TIDMFDBK

RNS Number : 3249L

Feedback PLC

29 July 2011

29 July 2011

Feedback plc

("Feedback" or "the Company")

Final Results for the year ended 31 May 2011

Chairman's Statement

Overview

My first annual statement as Chairman comes at the end of what

has been another difficult year for the Group but one that has also

seen a significant turnaround in recent months as the business

repositions itself for growth.

During the period under review the two operating companies

experienced differing fortunes. Our "locks and clocks" business,

Feedback Data Limited, showed promising signs with increased

turnover and reduced losses, whilst the educational business,

Feedback Instruments Limited, continued to suffer losses.

The Group made an encouraging start to the year but this was

followed by particularly poor trading in the third quarter for both

businesses. This resulted in Group revenues in the year ending 31

May 2011 of GBP6.3m, down from GBP7.4m in the previous year, and

operating losses worsening from GBP254k to GBP831k in the same

period. The loss after taxation in the period was GBP862k (2010:

GBP441k)

The continued poor performance of the Group over the last few

years has meant a greater reliance on the Group's banking

facilities and a focus on cash management. This, along with the

global economic environment and political unrest in some of our

international markets provides an uncertain backdrop as we seek to

turn the business around.

Feedback has a good name in its key markets but the Group has

failed to capitalise on its position and there is a clear need for

change. However, the trading performance over the last quarter of

the year has shown the Board that our trading proposition is

essentially sound.

We have begun the process of returning the Group to

profitability with a strong focus on sales and business development

combined with a range of operational initiatives that will drive

turnover, increase margin and cash flow, and better manage costs.

To a certain extent these early changes are laying the foundation

for the more strategic work which will follow as we clarify and

improve the Group's focus on its target markets, make sharper

funding and product decisions, and create a team to build upon and

then exceed the Group's historic trading performance.

Fundamental to the Group's future growth is a commitment to

building stronger relationships with our customers and partners.

Focusing on them, and offering products and services that

completely fulfil their needs, is at the heart of our success

strategy and is the principle that will deliver benefit to all our

stakeholders.

Investment in product development over the past two years in

both operating companies has yet to make a significant impact on

results but renewed focus and urgency has meant we are beginning to

see the benefit of this expenditure. Group IT issues highlighted in

last year's annual report continued to cause stock issues which in

turn has led to poor management information and unnecessary costs.

A second new system has been partially implemented with promising

initial results and is now being phased-in across all aspects of

the Group.

People

On 11 February 2011 my predecessor as Executive Chairman,

Michael Burt, left the company. Michael served as Chairman from

January 2008 and was appointed as Executive Chairman later that

year. He steered the Group through many initiatives, including

renewed investment in product development and the rebranding of the

Group.

I was appointed to the Group as Chairman and Chief Executive and

the Board appointed Mark Bird to join me on the Board as an

Executive Director at the same time. I've worked with Mark before

and asked him onto the team because of his experience in building

energetic sales groups and profitable commercial relationships.

Immediately before he agreed to join Feedback he spent two years in

a software start-up company and has previously served as either

sales director or managing director in a number of growth

companies.

Feedback Instruments Limited

Feedback Instruments Limited ("Instruments") continues to suffer

from delays in the release of public sector funding for education

projects around the world. Total revenue within Instruments fell to

GBP4.5m from GBP5.8m in the previous year with third quarter

trading in our International markets particularly

disappointing.

The rapid changes we've all witnessed this year in the Middle

East caused delays in expected business from the region and the

turmoil in Libya forced a large educational product order to be

shelved indefinitely. However, the short-term problems encountered

this year are not responsible for the long-term slide in

Instruments' export sales. I am therefore delighted to announce the

return to the Group of a previously successful Instruments Sales

Director who rejoined 1 June 2011 as Head of International

Sales.

One of the principal challenges facing Instruments is in new

product development. Supporting our broad range of legacy products,

and the continual demand to refresh them as technologies change,

draws resources away from designing products for newer and

potentially higher value engineering disciplines such as renewable

energies. Increased investment over the past two years has helped

and we will continue to invest with the aim of developing and

launching products that better meet the evolving needs of our

university customers.

Instruments' products are sold in North America through our

subsidiary Feedback Inc. which traded profitably at the operating

level in the year under review despite slightly reduced turnover.

This market has previously been very important to the Group but its

value has declined markedly in recent years as we've relied heavily

on third party multi-vendor agents and reduced our own sales staff,

eventually to nil. North America should be a stable and substantial

market for our products so we have reversed the recent policy of

reducing the sales force by appointing a full-time Head of Business

Development, based in the US, to work with - and add energy and a

Feedback focus to - our agent network.

