Just Group PLC BUSINESS UPDATE FOR YEAR ENDED 31 DECEMBER 2023 (0662A)

January 18 2024 - 1:00AM

UK Regulatory

TIDMJUST

RNS Number : 0662A

Just Group PLC

18 January 2024

NEWS RELEASE www.justgroupplc.co.uk

18 January 2024

JUST GROUP plc

BUSINESS UPDATE FOR THE YEAR ENDED 31 DECEMBER 2023

Just Group plc ("Just", the "Group") announces a business update

for the year ended 31 December 2023.

Highlights

-- Shareholder funded Retirement Income sales up 24% to GBP3.9bn, driven

by both Defined Benefit De-risking ("DB") and Guaranteed Income for

Life ("GIfL"). Total Retirement Income sales, which includes DB Partner,

were up 27% to GBP4.3bn.

-- Total DB sales were up 21% to GBP3.4bn . We completed 80 transactions

during the year (2022: 56 transactions), driven by our proprietary

bulk quotation service. LCP(4) estimate that 2023 industry volumes

were c.GBP50bn, a new record, with this strong momentum to carry into

2024.

-- Retail sales were up 59% to GBP0.9bn. The GIfL market was its largest

since the introduction of Pension Freedoms in 2014, driven by higher

interest rates, which stimulated customer and advisor demand. We believe

that GIfL market growth is also benefiting from the introduction of

the FCA's Consumer Duty, which is prompting advisers to help customers

achieve their objectives by carefully considering all retirement income

products.

-- Other illiquid asset origination(5) increased by 50% to GBP1.6bn (2022:

GBP1.0bn), which supports our new business pricing, while also diversifying

the in-force asset backing portfolio. This demonstrates the scalability

of our "manager of managers" origination model.

-- New business strain is again expected to be below 2% and H2 23 new

business margins are expected to be higher than the 8.5% achieved in

H1. We have maintained strong pricing discipline and a continued focus

on risk selection, derived from our unique insight and positioning

in buoyant markets.

2023 Retirement Income sales up 24% to GBP3.9bn

Year ended Year ended

Just Group new business(1) 31/12/23 31/12/22 Change

GBPm GBPm %

Defined Benefit De-risking 2,999 2,568 17

Guaranteed Income for Life(2) 894 564 59

----------- ----------- -------

Retirement Income sales (shareholder

funded) 3,893 3,131 24

DB Partner (funded reinsurance) 416 259 61

----------- ----------- -------

Total Retirement Income sales 4,309 3,390 27

----------- ----------- -------

Note: Total Defined Benefit De-risking

sales(3) 3,415 2,827 21

David Richardson, Group Chief Executive, said:

"Our performance in 2023 further demonstrates the strength of

our new business model, with another year of exceptional delivery

against our ambitious growth plans. Our success is underpinned by

the sheer number of DB opportunities available, scheme funding at

record levels, and our capability to provide innovative solutions

consistently across the entire market. Furthermore, the GIfL market

has been revitalised by higher interest rates, while regulatory

change has stimulated advisers to consider carefully all product

options to achieve their customers' objectives.

I am once again very grateful to my colleagues, who with their

commitment and hard work continue to deliver so much success. In

doing so, we fulfil our purpose to help more people achieve a

better later life. We are well positioned to continue benefiting

from the long term growth drivers and positive developments in both

of our markets, and are very optimistic about what we can achieve

in the years ahead.

Our successes in 2023 and positioning in buoyant markets give us

increased confidence in our prospects for 2024. These strong

foundations enable us to continue delivering 15% growth in

underlying operating profit per annum, on average over the medium

term."

Note 1: Numbers in table subject to rounding

Note 2: Care Plan sales are now reported within the GIfL figure,

and were GBP48m in 2023 (2022: GBP44m)

Note 3: Total Defined Benefit De-risking sales is the sum of

Defined Benefit De-risking and DB Partner (GBP2,999m + GBP416m =

GBP3,415m)

Note 4: LCP - a leading employee benefit consultant

Note 5: In addition to GBP1.55bn of other illiquids, Just also

funded GBP164m of lifetime mortgage assets

All the figures are unaudited

FINANCIAL CALENDAR DATE

Results for the year ended 31 December 7 March 2024 (provisional)

2023

============================

Annual General Meeting 7 May 2024

============================

Interim results for the six months ended 8 August 2024 (provisional)

30 June 2024

============================

Enquiries

Investors / Analysts Media

Alistair Smith, Investor Relations Stephen Lowe, Group Communications

Telephone: +44 (0) 1737 232 792 Director

alistair.smith@wearejust.co.uk Telephone: +44 (0) 1737 827 301

press.office@wearejust.co.uk

Paul Kelly, Investor Relations

Telephone: +44 (0) 20 7444 8127 Temple Bar Advisory

paul.kelly@wearejust.co.uk Alex Child-Villiers

William Barker

Telephone: +44 (0) 20 7183 1190

A copy of this announcement will be available on the Group's

website www.justgroupplc.co.uk

JUST GROUP PLC

GROUP COMMUNICATIONS

Enterprise House

Bancroft Road

Reigate

Surrey RH2 7RP

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUBVBRSAUAAAR

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

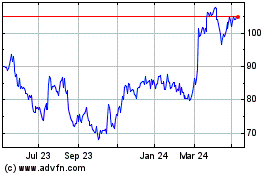

Just (LSE:JUST)

Historical Stock Chart

From Feb 2025 to Mar 2025

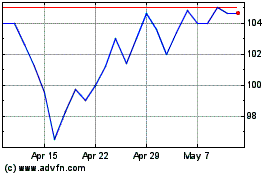

Just (LSE:JUST)

Historical Stock Chart

From Mar 2024 to Mar 2025