Maven Income and Growth VCT 3 PLC Statement re NAV and Interim Dividend (4204H)

August 03 2021 - 5:31AM

UK Regulatory

TIDMMIG3

RNS Number : 4204H

Maven Income and Growth VCT 3 PLC

03 August 2021

Maven Income and Growth VCT 3 PLC

Unaudited Net Asset Value (NAV) and Interim Dividend

The Directors of Maven Income and Growth VCT 3 PLC (the Company)

confirm that the unaudited NAV of the Company as at 31 May 2021 was

60.76p per Ordinary Share. This is an increase of 2.51p since the

previously announced NAV of 58.25p as at 28 February 2021, and

represents an uplift of 4.31%. The NAV increase is largely

attributable to several profitable realisations, all of which

completed at valuations ahead of carrying value, alongside uplifts

to the valuations of companies that are delivering growth in

recurring revenues. In addition, on 22 July 2021, GEN InCode was

successfully floated on AIM, raising GBP17 million and achieving a

market capitalisation at listing of GBP42 million.

The Board is pleased to declare that an interim dividend of

1.25p per Ordinary Share, in respect of the year ending 30 November

2021, will be paid on 10 September 2021 to Shareholders on the

register at close of business on 13 August 2021. Since the

Company's launch, and after receipt of this latest dividend, 90.42p

per share will have been distributed in tax-free dividends. It

should be noted that the effect of paying a dividend is to reduce

the NAV of the Company by the total cost of the distribution.

The Company has in place a Dividend Investment Scheme (DIS)

through which Shareholders may elect to have their dividend

payments used to apply for new Ordinary Shares issued by the

Company under the standing authority requested from Shareholders at

Annual General Meetings. Shares issued under the DIS should qualify

for VCT tax reliefs applicable for the tax year in which they are

allotted. Terms & conditions of the scheme, together with a

mandate form, are available from the Company's website at:

www.mavencp.com/migvct3 .

Shareholders who have not previously applied to participate in

the DIS and who wish to do so in respect of the dividend payable on

10 September 2021 , should ensure that a mandate form, or CREST

instruction if appropriate, is submitted prior to the dividend

election date of 27 August 2021.

Further to the information disclosed above, the Directors

confirm that they are satisfied that all inside information (as

defined by Article 7 of the Market Abuse Regulation (596/2014/EU))

that the Directors and the Company may have in their possession

relating to the Company during the 30 day closed period leading up

to the announcement of its interim results for the six months ended

31 May 2021 has been or will be notified to a regulatory

information service.

Issued on behalf of the Board

Maven Capital Partners UK LLP

Secretary

3 August 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRBGGDIRDGDGBX

(END) Dow Jones Newswires

August 03, 2021 06:31 ET (10:31 GMT)

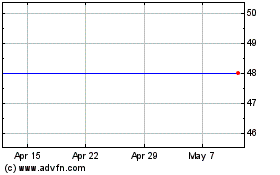

Maven Income And Growth ... (LSE:MIG3)

Historical Stock Chart

From Apr 2024 to May 2024

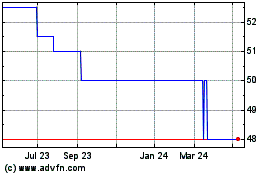

Maven Income And Growth ... (LSE:MIG3)

Historical Stock Chart

From May 2023 to May 2024