TIDMGDP

RNS Number : 2918W

Goldplat plc

17 August 2022

G ol dp lat plc / Ti cker: GDP / Index: AIM / Secto r: M in i ng

& E x p l o rati on

17 August 2022

Goldplat plc

( 'Goldplat', t he 'Group' or 'the Company ')

4(th) quarter operating results update

for the period ended 30 June 2022

G ol dp lat pl c, the AIM li sted g o ld p r o ducer, w ith

internati onal g o ld reco very o perati ons l o cated in South Afr

i ca and Ghana, is p leased to announce an operational update for

the 4(th) quarter, ended 30 June 2022 ("Q4").

The two recovery operations continued a strong combined

operating performance from the previous quarter and achieved a

combined operating profit for the quarter of GBP1,973,000 which

represents a 83% increase compared with Q4 in the previous period

(Q4, 30 June 2021 - GBP1,080,000).

The combined operating profit for the operating entities for 12

months ended 30 June 2022 increased by 51% to GBP7,996,000 (12

months ended 30 June 2021 - GBP5,300,000).

This quarter's strong numbers were supported by increased

operating performance in South Africa of GBP1,245,000 (Q4, 30 June

2021 - GBP350,000), whilst Ghana achieved steady operational

results of GBP728,000 (Q4, 30 June 2021 - GBP729,000).

The following have contributed to the excellent Q4 operating

results:

Ghana

-- We have remained focused on increasing our value offering to

clients in the processing of other types of by-products and have

increased our client base in Ghana as a result. This, together with

good volumes from current clients in Ghana, supported the operating

results for Q4.

-- We maintain our engagement with governments and mines in the

ECOWAS ("The Economic Community of West African States") to agree

processes and controls on the export of gold bearing products and

remain encouraged by the value we have identified that we can offer

in these countries.

-- We continue with our expansion into South America on a

measured basis, with limited capital allocated as yet.

South Africa

-- The strong operational profits for South Africa during the

quarter continue to be supported by good production through our

circuits, specifically gravity concentrators, and increased gross

profit realised on the sales of material processed during the

previous quarters. We are also seeing profits being supported by

services in and production of platinum group metals ("PGM's").

-- The construction of our PGM plant was completed during the

quarter at cost of GBP300,000 and we have continued production of

PGMs, whilst the commissioning of the flotation plan has been

ongoing. This will increase the flexibility in material we can

process and will enable us to further develop our PGM recovery

business.

-- As announced on the 16(th) of June, T he Department of Water

and Sanitation of the Republic of South Africa ('DWS') has

authorised the water use in South Africa, which include the

disposal of tailings on our new tailings storage facility ('TSF').

We are currently engaging with the DWS on certain conditions

stipulated in the license, but on current indications, we estimate

that the TSF will cost a further GBP 650,000, GBP 300,000 more than

originally planned. Of the GBP 650,000, GBP 300,000 has been

incurred during Q4.

-- Once commissioned, tailings will be deposited in the new TSF.

Subject to approvals and the installation of a pipeline, tailings

held in the old TSF will be reprocessed at a third-party facility

to recover an estimated 82,000 ounces of gold (Table 1).

Our cash balances in the group remained strong at GBP3,672,000

at the end of Q4 ( Q4, 30 June 2021, GBP3,110,000).

Werner Klingenberg, CEO of Goldplat commented: "I am pleased to

see the continued year-on-year strong operational numbers produced

by the recovery operations, with this being the third year it has

produced, at fluctuating gold prices, a combined operating profit

above GBP5,000,000. We continue to invest time into identifying

different methods to process materials containing various elements

and building relationships in different jurisdictions, which has

broadened the pipeline of potential projects going forward,

including the processing of the tailings facility which should add

a further revenue stream to the business in future."

For further i n fo rmat i on v i s it www .g o ld p lat.com, f o

l l ow on Twitter @GoldPlatPlc or contact:

Werner Klingenberg Goldplat plc Tel: +27 (0) 82 051 1071

(CEO)

Colin Aaronson / George Grant Thornton UK LLP Tel: +44 (0) 20 7383

Grainger / Samuel Littler (Nominated Adviser) 5100

Jessica Cave / Andrew WH Ireland Limited Tel: +44 (0) 207 220

de Andrade (Broker) 1666

Tim Thompson / Mark Edwards Flagstaff Strategic and Tel: +44 (0) 207 129

/ Fergus Mellon Investor Communications 1474

goldplat@flagstaffcomms.com

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Table 1

Mineral Resource Estimate of the Tailings Storage Facility,

South Africa

Total Resource

Domain Class Tonnes Density Au (g/t) Au (Oz) U(3) O(8) U(3) O(8) Ag (g/t) Ag (Oz)

(Mil) (g/t) (lbs)

----------- ------------ -------- --------- -------- ----------- ----------- --------- --------

TOTAL

RESOURCE Measured 0.87 1.32 1.82 50,907 61.41 117,754 4.85 135,573

----------- ------------ -------- --------- -------- ----------- ----------- --------- --------

Indicated 0.49 1.37 1.77 27,897 59.73 64,506 4.71 74,165

------------------------- ------------ -------- --------- -------- ----------- ----------- --------- --------

Inferred 0.07 1.30 1.4 3,154 71.40 11,016 2.82 6,356

------------------------- ------------ -------- --------- -------- ----------- ----------- --------- --------

Grand Total 1.43 1.34 1.78 81,959 61.32 193,276 4.70 216,094

------------ -------- --------- -------- ----------- ----------- --------- --------

The Tailings Mineral Resource Estimate was announced in

accordance with the JORC Code (2012) in a press release on 29

January 2016. Mark Austin of Applied Geology & Mining (Pty)

Ltd. was the Competent Person responsible for that announcement.

The Company confirms that all material assumption and technical

parameters underpinning the Resource Estimate continue to apply and

have not materially changed.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGPURGRUPPUAM

(END) Dow Jones Newswires

August 17, 2022 02:00 ET (06:00 GMT)

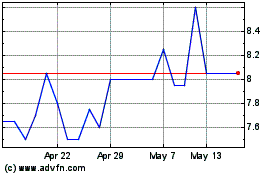

Goldplat (LSE:GDP)

Historical Stock Chart

From Jun 2024 to Jul 2024

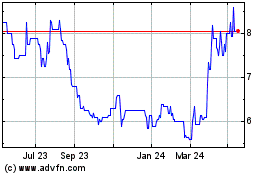

Goldplat (LSE:GDP)

Historical Stock Chart

From Jul 2023 to Jul 2024