Feedback Data Limited

Feedback Data Limited ("Data") also experienced a poor third

quarter but increased sales focus and energy has had an immediate

positive impact on order intake and the final result is

encouraging. Year-on-year, Data increased turnover from GBP1.6m to

GBP1.7m and reduced losses from GBP233k to GBP23k.

We restructured the Data business in March 2011 to align the

sales effort and internal operations more closely with the needs of

the market. The biggest change was in treating Service &

Support as a separate revenue driver rather than as a simple add-on

to an initial sale. The opportunity in this area derives from our

large installed base and the increasing importance our customers

place on the accuracy, reliability and availability of the

information our systems produce.

Our installed base presents the additional opportunity of

upgrades for existing customers. Much of our product development

investment over the past two years has gone into the new TS2020

line that is intended to replace earlier generations of our Time

& Attendance equipment.

The Nohmad range, which along with the TS2020 was mentioned in

last year's report, is a particularly significant development

because of it's use of the GPRS mobile 'phone network which allows

us to create contracts that generate long-term income. Early

customers identified the need for a suite of online tools to

support the Nohmad hardware and recent development effort has been

targeted in this area. We are now making good headway with existing

customers and are starting to see interest in new markets.

Focus and urgency

We are committed to restoring the business to growth and

profitability by building on the positives of the past year. I am

pleased with the actions of the last few months and see them as

first steps as we build momentum and deliver the required changes

within the Group.

However, more focus and urgency is required if we are to realise

the opportunity presented by our markets.

We are moving towards developing complete products that

completely fulfil our customers' needs. In Data, this means

products such as, the Nohmad, where we are supplying our hardware

products with software and services that can be implemented right

out of the box. In Instruments, this means putting maximum effort

into building new products that help universities deliver courses

that take students from the introduction of first principle to

complete understanding through experiment.

We are optimising our production capacity. Our recent

investments in business systems for both materials requirements

planning and customer relationship management give us real-time

transparency across the business and promise more responsive

working practices. The prime objectives are to manage costs more

effectively and to reduce the time products are in production so we

can fulfil orders and release working capital more quickly.

Both internally and externally we are refocusing the business so

that our customers find the Group easier to do business with. We

are starting to develop an attitude or service rather than system

which affects every interaction we have, whether by Web, email,

'phone, or face-to-face. In April 2011 we brought our working hours

more in line with our customers' needs and we are currently in the

middle of restructuring our Web presence around customer

groups.

Outlook

Achieving the turnaround of the business in the current economic

climate will not be easy and some aspects of the plan are likely to

take some time. However, the business has already delivered some

important initiatives that have already improved the Group's

trading performance.

In my opinion, Feedback is a great business that has lost its

way in recent years and is now starting to get back on track. The

Group has gone through much change already and I have been

delighted and proud of the way in which people at every level have

responded to the new initiatives that the Board have put in place.

I'd like to thank everyone involved for their continued hard work

and commitment which puts us in a significantly stronger position

to deliver our goals.

Nick Shepheard

Chairman

Statement of Comprehensive Income

for the year ended 31 May 2011

Note 2011 2010

GBP000 GBP000

REVENUE 2 6,308 7,443

Cost of Sales (3,969) (4,392)

-------- --------

GROSS PROFIT 2,339 3,051

Other Operating Expenses 3 (3,170) (3,305)

-------- --------

OPERATING LOSS (831) (254)

Net interest (9) 4

-------- --------

Loss on ordinary activities before taxation (840) (250)

Tax charge (22) (191)

-------- --------

Loss for the year attributable to the equity

shareholders of the Company (862) (441)

Other comprehensive expense

Translation differences on overseas operations (36) 28

-------- --------

Total comprehensive expense for the year (898) (413)

======== ========

LOSS PER SHARE (pence)

Basic and diluted 4 (0.79) (0.40)

======== ========

Consolidated Statement of Changes in Equity

for the year ended 31 May 2011

Share Share Capital Retained Translation

Capital Premium Reserve Earnings Reserve Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 June 2009 273 633 300 2,960 (206) 3,960

Total

comprehensive

expense for

the year - - - (441) 28 (413)

-------- -------- -------- --------- ------------ -------

At 31 May 2010 273 633 300 2,519 (178) 3,547

Total

comprehensive

expense for

the year - - - (862) (36) (898)

-------- -------- -------- --------- ------------ -------

At 31 May 2011 273 633 300 1,657 (214) 2,649

======== ======== ======== ========= ============ =======

Consolidated Balance Sheet

at 31 May 2011

2011 2010

GBP000 GBP000 GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment 5 1,505 1,603

