KCR Residential REIT PLC Acquisition of leasehold apartment (1499Z)

December 13 2017 - 1:00AM

UK Regulatory

TIDMKCR

RNS Number : 1499Z

KCR Residential REIT PLC

13 December 2017

13 December 2017

KCR Residential REIT plc

Acquisition of leasehold apartment

KCR Residential REIT plc ("KCR" or the "Company") is pleased to

announce that its wholly owned subsidiary, K&C (Osprey) Limited

("Osprey"), has acquired a further apartment within one of its

freehold retirement residential developments. The 67-year lease of

the apartment was purchased for a consideration of GBP317,500,

excluding costs.

The acquisition was funded via the drawdown of an additional

GBP0.5 million nominal value convertible loan note at par under the

instrument utilised for the convertible loan note of GBP1.35

million, issued on 10 July 2017. In common with that initial

tranche, the new loan note attracts interest at a rate of six per

cent. per annum, payable quarterly in arrears. The new loan note

will be redeemed on 30 June 2020 and can be converted into ordinary

shares of 10p in the Company at a price of either GBP1.20 per share

or, in certain circumstances, the price at which the Company places

further ordinary shares with investors prior to 30 June 2020.

In line with the previous leasehold acquisitions, the apartment

will be refurbished and sold subject to a new 125-year lease such

that Osprey retains the freehold interest.

Dominic White, the chief executive of KCR, said: "We reported

earlier in 2017 that, since acquiring the freehold Osprey portfolio

in May 2016, the asset had outperformed expectations. We have

subsequently acquired four leasehold apartments as part of our

strategy to improve yield generation and increase value over the

long term, and we will seek to make further leasehold acquisitions

as opportunities present themselves."

Contacts:

KCR Residential REIT plc info@kandc-reit.co.uk

Dominic White, Chief executive +44 20 3793

5236

Arden Partners plc

William Vandyk

Steve Douglas

+44 20 7614 5917

Yellow Jersey PR +44 7747 788

Charles Goodwin 221

Notes to Editors:

KCR's objective is to build a substantial residential property

portfolio that generates secure income flow for shareholders

through the acquisition of SPVs (Special Purpose Vehicles) with

inherent historical capital gains. The Directors intend that the

group will acquire, develop and manage residential property assets

in key residential areas in the UK.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQLLFSDFELFLID

(END) Dow Jones Newswires

December 13, 2017 02:00 ET (07:00 GMT)

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Apr 2024 to May 2024

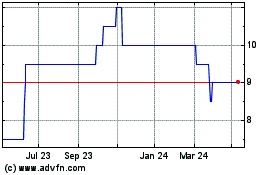

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From May 2023 to May 2024