain on acquisition and has now

switched it to this domain. This helps provide a clearer

opportunity to explore expansion into territories beyond the

UK.

TV Guide.co.uk

Completing the acquisition of the web and mobile platform assets

of TVGuide.co.uk remains a desired objective with the tech

re-platforming having taken longer than anticipated. To ensure the

site's stability and performance, Digitalbox assumed responsibility

to rebuild the site that is currently live and in the final testing

phase.

Social Chain

In August, the Company completed the acquisition of three of

Social Chain AG assets, 99Problems, 90's Life and The Life Network

Shopping on better terms than originally announced. Digitalbox's

management is convinced that having a greater audience scale

opportunity to operate within the walled gardens of the major

platforms will bring future dividends. These assets provide access

to an additional 12 million followers on social media, which more

than doubles Digitalbox's follower base.

The future

Digitalbox has historically pursued a strategy of maximising

profitability by driving audiences off the major platforms to its

websites. As the platforms adjust their approach, Digitalbox will

invest in a pivot to a much greater presence through video within

the walled gardens that are offering preferential treatment to this

type of content. As with The Daily Mash, assisted by AI tools we

expect to make this transition in our business over the next six to

twelve months.

Financial review

The Directors are pleased to report revenues ahead of the

Board's expectations for the period of GBP1.2m in H1. The team had

a clear understanding of the pressures that the tough economic

conditions would place on the platforms - most notably Google and

Meta - and budgeted accordingly whilst they explore a pivot to a

greater on platform presence fuelled by AI.

The anticipated period on period significant traffic reduction

impacted on the gross profit %, taking it from 87% last year to 77%

this year. Whilst this gross profit % is still exceptionally high,

this presents as a significant reduction leading to a gross profit

of GBP1.0m in H1 2023, down from GBP1.6m in H1 2022.

Despite these challenges, cash performance has been solid with

net cash (gross cash at the bank less government back loans) being

GBP2.3m at 30 June 2023, down from GBP2.5m as at 31 December 2022,

after corporation tax payments of GBP96k and loan repayments of

GBP60k in H1.

The business continues to be highly liquid with total net

current assets of GBP3.1m at 30 June 2023 (GBP3.4m at 30 June 2022)

driven by gross cash of GBP2.6m at the bank.

DIGITALBOX PLC

INTERIM CONSOLIDATED INCOME STATEMENT

for the six months ended 30 June 2023

Unaudited Unaudited Audited

Notes Six months Six months 12 months

to to to

30 June 23 30 June 22 31 December

22

GBP'000 GBP'000 GBP'000

Continuing Operations 3

Revenue 1,238 1,877 3,578

Cost of sales (282) (235) (534)

__________ __________ __________

Gross profit 956 1,642 3,044

Administrative expenses (1,245) (1,858) (2,999)

Other operating income - - -

__________ __________ __________

Operating (loss)/profit (289) (216) 45

"Adjusted EBITDA" being operating

profit/loss before exceptional charges,

share based payment charge, amortisation

and depreciation (139) 663 1,081

Depreciation (7) (3) (7)

Amortisation (105) (121) (191)

Impairment on goodwill and

intangible assets - (716) (716)

Share based payment charge (38) (39) (62)

Direct cost of business combinations

and capital restructure - - (60)

__________ __________ __________

Operating (loss)/profit (289) (216) 45

-------------------------------------- ------ -------------- -------------- --------------

Finance income 14 1 8

Finance costs (4) (5) (8)

_________ __________ __________

(Loss)/profit before taxation (279) (220) 45

Tax charge 100 6 759

__________ __________ __________

(Loss)/profit for the period

from continuing operations (179) (214) 804

TOTAL INCOME FOR THE PERIOD (179) (214) 804

============= ============= =============

OTHER COMPREHENSIVE INCOME - - -

FOR THE PERIOD

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD (179) (214) 804

============= ============= =============

Earnings p er share 4

Pence Pence Pence

Basic EPS from continuing operations (0.15) (0.18) 0.68

__________ __________ __________

Diluted EPS from continuing

operations (0.15) (0.18) 0.67

__________ __________ __________

DIGITALBOX PLC

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2023

Share Share Premium Share based Retained Total

Capital reserve payment earnings

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January

2022 1,163 11,149 464 297 13,073

Total comprehensive income

for the period - - - (214) (214)