Intangible assets 6 732 733

Deferred tax asset 134 156

------- -------

2,371 2,492

Current assets

Inventories 7 1,030 1,300

Trade receivables 930 1,578

Other receivables 233 176

Cash and cash equivalents 9 25

------- -------

2,202 3,079

------- -------

Total assets 4,573 5,571

------- -------

LIABILITIES

Non-current liabilities

Deferred tax liabilities 198 199

Current liabilities

Trade payables 909 959

Other payables 8 817 866

------- -------

1,726 1,825

------- -------

Total liabilities 1,924 2,024

------- -------

TOTAL NET ASSETS 2,649 3,547

======= =======

EQUITY

Capital and reserves attributable

to the Company's equity

shareholders

Called up share capital 273 273

Share premium account 633 633

Capital reserve 300 300

Retained earnings 1,443 2,341

------- -------

TOTAL EQUITY 2,649 3,547

======= =======

Consolidated Cash Flow Statement

for the year ended 31 May 2011

2011 2010

GBP000 GBP000 GBP000 GBP000

Cash flows from operating activities

Loss before tax (818) (250)

Adjustments for:

Net finance expenditure - (4)

Depreciation and amortisation 565 439

Foreign exchange difference (36) 28

Decrease in inventories 270 34

Decrease in trade receivables 956 130

(Increase)/decrease in other receivables (8) 53

(Decrease)/increase in trade payables (357) 214

(Decrease) in other payables (111) (284)

------- -------

1,279 610

------- -------

Net cash generated in operating

activities 461 360

Cash flows from investing activities

Interest received - 5

Purchase of tangible fixed assets (98) (122)

Purchase of intangible assets (370) (486)

------- -------

Net cash used in investing activities (468) (603)

Cash flows from financing activities

Interest paid (9) (1)

------- -------

Net cash used from financing activities (9) (1)

------- -------

Net decrease in cash and cash equivalents (16) (244)

Cash and cash equivalents at beginning

of year 25 269

------- -------

Cash and cash equivalents at end

of year 9 25

======= =======

1. ACCOUNTING POLICIES

Basis of preparation

These financial statements have been prepared in accordance with

those IFRS standards and IFRIC interpretations issued and effective

or issued and early adopted as at the time of preparing these

statements (July 2011). The accounting policies have been

consistently applied to all the years presented.

These consolidated financial statements have been prepared under

the historical cost convention.

The financial information set out above does not comprise the

Company's statutory accounts for the periods ended 31 May 2011 or

31 May 2010. Statutory accounts for 31 May 2010 have been delivered

to the Registrar of Companies and those for 31 May 2011 will be

delivered following the Company's Annual General Meeting. The

auditors have reported on those accounts; their report was

unqualified, did not include references to any matters to which the

auditors drew attention by way of emphasis of matter without

qualifying their report and did not contain statements under

section 498(2) or (3) of the Companies Act 2006 in respect of the

accounts for 2011 or for 2010.

2. SEGMENTAL REPORTING

The directors have determined the operating segments based on

the management reports that are used to make strategic decisions.

The Group's business is analysed below between the Instruments

segment and the Data segment. The Instruments segment primarily

relates to the subsidiary companies Feedback Instruments Limited

and Feedback Incorporated. The Data segment primarily relates to

the subsidiary company Feedback Data Limited and Feedback Data

GmbH.

Year ended 31 May 2011

Instruments Data Other Total

GBP000 GBP000 GBP000 GBP000

Revenue

External 4,558 1,750 - 6,308

------------ ------- -------- --------

Finance expense - - 9 9

------------ ------- -------- --------

Loss before tax (466) (23) (351) (840)

============ ======= ======== ========

Balance sheet

Assets 1,359 975 3,329 5,663

Liabilities (1,096) (985) (1,635) (3,716)

------------ ------- -------- --------

263 (10) 1,694 1,947

============ ======= ======== ========

Capital expenditure 6 37 53 96

============ ======= ======== ========

Year ended 31 May 2010

Instruments Data Other Total

GBP000 GBP000 GBP000 GBP000

Revenue

External 5,828 1,615 - 7,443

------------ ------- -------- --------

Finance expense - - 1 1

------------ ------- -------- --------

Profit/(loss) before tax (53) (233) 36 (250)

============ ======= ======== ========

Balance sheet

Assets 2,249 991 5,219 8,459

Liabilities (3,019) (999) (1,612) (5,630)

------------ ------- -------- --------

(770) (8) 3,607 2,829

============ ======= ======== ========

Capital expenditure 10 21 90 121

============ ======= ======== ========

Reported segments' assets are reconciled to total assets as

follows:

2011 2010

GBP000 GBP000

Segment assets for reportable segments 5,663 8,459

Unallocated:

