ITM Power PLC Trading Update (2578E)

October 27 2022 - 1:00AM

UK Regulatory

TIDMITM

RNS Number : 2578E

ITM Power PLC

27 October 2022

27 October 2022

ITM Power plc

("ITM Power" or the "Company")

Trading Update

As outlined in the final results, ITM Power, the energy storage

and clean fuel company, continues to make encouraging technological

progress with the development of the 2MW MEP 2.0 stack. This latest

generation of stack modules represents a step change in performance

and operating efficiency, and the core technology continues to

perform very well, delivering high conversion efficiency and market

leading current density.

Due to manufacturing issues including delays in finalising the

tooling and testing of these stacks, the Company now expects that

full year output and revenue is likely to be towards the bottom of

the current guidance range. The timing of this revenue will be

weighted towards the final quarter of the current financial year,

and will be dependent on success of the current work to resolve

these issues. The previously announced range is 48MW-65MW of

delivered product and revenue of GBP23m-GBP28m.

These production issues have resulted in limited deliveries of

new, first of kind product which in turn has meant only limited

field data for performance to assess the level of warranty

provisions. As a consequence of the limited field data, the

warranty provision for these next generation contracted products

will need to materially increase from the current level of GBP3m at

FY22 year end and may result in a revision to EBITDA loss guidance.

The accuracy of the product warranty provision will improve as more

field data is acquired. This is evolving technology and by its

nature that creates inherent uncertainty applicable to any company

introducing new technology into a rapidly developing industry.

The Board is aware of the potential risk associated with the

growing and uncertain levels of warranty provisions and is seeking

to mitigate this portfolio risk. As a result, the Company expects

there may be delays in finalising contracts in the final stages of

negotiation which could place large scale projects at risk of

deferred financial close. The Company remains fully committed to

the successful delivery of the order backlog and is working closely

with customers to get projects finalised.

The Company continues to benefit from a strong balance sheet

with current cash of some GBP320m, and has an increased focus on

operational cash and cost management. Taking into account the

committed capital expenditure, a lower level of inventory build,

and cost control the year end cash forecast is expected to be

GBP240-270m.

The search for a new Chief Executive Officer is progressing

well. Further guidance will be provided as to the current year's

revenue and production as well as warranty provisions in the

Trading Update in December.

For further information please visit www.itm-power.com or

contact:

ITM Power plc

James Collins, Investor Relations +44 (0)114 551 1205

Justin Scarborough, Investor Relations +44 (0)114 551 1080

Investec Bank plc (Nominated Adviser

and Broker) +44 (0)20 7597 5970

Jeremy Ellis / Chris Sim / Ben

Griffiths

Tavistock (Financial PR and IR) +44 (0)20 7920 3150

Simon Hudson / Tim Pearson / Charlie

Baister

About ITM Power plc:

ITM Power manufactures integrated hydrogen energy solutions for

grid balancing, energy storage and the production of renewable

hydrogen for transport, renewable heat and chemicals. ITM Power PLC

was admitted to the AIM market of the London Stock Exchange in

2004.

ITM Power operates from the world's largest operational

electrolyser factory in Sheffield with a capacity planned to reach

1.5 GW (1,500 MW) per annum and has an ambition to grow capacity in

line with demand to 5 GW per annum, supported by a GBP250m equity

raise in Q4 2021. Partners include Linde, Shell, Snam, and Vitol

among others.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFZMZGMVZGZZZ

(END) Dow Jones Newswires

October 27, 2022 02:00 ET (06:00 GMT)

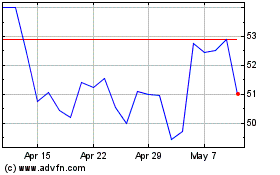

Itm Power (LSE:ITM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Itm Power (LSE:ITM)

Historical Stock Chart

From Mar 2024 to Mar 2025