Issue of new shares 16 20 - - 36

Share based payment charge - - 39 - 39

_____ _____ _____ _____ _____

Balance at 30 June 2022 1,179 11,169 503 83 12,934

Total comprehensive expense

for the period - - - 1,018 1,018

Share based payment charge - - 23 - 23

Reserve transfer for

lapsed options - - (330) 330 -

_____ _____ _____ _____ _____

Balance at 31 December

2022 1,179 11,169 196 1,431 13,975

Total comprehensive income

for the period - - - (179) (179)

Reserve transfer for

lapsed options - - (135) 135 -

Share based payment charge - - 38 - 38

_____ _____ _____ _____ _____

Balance at 30 June 2023 1,179 11,169 99 1,387 13,834

_____ _____ _____ _____ _____

DIGITALBOX PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 June 2023

Unaudited Unaudited Audited

Notes 30 June 23 30 June 22 31 December

22

GBP'000 GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Property, plant and equipment 5 51 18 52

Intangible assets 6 10,105 9,960 10,194

Deferred tax asset 19 712 - 617

______ ______ _______

TOTAL NON-CURRENT ASSETS 10,868 9,978 10,863

______ ______ _______

CURRENT ASSETS

Trade and other receivables 15 713 1,046 952

Corporation tax recoverable 40 - -

Cash and cash equivalents 16 2,579 2,805 2,827

______ ______ _______

TOTAL CURRENT ASSETS 3,332 3,851 3,779

______ ______ _______

TOTAL ASSETS 14,200 13,829 14,642

______ ______ _______

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 104 95 288

Bank loans 112 94 112

Corporation tax payable - 288 61

_______ _______ ________

TOTAL CURRENT LIABILITIES 216 477 461

_______ _______ ________

NON-CURRENT LIABILITIES

Bank loans 150 281 206

Deferred tax - 138 -

_______ _______ ________

TOTAL NON-CURRENT LIABILITIES 150 419 206

_______ _______ ________

TOTAL LIABILITIES 366 896 667

TOTAL NET CURRENT ASSETS 3,116 3,374 3,318

_______ _______ ________

TOTAL NET ASSETS 13,834 12,933 13,975

_______ _______ ________

CAPITAL AND RESERVES

ATTRIBUTABLE TO EQUITY SHAREHOLDERS

Issued share capital 7 1,179 1,179 1,179

Share premium account 11,169 11,168 11,169

Share based payment reserve 99 503 196

Retained earnings 1,387 83 1,431

_______ _______ ________

13,834 12,933 13,975

_______ _______ ________

DIGITALBOX PLC

CONSOLIDATED CASH FLOW STATEMENT

for the six months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Period to

to to

30 June 23 30 June 22 31 December

22

GBP'000 GBP'000 GBP'000

OPERATING ACTIVITIES

(Loss)/profit from ordinary activities (179) (214) 804

Adjustments for:

Income tax expense (100) (6) (759)

Share based payment charge 38 39 62

Amortisation of intangibles 105 121 191

Impairment on goodwill and intangible

assets - 716 716

Depreciation on property plant and

equipment 7 3 7

Loss on disposal of property, plant

and equipment - - 30

Finance costs 4 5 8

Finance income (14) (1) (8)

_____ _____ _____

Cash flows from operating activities

before changes in working capital (139) 663 1,051

Decrease in trade and other receivables 239 718 818

Decrease in trade and other payables (184) (644) (451)

_____ _____ _____

Cash generated by operations (84) 737 1418

Income tax paid (96) - (235)

