TIDMHICL

RNS Number : 4049S

HICL Infrastructure PLC

06 November 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN OR INTO, THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR THE

REPUBLIC OF SOUTH AFRICA.

This announcement has been determined to contain inside

information for the purposes of the market abuse regulation (EU)

No.596/2014.

6 November 2023

HICL Infrastructure PLC

"HICL" or the "Company" and, together with its corporate

subsidiaries [1] , the "Group", the London-listed infrastructure

investment company managed by InfraRed Capital Partners Limited

("InfraRed" or the "Investment Manager").

Net Asset Value

The Company's Interim Results are scheduled for release on 22

November 2023.

The Board expects to announce a decrease in the Company's

unaudited Net Asset Value ("NAV") per share of approximately 5.5

pence to 159.4 pence as at 30 September 2023 (31 March 2023: 164.9

pence). This statement explains the Company's approach to

determining the NAV as at 30 September 2023.

The most significant driver of the movement in NAV per share has

been an increase in the portfolio's weighted average discount rate

from 7.2% to 8.0%, reflecting higher market return requirements. In

establishing the appropriate movement in the discount rate, the

level implied by the increases in long-term government bond yields

has been evaluated in the context of the Company's own recent

cross-sector and cross-geography transactional data.

The operational performance of the portfolio has remained in

line with expectations, with the expected decrease in NAV

attributable to the following macro-economic factors:

-- The significant increases in long-term government bond yields

since the last valuation date of 31 March 2023, particularly

in the UK, have been the primary driver of an increase in

the portfolio's weighted average discount rate to 8.0% (31

March 2023: 7.2 %). The weighted average equity risk premium

at 30 September 2023 was 3.3% (31 March 2023: 3.4%);

-- Higher actual and forecast UK inflation compared with the

assumptions included in the portfolio valuation as at 31

March 2023. UK RPI is now assumed to be 6.5% in FY2024, 3.5%

in FY2025, 3.25% to 31 March 2030 and 2.50% thereafter. This

remains 0.7% below the inflation rate implied by the 30 Year

UK gilt yield on a weighted average basis; and

-- Increases in deposit rate assumptions in all jurisdictions

due to higher prevailing interest rates.

Breakdown of the movement in Net Asset Value per share

Net Asset Value per share as at 31 March 2023 (audited) 164.9p

Portfolio return

---- -------

Actual inflation 0.8

---- -------

Other portfolio performance [2] 6.1

---- -------

6.9

---- -------

Discount rate (13.9)

---- -------

Macro-economic assumptions

---- -------

Forecast inflation 5.1

---- -------

Interest + tax rates 2.6

---- -------

7.7

---- -------

Fund and interest costs (1.9)

---- -------

Foreign exchange (net of hedging) (0.2)

---- -------

Dividends paid (4.1)

---- -------

Net Asset Value per share as at 30 Sept 2023 (unaudited) 159.4p

---- -------

Inflation

The portfolio's cashflows and valuation are positively

correlated to inflation. In addition, aggregate forecast inflation

for the UK for the rest of this financial year and the year to 31

March 2025 is ahead of the assumptions used in the 31 March 2023

portfolio valuation, leading to higher expected portfolio

cashflows. The movement in forecast assumptions is largely limited

to the UK portfolio.

Discount rates

Long-term government bond yields, particularly in the UK, have

increased materially since the Company's 31 March 2023 valuation.

As discount rates used to value projects do not follow bond yields

on a like-for-like basis, the Investment Manager considers asset

pricing observed in core infrastructure transactions across HICL's

key geographies, as well as the level of risk premium implied by

movements in bond yields.

Over the last six months, the Company has announced eight

selective disposals in several sectors and geographies at or above

the carrying value of the relevant asset, as part of an active

management approach to asset rotation. These asset sales offered

clear supporting evidence of the robustness of the Company's Net

Asset Value and provided data which indicated that higher discount

rates and inflation assumptions are being used by secondary market

participants in determining valuations. Taking into account the

significant increase in long-term government bond yields and the

corresponding reduction in the implied equity risk premium over the

last six months, the Investment Manager has increased the

portfolio's weighted average discount rate from 7.2% to 8.0%. The

weighted average risk-free rate for the portfolio is 4.7% (31 March

2023: 3.8%) and the weighted average risk premium is 3.3% (31 March

2023: 3.4%). The largest discount rate increases were in the UK

(+100bps) and the US and New Zealand (+60bps respectively).

InfraRed will continue to closely monitor market activity and

will provide a further update as part of HICL's Interim Results on

22 November 2023.

Foreign Exchange

The Company is exposed to movements in the Canadian dollar, the

Euro, the New Zealand dollar and the US dollar. 62% of the

Company's exposure to foreign currency was hedged as at 30

September 2023, giving rise to a small valuation loss in the

period.

Funding position

At 30 September 2023 the Group had net debt of GBP496.8m (31

March 2023: net debt GBP147.6m), comprising cash of c. GBP24m,

drawings on the Revolving Credit Facility ("RCF") of c. GBP370m and

the private placement of GBP150m. Following the completion of the

recently announced disposals, the pro forma drawings on the RCF are

expected to be c. GBP130m and gearing is expected to be c.10%.

