Ediston Property Inv Comp PLC Related Party Transaction (8397Y)

January 05 2024 - 9:00AM

UK Regulatory

TIDMEPIC

RNS Number : 8397Y

Ediston Property Inv Comp PLC

05 January 2024

5 January 2024

For immediate release.

Ediston Property Investment Company plc

(the "Company")

(LEI: 213800JRL87EGX9TUI28)

Related Party Transaction

Further to the announcement of 20 December 2023, the board of

the Company (the "Board") announces that the Company has

successfully transferred its debt facilities to Ediston Capital

Limited ("ECL") (the "Transfer").

In consideration of the Company agreeing to the Transfer, ECL

and the Company have agreed that the net interest received by ECL

(being, in summary, the difference between: (i) the interest earned

on the principal amount of the debt facilities housed in a bank

account up to the Discharge Date (as defined below); and (ii) the

costs of servicing the debt facilities) (the "Net Interest") shall

be applied as follows:

-- firstly, in settlement of all costs and expenses (including

legal fees) incurred by ECL, the Company or owed by the Company to

Aviva Commercial Finance Limited (the "Lender") in connection with

the negotiation or execution of the Transfer (the "Transfer

Costs");

-- secondly, until an amount of GBP200,000 of Net Interest has

been applied in aggregate, all amounts of Net Interest will be

split equally and paid to the Company and retained by ECL in equal

amounts; and

-- thirdly, once an aggregate amount of GBP200,000 of Net

Interest has been paid or retained pursuant to the paragraph above,

one third of all further amounts of Net Interest will be paid to

the Company with the remainder retained by ECL.

The Discharge Date is the earlier of: (i) the date on which all

amounts owing by ECL to the Lender have been paid and discharged in

full; (ii) assuming the Company enters into members' voluntary

liquidation on 11 January 2024, the date on which the liquidators

of the Company make their final distribution to the Company's

shareholders; and (iii) 30 June 2024. It is anticipated that all

amounts owning by ECL to the Lender will be paid and discharged in

full on or around 29 March 2024.

In the event that insufficient Net Income is generated such that

the Transfer Costs are not settled in full, the Company's

investment manager has confirmed that Ediston will pay the

Company's Transfer Costs. The Company has also been unconditionally

released from all obligations under its existing facilities

agreement pursuant to the Transfer.

Under the Listing Rules of the FCA, ECL is a related party of

the Company. When the Transfer is aggregated with all other amounts

paid to Ediston pursuant to transactions or arrangements entered

into in the previous 12 months, the Transfer is a related party

transaction to which, by virtue of Listing Rule 11.1.11R, Listing

Rule 11.1.10R applies.

William Hill, Chairman of the Company commented:

"The decision not to repay the Company's debt at the time its

property assets were sold has enabled the Company to benefit from

the difference between the current deposit interest rates and the

costs of serving the debt. The Transfer is expected to enable

further value to be extracted during the period in which the

Company is in liquidation (assuming such liquidation is approved by

shareholders). Any funds received will be distributed by the

Company's liquidators as part of any final distribution that is

made during the liquidation process. Such final distribution, if

any, will be at a time to be determined solely by the liquidators

but is envisaged to be in the region of six to nine months after

the entry into of the liquidation. The Board considers that the

interest sharing arrangements are appropriate given: the benefits

noted above; it was not possible to realise value by transferring

the debt to a third party (other than Ediston); Ediston has taken a

cost risk in setting up the transaction; and it is Ediston's

relationship with the Lender that has made the Transfer

possible."

Enquiries

Douglas Armstrong - Dickson Minto

Advisers 020 7649 6823

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUVVSRSWUARAR

(END) Dow Jones Newswires

January 05, 2024 10:00 ET (15:00 GMT)

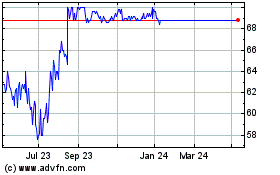

Ediston Property Investm... (LSE:EPIC)

Historical Stock Chart

From Nov 2024 to Dec 2024

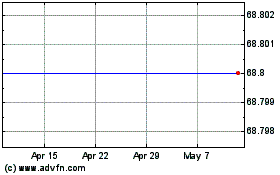

Ediston Property Investm... (LSE:EPIC)

Historical Stock Chart

From Dec 2023 to Dec 2024