_____ _____ _____

Cash generated by operating activities (180) 737 1,183

_____ _____ _____

INVESTING ACTIVITIES

Purchase of property, plant and equipment (6) (6) (43)

Purchase of intangible assets (16) (87) (391)

Proceeds on the sale of property, plant - 31 -

and equipment

Finance income 14 1 -

Interested Received - - 8

_____ _____ _____

Cash used in investing activities (8) (61) (426)

_____ _____ _____

FINANCING ACTIVITIES

Issue of new share capital - 35 36

Finance costs - - (8)

Loan and lease repayments (60) (92) (144)

_____ _____ _____

Cash used in financing activities (60) (57) (116)

--------------- --------------- ---------------

INCREASE IN CASH AND CASH EQUIVALENTS (248) 619 641

Cash and cash equivalents brought forward 2,827 2,186 2,186

_____ _____ _____

CASH AND CASH EQUIVALENTS CARRIED FORWARD 2,579 2,805 2,827

_____ _____ _____

Represented by:

Cash at bank and in hand 2,579 2,805 2,827

======== ======== ========

DIGITALBOX PLC

NOTES TO THE INTERIM REPORT

for the six months ended 30 June 2023

1. Corporate information

The interim consolidated financial statements of the group for

the period ended 30 June 2023 were authorised for issue in

accordance with a resolution of the directors on 25 September 2023.

Digitalbox plc ("the company") is a Public Limited Company listed

on AIM, incorporated in England and Wales. The interim consolidated

financial statements do not comprise statutory accounts within the

meaning of section 434 of the Companies Act 2006.

2. Statement of Accounting policies

2.1 Basis of Preparation

The entities consolidated in the half year financial statements

of the company for the six months to 30 June 2023 comprise the

company and its subsidiaries (together referred to as "the

group").

The interim consolidated financial statements do not include all

the information and disclosures required in the annual financial

statements.

The directors are satisfied that, at the time of approving the

consolidated interim financial statements, it is appropriate to

adopt a going concern basis of accounting and in accordance with

the recognition and measurement principles of International

Financial Reporting Standards adopted for use in the United Kingdom

("IFRS"). In reaching this conclusion the directors have considered

the financial position of the Group, its cash, liquidity position

and borrowing facilities together with its forecasts and

projections for a period in excess of 12 months from the date of

approval. At the reporting date the Group had GBP2,579k of cash at

bank and in hand providing a strong position to support the

continued and future success of the Group.

2.2 Accounting Policies

The principal accounting policies adopted in the preparation of

the financial statements are set out in the consolidated financial

statements of the Group for the year ended 31 December 2022. The

policies have been consistently applied to all the years presented,

unless otherwise stated. The Group's accounting policies have been

consistently applied in accordance with IFRS continued into the six

months ended 30 June 2023.

This Interim Statement is prepared in accordance with IAS 34

"Interim Financial Reporting". Accordingly, whilst

the Interim Statement has been prepared in accordance with IFRS,

and the primary statements follow the format of the annual

financial statements, only selected notes are included - those that

provide an explanation of events and transactions that are

significant to an understanding of the changes in financial

position and performance of the Group since the last annual

reporting date. IAS 34 states a presumption that anyone who reads

the Group's Interim Statement will also have access to its most

recent annual report. Accordingly, annual disclosures are not

repeated in this Interim Statement.

The preparation of these consolidated half year financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and expense.

Actual results may differ from these estimates in preparing these

consolidated half year financial statements.

3. Segment Information

The Group's primary reporting format for segment information is

business segments which reflect the management reporting structure

in the Group and of its four media assets.