Macro-economic assumptions used in the valuation

Assumption Jurisdiction 30 September 2023 31 March 2023

Discount rate

(WADR) 8.0% 7.2%

--------------------- --------------------

Inflation UK (RPI and RPIx) 6.50% to 31-Mar-24 5.00% to 31-Mar-24

3.50% to 31-Mar-25 2.75% to 31-Mar-30

3.25% to 31-Mar-30 2.00% thereafter

2.50 % thereafter

------------------- --------------------- --------------------

UK (CPI/CPIH) 5.75% to 31-Mar-24 4.25% to 31-Mar-24

2.75% to 31-Mar-25 2.00% thereafter

2.50 % thereafter

------------------- --------------------- --------------------

Eurozone (CPI) 4.75% to 31-Mar-24 5.00% to 31-Mar-24

2.25% to 31-Mar-25 2.00% thereafter

2.00% thereafter

------------------- --------------------- --------------------

Canada (CPI) 3.00% to 31-Mar-24 3.00% to 31-Mar-24

2.25% to 31-Mar-25 2.00% thereafter

2.00 % thereafter

------------------- --------------------- --------------------

US (CPI) 3.00% to 31-Mar-24 3.00% to 31-Mar-24

2.00 % thereafter 2.00% thereafter

------------------- --------------------- --------------------

New Zealand 5.00% to 31-Mar-24 5.00% to 31-Mar-24

2.75% to 31-Mar-25 2.50% to 31-Mar-25

2.25% thereafter 2.25% thereafter

------------------- --------------------- --------------------

Deposit rates UK 5.00% to 31-Mar-24 3.25% to 31-Mar-25,

4.50% to 31-Mar-25, 2.50% thereafter

3.5 % thereafter

------------------- --------------------- --------------------

Eurozone 3.00% to 31-Mar-25, 2.25% to 31-Mar-25,

2.25 % thereafter 2.00% thereafter

------------------- --------------------- --------------------

Canada 3.75% to 31-Mar-25 3.50% to 31-Mar-25,

3.25 % thereafter 3.00% thereafter

------------------- --------------------- --------------------

US 4.25% to 31-Mar-25 4.00% to 31-Mar-25

3.25 % thereafter 3.00% thereafter

------------------- --------------------- --------------------

New Zealand 4.50% to 31-Mar-24 4.00% to 31-Mar-24

4.25% thereafter 4.25% thereafter

------------------- --------------------- --------------------

Foreign exchange

rates USD 1.22 1.23

------------------- --------------------- --------------------

EUR 1.15 1.14

-------------------------------------- --------------------- --------------------

CAD 1.66 1.67

-------------------------------------- --------------------- --------------------

NZD 2.03 1.97

-------------------------------------- --------------------- --------------------

-ends-

Enquiries

InfraRed Capital Partners Limited +44 (0) 20 7484 1800 / info@hicl.com

Edward Hunt

Helen Price

Mohammed Zaheer

Brunswick Group Advisory Ltd +44 (0) 20 7404 5959 / HICL@brunswickgroup.com

Sofie Brewis

Investec Bank plc

David Yovichic +44 (0) 20 7597 4952

RBC Capital Markets

Matthew Coakes

Elizabeth Evans +44 (0) 20 7653 4000

Aztec Financial Services (UK)

Limited

Chris Copperwaite

Sarah Felmingham +44 (0) 203 818 0246

HICL Infrastructure PLC

HICL Infrastructure PLC ("HICL") is a long-term investor in

infrastructure assets which are predominantly operational and

yielding steady returns. It was the first infrastructure investment

company to be listed on the London Stock Exchange.

With a current portfolio of over 100 infrastructure investments,

HICL is seeking further suitable opportunities in core

infrastructure, which are inherently positioned at the lower end of

the risk spectrum.

Further details can be found on the HICL website www.hicl.com

.

This statement aims to give an indication of material events and

transactions that have taken place in the period from 1 April 2023

to 30 September 2023 and their impact on the financial position of

HICL. These indications reflect the Board's current view. They are

subject to several risks and uncertainties and could change.

Factors which could cause or contribute to such differences

include, but are not limited to, general economic and market

conditions and specific factors affecting the financial prospects

or performance of individual investments within the portfolio of

HICL.

Investment Manager (InfraRed Capital Partners)

The Investment Manager to HICL is InfraRed Capital Partners

Limited ("InfraRed") which has successfully invested in

infrastructure projects since 1997. InfraRed is a leading

international investment manager, operating worldwide from offices

in London, New York, Seoul and Sydney and managing equity capital

in multiple private and listed funds, primarily for institutional

investors across the globe. InfraRed is authorised and regulated by

the Financial Conduct Authority.

The infrastructure investment team at InfraRed consists of over

100 investment professionals, all with an infrastructure investment

background and a broad range of relevant skills, including private

equity, structured finance, construction, renewable energy and

facilities management.

InfraRed implements best-in-class practices to underpin asset

management and investment decisions, promotes ethical behaviour and

has established community engagement initiatives to support good

causes in the wider community. InfraRed is a signatory of the

Principles of Responsible Investment.

Further details can be found on InfraRed's website www.ircp.com

.

[1] The Corporate subsidiaries are Infrastructure Investments

Limited Partnership and HICL Infrastructure 2 s.a.r.l., as

disclosed in HICL's Annual Report and Accounts 2023

[2] Performance comprises the unwinding of the discount rate

(Value Preservation) and the Investment Manager's Value Enhancement

initiatives

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVFLFVTLDLVIIV

(END) Dow Jones Newswires

November 06, 2023 02:00 ET (07:00 GMT)

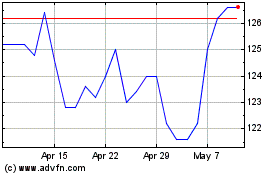

Hicl Infrastructure (LSE:HICL)

Historical Stock Chart

From Apr 2024 to May 2024

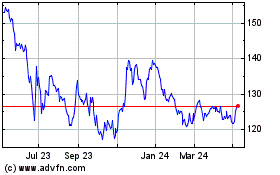

Hicl Infrastructure (LSE:HICL)

Historical Stock Chart

From May 2023 to May 2024