TIDMECO

RNS Number : 8631I

Eco (Atlantic) Oil and Gas Ltd.

10 August 2023

10 August 2023

ECO (ATLANTIC) OIL & GAS LTD.

("Eco," "Eco Atlantic," "Company," or together with its

subsidiaries, the "Group")

Acquisition of additional 60% Operated Interest in Orinduik

Block Guyana from Tullow Oil

Eco (Atlantic) Oil & Gas Ltd. (AIM: ECO, TSX -- V: EOG) ,

the oil and gas exploration company focused on the offshore

Atlantic Margins, is pleased to announce that it has signed a Sale

Purchase Agreement (the "Agreement") pursuant to which its wholly

owned subsidiary, Eco Guyana Oil and Gas (Barbados) Limited ("Eco

Guyana"), will acquire a 60% Operated Interest in Orinduik Block,

offshore Guyana, through the acquisition of Tullow Guyana B.V.

("TGBV") , a wholly owned subsidiary of Tullow Oil Plc. ("Tullow")

(the "Transaction") in exchange for a combination of upfront cash

and contingent consideration .

The Transaction is in line with Eco's strategy to deliver

material value for its stakeholders through early entry and

exploring for hydrocarbons in some of the most prolific petroleum

basins in the world. Eco, via its wholly owned subsidiary Eco

(Atlantic) Guyana Inc, currently holds a 15% working interest in

the Orinduik Block. On completion of the Transaction, Eco, as

operator and majority interest holder in the Orinduik Block,

intends to drive the exploration process and focus on its strategy

to attract new partners to join the license and proactively engage

in drilling.

Transaction summary:

-- US$700,000 cash payment upon transfer of TGBV's 60%

Participating Interest and operatorship of the Orinduik licence to

Eco Guyana, to be paid to Tullow Overseas Holdings B.V., the parent

of TGBV ("TOHBV") on completion of the Transaction (the "Initial

Consideration").

-- Contingent consideration payable to TOHBV is linked to the

success of a series of potential future milestones, as follows:

o US$4 million in the event of a commercial discovery;

o US$10 million payment upon the issuance of a production

licence from the Government of Guyana; and

o Royalty payments on future production - 1.75% of the 60%

Participating Interest entitlement revenue net of capital

expenditure and lifting costs.

-- Transaction and payment of the Initial Consideration is

subject to certain market-standard conditions precedent, including

customary Government and JV partner approvals.

-- Completion is expected to occur in the second half of 2023.

On closing of the Transaction, the interests of the JV partners

in the Orinduik License will be as follows:

-- Eco will hold an aggregate 75% Participating Interest via Eco

Guyana and Eco (Atlantic) Guyana Inc., and be Operator of the

Block; and

-- TOQAP Guyana B.V will continue to hold a Participating Interest of 25%.

Gil Holzman, President and Chief Executive Officer of Eco

Atlantic, commented:

"We are delighted to have reached this agreement with Tullow and

to be able to begin to unlock the Orinduik Block's full potential.

Since 2014, we have believed in the potential of this Block, with

our initial two wells in 2019 proving two different oil plays. We

will proactively engage in a farm out process for this highly

prospective license and begin preparations to drill a well testing

the cretaceous, where all light oil discoveries have been made in

the adjacent Stabroek Block."

Colin Kinley, Co-founder and Chief Operating Officer of Eco

Atlantic, added:

"The Orinduik Block sits on the series of continental shelves

leading into the basin. This rich and prolific basin is clean sand

filled and sealed nicely to trap the massive volumes of oil found

thus far. Following ten years of basin evaluation and research, we

have a solid and highly experienced team to take over the

Operatorship role. We will start by targeting stacked pay

opportunities we see in the cretaceous and look forward to

continuing our aggressive approach to discovery. We see an

opportunity in the multi hundred millions of recoverable range and

now is the time to drill our targets."

Transaction Structure

TOHBV will transfer its entire interest in the Orinduik licence

via the sale of TGBV to Eco Guyana in exchange for the Initial

Consideration and a series of contingent payments based on future

milestones as described above.

TGBV holds a 60% participating interest in, and Operatorship of,

the Orinduik Block pursuant to: (i) a petroleum agreement between

the Minister responsible for Petroleum representing the Government

of the Co-operative Republic of Guyana, Eco (Atlantic) Guyana Inc.

and TGBV dated 14 January 2016 (as amended from time to time) and

(ii) the joint operating agreement dated between TGBV, Eco

(Atlantic) Guyana Inc., and TOQAP dated 18 January 2016 (as amended

from time to time). Tullow will retain its interest in the Kanuku

Block.

Additional cash consideration may be payable to TOHBV, in the

form of contingent payments, including a royalty payment, as noted

above, on upstream revenues once production from the Orinduik

licence commences .

Subject to the satisfaction of certain market standard

conditions precedent and customary approvals, including Government

and JV partner approvals , the Transaction is expected to complete

in the second half of 2023.

On 31 December 2022 as per the audited TGBV financial

statements, the gross asset value attributable to the interests

being acquired through the Transaction amounted to US$1.5 million,

with attributable losses of US$713,000 (excluding a one-off write

down of exploration expenses). As of 31 December 2022, the gross 2C

resource attributable to the transferred interests amounted to

47.7mmbls.

**ENDS**

For more information, please visit www.ecooilandgas.com or

contact the following :

Eco Atlantic Oil and Gas c/o Celicourt +44 (0) 20

8434 2754

Gil Holzman, CEO

Colin Kinley, COO

Alice Carroll, Head of Corporate Sustainability +44(0)781 729 5070

Strand Hanson (Financial & Nominated Adviser) +44 (0) 20 7409 3494

James Harris

James Bellman

Berenberg (Broker) +44 (0) 20 3207 7800

Matthew Armitt

Detlir Elezi

Echelon Capital (Financial Adviser N.

America Markets)

Ryan Mooney +1 (403) 606 4852

Simon Akit +1 (416) 8497776

Celicourt (PR) +44 (0) 20 7770 6424

Mark Antelme

Jimmy Lea

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended).

About Eco Atlantic:

Eco Atlantic is a TSX-V and AIM-quoted Atlantic Margin-focused

oil & gas exploration company with offshore license interests

in Guyana, Namibia, and South Africa. Eco aims to deliver material

value for its stakeholders through its role in the energy

transition to explore for low carbon intensity oil and gas in

stable emerging markets close to infrastructure.

Offshore Guyana in the proven Guyana-Suriname Basin, the Company

holds a 15% Working Interest in the 1,800 km(2) Orinduik Block

Operated by Tullow Oil. In Namibia, the Company holds Operatorship

and an 85% Working Interest in four offshore Petroleum Licences:

PELs: 97, 98, 99, and 100, representing a combined area of 28,593

km(2) in the Walvis Basin.

Offshore South Africa, Eco is Operator and holds a 50% working

interest in Block 2B and a 26.25% Working Interest in Block 3B/4B

operated by Africa Oil Corp., totalling some 20,643km (2) .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQZZGGRGLDGFZZ

(END) Dow Jones Newswires

August 10, 2023 02:00 ET (06:00 GMT)

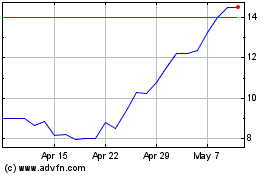

Eco (atlantic) Oil & Gas (LSE:ECO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Eco (atlantic) Oil & Gas (LSE:ECO)

Historical Stock Chart

From Feb 2024 to Feb 2025