Unaudited six months to 30 June 2023

Entertainment The The The Poke Head Total

Daily Daily Tab Office Six months

Mash to 30 June

2023

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 656 58 422 102 - 1,238

Cost of sales (137) (87) (43) (15) - (282)

Admin

expenses* (286) (48) (243) (41) (477) (1,095)

Other

operating

income

---------------- ---------------- ---------------- ---------------- ---------------- --------------------

Adjusted

EBITDA 233 (77) 136 46 (477) (139)

Amortisation

and

depreciation - - (44) - (68) (112)

Share based

payment

charge - - - - (38) (38)

Finance income - - - - 14 14

Finance costs - - - - (4) (4)

Tax - - - - 100 100

---------------- ---------------- ---------------- ---------------- ---------------- --------------------

Profit/(loss)

for

the period 233 (77) 92 46 (473) (179)

---------------- ---------------- ---------------- ---------------- ---------------- --------------------

Unaudited six months to 30 June 2022

Entertainment The The The Poke Head Total

Daily Daily Tab Office Six months

Mash to 30 June

2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 1,282 82 513 - - 1,877

Cost of sales (106) (88) (41) - - (235)

Admin

expenses* (261) (43) (187) - (488) (979)

Other - - - - - -

operating

income

---------------- ---------------- ---------------- ---------------- ---------------- --------------------

Adjusted

EBITDA 915 (49) 285 - (488) 663

Amortisation,

depreciation

and

impairment - (777) (44) - (19) (840)

Share based

payment

charge - - - - (39) (39)

Finance income - - - - 1 1

Finance costs - - - - (5) (5)

Tax - - - - 6 6

---------------- ---------------- ---------------- ---------------- ---------------- --------------------

Profit/(loss)

for

the period 915 (826) 241 - (544) 214

---------------- ---------------- ---------------- ---------------- --------------------

3. Segment Information (continued)

12 months to 31 December 2022

Entertainment The The The Poke Head Total

Daily Daily Tab Office Year to

Mash 31 December

2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 2,261 243 1,059 15 - 3,578

Cost of sales (224) (190) (118) (2) - (534)

Admin

expenses* (529) (111) (398) (6) (919) (1,963)

Other - - - - - -

operating

income

---------------- ---------------- ---------------- ----------------- ---------------- --------------------

Adjusted

EBITDA 1,508 (58) 543 7 (919) 1,081

Amortisation,

depreciation

and

impairment - - -- - (914) (914)

Acquisition

and listing

costs - - - - (57) (57)

Capital

restructure

costs - - - - (3) (3)

Share based

payment

charge - - - - (62) (62)

Finance income 8 8

Finance costs - - - - (8) (8)

Tax - - - - 759 759

---------------- ---------------- ---------------- ----------------- ---------------- --------------------

Profit/(loss)

for

the period 1,508 (58) 543 7 (1,196) 804

---------------- ---------------- ---------------- -------------- ---------------- --------------------

* Admin expenses exclude share based payment charges,

amortisation, depreciation, impairment charges and acquisition and

listing costs.

External revenue by location of customer

Six months Six months Year to 31

to 30 June to 30 June December

2023 2022 2022

GBP'000 GBP'000 GBP'000

United Kingdom 607 310 759

Europe 506 810 1,381

Rest of World 125 757 1,438

________ ________ ________

Total 1,238 1,877 3,578

________ ________ ________

4. Earnings per share

The calculation of the group basic and diluted loss per ordinary

share is based on the following data:

Unaudited Unaudited Audited

Six months Six months 12 months

to to to

30 June 23 30 June 31 December

22 22

GBP'000 GBP'000 GBP'000

The earnings per share is based

on the following:

Continuing earnings post tax

(loss)/profit attributable to

shareholders (179) (214) 804

========== ========== ==========

Basic Weighted average number

of shares 117,718,533 117,516,820 117,718,533

Diluted Weighted average number

of shares 119,103,181 120,525,628 120,002,622

========== ========== ==========

pence pence pence

Basic earnings per share (0.15) (0.18) 0.68

Diluted earnings per share (0.15) (0.18) 0.67

========== ========== ==========

Earnings per ordinary share has been calculated using the

weighted average number of shares in issue during the relevant

financial periods. IAS 33 requires presentation of diluted EPS when

a company could be called upon to issue shares that would decrease

earnings per share or increase the loss per share.