Inter-company receivables adjustment (1,541) (3,340)

Intangible assets 732 733

Investments (281) (281)

-------- --------

Total assets per the balance sheet 4,573 5,571

======== ========

Reported segments' assets are reconciled to total assets as

follows:

2011 2010

GBP000 GBP000

Segment liabilities for reportable segments 3,716 5,630

Inter-company payables adjustment (1,990) (3,805)

Deferred tax 198 199

-------- --------

Total liabilities per the balance sheet 1,924 2,024

======== ========

External revenue Total assets Capital expenditure

by location of by location of by location of

customer assets assets

2011 2010 2011 2010 2011 2010

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

United

Kingdom 2,820 2,841 4,312 5,181 95 117

Rest of

Europe 879 1,245 14 135 - -

United

States of

America 734 815 247 255 1 4

Other

Americas 148 47 - - - -

Asia 792 1,322 - - - -

Africa 192 446 - - - -

Middle East 743 727 - - - -

--------- -------- -------- -------- ---------- ----------

Total 6,308 7,443 4,573 5,571 96 121

========= ======== ======== ======== ========== ==========

3. OTHER OPERATING EXPENSES

2011 2010

GBP000 GBP000

Distribution costs 1,352 1,662

Administrative costs:

Research and development 526 420

Other 1,292 1,223

------- -------

3,170 3,305

======= =======

4. LOSS PER SHARE

Basic earnings per share is calculated by reference to the loss

on ordinary activities after taxation of GBP862,000 (2010:

GBP441,000) and on the weighted average of 109,146,746 (2010:

109,146,746) shares in issue.

5. PROPERTY, PLANT AND EQUIPMENT

Land and Plant and Motor

Buildings Equipment Vehicles Total

GBP000 GBP000 GBP000 GBP000

Cost of valuation

At 31 May 2009 1,441 696 14 2,151

Additions - 117 5 122

Disposals - (71) - (71)

Exchange adjustments - 15 - 15

----------- ----------- ---------- -------

At 31 May 2010 1,441 757 19 2,217

Additions - 96 - 96

Exchange adjustments - 2 - 2

----------- ----------- ---------- -------

At 31 May 2011 1,441 855 19 2,315

----------- ----------- ---------- -------

Depreciation

At 31 May 2009 47 515 12 574

Charge for the year 24 69 3 96

Disposals - (71) - (71)

Exchange adjustments - 15 - 15

----------- ----------- ---------- -------

At 31 May 2010 71 528 15 614

Charge for the year 23 170 1 194

Exchange adjustments - 2 - 2

----------- ----------- ---------- -------

At 31 May 2011 94 700 16 810

----------- ----------- ---------- -------

Net Book Value

At 31 May 2011 1,347 155 3 1,505

=========== =========== ========== =======

At 31 May 2010 1,370 229 4 1,603

=========== =========== ========== =======

6. INTANGIBLE ASSETS

Development

Expenditure

GBP000

Cost

At 31 May 2009 3,239

Additions 486

-------------

At 31 May 2010 3,725

Additions 370

-------------

At 31 May 2011 4,095

-------------

Amortisation

At 31 May 2009 2,649

Charge for the year 343

-------------

At 31 May 2010 2,992

Charge for the year 371

-------------

At 31 May 2011 3,363

-------------

Net Book Value

At 31 May 2011 732

=============

At 31 May 2010 733

=============

7. INVENTORIES

2011 2010

GBP000 GBP000

Raw materials and consumables 432 492

Work in progress 11 431

Finished goods 587 377

------- -------

1,030 1,300

======= =======

8. OTHER PAYABLES

2011 2010

GBP000 GBP000

Amounts falling due within one year

Other payables 260 368

Other taxes and social security 102 114

Accruals and deferred income 455 384

------- -------

817 866

======= =======

9. PUBLICATION OF ANNOUNCEMENT AND REPORT AND ACCOUNTS

A copy of this announcement will be available at the Company's

registered office (Park Road, Crowborough, East Sussex TN6 2QR) and

on its website - www.feedback-group.com.

This announcement is not being sent to shareholders. The Annual

Report will be posted to shareholders shortly and will be made

available on the website.

For further information contact:

Feedback plc Tel: 01892 653

322

Nick Shepheard

Merchant Securities Limited

Simon Clements/Lindsay Mair Tel: 020 7628

2200

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR VVLFLFDFBBBV

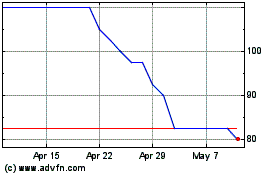

Feedback (LSE:FDBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Feedback (LSE:FDBK)

Historical Stock Chart

From Jul 2023 to Jul 2024