5. Tangible Assets

5.

Office equipment

GBP'000

Cost

At 1 January 2023 58

Additions 6

Disposals -

_____

At 30 June 2023 64

Depreciation

At 1 January 2023 6

Charge for the period 7

Depreciation on disposal -

_____

At 30 June 2023 13

_____

Net book value

30 June 2023 51

_____

31 December 2022 52

_____

6. Intangible Assets

7.

Goodwill Other Intangible Development

arising on Assets costs

consolidation Total

GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2023 9,610 1,696 292 11,598

Additions - - 16 16

_____ _____ _____ _____

At 30 June 2023 9,610 1,696 308 11,614

Amortisation & impairment

At 1 January 2023 321 1,012 71 1,404

Charge for the period - 67 38 105

_____ _____ _____ _____

At 30 June 2023 321 1,079 109 1,509

_____ _____ _____ _____

Net book value

30 June 2023 9,289 617 199 10,105

_____ _____ _____ _____

31 December 2022 9,289 684 221 10,194

_____ _____ _____ _____

The other intangible assets are being amortised over a period of

7 years and development costs are being amortised over 3 years on

completion of the project.

Amortisation is charged to administrative costs in the Statement

of Comprehensive Income.

7. Share capital

Allotted, issued and No. Value

fully paid GBP'000

Ordinary shares of

0.01p each 117,923,393 1,179

--------------------------- -------------------------

Total 117,923,393 1,179

============= ============

There were no shares issued in the 6 months to 30 June 2023 (6

months to 30 June 2022: 1,590,936).

8. Related party transactions

During the period, Integral 2 Limited charged GBP36k (6 months

to 30 June 2022: GBP37k, 12 months to 31 December 2022: GBP65k) to

the Group, a company related by virtue of David Joseph, a member of

key management personnel, having control over the entity. As at 30

June 2023, GBP6k (30 June 2022: GBP5k, 31 December 2022: GBP6k) was

owed to Integral 2 Limited. On 13 January 2023 David Joseph

acquired 550,000 shares in Digitalbox plc at 8 pence per share

through Integral 2 Limited taking his total holding to 1,150,000

shares.

During the period, M Capital Investment Partners (Holdings)

Limited billed GBP6k (6 months to 30 June 2022: GBP12.5k, 12 months

to 31 December 2022: GBP25k) to the Group, a company related by

virtue of Martin Higginson, a member of key management personnel

during the period, and having control over the entity. As at 30

June 2023, GBPnil (30 June 2022: GBPnil, 31 December 2022: GBP2.5k)

was owed to M Capital Investment Partners (Holdings) Limited.

Martin Higginson resigned as a director of Digitalbox plc on 30

April 2023.

The key management personnel are considered to be the Board of

Directors. Key management were remunerated GBP211k in the six

months to 30 June 2023 (6 months to 30 June 2022: GBP192k, 12

months to 31 December 2022: GBP406k).

The key management personnel have been provided with a total of

3,008,882 effective share options resulting in a charge of GBP14k

in the period (6 months to June 2022: GBP17k, 12 months to 31

December 2022: GBP17k).

9. Events after the interim period

On 31 August 2023, Digitalbox plc acquired the digital assets of

99 Problems, Student Problems and The Life Network Shopping from

Media Chain Group Limited (part of "Social Chain AG") for a total

cash consideration of $600,000.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LAMFTMTATBPJ

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

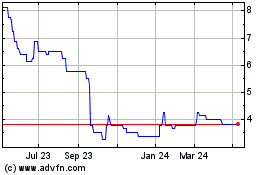

Digitalbox (LSE:DBOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

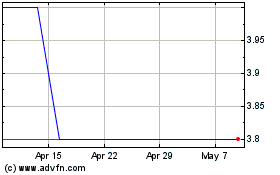

Digitalbox (LSE:DBOX)

Historical Stock Chart

From Apr 2023 to Apr 2024